[ad_1]

yujie chen/iStock Editorial via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on November 21st, 2022.

The VanEck Morningstar Wide Moat ETF (BATS:MOAT) invests in cheaply valued companies with sustainable competitive advantages, or moats, as determined by Morningstar. MOAT’s strategy seems to be working, with the fund consistently outperforming relative to the S&P 500, although only slightly so.

MOAT’s strong strategy and above-average performance track record make the fund a buy. MOAT only yields 1.2%, and so is not an effective income vehicle.

MOAT – Strategy Analysis

MOAT invests in cheaply valued companies with wide moats. Cheaply valued stocks are meant to outperform, contingent on valuations normalizing. Companies with wide moats are meant to outperform too, due to their stronger, more sustainable business models and growth prospects. MOAT

MOAT is technically an index fund, tracking the Morningstar Wide Moat Focus Index. In practice, MOAT functions as an actively-managed fund, as its underlying index is very discretionary: security selection is ultimately at Morningstar’s discretion.

MOAT’s strategy starts by identifying sources of moat. Morningstar has identified five sources. These form the core of the fund’s strategy, so let’s have a close look at each.

Switching costs, which make switching products or services difficult, expensive, and / or time-consuming, locking-in customers. Enterprise software providers, including Salesforce (CRM), the fund’s seventh-largest holding, tend to have high switching costs. Companies using Salesforce software are generally loathe to switch providers, as doing so would almost certainly disrupt operations and necessitate significant workforce re-training. Switching is difficult and painful, so most companies avoid doing so in most situations. Salesforce’s customers are locked-in, which means it is very difficult for a competitor to arise. Switching costs give Salesforce a sustainable competitive advantage, in my opinion, and in the opinion of Morningstar.

Intangible assets, which sometimes increase customer willingness to pay, and sometimes make it difficult for companies to enter the industry. IPs are a key source of intangible assets, and few companies have stronger IP portfolios than Disney (DIS), MOAT’s eight-largest holding. Disney owns many of the world’s most well-known fictional characters and settings, including Star Wars, Frozen, most Marvel IP, and others. I can personally recognize all major offerings in Disney Plus, even the more recent ones targeted towards children.

Disney Plus

It is very difficult to compete against Disney’s massive IP catalog. Few companies own the rights to characters as memorable or well-known as Boba Fett or the Avengers. Fewer still have characters as beloved by children as Elsa or Anna (Frozen). Disney’s IP catalog / intangible assets provide the company with a sustainable competitive advantage, in my opinion at least.

Network effects, which increases the value of a product or service as more people use it, which benefits larger, more established companies, while harming smaller, newer entrants. Lots of tech companies here, including Etsy (ETSY), MOAT’s fifth-largest holding, and Amazon (AMZN). The more sellers in Etsy or Amazon, the more useful it is for customers (more products and more variation). The more customers using Etsy or Amazon, the more useful it is for sellers (greater market reach and potential sales). The opposite is true as well: an online retailer with few sellers or customers is of little use to either. New entrants almost always start small, with few sellers and customers, which makes competing against the established players incredibly difficult. Etsy and Amazon’s network effects provide the companies with sustainable competitive advantages, in my opinion at least.

Cost leadership, which can be gained through economies of scale or access to lower-cost markets or products, and which allows companies to undercut the competition. Walmart (WMT) is one of the best-known companies with significant cost leadership, incredibly important in industries with razor-thin margins like retail. Looking through MOAT’s holdings, I’m not seeing any companies with obvious cost advantages like Walmart. It seems likely that I’ve missed some, as I’m not knowledgeable about the cost structure of most companies, but I do think it’s likely that the fund is currently not heavily invested in these companies.

Efficient scale, which might be better phrased as low competition. Low competition could be due to low market size, economies of scale, or regulatory restraints. ISPs, including Comcast (CMCSA), MOAT’s 20th largest holding, are a fantastic example. ISPs operate in industries with low competition, due to the massive capital costs required to provide internet and similar services to consumers, and due to regulatory reasons / barriers to entry. Communication services are heavily regulated, which discourages entering markets with established players (lower profits, high costs). Tens of millions of U.S. citizens live in areas with only one broadband option, which allows ISPs like Comcast to charge high prices without losing market share. Comcast’s efficient scale, and relative lack of competition, provide the company with a sustainable competitive advantage, in my opinion at least.

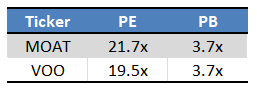

MOAT first selects companies with wide moats, which can come from switching costs, intangible assets, network effects, cost leadership, or efficient scale. The fund then invests in the forty such companies with the most attractive prices, defined as those with the lowest market price to fair value ratios. Fair value is estimated by Morningstar, by running a discounted cash flow model. MOAT’s valuation is slightly higher than that of the S&P 500, almost certainly because companies with moats tend to sport premium valuations.

