[ad_1]

peeterv/iStock via Getty Images

Opportunity Overview

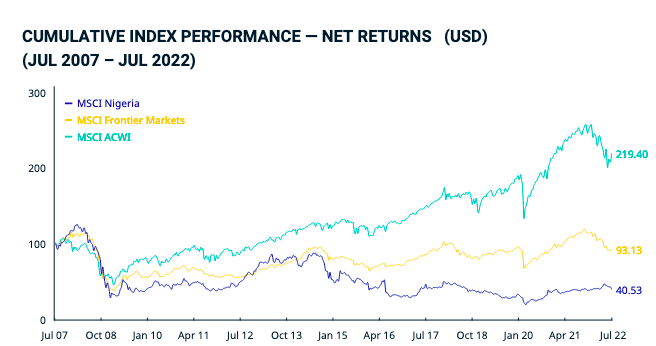

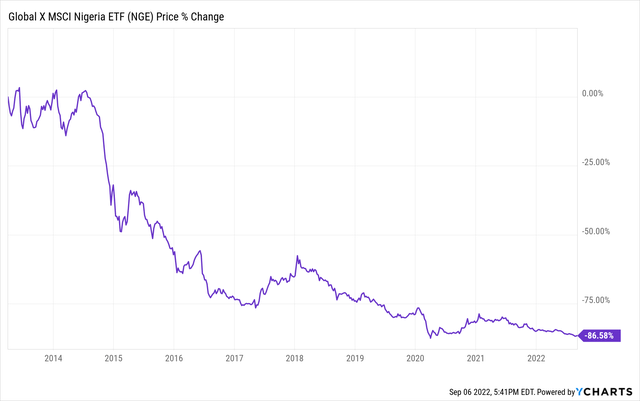

Nigeria has been a substantial underperformer among frontier markets since 2015, which was initially driven by a decline in oil prices in 2014.

MSCI

However, Nigeria has still not been able to perform well, even with oil prices recovering considerably in 2021 and 2022. Nigeria’s macroeconomic issues will likely run into 2022 and 2023, which means there are no significant catalysts for Nigerian equities in the short term. I’m still holding a very small position in the Global X MSCI Nigeria ETF (NYSEARCA:NGE), but I’m not too optimistic about the short-term performance of the market.

Nigeria will not benefit from Rising Oil Prices

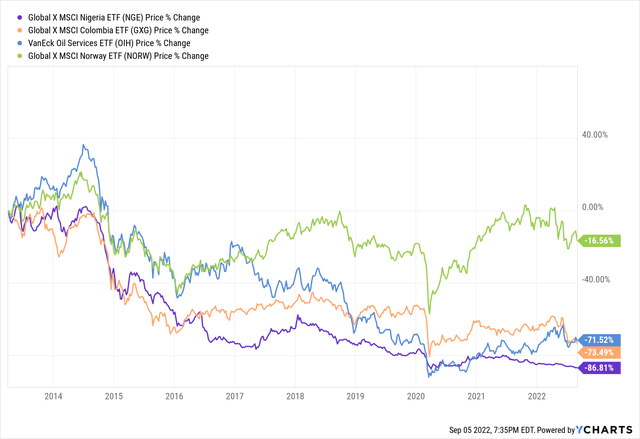

One of the key benefits I highlighted in my first article on Nigeria in 2015 was the potential for Nigeria to benefit from rising oil prices in the future, which could help boost the equity markets and eventually help create a more diversified economy. The market also traded at a very attractive valuation at that time and it still does. However, the recovery in the price of oil has taken longer than anticipated, and now Nigeria’s oil production has been declining. It’s unlikely that Nigeria will benefit from this trend, even if oil prices rise above $100/barrel again. The Global X MSCI Nigeria ETF has underperformed other ETFs in Colombia and Norway, as well as the VanEck Oil Services ETF (OIH). This continued especially during 2021-2022, when all of the ETFs rallied as oil prices rose.

