[ad_1]

Matteo Colombo

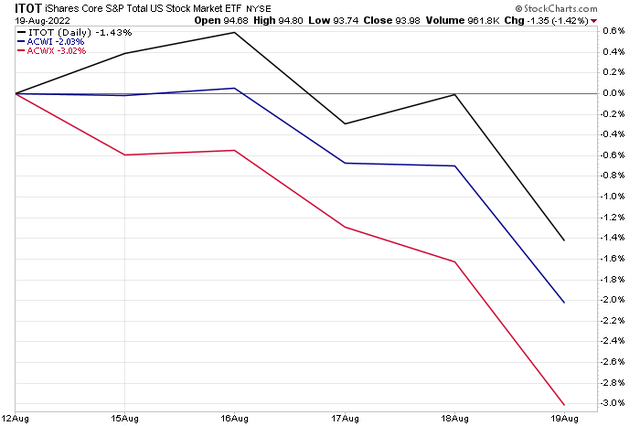

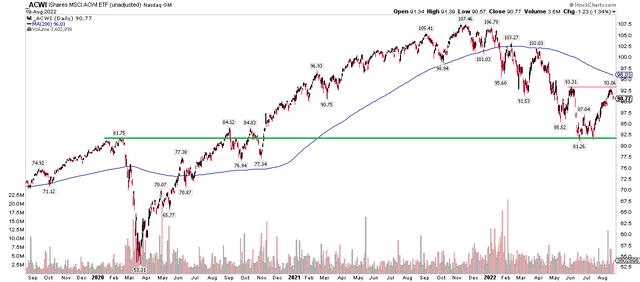

Global stocks, as measured by the iShares MSCI ACWI ETF (NASDAQ:ACWI) fell 2% last week as the market takes a well-deserved breather following a massive run-up from the lows two months ago. U.S. equities were the relative winner during the options expiration week, with the iShares Core S&P Total U.S. Market ETF (ITOT) declining just 1.4% while the iShares ACWI ex-US ETF (ACWX) gave back more than 3%.

Global Equities Fell 2% Last Week

Stockcharts.com

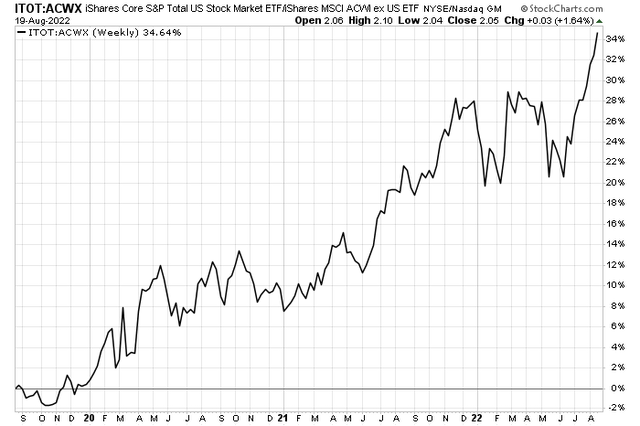

The relative strength among domestic stocks is notable. In fact, the ratio chart of ITOT to ACWX is now at a fresh high, aided by a surging U.S. dollar. A strong USD also pressures oil prices despite the Energy sector’s recent advance.

U.S. vs Rest Of World: Fresh All-Time Highs

Stockcharts.com

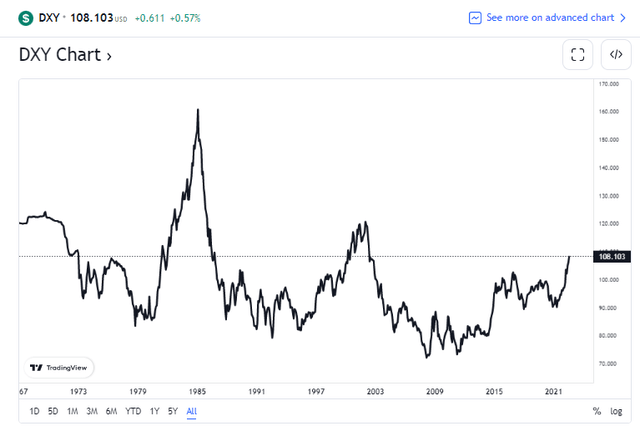

The greenback soared to near its highest mark since 2002 amid ongoing geopolitical tensions and a worsening energy crisis in Europe.

