[ad_1]

Jitalia17

Author’s note: This article was released to CEF/ETF Income Laboratory members on September 28th.

The iShares Core U.S. Aggregate Bond ETF (NYSEARCA:AGG) is the largest, most well-known U.S. bond index fund, and the industry benchmark. Skyrocketing inflation has led to several important developments in bond markets, which I thought to share with readers and subscribers.

Nominal interest rates are moderately higher than average, which could lead to moderate capital gains and above-average returns once economic conditions normalize.

Real interest rates are significantly lower than average, which could lead to significant capital losses if inflation remains elevated, and if interest rates continue to increase.

Spreads between investment grade and non-investment grade bonds are wider than average, so non-investment grade bonds and bond funds could perform particularly well moving forward.

Spreads between long-term bonds and short-term bonds, term premia, are significantly below average, so short-term bonds look particularly compelling right now.

These developments are particularly important for AGG, as the industry benchmark, but are relevant for most bond funds too.

In my opinion, above-average nominal interest rates are a benefit for AGG, but below-average real interest rates are a much greater drawback. As such, I would not be investing in the fund until real interest rates are higher, either due to lower inflation or higher interest rates.

Short-term corporate bond funds look particularly compelling right now. The iShares 0-5 Year High Yield Corporate Bond ETF (SHYG) focuses on these securities, last covered by myself here.

AGG – Quick Overview

AGG is a diversified bond index ETF, tracking the Bloomberg US Aggregate Bond Index, the bond industry benchmark. AGG’s underlying index includes almost all relevant U.S. bonds, including treasuries, investment-grade bonds, mortgage-backed securities (MBS), and other government-related securities. It does exclude high-yield corporate bonds, although these only account for around 8% of the U.S. bond market.

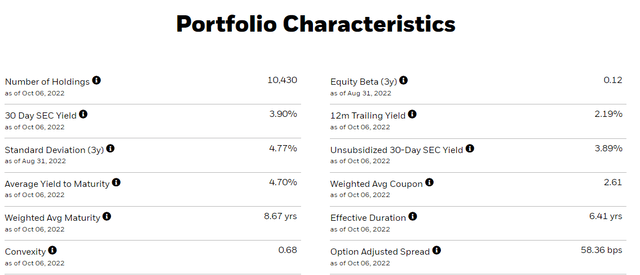

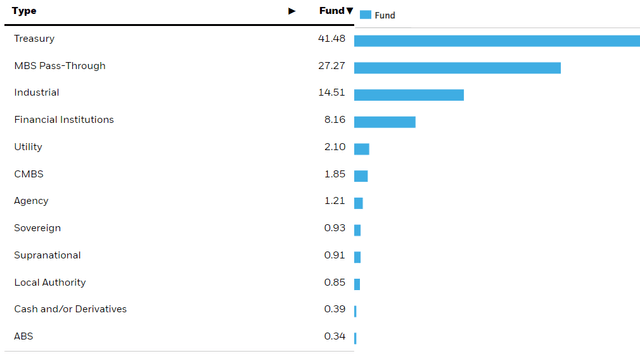

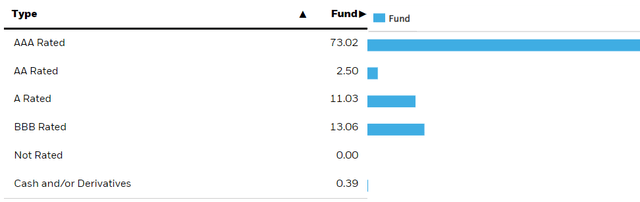

AGG’s underlying index is remarkably broad, which results in an incredibly well-diversified fund, with investments in over 10,000 securities from all relevant industry niches. Fund fundamentals are as follows.

AGG

AGG

AGG

AGG provides investors with broad-based exposure to U.S. bonds. These securities have been strongly impacted by increased inflation in several key ways. Let’s have a look at these.

