[ad_1]

270770

The ETFMG Prime Junior Silver Miners ETF (NYSEARCA:SILJ) provides exposure to a cohort of small-size precious metal mining stocks with a material share of revenues coming from silver, including both pure- and non-pure plays.

SILJ bulls would note here that the long-term supply/demand picture for the white metal looks rather bullish owing principally to the industrial and energy end-markets, and highly volatile plays like the small-cap mining ETF are the best way to capitalize on it.

Are there downsides? Aplenty. To profit from the demand trends using SILJ, investors should be prepared for frenetic price swings and steep drawdowns.

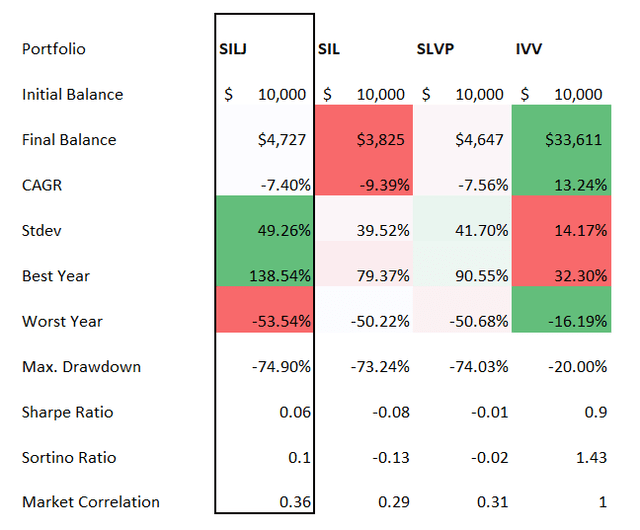

We expect this highly volatile concentrated SILJ to outperform the U.S. bellwethers like the iShares Core S&P 500 ETF (IVV) during the bull markets and meaningfully underperform them during the bear phase. For context, during the silver price rally of 2016, SILJ delivered an astounding 138.5% gain while IVV rose by just slightly more than 12%. It also outperformed its peer funds Global X Silver Miners ETF (SIL) and iShares MSCI Global Silver and Metals Miners ETF (SLVP). Yet, its max drawdown since inception is a staggering 75%. We are also uncertain whether topping up allocation to silver makes sense to immunize portfolios against the repercussions of a recession or stagflation as historical data is mixed.

Investment strategy: looking under the hood

SILJ’s investment mandate is to track the modified float-adjusted market-cap-weighted Prime Junior Silver Miners & Explorers Index. Please take notice that before August 2017, its underlying index was the ISE Junior Silver (Small Cap Miners/Explorers) Index.

The index draws its components from a small-size league of exploration & production silver mining companies. To ensure the benchmark is adequately diversified, the index provider mixes pure plays or those with 50% or higher contribution of the white metal to the top line with non-pure ones. This implies investors should be prepared for gold, cobalt, copper, and other metals influencing the fund’s returns.

According to the methodology, companies with market values from $20 million to $3 billion are eligible. They would not be removed unless the market cap plunges below $10 million.

In the current version, the fund oversees a portfolio of 55 stocks and is concentrated in Turquoise Hill Resources (TRQ), a Toronto-quoted copper-focused miner also producing gold and silver, with around 15.8% of the net assets allocated. TRQ is a grossly profitable company, with the highest net income amongst the index constitutes, over $699 million in the last twelve months. The stock has seen a meteoric price growth this year, delivering an over 94% return. What investors should pay attention to here is that Rio Tinto (RIO), a mining juggernaut, will acquire the remaining shares in TRQ, thus the stock will be removed from the SILJ portfolio as a consequence; assuming the special meeting of the Turquoise Hill shareholders is anticipated in Q4, I expect TRQ will be no longer SILJ’s top investment in early 2023.