U.S. Dollar Index: Pacing For Its Best Monthly Settle In Two Decades

TradingView

The benchmark natural gas price for much of Europe is the Dutch TTF contract. That energy gauge settled at an all-time high to cap off a tumultuous week for the major European bourses. On Friday, it was reported that PPI in Germany climbed to a record level, too, according to Reuters. That startling data point came after hotter-than-expected July inflation figures in the U.K, per CNN. All the while, the U.S. consumer price situation appears on the mend.

All eyes will indeed be on price action in both TTF and Great Britain’s NBP natural gas prices. Governments in the region may be forced to enact more aid packages to assist businesses and families with home heating costs this winter.

TTF Natural Gas Power Higher Ahead of Heating Season

TradingView

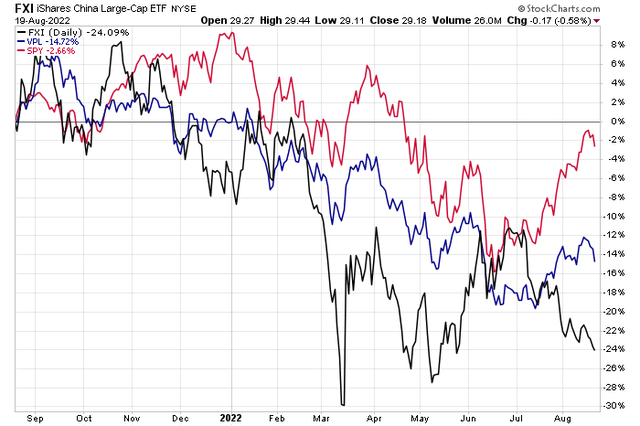

The world is troubled not only by energy woes across the pond but also jitters in the South China Sea between the world’s second-largest economy and Taiwan. Many pundits fear that an escalation between those two nations could spark a semiconductor crisis.

Chinese stocks and Pacific Rim equities writ large have not surprisingly suffered over the last year as brinksmanship wears on. Both the iShares China Large-Cap ETF (FXI) and the Vanguard Pacific Stock Index Fund (VPL) have sharply underperformed the S&P 500 SPDR Trust ETF (SPY) over the past 12 months.

Troubled Waters: China & Pacific Stock Plunge Y/Y

Stockcharts.com

That’s a lot for global investors to digest. But where does ACWI stand right now? Is it time to load up on the world of stocks as we head into the notoriously volatile late-August and September period?

I think markets could continue to correct off the rebound since mid-June. Moreover, ACWI did not get to its downtrending 200-day moving average like SPY and ITOT did last week – indicating relative weakness.

ACWI failed at a try to rally above its early June 2022 peak, near $93. I see a move to the $87 to $88 range in play over the coming weeks – $87 and change was resistance in late June and July. It’s a natural re-test spot.

The good news, in my eye, is that ACWI’s low back on June 17 at $81.26 was successfully tested on July 14. Another shot in the arm for the bulls is that the global stock fund’s February 2020 high proved to be support at this year’s bear market low. So that’s a longer-term buy sign.

ACWI: Near-Term Downside Risks, Longer-Term Support

Stockcharts.com

The Bottom Line

Don’t be surprised to see some further weakness in ACWI as folks return to their trading desks after an August holiday. ACWI appears poised to drop a bit further, but this summer’s price action helped establish a good-looking low to me.

[ad_2]

Source links Google News