bymuratdeniz

It’s often a bad idea to buy something which has already substantially risen in value. But it seems to me that oil would perform well in 2023. One of the possible options to benefit from an oil price rally would be the Energy Select Sector SPDR ETF (NYSEARCA:XLE).

There are plenty of political and macroeconomic reasons to be bullish on oil. But I am in favor of XLE. It boasts more than four times the assets of the second-largest exchange-traded fund (“ETF”) in the category, and its average trading volume is about 30 million shares each session. The small bid-and-ask spread and low volatility are all good points for investors. Although it doesn’t boast too many oil stocks (just 23 of them), it includes the largest and the most profitable companies in the US. But let me explain my bullish thesis on both XLE and “black gold.”

Oil prices to soar in 2023

You might think I like to suggest buying high. Not at all. Instead, I position myself as a value investor, which means the more a particular asset’s price falls, the more I’d be interested in buying it. Oil has had an excellent time both in 2021 and 2022. But I believe there is much more to come in 2023. Let me explain why.

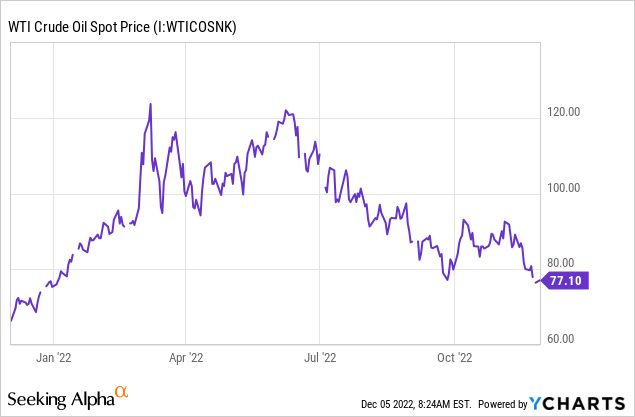

Recently it was announced OPEC+ would keep its production cuts at 2 million barrels per day. Just a quick reminder, at the beginning of October, OPEC already cut production by 2 million barrels per day. So, the cartel’s decision was unchanged this time due to “uncertainty” governing the markets. I’d analyze these uncertainty factors later on. After the October decision was announced, crude prices all of a sudden exceeded $90 per barrel. About a week ago, the oil prices fell to as low as $73 per barrel.

To better illustrate the situation, please see the graph below. It covers the WTI price history.

Y-Charts

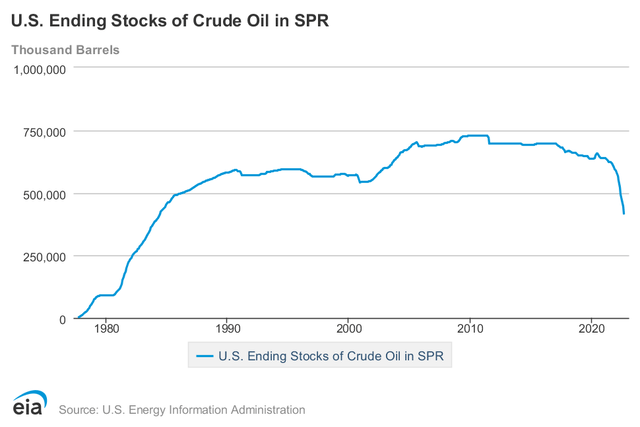

OPEC+’s decision was taken negatively by the White House administration. After the decision was announced, the administration promised to release additional output from the U.S. Strategic Petroleum Reserve (“SPR”). Unfortunately, it won’t always be possible to do that since the oil volumes in the Strategic Petroleum Reserve keep falling.

EIA

What is more, it is hard to replenish the reserves, since oil production in the U.S. is not rising by as much as the administration would like to. The problem is that major oil producers are very careful about boosting their production levels. Indeed, they have obligations toward their stockholders. Amongst others, they involve improving their balance sheets, paying dividends, and buying their shares back. Major corporations that mostly make up the XLE index ETF don’t have to worry too much about their balance sheets, but some U.S. shale companies do. The excellent oil price situation that has been enduring since 2021 allowed some oil firms to survive, and now instead of dramatically raising production levels, they want to make their financial positions even better.

Even more interesting for the “black gold” markets is the Russian oil embargo. A maximum price on Russian oil transported via the sea entered into force on Monday. After a round of negotiations, G7 countries and Australia reached a compromise of the $60 per barrel price ceiling. This agreement is subject to adjustments – the cap is to be at least 5% below the market price. This deal would also be reconsidered every two months.

So, according to this agreement, G7 and EU tankers are allowed to ship oil from Russia only if it is purchased at or below $60 per barrel. The same rule applies to G7 credit institutions, insurance firms, and transport services companies. This is important because 95% of the global oil tankers are covered by the International Group of P&I Clubs in London as well as EU companies.