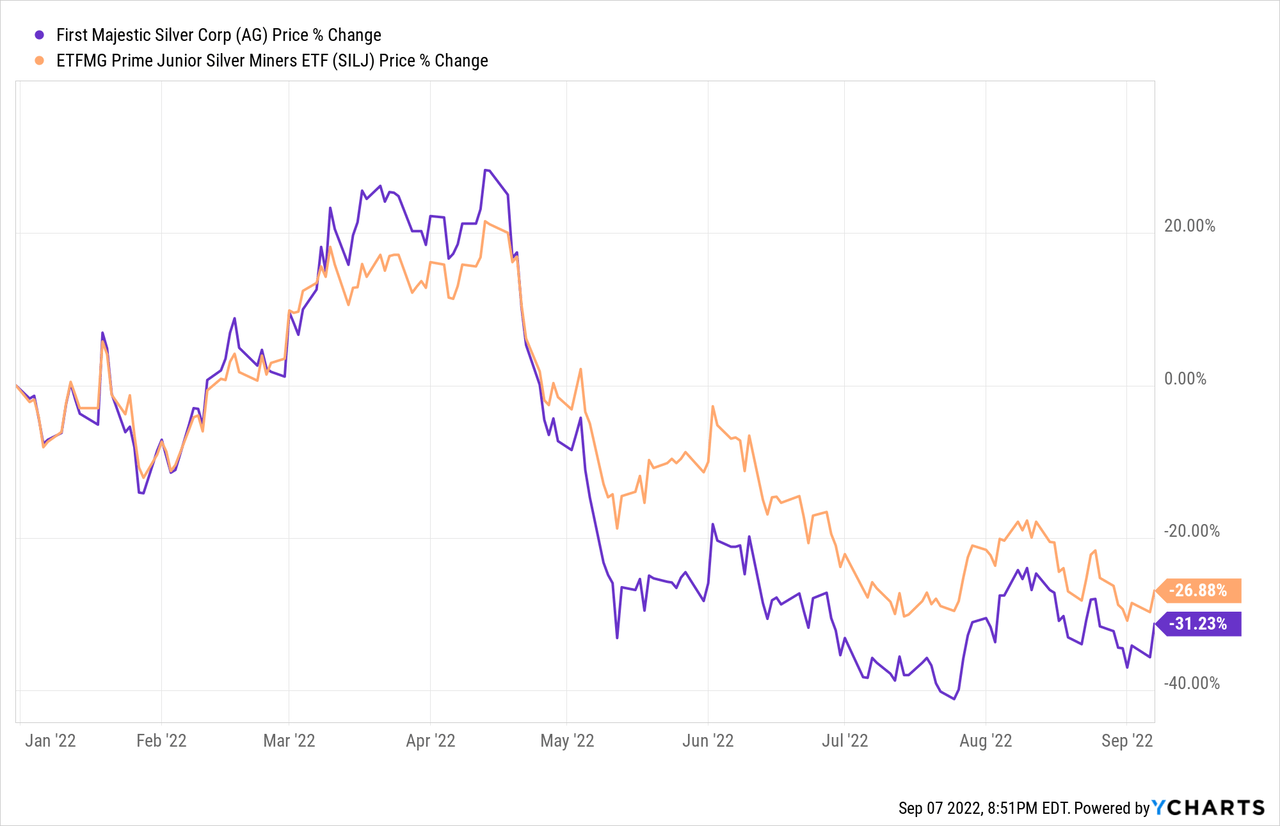

First Majestic Silver (AG) comes second, sporting almost 14% weight. AG is technically a small-cap, with a market value marginally south of $2 billion after a painful ~46% price decline since the beginning of the year, mostly owing to the white metal’s lackluster price performance since March.

It operates principally in the U.S. and Mexico, with the San Dimas Silver/Gold Mine located in Durango and Sinaloa states and the Santa Elena Silver/Gold Mine located in Sonora state being its major assets. AG derives roughly 50% of its revenues from silver with the remaining share coming from gold.

Delving deeper into the portfolio, there are numerous nano-cap plays, some still in the exploration stage and yet to deliver first revenues. Amongst examples worth mentioning there is Canada Silver Cobalt Works (CCW:CA), a ~C$20 million nano-cap with revenues only to be achieved at some point in the future, and with ~C$3.8 million spent on exploration and evaluation in H1 2022. The silver lining is that SILJ’s exposure to such companies is fairly small, i.e., CGW:CA accounts for ~0.02% of the net assets.

Long-term trends shore up the multi-year bullish case

There is a lot to like about the long-term trends bolstering the bullish picture for the white metal. Silver has a multitude of applications, from jewelry to healthcare and the industrial and energy end-markets, thanks to its conductivity and corrosion resistance. In my view, the latter two lie at the crux of the long-term bullish case. Specifically, the gradual shift towards renewables and the EV revolution are supposed to propel the demand for it together with copper, cobalt, etc., over the long term as silver plays a vital role in the fabrication of solar panels; at the same time, electric vehicles require much more white metal than legacy ICE cars.

Yet there are risks to the rosy demand picture. In case the energy woes exacerbate, with the oil and natural gas markets entering the phase of protracted supply chain recalibration, and with the LNG market supply/demand discussed in my recent note on the iShares MSCI Qatar ETF (QAT) worth mentioning, the trend could be meaningfully slowed down, reducing forecast growth for the white metal consumption and consequently resulting in sluggish price performance. Highly volatile plays like SILJ could experience steeper drawdowns in such an environment, and historical performance data discussed below support this point.

Risks surrounding the vehicle

There is a panoply of risks that come with the SILJ ETF.

Let us begin with the small-size factor. As I explained a few times in my articles, this factor correlates with weaker quality. Thus investors should be prepared for paltry EBITDA margins and measly or negative Returns on Total Capital. In the current version of the portfolio, around 22% of the holdings are cash-burning, which is a meaningful risk in the higher rates environment. Also, the quality-light strategy expectedly cannot produce a meaningful income, which is a painful downside for dividend investors who would be better off avoiding the ETF.