Higher Nominal Interest Rates

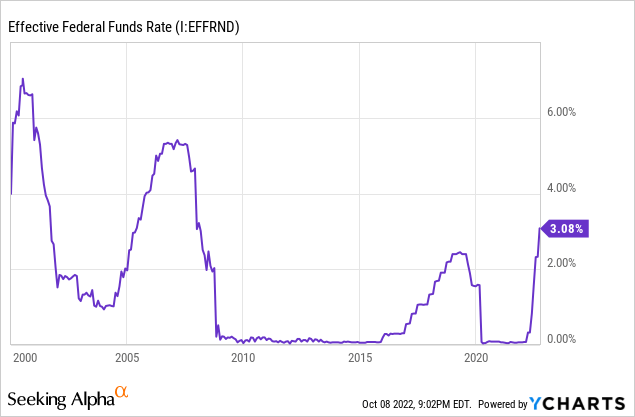

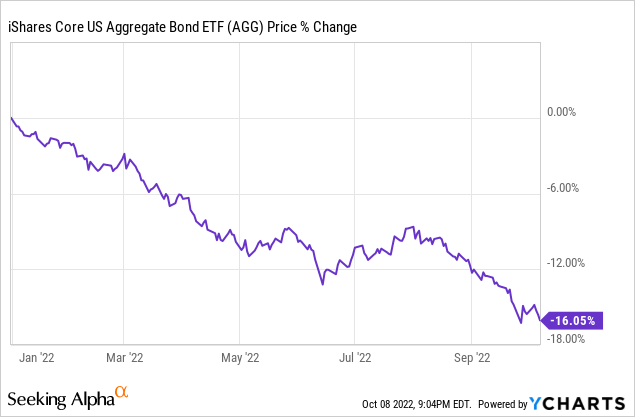

Interest rates have risen all year, as the Federal Reserve hikes rates to combat skyrocketing inflation. Federal Reserve benchmark rates have risen by around 3.0% YTD, one of the fastest set of rate hikes in history. Rates have risen by a lot, and are at their highest levels since the financial crisis / housing bubble. Rates were quite a bit higher in prior decades, although there have been structural economic changes since, so rates will likely remain lower moving forward, in my opinion at least.

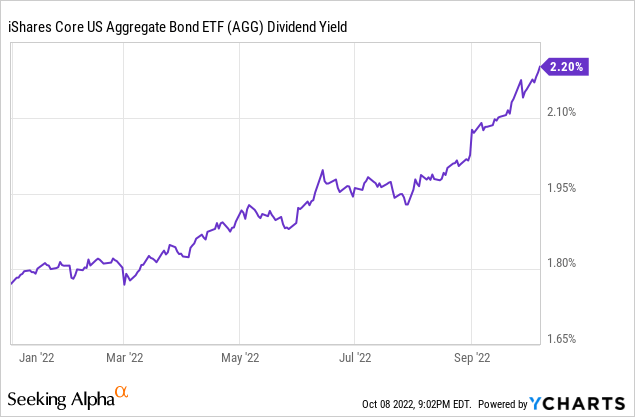

Higher Federal Reserve rates have led to higher interest rates on most bonds, including those held by / bought by AGG. As the yield on AGG’s underlying holdings increases, so does the fund’s generation of income, ultimately resulting in higher dividends for the fund and its shareholders. AGG’s yield has steadily risen all year, as expected.

As can be seen above, even though AGG’s yield has risen, it remains somewhat below the fund’s historical average. This is because it takes quite a bit of time for higher interest rates to lead to higher dividends for bond funds. Funds must generally wait for their older, lower-yielding bonds to mature to buy newer, higher-yielding bonds, and funds must then wait for these newer funds to start paying interest before distributing the proceeds to shareholders. The process could take years to play out, but has already started, as can be seen above.

AGG sports a SEC yield, a standardized measure of short-term income, of 3.9%. ETFs tend to distribute any and all generated income to shareholders as dividends, so expect the fund’s dividend yield to increase to around 3.9% in the coming months. AGG sports a yield to maturity, a measure of long-term expected returns and yields, of 4.7%. AGG’s dividend yield should increase to 4.7% in the coming years, assuming interest rates remain roughly the same. Both of these figures are significantly higher than the fund’s historical average yield, a benefit for the fund and its shareholders.

Above-average nominal interest rates, SEC yields, and yield to maturity metrics are all important benefit for AGG and its shareholders.

Real Interest Rates

Interest rates have risen these past few months, but so has inflation, and by much, much more.