I think it’s highly likely that no seaborne oil from Russia would be shipped to Europe. Earlier on, Russia’s energy minister Alexander Novak said no price caps are acceptable and Russian crude would only be sold at market prices. The minister added oil would be redirected to “market-oriented partners,” notably China and India. Russia also has its own oil tanker fleet. So, that shouldn’t be a problem. The G7 countries, in turn, would face substantial oil shortages and ask other oil-exporting countries, most importantly Saudi Arabia, to increase supplies to the EU. It remains to be seen whether Saudi Arabia and other Gulf countries would do this since they are interested in higher prices. The recent OPEC+ decision clearly demonstrated this. That is why it is highly likely that oil prices would remain quite high. There are, however, still factors of uncertainty that can serve as both positives and negatives, depending on what will happen in the future.

Risks

So, here are some risk factors that could affect commodity prices, and obviously the XLE as a result.

- The tightening of the Fed’s monetary policy is the major likely threat I see on the horizon. Recently the market has been reacting negatively to any good macroeconomic statistics, including the jobs data and the manufacturing factory orders. In other words, the stronger the economy is, the more reasonable it would be for the Fed to raise the interest rates. At the same time, if a piece of macroeconomic statistics comes far below expectations and the inflation rate also comes down substantially, the Fed will highly likely get dovish. This is also true of other central bankers, including the ECB. Obviously, it will be bullish for oil.

- The Covid-19 situation in China and the zero-Covid policies also matter. The Chinese Covid news is quite controversial. On one hand, the Chinese government eased some regulations. For example, earlier on it was required from travelers to China to do two coronavirus tests. Now it is only required to do one test within 48 hours before entry to the country. Also, massive Covid-19 testing was also canceled. However, large cities go through lockdowns even when very few positive Covid cases get discovered. This is obviously counterproductive for the country’s economy. It’s possible for the Chinese government to therefore ease the coronavirus restrictions even further. However, all is possible, and even tighter measures may be announced. As we all know, China is the main importer of black gold. So, China matters here.

- There are also two factors I would discuss together – namely, either the U.S. or the OPEC+ would increase production. I consider these threats to be of lesser importance. Here is why. The U.S. companies, especially the shale companies, as I have mentioned before, are more concerned with their business fundamentals. U.S. oil might indeed raise production if they get strong financial incentives from the U.S. government. Alternatively, the oil prices should stay over and above $100 per barrel for a long time, to make huge production rises economically prudent. And the U.S. companies still cannot fully solve their logistics problems. Due to Covid-19 many supply chains suffered. So, oil companies in the U.S. still face equipment deficits. The OPEC+ problem is even simpler – the Gulf economies are interested in higher prices. So, only if the global economy fully recovers from Covid-19 and does not enter recession, will they ramp up production.

- The final and the smallest risk, in my view, is the easing of sanctions against Russia. The situation does not seem to be getting any better. So, although it is still possible but hardly unlikely. In fact, it is more probable the situation will only get worse.

Why should I buy XLE?

Why indeed XLE? Why not any other ETF? Whilst these questions do sound reasonable, there are plenty of benefits of this particular ETF. First, as I have mentioned before, only the major companies make up this ETF. Below I prepared a table with all the components of XLE.

XLE components

| Name | Ticker | Weight in % | Sector | Credit Rating |

| Exxon Mobil Corporation | (XOM) | 22.813366 | Oil, Gas & Consumable Fuels | Aa2 (Moody’s) |

| Chevron Corporation | (CVX) | 19.660713 | Oil, Gas & Consumable Fuels | Aa2 (Moody’s) |

| Schlumberger | (SLB) | 5.113118 | Energy Equipment & Services | A2 (Moody’s) |

| EOG Resources, Inc. | (EOG) | 4.383395 | Oil, Gas & Consumable Fuels | A3 (Moody’s) |

| ConocoPhillips | (COP) | 4.297537 | Oil, Gas & Consumable Fuels | A2 (Moody’s) |

| Marathon Petroleum Corporation | (MPC) | 3.945072 | Oil, Gas & Consumable Fuels | Baa2 (Moody’s) |

| Pioneer Natural Resources Company | (PXD) | 3.868475 | Oil, Gas & Consumable Fuels | Baa1 (Moody’s) |

| Phillips 66 | (PSX) | 3.525105 | Oil, Gas & Consumable Fuels | A3 (Moody’s) |

| Occidental Petroleum Corporation | (OXY) | 3.479352 | Oil, Gas & Consumable Fuels | Ba1 (Moody’s) |

| Valero Energy Corporation | (VLO) | 3.352991 | Oil, Gas & Consumable Fuels | Baa2 (Moody’s) |

| Devon Energy Corporation | (DVN) | 3.066062 | Oil, Gas & Consumable Fuels | Baa2 (Moody’s) |

| The Williams Companies, Inc. | (WMB) | 2.929575 | Oil, Gas & Consumable Fuels | Baa2 (Moody’s) |

| Hess Corporation | (HES) | 2.756389 | Oil, Gas & Consumable Fuels | Baa3 (Moody’s) |

| Kinder Morgan, Inc. Class P | (KMI) | 2.589079 | Oil, Gas & Consumable Fuels | Baa2 (Moody’s) |

