[ad_1]

Pgiam/iStock via Getty Images

We believe in the theory of contrary opinion, and the Sentiment King focuses on studying and measuring investor sentiment. This article is part of a continuing series of articles (here) on how to use investor activity in exchange-traded funds (“ETFs”) to help determine the direction of the stock market. Since ProShares has over 130 ETFs with more than $50 billion in assets – many with 2X and 3X leverage – it is the perfect fund family to use for this purpose.

SDS – ProShares UltraShort S&P 500

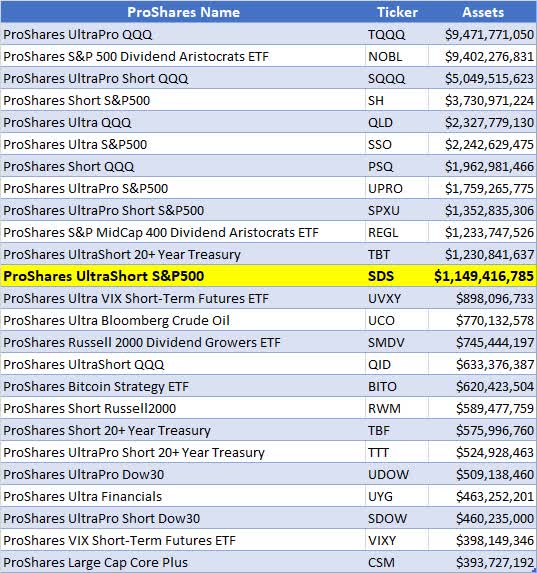

SDS is one of a number of 2x ProShares ETFs (the Ultra Series) that goes double-short a major market index, in this case the S&P 500. It has 21.2 million shares outstanding and total assets of $1.149 billion. By assets, it’s ranked 12th of 136 funds in the ProShares family.

ProSahres Asset Ranking (Michael McDonald)

ProShares writes the following about SDS:

ProShares Ultra S&P500 seeks a return that is 2x the return of its index (target) for a single day, as measured from one NAV calculation to the next. Due to the compounding of daily returns, holding periods of greater than one day can result in returns that are significantly different than the target return and ProShares’ returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period. These effects may be more pronounced in funds with larger or inverse multiples and in funds with volatile benchmarks. Investors should monitor their holdings as frequently as daily. Investors should consult the prospectus for further details on the calculation of the returns and the risks associated with investing in this product.

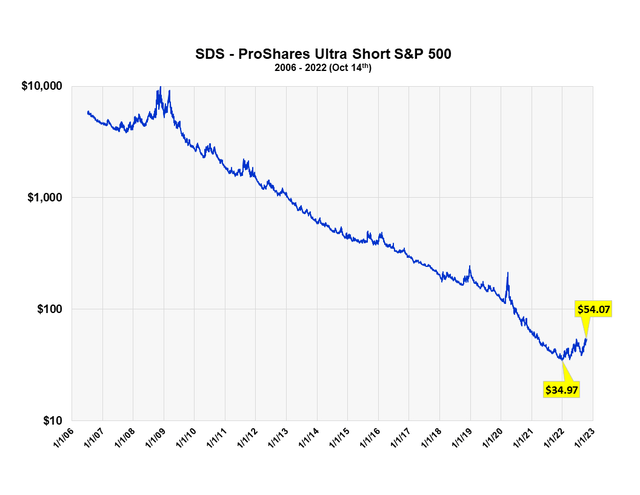

SDS Graph

This graph shows the entire price history of SDS since its inception on July 11th, 2006. The fund started with an adjusted price of $5,600 and it’s currently at $54.07. This is a loss of 99% and is due to the 2x leverage, low interest rates and the long-term bull market that began during the financial crisis of 2008 and severely punished short selling.

At the beginning of the year, the fund was priced at $34.97. During the bear market, the price has risen 55% to $54.07 as of October 14th. These facts highlight why leveraged ETFs should only be used for short to intermediate-term movements and not as long-term investments.

The Adjusted Price of SDS Since Inception (Michael McDonald)

Purchasing Levels Of SDS

How do you measure investor buying in ETFs? Looking at sales like one does any stock is insufficient, since it doesn’t specify how much is from investor buying. With stocks, sales do represent the amount of buying, since buying and selling amounts are always equal. But with ETFs they aren’t. If there are more buyers than sellers of an ETF, the fund creates more shares for the excess buyers. If there are more sellers than buyers, they retire the excess shares.