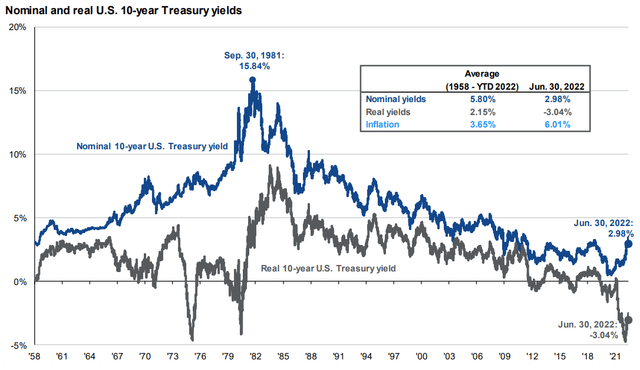

Inflation reached 8.3% this past August, significantly higher than the Federal Reserve target of 2.0%, and significantly higher than average realized inflation these past few years. Interest rates, on the other hand, are barely above their historical averages right now. Real interest rates, meaning interest rates minus inflation, are at historically below-average levels, as one would expect from such a situation.

J.P. Morgan Guide to the Market

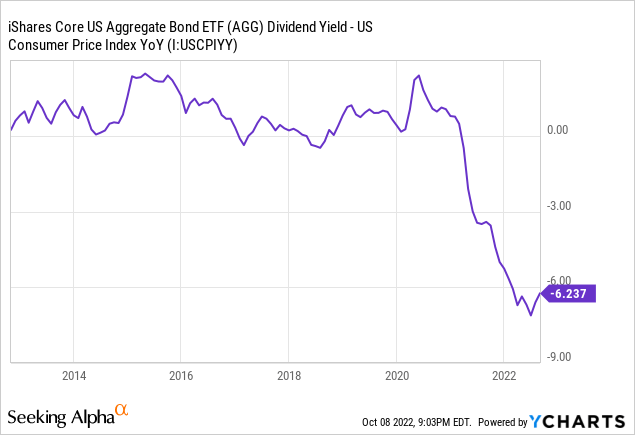

Real interest rates on AGG are at their lowest levels in history too, and by quite a large margin. AGG tends to yield slightly more than inflation, but currently yields 6.2% less than inflation, lowest figure on record.

Significantly below-average real interest rates are significant negatives for two key reasons.

First, is the simple fact that current real interest rates mean most bonds and bond funds, including AGG, fail to keep up with inflation and rising cost of living. Investing in AGG means accepting a significant loss of purchasing power year after year, a self-evident negative for investors.

Second, is the fact that negative real interest rates are an indication that nominal interest rates are (probably) too low, and will (probably) need to increase moving forward.

Last time inflation was this high / real rates this low was in the 70s. The Federal Reserve was forced to hike rates in the double-digits to crush inflation then, and it might very well be forced to do so again today. In my opinion, there have been significant structural economic changes since, so double-digit rates are unlikely, but further hikes do seem likely. Hikes would lead to lower bond prices, and hence capital losses for bond and bond fund investors. Rates have risen all year, during which AGG has seen relatively large capital losses, as expected.

In my opinion, significantly below-average real interest rates are significant negatives for AGG. Under these conditions, I would not invest in the fund.

Investment Grade / Non-Investment Grade Spreads

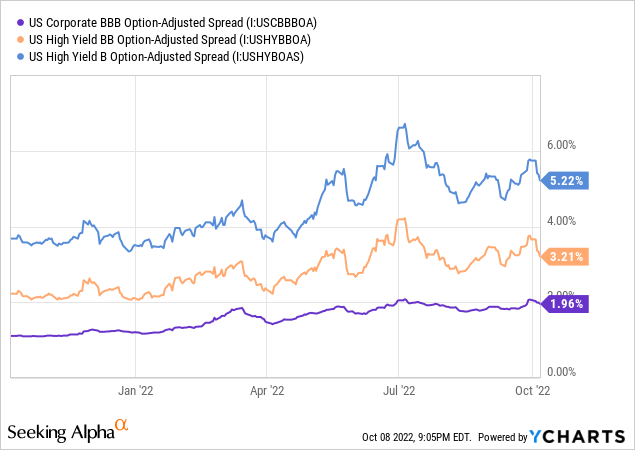

Increased inflation has led to rising interest rates, which have, in turn, led to a worsening of economic fundamentals and investor sentiment. As the economy worsens, the fundamentals of riskier, less resilient companies worsen as well, which makes it difficult, and expensive, for them to issue debt. Investors are not willing to loan money to risky enterprises amidst recession fears, or, at least, are not willing to do so cheaply. The result is rapidly increasing high-yield bond interest rates and spreads. Bonds rated BB, the least risky high-yield corporate bonds, yielded 2.0% more than comparable investment-grade bonds in early 2022. Today, these same bonds yield 3.2% more than their investment-grade peers, a significant increase in yield spreads.

