[ad_1]

OwenPrice/E+ via Getty Images

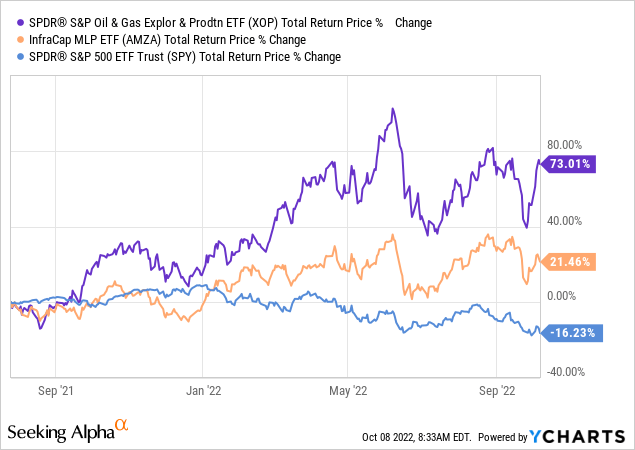

Investing comes down to choosing the best alternative amongst the choices you have. That best choice for you might not be the same for someone else. Nonetheless, you need to figure out what that choice is. In our own case, we came into 2022 with a bullish view on energy and that was the easy part. The harder part was which sector would serve us best. In looking at this, we saw two distinct categories. The midstream sector, represented best by the InfraCap MLP ETF (NYSEARCA:AMZA), and the oil exploration and production sector, best represented by the SPDR S&P Oil & Gas Exploration & Production ETF (NYSEARCA:XOP).

The Story So Far

In July 2021, we wrote about the two and concluded, why midstream was likely to lag. There was no mystery message there, and you did not even have to get past the title.

Seeking Alpha

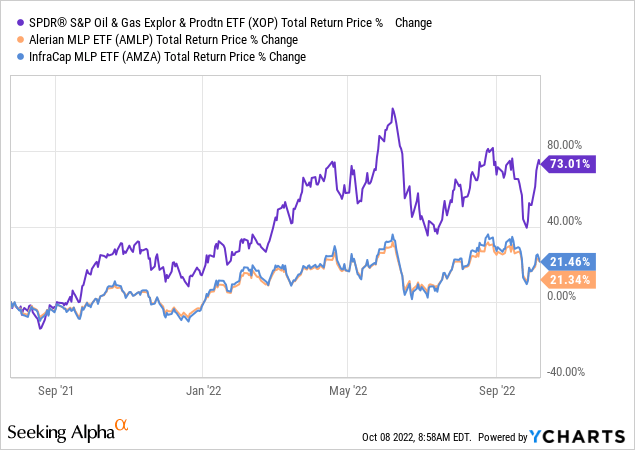

We doubled down on that message in late December (see DUC TALES), even though it ate into our Christmas celebrations. We stuck with that again in July 2022. Mind you, we never rated AMZA a Sell, it was always a “Hold”, but we did put Buy ratings on XOP and several other individual exploration and production companies. Since our first article, XOP has beaten AMZA by 51.57%.

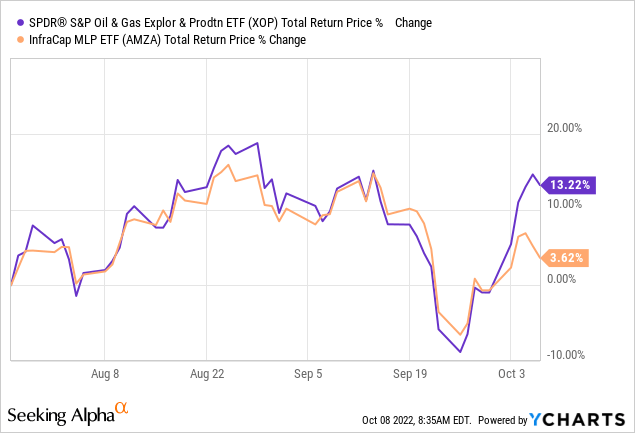

Since our last article, XOP has outperformed by about 10%.

We look at what has worked and what has not, and whether the trade may be ending to the point we can give equal weightage to both these.

Outperformance Reason 1

The first reason we favored upstream over midstream was that we were absolutely certain that analysts were overestimating the supply response. Exploration and production companies were tired with years of poor returns and disgruntled shareholders. All excess cash flow was going towards improving the poor balance sheets, or towards buybacks and dividends. Yes, the supply response was coming, but they were in no hurry and month after month of EIA reports disappointed. Anyone who thought that midstream would do as well as upstream, likely counted on a brisk production increase to cap oil prices and increase flowing volumes. That was proven wrong and continues today as well. Midstream pricing power is still about average and upstream continues to favor shareholder returns over patting themselves on the back on a self-destructive strategy. There is some pick up happening though and these numbers should help midstream a bit more.