Ycharts

Despite being the largest oil producer in sub-Saharan Africa, Nigeria has not been able to fully benefit from the increase in oil prices due to lower oil production. Nigeria’s oil production recently only reached 1.2 million barrels per day, compared to OPEC’s quota of 1.76 million. Energy subsidies in Nigeria have also become more expensive, which has put an increased burden on Nigeria’s debt.

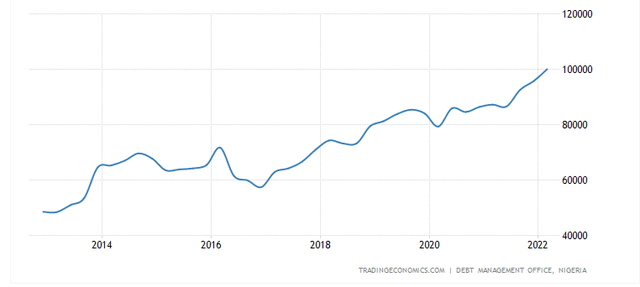

Although its public debt is much lower than that of other frontier markets, Nigeria still struggles due to the high percent of revenue spent on interest. Only 10% of government revenue was used for debt payments during 2014. The government will spendmore than 90% of its revenue on interest payments by 2022, according to the IMF. Revenue during the first four months of this year was not even sufficient to make interest payments.

Nigeria’s Public Debt

Trading Economics

Nigeria’s public debt has risen substantially since 2013.

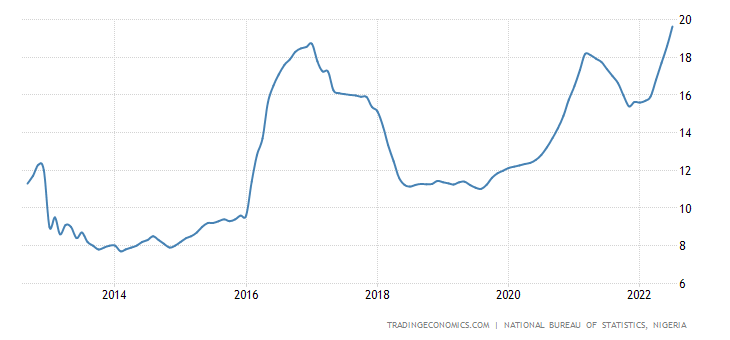

Inflation is still an issue

Nigeria’s inflation rate rose to nearly 20% during July 2022, which was driven largely by the increase in food and gas costs. Nigeria is heavily exposed to global commodity price movements and is a net importer of food.

Trading Economics

Inflation has been an ongoing issue, as inflation has already remained above 10% since 2016. Consequently, Nigeria’s Central bank rose interest rates for the second time this year, and the benchmark interest rate is currently 14%. This also could put a huge strain on banks, as consumer and business loans experience higher NPLs due to rising rates and inflation. NPLs have historically been as high as 37% in Nigeria.

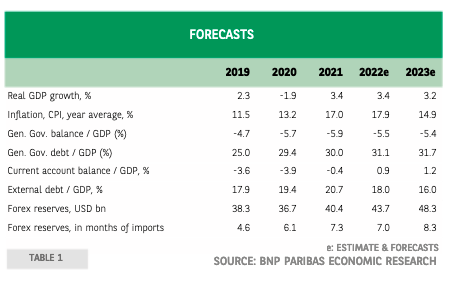

Mild Recovery from 2020

Nigeria is on track to recover from the decline in growth experienced in 2020. Nigeria previously experienced a recession during 2020, indicated by two consecutive quarters of economic contraction (6.1% and 3.2%) in Q2 and Q3 2020.

Nigeria’s economy had a current account surplus during 2021 for the first time in years, and growth should be somewhat favorable. However key issues remain, including inflation, increased public debt, and lower foreign exchange reserves. The deciding reserves have put a huge strain on Nigeria’s currency as well. Furthermore, Nigeria’s economy is not strongly diversified, and things could become worse if oil prices drop.