So, sales numbers alone don’t tell you how much money is going into or out of an ETF; you must combine sales with changes in the number of shares outstanding to determine that. Once this is done, multiplying the number of shares being purchased by the fund’s NAV yields how much money is going into the fund on a daily basis.

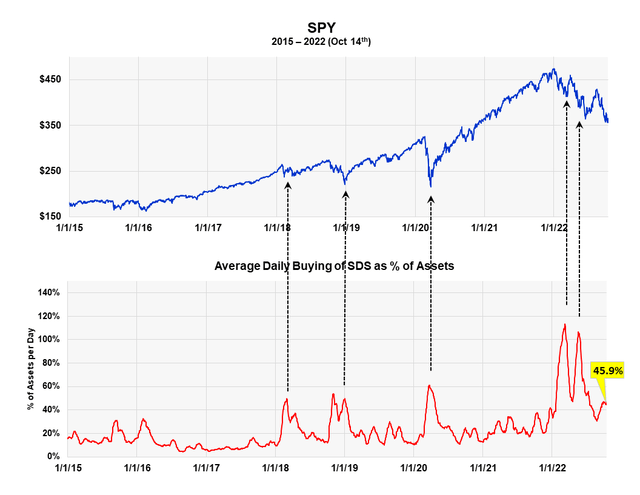

Measuring the dollar amount going into a fund is not the best measure, however. What’s better is the amount of money going into the fund divided by the total assets in the fund. Producing a ratio allows for historical comparisons; absolute values don’t. The current daily purchasing ratio for SDS is 45.9%.

Graphs the Price of SPY against historic Purchasing levels of SDS (Michael McDonald)

As the graph shows, the current purchasing ratio is less than at all major intermediate and bear market lows since 2015, including the two peaks in buying this spring, when the ratio went over 100%. These large purchase ratios, which are average dollar purchases per day divided by total assets, is one indicator that shows how many short-term traders trade SDS.

The current ratio of 45.9%, while higher than average, it’s still below the levels reached at past major lows. If one believes in this historical SDS data, the obvious conclusion would be that the bear market is not over and probably won’t be until more investors trade SDS. This relatively low purchasing level is similar to the low level in the ProShares QLD.

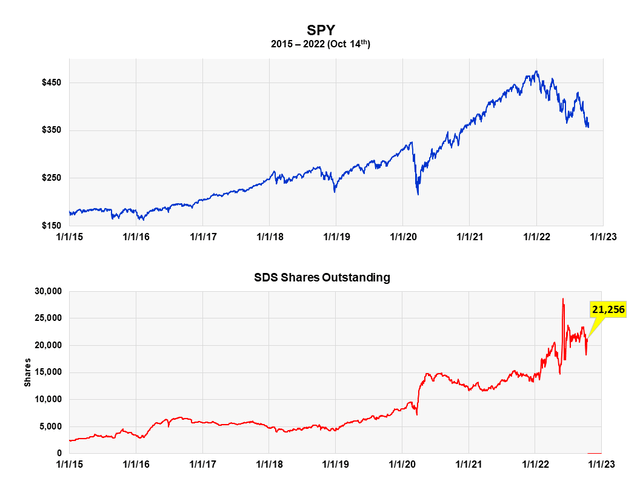

The History Of Outstanding Shares In SDS

The graph below plots SPY against the number of shares outstanding in SDS. When more investors enter a fund than leave it, the number of shares outstanding increases. When more investors sell the fund than buy it, the number deceases. The current number is 21,256,000 shares.

Shares Outstanding of SDS graphed against SPY (Michael McDonald)

While it is usually helpful to graph changes in the number of shares outstanding of ProShares ETFs – as you can see (here) and (here) in two previous ProShares articles – it does not appear to have as much value here. For one, there appears to be a lot of noise in the data this year. It is clear from the chart that a very large trader purchased a large number of shares at the beginning of June and then sold a week or two later.

That said, what normally happens with SDS is that the number of shares outstanding decline near the bottom of the market, and then expand dramatically as the market rallies. We haven’t seen that yet. The lack of a significant drop in SO during this bear market may mean we are possibly headed lower. It seems to reinforce the idea that the final shoe hasn’t dropped and further price declines are needed to finally bring in more buyers to SDS.

However, other sentiment indicators, including one formed from investor activity in the entire ProShares family, seem to point to the opposite conclusion.