Due to sustained higher oil prices, World Oil forecasts a noticeable uptick in drilling activity for the remainder of the year, projecting 18,600 total wells for 2022—a 34% increase from the 2021 count of 13,877. Total footage is projected to increase from 191.5 MMft in 2021 to 256.4 MMft in 2022—an increase of 34%. During 2022, 8,769 wells are estimated to have been drilled during the first six months, while 9,831 are expected to spud in the second half of the year, for a half-to-half increase of 12.1%. A 14.9% increase in footage is expected in the last six months.

Despite a sizeable drop in recoverable resources, U.S. oil production remains on track for a record in 2023, even as output grows more slowly than anticipated amid increased costs and labor shortages in America’s shale fields. Output is expected to expand at an average 840,000 bopd next year, down from a prior forecast of 860,000 bopd, according to the EIA. While production is still seen reaching an all-time high in 2023, the government revised its forecast slightly lower to 12.7 MMbopd. The current, annual, U.S. record average is 12.3 MMbopd, set in 2019.

Source: World Oil

With more pipelines being used, revenues and pricing power should improve for midstream and this becomes less of a relative tailwind for XOP’s outperformance vs AMZA.

Outperformance Reason 2

Tightening oil supply demand fundamentals, coupled with a very steep backwardation in the futures curve, meant that inventories would be drained quickly. We saw this coming and felt that it would be really bad for storage assets. That is one reason we have stayed away from a buy rating on firms like NuStar (NS), even though we liked the pipeline side of the story. US inventories have fallen a lot over the last 15 months and storage pricing power is likely be extraordinarily weak. This reason for upstream outperformance has actually gotten stronger.

Outperformance Reason 3

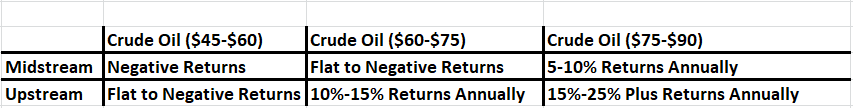

Valuation has been the biggest reason we felt that upstream would do better. We explained how that would likely play out at different price points last July.

Author’s Estimates & Forecasts

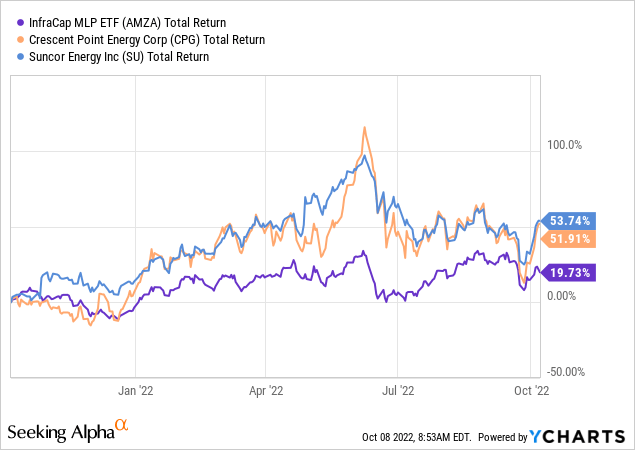

Over the last 15 months, crude oil has averaged at the upper end of the column. In the last 9 months, it has exceeded the upper band of the third column. This essentially explains the bulk of our returns with our largest holdings having delivered big returns vs. AMZA.

Verdict

It is easy to hop off a train too soon. We all want to declare victory and move away from the pressure of the competition. Here, it is certainly tempting as well. There is nothing wrong with ending the call, when we are up over 50% on it. That is not what we are going to do. Weighing all three forces playing out currently makes us confident that upstream should outperform midstream, again, over the next 12 months. We expect prices to average in the middle of the third band once more and that gives us confidence in our forecast. One extraordinary aspect of XOP beating AMZA is that XOP does not use leverage, while AMZA does. We used AMZA in our comparisons as it is a popular ETF we followed for a long time. XOP’s performance to an unleveraged midstream vehicle, ALPS Alerian MLP ETF (AMLP) shows that AMZA, despite its leverage, is not beating AMLP.

We do like select midstream plays for income (see here and here), but from a total return standpoint, XOP is the horse we are betting on. XOP won’t wipe the floor with AMZA like it did in the past 15 months, but it should outperform.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

[ad_2]

Source links Google News