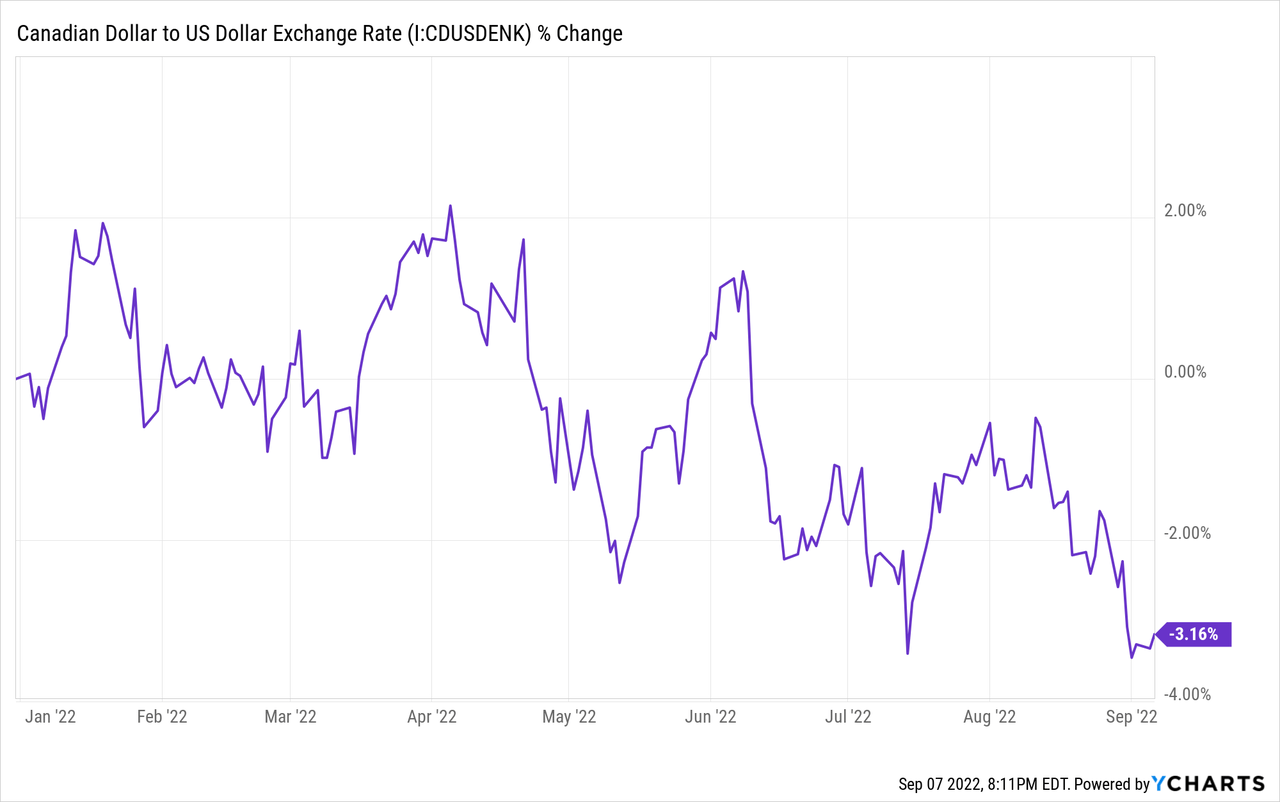

Next, please do not overlook the considerable exposure to the Canadian dollar owing to more than 60% of the holdings being Toronto-quoted. Another way of saying, investors who are bullish on SILJ should also be implicitly bullish on the CAD, and vice versa. If there are reasons they believe the loonie is prone to further decline, it would be better to steer clear of the junior silver miner’s ETF.

The Bank of Canada is fighting inflation vigorously, with the most recent aggressive interest rate increase of 75 bps announced on September 7, with even higher rates in the cards. This should be supportive of the loonie, yet this year it is still down ~3% vs. the USD even despite the oil price rally and exceedingly hawkish moves from the central bank including the 100 bps interest rate hike in July. And yes, it would be pertinent to note here that the oil price does indirectly influence SILJ’s returns since the CAD is considered an oil-dependent currency.

Next, volatility, drawdowns, and returns. In essence, the fund has never been a consistent outperformer. Its CAGR since inception (December 2012 – August 2022) is negative, while the maximum drawdown is simply dismal even compared to the peer silver mining ETFs. The best year (2016) is phenomenal, yet the worst year is horrible as it underperformed IVV and all the selected peers. The standard deviation speaks for itself. So the D- Risk Grade does not come as a surprise.

Created by the author using data from Portfolio Visualizer

In conclusion

There is no denying that SILJ ETF provides a solid opportunity to reap gains from the long-term structural trends that should gradually push the white metal price higher, principally stemming from demand created by the green revolution.

On the downside, there are the Canadian dollar risk, excruciating volatility, and steep drawdowns observed in the past. The latter two are barely surprising for an ETF with meaningful exposure to the small-size league of unprofitable companies, in many cases even without revenues. In sum, investors who can tolerate frenetic price swings to capture more upside should take a closer look at this vehicle. In other cases, SILJ is a suboptimal investment.

[ad_2]

Source links Google News