[ad_1]

vadimrysev/iStock via Getty Images

Art Cashin has been working on Wall Street for over a half century. He’s a managing director and the Director of floor operations at the New York Stock Exchange for UBS Financial Services. He’s also a frequent guest on CNBC as he has had a first-row seat for the bull and bear markets in his career. Early in his career, Art learned a lesson that is relevant today as Russia has been saber-rattling and threatening a nuclear strike in Ukraine and, perhaps, beyond its borders. In late 2021, Art told CNBC:

This particular story centered around the very dark days of the Cuban Missile Crisis in late 1962, when it momentarily appeared as if nuclear war was about to break out between Russia and the U.S. A panicked, very young Art Cashin thought he was being smart by buying stock puts, a bet the market would drop.

He ran to the bar where Professor Jack was drinking and told him what he had done.

“And he said to me, “Kid, sit down and buy me a drink.” That was tuition for school. I paid tuition by buying Jack Scotch Old Fashioneds and class lasted as long as I could afford to buy them, or as long as Jack could talk after drinking.”

“I offered him a drink. And he said, ‘Now, sit down and listen to me.’ And I said, ‘yes?’ And he said, ‘When you hear the missiles are flying, you buy them, you don’t sell them.’

“And I said, ‘You buy them? Why would you buy them if the missiles are flying?’

He said, “You buy them because if you’re wrong, the trade will never clear. We’ll all be dead!”

“I loved him, I said you don’t ever learn that in the Wharton School or the Stern School. This man in this bar has just given me an insight about Wall Street that will last me forever. That things are not often what they appeared to be on the face of it and think of the ultimate consequence and that’s the action you take.”

Art’s wish for 2022: “Let’s keep the missiles from flying.”

Source: CNBC

The takeaway is critical in the current environment. However, the Russian aggression, tensions with China surrounding Taiwan, and nuclear aspirations for North Korea and Iran mean that the US, Europe, and the rest of the world will pay a lot more for defense over the coming months and years. The iShares US Aerospace and Defense ETF product (BATS:ITA) holds shares in the leading US contractors that will continue to profit from the global military buildup.

Severe threats to world peace

Russia and China agreed on a massive trade deal at the Beijing Winter Olympics opening ceremonies in early February 2022. Moreover, President Putin and Xi shook hands on a “no-limits” alliance. Russia waited until after the closing ceremony to invade Ukraine, and eight months later, the war on Western Europe’s doorstep continues to rage.

Russia considers Ukraine part of its territory, while China believes Taiwan is not a sovereign country and a breakaway republic under its umbrella. The US and Europe support sovereignty for Ukraine and Taiwan, causing dangerous bifurcation between the world’s leading nuclear powers.

President Putin had assumed and hoped Ukrainians would greet Russian troops with flowers, but the response has been fierce, causing mounting losses and ongoing battles. This week, after Ukraine took out a critical logistical supply route, a significant bombing campaign commenced. Russia is mobilizing more troops, and Ukraine is receiving substantial military and monetary support from the US and NATO countries. So far, China has stood behind Russia.

Responding to sanctions and Ukrainian aid from “unfriendly” countries, Russia has retaliated using energy as a weapon. Natural gas flows to Europe have declined, and threats have increased. The Russian President has said that he views Ukrainian support as an existential threat to Russia, opening the door for using tactical nuclear weapons or even long-range nukes in response. The bottom line is the world faces the most dangerous nuclear threat since the 1962 Cuban Missile Crisis. Since markets reflect the economic and geopolitical landscapes, the nuclear threat has only intensified selling pressure in the stock market alongside rising interest rates and the strongest US dollar in two decades. Higher interest rates attract capital away from stocks to bonds. A rising US dollar weighs on US multinational company earnings, making the US less competitive against other worldwide companies. The nuclear threat has only turbocharged the bearish price action in the US stock market.

MAD Equals Fear

In late 1989, when the Berlin Wall fell, the term MAD nearly disappeared from the global vernacular. Mutually assured destruction was the concept that saved the world during the 1962 Cuban crisis and throughout the cold war between the US and Russia. The potential of nuclear winter and incalculable death toll created a standoff that saved the world from atomic weapons. Since the US dropped two atomic bombs on Japan on Aug. 6, 1945, there has been no deployment of nuclear weapons.