Fund Filings – Chart by author

MOAT is an equal-weighted fund. As with most indexes, there are several other smaller rules, meant to ensure diversification and liquidity, while reducing turnover. Turnover rules seem particularly strict, with the fund generally investing in more than 40 stocks (48 currently). Although not explicitly stated, it seems that MOAT is a large-cap fund.

MOAT has an expense ratio of 0.46%. Expenses are about normal for a niche index fund, although definitely higher than that broader U.S. equity indexes. As an example, the SPDR S&P 500 Trust ETF (SPY), the largest U.S. equity fund in the market, has an expense ratio of just 0.09%. MOAT’s relatively high expense ratio reduces shareholder returns, a negative for the fund and its investors. As expenses are reasonable, I don’t consider this to be a deal-breaker, but it is definitely a negative.

Besides the above, not much else stands out about the fund’s strategy. Focusing on companies with moats, as defined above, seems to be core to the fund’s strategy and investment thesis. In my opinion, the above is the most important consideration for investors thinking about initiating a position. MOAT is basically the strategy and process described above, so investors should only consider an investment in the fund if the strategy sounds enticing or appropriate, consider other alternatives otherwise.

MOAT – Holdings Analysis

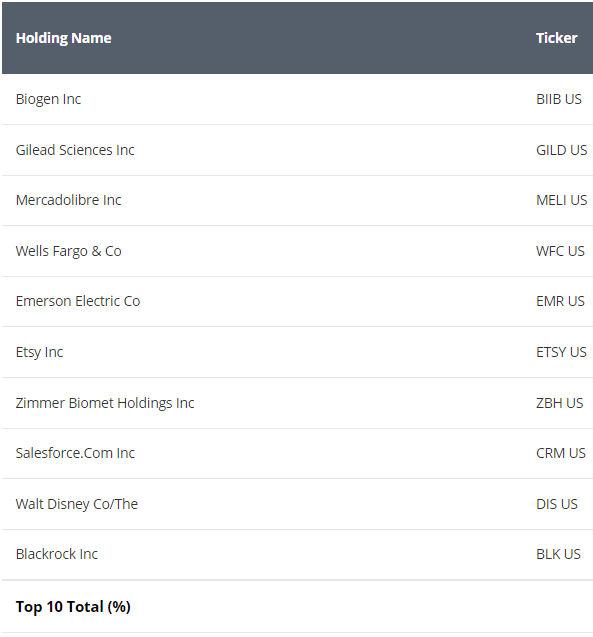

MOAT is an equal-weighted portfolio, so the fund’s largest holdings are simply those with the strongest short-term performance. Although this is not a particularly important set of companies, still thought to include them, to have an idea of what the fund invests in.

MOAT

In general terms, MOAT’s larger holdings are companies with sizable moats, as defined by Morningstar. Biogen (BIIB), Gilead (GILD), and Zimmer Biomet (ZBH) have significant intangible assets, from their IP portfolios / drug monopolies. Disney too, with their IP portfolios / well-known characters and settings. MercadoLibre (MELI) and Etsy have network effects in their respective e-commerce platforms. Salesforce (CRM) has high switching costs. I think the same is true for Emerson Electric (EMR), although I’m less knowledgeable of that company. BlackRock (BLK) is a combination of switching costs for its institutional clients, and efficient scale + cost leadership in general (Vanguard operating as a co-op means there are few profits and competition in lots of investment markets). Wells Fargo’s (WFC) moat is probably due to regulatory barriers to entry, but including the company seems a bit questionable: customers have access to several large national banks, and most have access to several smaller regional banks too.

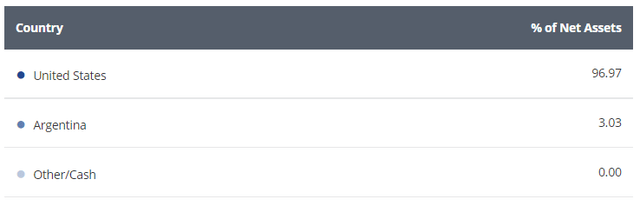

MOAT focuses on U.S. equities, with an investment in a single international stock MercadoLibre.

MOAT

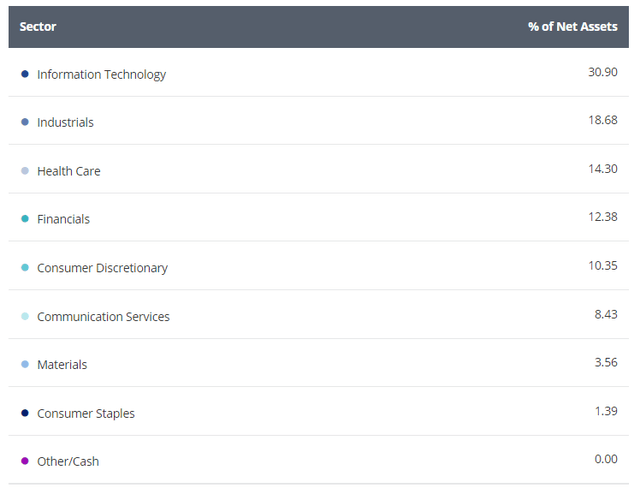

MOAT provides investors with diversified industry exposure. The fund is slightly overweight industrials and tech, while being significantly underweight consumer staples and energy. Industry allocations seem to be somewhat consistent with the fund’s investment strategy, in my opinion at least.

