[ad_1]

Evgenii Mitroshin

Thesis

Energy markets headed into December much weaker than the highs they reached in Q2/Q3. WTI Crude (CL1:COM) has struggled for traction as it re-tested its September lows, with oil bulls under significant pressure to defend that level. We postulate that a decisive break of CL1’s $75 level would likely send it down to the $60+ region.

NYMEX Natural gas (NG1:COM) bulls have been unable to push NG1 toward the August/September highs after recovering from its October lows. While the medium-term bullish initiative remains with NG1 buyers, the upward momentum is increasingly less convincing. Therefore, we postulate sellers have been waiting at critical resistance zones to stanch further upside as they anticipate further digestion of NG1 gains.

However, the Energy Select Sector SPDR ETF (NYSEARCA:XLE) has surged above its June highs as energy bulls piled into energy stocks. However, we believe such bifurcation is not sustainable if the underlying markets continue to weaken. Therefore, investors should be prepared to capitalize on the recent rally to cut exposure.

The European Union (EU) has also agreed to a $60 price cap on Russia’s oil exports. However, Russia’s key oil buyers, such as China and India, are already paying less than the finalized price cap. Therefore, it’s not likely to have a material impact on cutting Russia’s global oil flows unless it decides to cut its production significantly at the upcoming OPEC+ meeting on December 4.

Europe has also been unable to agree on its dynamic gas price cap. The proposed arrangement was seen as ineffective, as it wouldn’t have caused a material impact against the previous price spikes seen in August. Despite that, Europe is under significant pressure to nail out an effective arrangement, as its industries (particularly in Germany) have continued to suffer from high energy prices.

With the global economy’s inflation spiral likely peaked (per Bloomberg Economics), we postulate that the likelihood of further spikes in energy prices is looking increasingly unlikely. However, the IMF’s global economic forecasts for 2023 also suggest significant caution as economies weaken further against elevated inflation.

Still, China remains the critical demand driver for oil bulls, betting on its reopening from COVID restrictions. Therefore, it has likely driven oil buyers to commit to stanch further downside in CL1.

With XLE having re-tested its June highs and likely reversing, we believe it’s appropriate for investors to consider taking some profits and risks off the table. In addition, today’s (December 2) robust employment report could cause the Fed to rethink its duration and extent of holding interest rates in the restrictive zone.

With earnings estimates for the oil and gas industry still being revised upward through November, we believe it could set up the industry for a steep fall if the market anticipates a worse-than-expected recession due to a much more hawkish Fed.

Revising from Hold to Sell.

OPEC+ Cut 1M In Oil Production In November

All eyes are on OPEC+ as it heads into its weekend meeting. WSJ put out a report in November suggesting that OPEC+ could be looking to increase production, which was flatly rejected. Still, OPEC+ did not cut its output by its previously proposed 2M level in November.

Bloomberg’s estimates suggest the cut was closer to the 1M levels, with Saudi Arabia leading the curtailment. However, OPEC+’s reduction was mitigated by Russia’s increase, as China and India continued to be fervent buyers. Also, a Nikkei Asia report highlighted that China is looking to enhance its energy security moving forward, which should continue to drive its demand for Russia’s discounted crude.

We postulate that the structural drivers in crude oil remain intact. However, it doesn’t mean that a further selloff cannot occur. Furthermore, Europe’s confirmation of a $60 price cap on Russia’s crude should not lead to material damage to Russia’s oil flows.

Notably, its crude was already discounted in the market. Moreover, Russian Foreign Minister Sergei Lavrov indicated that “he thought the price cap level was irrelevant.” As such, we don’t think it would lead to significant action from Moscow to reject exports on the latest curbs, keeping Russia’s oil flowing in the market.

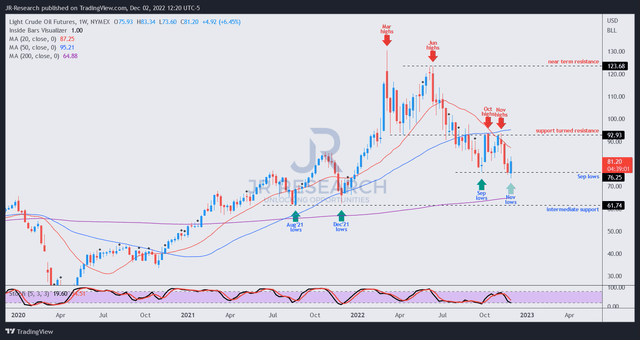

CL1 futures price chart (weekly) (TradingView)

As seen above, CL1 is re-testing its critical $75 support zone. In addition, we believe the price action has likely anticipated further cuts in production emanating from the upcoming OPEC+ meeting. As a result, oil buyers appear ready to support WTI crude oil futures’ lost medium-term bullish bias.

However, we postulate that it could be set to change if the meeting outcome turned out to be less favorable (no cuts/immaterial cuts/increase) than what the market could expect. For now, the re-test is constructive, but we need to assess the price action over the next few weeks (post-OPEC+ meeting) to have more clarity.

Is XLE ETF A Buy, Sell, Or Hold?

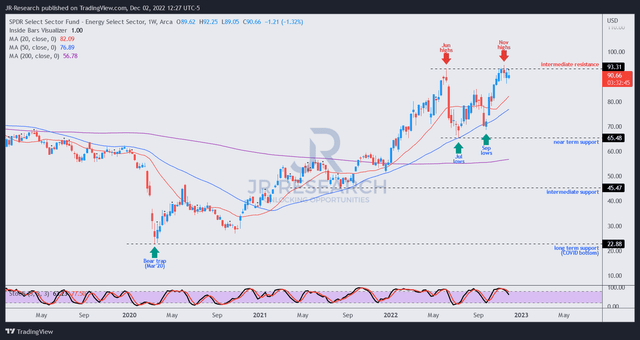

XLE price chart (weekly) (TradingView)

However, the XLE price chart painted a different picture from the weakness seen in WTI crude futures.

Notwithstanding, we postulate that the re-test at its November highs (predicated against June highs) has met with stiff resistance. Hence, we assess that XLE is primed for a steeper pullback, in line with the weakness observed in its underlying markets.

Hence, investors are urged to consider leveraging the recent rally to cut exposure/take profits off the table.

Revising from Hold to Sell.

[ad_2]

Source links Google News