BNP Paribas Report

Nigeria’s economic progress will not be enough to drive a significant bull market in equities, and there are multiple lingering macroeconomic issues:

-

The projected 2022 budget deficit is 3.39% of GDP, which is slightly above the FRA’s ceiling of 3%.

-

Nigeria’s fiscal deficit is expected to reach 6.1% this year according to the IMF.

-

Agriculture and services grew by 2.6% and 5.6% in 2021, which helped to offset the 8.3% contraction in the oil sector. Overall, Nigeria’s economic growth in 2021 was 3.6%, compared to the 1.6% contraction in 2020.

-

Public debt was only 22.5% of GDP as of 2021 but is projected to rise to 40% of GDP by 2024 according to AFDB.

Although Nigeria’s public debt levels still seem low relative to its emerging market peers, the government still has to spend the majority of its revenue on interest payments. Declining oil revenues may further exacerbate this risk, as other sectors of the economy may not be able to make up for this shortcoming.

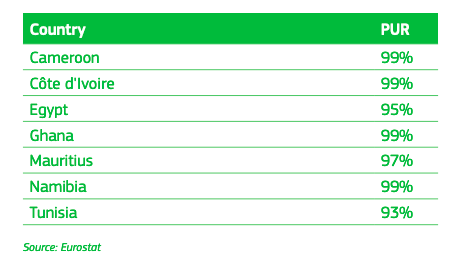

Manufacturing Challenges

I’m very interested in the potential of Africa, and Nigeria is an intriguing play that investors can access on US exchanges. Africa does have the potential to emerge as a manufacturing hub, which could be driven by multiple factors:

-

Countries may choose to diversify away from China and other markets to have more reliable supply chains.

-

Countries like Nigeria are close to Europe and could benefit from existing and new free trade agreements.

-

Africa can benefit as China and other Southeast Asian countries move up the value chain to focus on higher-quality exports.

-

Other regions, including China, Russia and MENA may express increased interest in countries like Nigeria in the coming decade.

Eurostat

However, Nigeria currently faces very strong competition from North African countries and is currently not positioned to be the main beneficiary of a lower-end manufacturing shift from Asia to Africa. Nigeria will need to continue to diversify away from oil to boost its manufacturing sector and export markets to fully exploit its position as Africa’s most populous country. However, this transition will take time, and Nigeria is not in an immediate position to leverage oil revenues to build a more diversified economy.

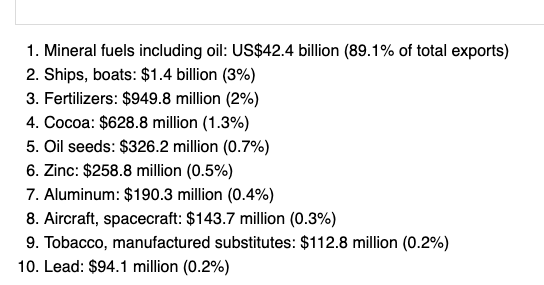

Nigeria’s manufacturing sector accounts for 10% of GDP. However, three sectors (F&B, textiles, and cement) account for 77% of total manufacturing output. Nigeria’s export structure is not very diversified, as it relies heavily on oil exports ( 89% of total exports). For example, Nigeria exports less than $6 million in textiles to its top 5 textile export destinations.

World’s Top Exports

The Transition Needed

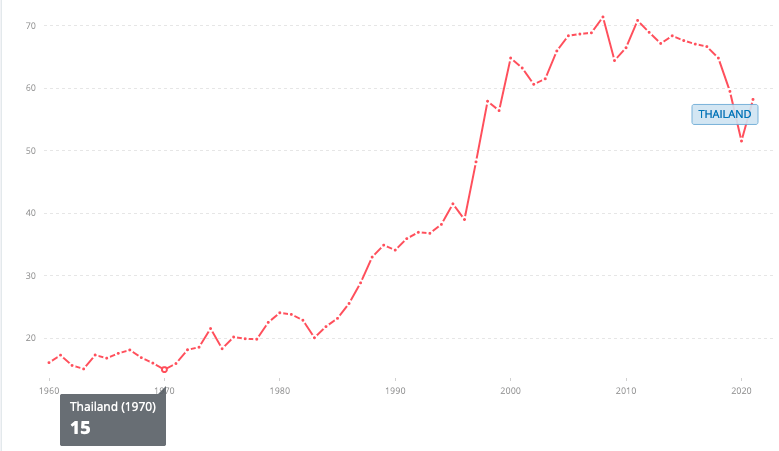

For Nigeria, and other countries in Africa to be successful, they would need to follow a similar transition that Asia undertook beginning in the 70s and 80s.

