[ad_1]

Justin Paget

The iShares Global Infrastructure ETF (NASDAQ:IGF) contains a lot of thoroughfare stocks with literal toll-road economics. There’s a fair bit to like in this ETF from a fundamental view, but the companies are too expensive, and the ETF multiple is not reasonable in our opinion. There are structural reasons why the multiple has stayed high, but they are not reasons that should convince value investors. This ETF is not compelling.

IGF Breakdown

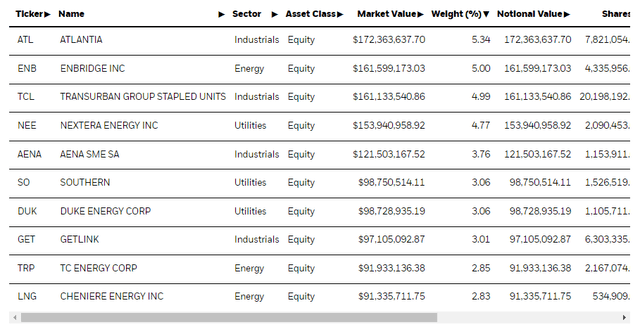

Let’s quickly review some of the ETF’s top holdings.

Top Holdings ((iShares.com))

Atlantia (OTCPK:ATASF) is at the top with a 5.3% allocation. They were responsible for the Ponte Morandi collapse and have therefore been forced to sell their concession to the Italian highways. They remain with other major thoroughfare concessions in Spain and France, but the majority was the Italian concession. They didn’t get such a good deal on it, selling 33% of their EBITDA in 2019 for about 25% of the company’s value. A lower than 10x multiple is likely because they were under major political pressure to do away with the assets after the Morandi fiasco to an approvable buyer, selling it to the Cassa Depositi e Prestiti as a consortium leader with Blackstone and Macquarie which is a state fund. Barring the political and humanitarian disaster of the collapse, its thoroughfares are valuable, and are probably a little cheap. They also operate major airports in Italy including FCO Rome which might be driving down multiples. The overall Atlantia multiple is somewhere below 10x EV/EBITDA, and other Italian airport comps, albeit much less commercial ones, trade at quite similar multiples in the >9x area.

Atlantia looks cheapish, but as you go down the portfolio, things get more expensive. Enbridge (ENB) trades at a 5% earnings yield, and other midstream energy players trade in that area as well. It’s not a great yield considering structural risks exist for oil as the Green Agenda is not dead yet. Other regulated utilities trade at even lower earnings yields, including water utilities, but also grids and other transmission utility networks. Utility companies with any renewable exposure similarly trade at high levels. Utilities are 38% of the ETF’s allocations, so it’s quite high.

While Atlantia is cheap in the thoroughfare space, Transurban (OTCPK:TRAUF) trades at more than 20x EV/EBITDA or a 74x PE, which is where we start understanding the problem with infrastructure. Even more obscure thoroughfare players like Aena (OTCPK:ANNSF) which has more cyclical construction-oriented exposures from operating duty-free at airports and other airport services including services related to freight and cargo trade at 13x multiples.

No Thanks

Corporate bonds with A and BBB ratings offer a YTM at 5.5% now. Why would you want the IGF when its comprehensive multiple is 20x driven by high infrastructure multiples, meaning an earnings yield of 5%? It’s not competitive. The reason is because more and more money gets ploughed into infrastructure, with fund managers all the while knowing that infra returns are going to fall – not because of business fundamentals but just supply/demand dynamics associated with infrastructure deals. Indeed, where productivity issues have been central to our current bout of economic troubles, we think it makes sense that projects to develop assets whose purpose is to make life easier and more efficient are more scarce.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Source links Google News