Increased high-yield spreads means high-yield bond and bond funds offer comparatively strong yields, albeit at an above-average level of risk. AGG focuses on investment-grade bonds, so does not benefit from rising high-yield spreads. Under these conditions, an investment in AGG looks comparatively worse than one in high-yield corporate bond funds.

Long-Term / Short-Term Spreads

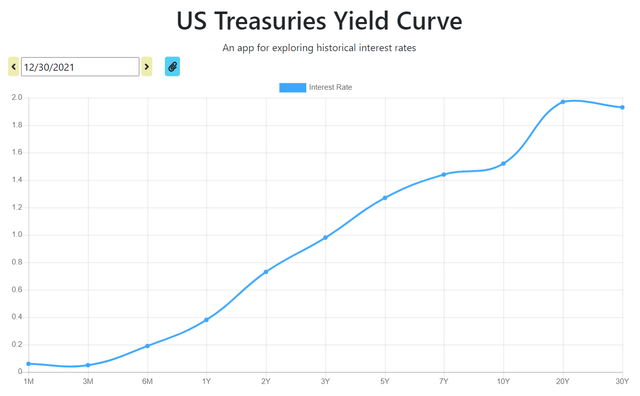

In the vast majority of cases, long-term bonds have higher interest rates than comparable short-term bonds, to compensate investors for locking-up their cash for longer periods of time, and as compensation for increased interest rate risk. As an example, let’s have a quick look at U.S. treasury yield curves in early 2021.

U.S. Treasury Yield Curve

As can be seen above, longer-term treasuries tend to have higher interest rates than shorter-term treasuries, as one would expect. There are small hiccups here and there, but the overall trend-line seems clear enough.

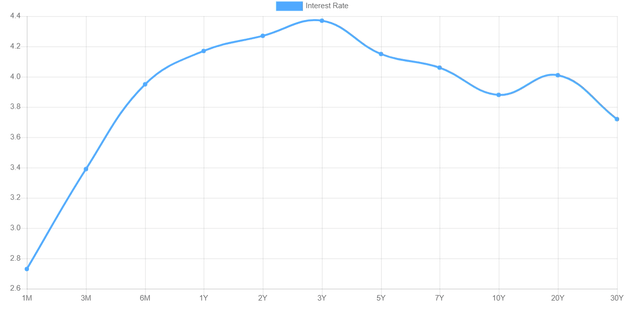

The situation right now is quite different, and somewhat complicated. Investment markets remain concerned about inflation, but expect it to be a relatively short-lived, transitory phenomenon, that will be solved quickly by aggressive rate hikes in the coming months, perhaps a year or two. Once inflation is under control, rates would normalize, and would come down. The result is a somewhat inverted yield curve. Short-term rates are high, due to expectations of aggressive rate hikes in the coming months. Long-term rates are somewhat lower, as investors expect the aforementioned rate hikes to be transitory. The current treasury yield curve is as follows.

U.S. Treasury Yield Curve

As longer-term rates are currently somewhat lower than shorter-term rates, longer-term bonds and bond funds are simply not looking like compelling investment opportunities. Longer-term bonds are riskier, would see very significant losses if rates continue to increase, and yield less than shorter-term bonds. Under these conditions, I would not be investing in longer-term bonds.

AGG itself is a medium-term fund, with an average maturity of 8.7 years, and an average duration of 6.4 years. Although neither of these figures is excessively high, there are funds focusing on shorter-term bonds, with look like much more compelling investment opportunities under current conditions.

Conclusion

Skyrocketing inflation has led to increased interest rates these past few months. Interest rates remain significantly below inflation. Under these conditions, bond funds like AGG provide investors with few benefits, but several risks and negatives. As such, I would not be investing in AGG at the present time.

[ad_2]

Source links Google News