Exports as a % of GDP in Thailand

World Bank

For example, Thailand’s total exports as a % of GDP rose from more than 15% in 1970 to over 50% of GDP during the past two decades. The transition among other East Asian countries is roughly the same. This would be a very long endeavor and would require Nigeria to do the following:

- Diversify away from oil exports

- Develop closer trade relationships with MENA and Europe in particular

- Focus on lower-end exports as Asia moves up the value chain and develops an economic model that is more based on services rather than manufacturing

- Exploit the favorable demographic trends ( median age of 20 years old) during the next decade

Africa’s current state is definitely not similar to Asia’s past. However, these are all natural transitions that all economies go through. Africa’s path to growth involves a shift away from agriculture/resources to manufacturing and then to a services-based economy. Africa can’t compete with Asia, but it can begin to capture some of the lower-end manufacturing market share during the next decade.

Looking at Equities

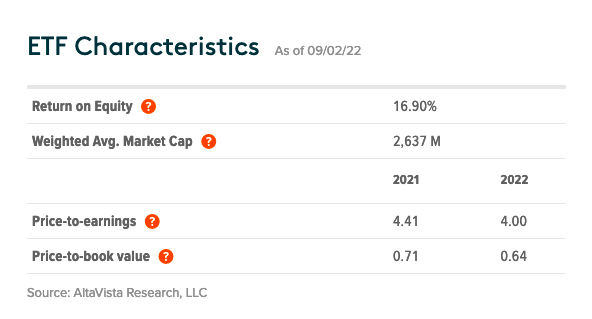

Equities in Nigeria do trade at a 28% discount to frontier markets, which is appropriate given the higher level of political and economic risk. I would be much more bullish if Nigeria’s oil production could meet OPEC quotas, allowing the economy to benefit from rising oil prices. But other sectors have had to carry the weight this year to help keep Nigeria out of a recession.

MSCI

There also are other cheap frontier and smaller emerging markets out there to consider.

|

P/E |

P/B |

Dividend Yield |

|

|

Nigeria |

7.44 |

1.54 |

8.0% |

|

Kenya |

8.82 |

3.03 |

5.6% |

|

Egypt |

5.44 |

1.18 |

4.7% |

|

Pakistan |

3.90 |

0.66 |

7.2% |

Source: MSCI latest data

Global X MSCI Nigeria ETF

I’m holding a small position in the Global X MSCI Nigeria ETF, which is the best vehicle for US investors to gain exposure to equities in Nigeria.

YCharts

It will probably take until the 2030s for this to play out, but there’s strong upside potential if Nigeria can rebound to previous levels.

Global X ETFs

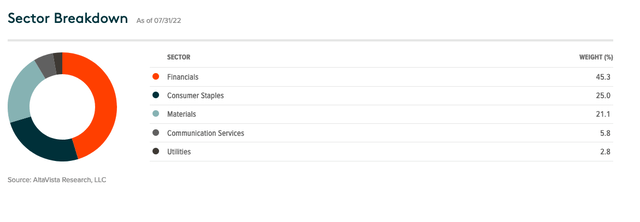

Like other ETFs, this ETF invests heavily in the financial sector, which results in a lower valuation for the ETF.

Global X ETFS

Over 90% of the ETF’s assets are invested in financial, consumer and materials stocks. This ensures that the ETF efficiently tracks Nigeria’s macroeconomic performance.

[ad_2]

Source links Google News