| Halliburton Company | (HAL) | 2.349561 | Energy Equipment & Services | Baa1 (Moody’s) |

| ONEOK, Inc. | (OKE) | 2.053414 | Oil, Gas & Consumable Fuels | Baa3 (Moody’s) |

| Baker Hughes Company Class A | (BKR) | 2.044470 | Energy Equipment & Services | A3 (Moody’s) |

| Diamondback Energy, Inc. | (FANG) | 1.775934 | Oil, Gas & Consumable Fuels | Baa2 (Moody’s) |

| Coterra Energy Inc. | (CTRA) | 1.466624 | Oil, Gas & Consumable Fuels | Baa2 (Moody’s) |

| Marathon Oil Corporation | (MRO) | 1.359671 | Oil, Gas & Consumable Fuels | Baa3 (Moody’s) |

| APA Corp. | (APA) | 1.050161 | Oil, Gas & Consumable Fuels | Baa2 (Moody’s) |

| Targa Resources Corp. | (TRGP) | 0.962854 | Oil, Gas & Consumable Fuels | Baa3 (Moody’s) |

| EQT Corporation | (EQT) | 0.809475 | Oil, Gas & Consumable Fuels | Ba1 (Moody’s) |

Source: Prepared by the author.

There is a total of 23 components, not too many. But as you can see from the table above, the companies that make up most of this index are financially sound. In other words, A-rated firms, with high investment grades, make up almost 62% of the whole index. The rest are rated Baa3 or above, also investment grade. Only Occidental Petroleum (OXY) and EQT Corporation (EQT) are speculative. That means the ETF fund is a low-volatility one.

So, even if the oil prices fall substantially, the XLE investors are highly unlikely to record too-high paper losses. It is also the biggest energy ETF with a record $41,383 million in assets under management. The expense rate is only 0.10% per year, not expensive, indeed. Moreover, since the ETF’s inception in 1998, its annual average gain has been 8.6%. Don’t forget there have been several recessions since then, and most notably the 2020 oil price crash. Now, a couple of words about the ETF’s valuation.

Valuation

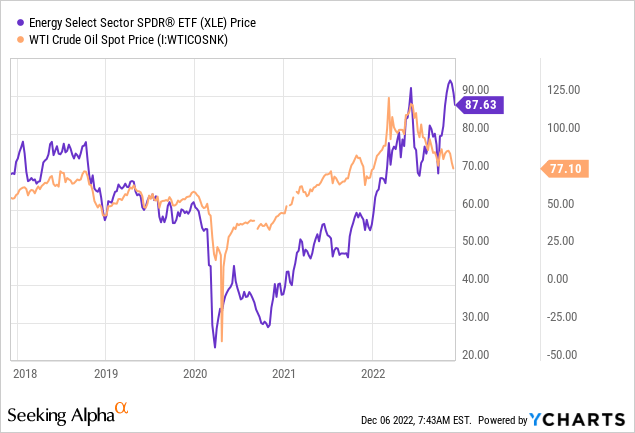

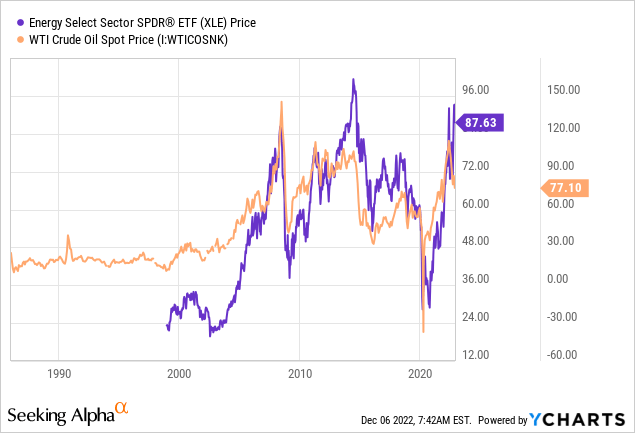

If we see the graphs below, we will see how XLE performed relative to crude oil over the five-year period and also since the ETF’s inception in 1998.

The five-year graph shows the ETF is somewhat overvalued relative to WTI.

But the longer-period graph shows it has been rather normal for XLE to outperform crude oil.

However, the key ratios show the ETF is not too overvalued. The ETF’s average P/E ratio of just above 8 is quite moderate, and a P/B below 3 is also fine. As of the time of writing, a share of XLE is worth about $85, even below the current NAV. Yes, I’d prefer XLE to have a larger margin of safety. But the ratios still do not suggest overvaluation.

| Price/Book Ratio | 2.47 |

| Price/Earnings Ratio FY1 | 8.30 |

| NAV (Net asset value) | $87.60 |

Source: Prepared by the author

Overall, XLE is fairly valued, I think.

Conclusion

The oil prices seem to have a great future although there are still uncertainty factors. The XLE ETF is sound, large, and low-expense. Investors might benefit from low volatility thanks to its key components. However, the ETF fund is not particularly undervalued right now. Although I believe there are plenty of gains to be made in 2023, investors should buy the XLE ETF after small technical corrections.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!