[ad_1]

naphtalina/iStock via Getty Images

Vanguard Financials Index Fund ETF (NYSEARCA:VFH) is an exchange-traded fund that seeks to track the performance of its chosen benchmark index, the “Spliced US IMI Financials 25/50” per its factsheet; this is a benchmark index constructed by MSCI with a methodology that caps any position exceeding 25% of the index, and caps 5% positions to no more than 50% in aggregate (i.e., 25/50, a popular method for reducing index/portfolio concentration). The expense ratio is just 0.10% (Vanguard funds are typically cheap), and assets under management were $8.9 billion as of July 31, 2022. There were 372 holdings.

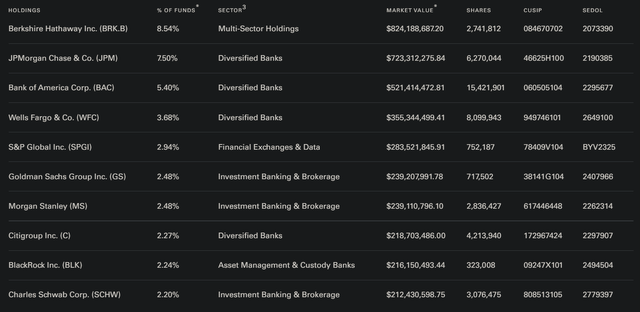

VFH does not just hold banks; Berkshire Hathaway (BRK.B) was VFH’s largest position as of July 31, 2022, at 8.54% of the portfolio. Berkshire Hathaway is Warren Buffett’s famously popular conglomerate of businesses. Nevertheless, most of VFH’s portfolio does consist of conventional financial institutions.

Vanguard.com

About 40% of VFH is concentrated in its top 10 holdings, which is not too concentrated if compared to other major indices (which tend to be over-weight technology companies). Currently, based on both historical and SEC-yield bases, VFH’s dividend yield is about 2.2%, which is well below the current U.S. 10-year yield of 3.2%. While dividend yields and bond yields should not necessarily be compared directly, VFH is invested in largely mature industries, and so the higher the delta here (in favor of risk-free bond yields), the pricier funds like VFH appear (at least intuitively speaking).

The main problem I have with VFH at present, is where we are in the cycle. VFH has done well on the back of growing inflationary pressures, and rates have risen alongside inflation rates (albeit not commensurately), and this typically supports the margins of lenders (financial institutions that VFH invests in). However, VFH is also another form of beta, given its portfolio breadth. On a year-to-date basis, the S&P 500 U.S. equity index has fallen by -18.19%, while VFH has fallen by -17.23%. The five-year beta for VFH is circa 1.23x. The point is, VFH is not a safe haven in the current macroeconomic nor market environment.

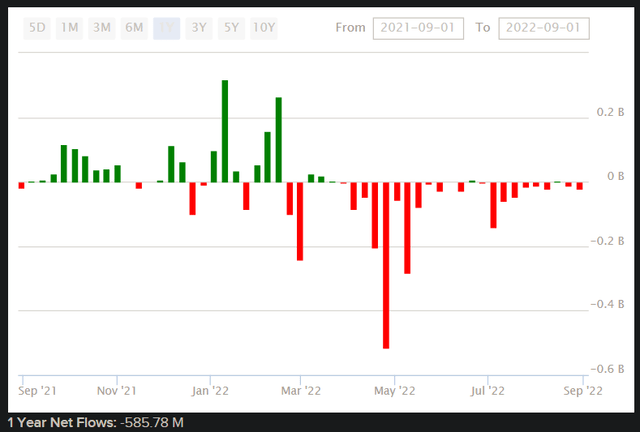

Further, inflationary pressures will eventually abate, we may well have a recession of some kind, and in any case yields are likely to peak. VFH is therefore likely to face some headwinds, and so I would imagine the “down beta” will exceed any “up beta”. Also, the rates and financials narrative outlined above has not exactly held up in 2022. Outflows have been strong and consistent over the past year or so.

ETFDB.com

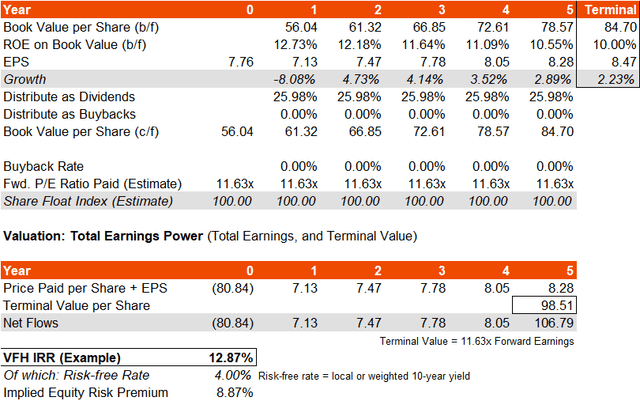

Since the uncapped benchmark index of VFH is not materially dissimilar to the capped version, we can use the data available from the former to gauge the valuation of VFH relative to the present price of $80.84 per share at the time of writing. The benchmark indicates, as of July 29, 2022 (admittedly slightly out of date by now), trailing and forward price/earnings ratios of 10.69x and 11.63x, respectively. “Post covid” earnings are therefore still on track to be lower for financials stocks, which makes sense given the lending boom during the “covid period”, hence the forward price/earnings ratio is higher than its trailing counterpart. The implied forward return on equity is however still strong at over 12%.