Recently, the Russian President cited the US’s 1946 bombing as a precedent and justification to potentially end the Ukraine war. President Putin and other Russian officials have threatened to use tactical nuclear weapons in Ukraine to force a surrender. The potential for atomic war is causing global fear of the unthinkable consequences at a time when the world is emerging from the impact of the COVID-19 pandemic. Markets operate on fear and greed, and nuclear war could be history’s most significant fear-producing potential. Aside from calls for a US recession, inflation at the highest level in four decades, and the US political division heading into the mid-term elections, nuclear war is more than a cherry on top of a bearish sundae for the stock market.

Military spending will continue to soar

Germany and Japan disarmed at the end of WW II, leaving Stalin’s Russia and Truman’s US the world’s leading powers. Over the past decades, the rise of China and the fall of the former Soviet Union changed the dynamic. The Chinese-Russian alliance opposing the US and its NATO partners and allies in Asia means that Germany and Japan will dramatically increase their military capabilities. The war in Ukraine and former Soviet satellites are on Germany’s borders, and North Korea and China threaten peace and security in Japan. Moreover, the US and its allies have been shipping arms to Ukraine. The military support and increasing tensions mean weapons budgets will soar over the coming years. Defense contractors in the private sector stand to reap the benefits of geopolitical tensions.

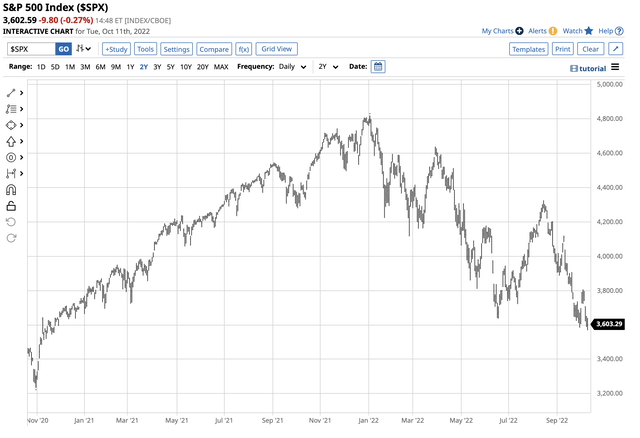

In 2022, the S&P 500 index plunged.

Chart of the S&P 500 Index Losses in 2022 (Barchart)

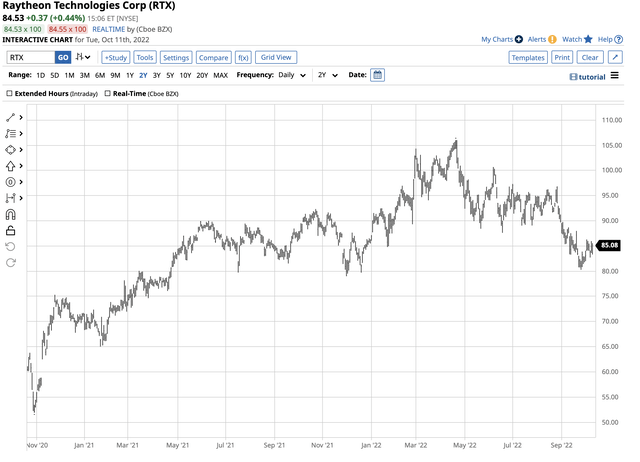

At the 3,600 level, the most diversified US stock market index is over 24% lower than the closing level on Dec. 31, 2021. Shares of one of the leading defense contractors, Raytheon Technology Corporation (RTX), have outperformed the S&P 500.

Chart of RTX Shares- Outperforming the overall stock market in 2022 (Barcahrt)

The chart shows that RTX shares at $84.53 were only 1.8% lower than the 2021 closing level on Oct. 11. RTX’s $2.20 dividend, translating to a 2.6% yield, means shareholders are above water in 2022 while the stock market has plunged.