MOAT

MOAT’s holdings and industry exposures seem reasonable, without any significant drawbacks or negative. As mentioned previously, the fund’s strategy is key, so I would focus on that over its holdings, which are liable to change.

MOAT – Performance Analysis

MOAT’s performance track-record is quite strong, with the fund consistently outperforming relative to the S&P 500, although generally by little, less than 1.0% by year.

MOAT

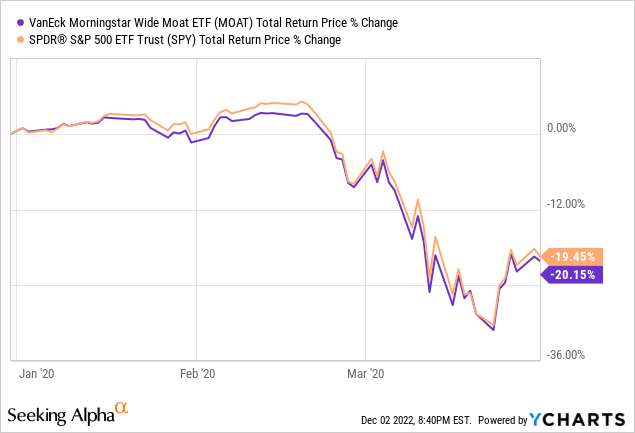

MOAT does not seem to be significantly different from the S&P 500 on matters of risk, or of potential losses during downturns. As an example, MOAT slightly underperformed relative to the S&P 500 in early 2020, the onset of the coronavirus pandemic.

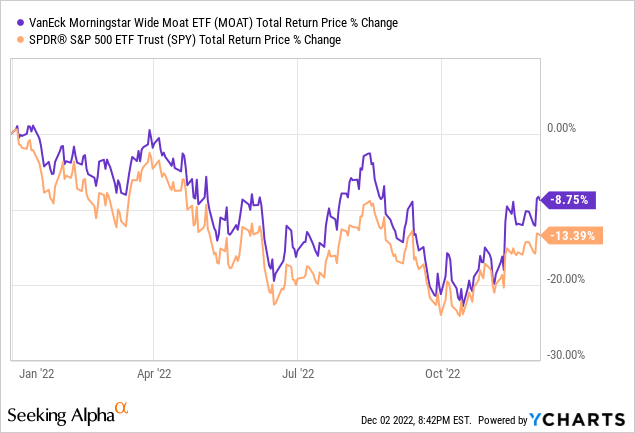

On the other hand, the fund has moderately outperformed YTD, another period of significant market losses.

MOAT actually seems to be slightly less risky than the S&P 500, although I wouldn’t put too much emphasis on these examples. Each recession and bear market is different, so the fund could conceivably outperform or underperform during the next one. Still, at the very least, it does not seem like MOAT is riskier than average.

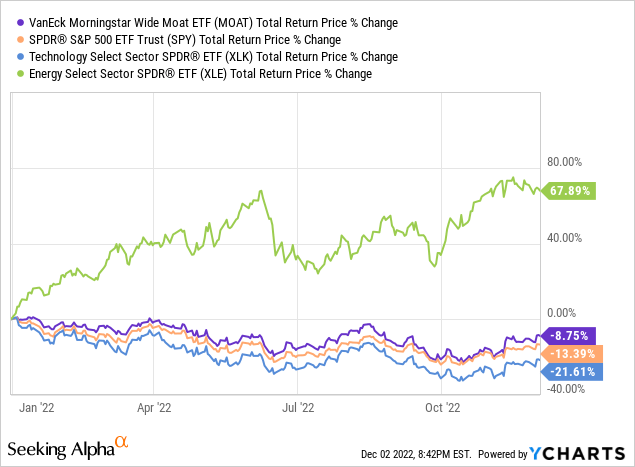

MOAT’s outperformance is not explained by the fund’s industry exposures. As an example, the fund is slightly overweight tech, which has moderately underperformed YTD. At the same time, the fund is significantly underweight energy, which has significantly outperformed YTD. These industry weights clearly detracted from MOAT’s performance, but the fund has still managed to outperform YTD.

MOAT’s outperformance is also not explained by the fund’s valuation, which is very similar to that of the S&P 500, or its meager 1.2% yield, or its tiny allocation to international stocks.

In my opinion, and considering the above, MOAT’s outperformance is almost certainly due to the fund’s investment strategy and security selection. It is the most logical conclusion, and more or less the only possible one too. MOAT’s investment strategy seems to have led to outperformance in the past and will, I believe, lead to further outperformance in the future.

Conclusion

MOAT invests in cheaply valued companies with sustainable competitive advantages, as determined by Morningstar. MOAT’s strong strategy and above-average performance track-record make the fund a buy.

[ad_2]

Source links Google News