Assuming return on equity holds up at least 10% over the next few years, five-year earnings growth would (including the forward one-year decline of about 8% forecast) come out to circa 1.3% per year. That is weak, most likely below inflation (unless we get sudden deflationary pressures; a complete reversal from the present situation). Still, at least we can start with that conservative estimate. Valuing VFH on its total earnings potential on this earnings outlook, I arrive at an implied equity risk premium of circa 8-9%.

Author’s Calculations

Scaling back the implied ERP by VFH’s 1.23x beta, the ERP might be closer to 7.2%, which is still high. This is also using a somewhat arbitrary risk-free rate of 4% (the current 10-year yield), as mentioned, is lower, at 3.2%. I am being cautious and adding in some surplus in case of further 10-year lift-off. I think part of the problem is that, as the economic cycle matures, the demand for lending will fall, and risks will rise for lenders. We might see blow-ups, which could hit insurance company earnings. There are all sorts of pockets of risk that are liable to explode into recessions. Financials are riskier; they crashed harshly during 2007/08, and we saw a repeat of that into March 2020 (VFH fell harder than the broader equity indices).

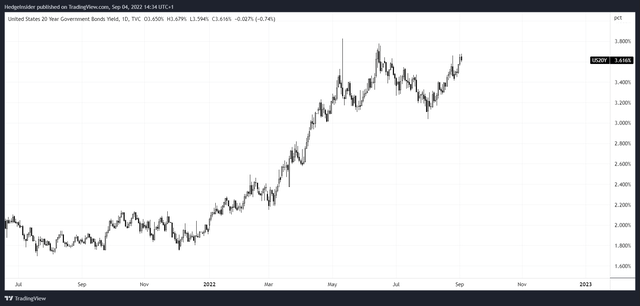

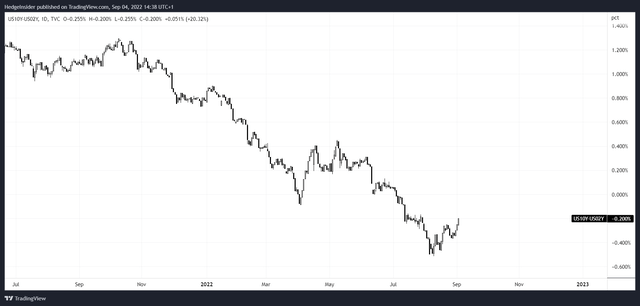

We are also seeing various yield curve inversions across the U.S. yield curve at the moment, and even the 20-year to 2-year spread inverted briefly in August. I actually think we will see more of this. For instance, the R* interest rate (basically, the U.S. central bank rate at which the economy is likely to move in a stable fashion; as to growth, inflation, unemployment, etc.) is less than 0.5% (see here). Long-term inflation, if the long-term past (driven by long-term supply-side factors, demographics, etc.) is any indication (and it usually is), is unlikely to exceed 3%. So, the U.S. 20-year yield should probably settle in the region of 0.5% + 2.5-3%, or 3-3.5%. It is currently at 3.6%.

TradingView.com

Meanwhile, in the short term, while inflationary pressures are high, the Federal Reserve is hiking rates. This month, on September 19, 2022, the Fed is due to meet again, and will (in my opinion) probably go for another 75-basis point hike (75 as opposed to less, given that this is on the table, and the long-term risks to the economy of persistently elevated inflation are too high to ignore). This would take the Fed rate to circa 3.25%, close to our 20-year yield range. And a recession is likely to drop growth and inflationary expectations down, which should put pressure on longer-term yields (hence the likelihood of further inversion). In any case, long-term yield spreads are marginal and will likely remain so, and this is negative for VFH (financials stocks). The 10-year/2-year spread, as illustrated below, remains inverted.

TradingView.com

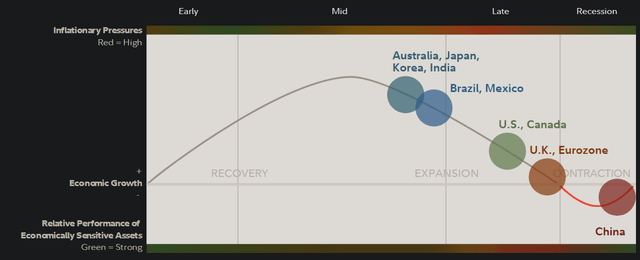

Only China, per Fidelity research, is likely to experience stronger bond yields in the medium term, given that it is ahead of the pack in terms of its current business cycle (as of Q3 2022).

Fidelity.com

The U.S., Canada, the U.K., and the Eurozone are all major economies that are likely due for a recession in the medium term. The stock market usually leads the economy, however more recently (probably given greater “financialization” and equity market participation) the stock market has become less of an abstraction. If the stock market is art, and the real economy is life, life is imitating art. The weaker the market, the more likely we will see a recession, and it would seem like this would be in the interests of major central banks given inflationary pressures.

I would reiterate the point: another 75-basis-point hike is likely this month, from the Fed. A lower stock market is almost an extension of monetary policy at this point. And with QT draining liquidity from the system, I am not optimistic on banks’ ability to out-perform broader markets at this juncture. Based on my basic valuation gauge, VFH does not look expensive, but it is priced for a risky period in the near term; expect elevated returns if inflationary pressures quickly abate without a material recession, but in all other cases, the elevated equity risk premium may well prove fair.

[ad_2]

Source links Google News