ITA is a liquid defense and military ETF product

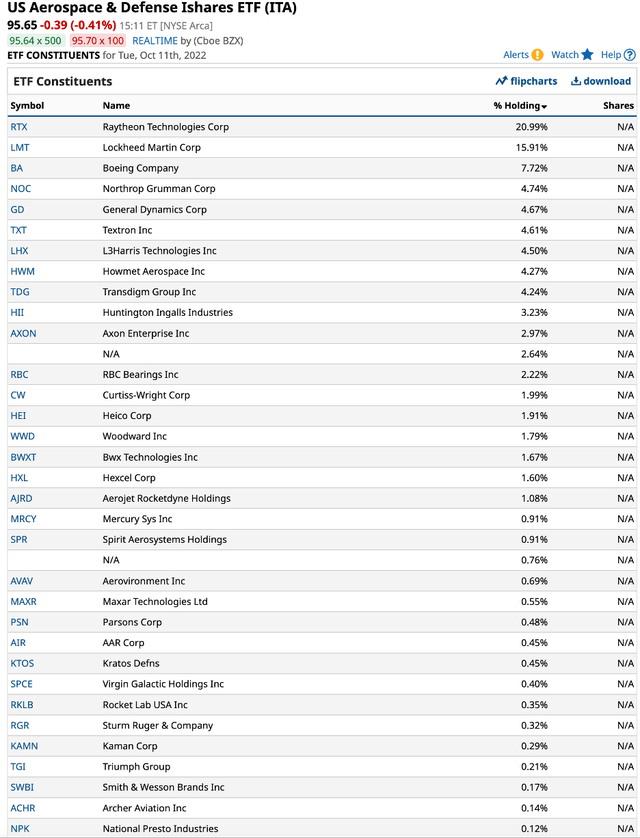

The top holdings of the iShares US Aerospace and Defense ETF product (ITA) include:

Top Holdings of the ITA ETF Product (Barchart)

The ETF holds a nearly 21% exposure to RTX and owns shares in many of the other leading defense contractors, including an over 33% exposure to Lockheed Martin (LMT), Boeing (BA), Northrop Grumman (NOC), and General Dynamics (GD). The ETF also holds shares in many other top contractors supplying weapons systems and military equipment in the US and worldwide.

At the $95.78 level, ITA had over $3.582 billion in assets under management. The ETF trades an average of 372,214 shares daily and charges a 0.42% management fee.

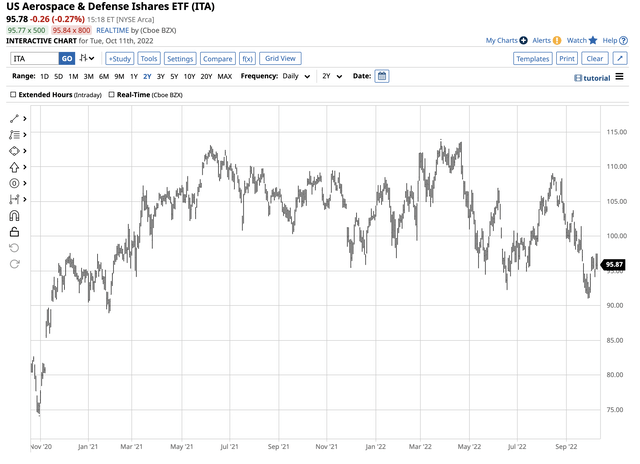

Chart of the ITA ETF Product (Barchart)

ITA moved from $102.78 on Dec. 31, 2021, to $95.78 on Oct. 11, a 6.8% decline, far outperforming the over 24% drop in the S&P 500 over the period. ITA pays shareholders a blended $0.98 dividend or a 1.02% yield, slightly improving its 2022 performance.

A potentially safe investment in 2022 and 2023

Watershed geopolitical events in 2022 will likely support the ITA ETF as military spending is going nowhere but higher. It’s more than challenging to find safety in the stock market in October 2022, with Jamie Dimon and other leading market movers and shakers saying the stock market could fall another 20% or more before it finds a bottom. Meanwhile, a defensive portfolio should contain defense stocks in the current environment as the bifurcation between the world’s nuclear power translates to far higher military budgets for as far as the eye can see.

Art Cashin learned a lesson in 1962 that we should all embrace as the fears of a nuclear war increase. However, defense stocks could be the best line of defense for our nest eggs over the coming months and perhaps, years.

[ad_2]

Source links Google News