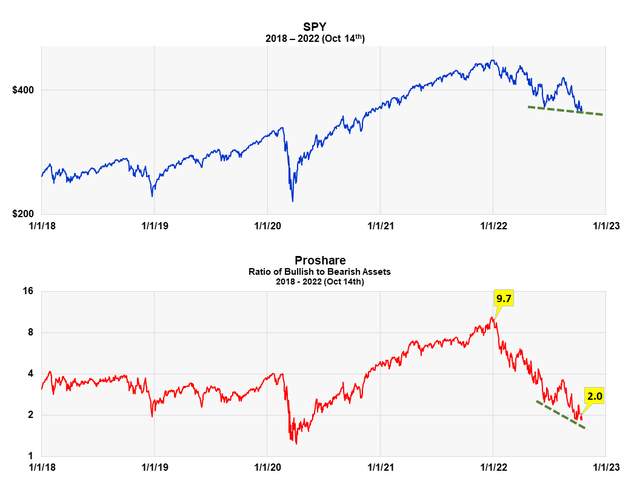

The Ratio Of Bull And Bear Assets In ProShares ETFS

The ProShares bull to bear asset ratio is another way we measure investor sentiment or expectations. It’s a contrary opinion indicator. It takes the dollar value in all the ProShares bull funds and divides it by the dollar value of all the bear funds. At the market top in December there was over 10 times more money in bullish ProShares ETFs than bear market ETFs. It is now down to a little over two.

For example, the graph clearly shows the surge of money into ProShares bull funds from September to December of last year, right before the start of the bear market. The ratio went from 6.5 to 10.5. Extremely bad timing. The current ratio is two to one, which is much closer to the bear market lows of 2020.

Compares the ratio of bullish to bearish Proshare assets against SPY (Michael McDonald)

What’s important now is that the asset ratio went to new lows as the S&P just slightly broke below the price lows of May. Notice the two broken green lines in the graph. It’s flat for stocks and slanted lower for the ratio. This means that even more ProShares investors believe the market’s headed lower than at the May low. This again is what you want to see if you’re a contrarian. It suggests stock prices should move higher over the intermediate term. This idea is just not yet confirmed by metrics on investor activity in SDS. It is confirmed, however, by the Master Sentiment Index, which is registering the most extreme bearish reading in 17 years. If you are a contrarian, this is positive.

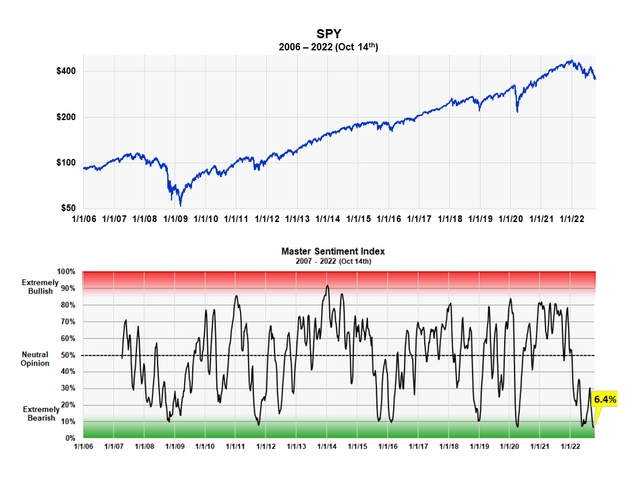

The Master Sentiment Indicator At Its Most Extreme Reading

The 16-year chart below plots the Master Sentiment Index, which is a composite index made from seven established sentiment indicators, against the S&P 500 SPDR ETF (SPY). The seven indicators include the total puts to calls ratio, the equity puts to calls ratio, the American Association of Individual Investors survey, the NAAIM survey, Hilbert sentiment statistics, investor activity in the ProShares S&P short fund (SH) and the CME commitment of trader data. All the information below is as of October 14th. The MSI is designed to signal long-term market trends; it is not a short-term indicator.

Graphs the History of the Master Sentiment Index (Michael McDonald)

It is easy to see the correlation between major market lows and extreme bearish readings on this index. The current reading of 6.4% is the same as last week and is the lowest number over the last 17 years. If you are a contrarian, this is highly bullish for the stock market.

An Important Caveat

While I’m not so worried about the American economy dragging the stock market much lower, I am worried about a global financial crisis doing it, triggered by the actions of narrow-minded central bankers focused on just their own economy. While central banks are looking after their own economies, no agency is looking after the well-being of the entire global financial system. This is a serious issue which I explain in the second half of the article (here) I wrote on the Puts and Calls ratio.

[ad_2]

Source links Google News