[ad_1]

jetcityimage

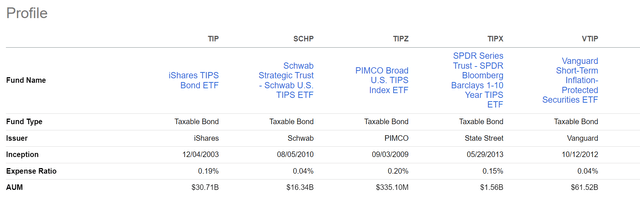

With inflation soaring, many investors may wish to seek the safety of Treasury Inflation-Protected Securities through investing in TIPS-focused funds like the iShares TIPS Bond ETF (NYSEARCA:TIP), the Schwab U.S. TIPS ETF (SCHP) or the PIMCO Broad U.S. TIPS Index ETF (TIPZ).

While individual TIPS may be protected from inflation with adjustments in its principal and coupons, investors are reminded that a fund of TIPS still suffers from duration risk, which has led to YTD losses. One possible solution may be to hold the TIPS-focused fund like the TIP as a pair trade against a medium-term treasury bond fund like the IEF.

Funds Overview

While this article mainly focuses on the iShares TIPS Bond ETF, the ideas are applicable to other TIPS-focused funds like SCHP and TIPZ. The TIP ETF is a fund that aims to track the returns of an index of inflation-protected U.S. Treasury bonds. It has $30 billion in AUM.

Strategy

TIPS-focused ETF funds provides convenient vehicles to invest in U.S. TIPS, government bonds whose face value rises with inflation.

Treasury Inflation-Protected Securities (“TIPS”) are well known bonds issued by the U.S. Treasury Department that provide protection against inflation. The principal of a TIPS increases with inflation as measured by the Consumer Price Index (“CPI”), and decreases with deflation. When a TIPS matures, investors are paid the greater of the adjusted principal or original principal.

TIPS pay fixed rate bi-annual interest that is calculated on the adjusted principal, so the interest payments increase with inflation as well.

Portfolio Holdings

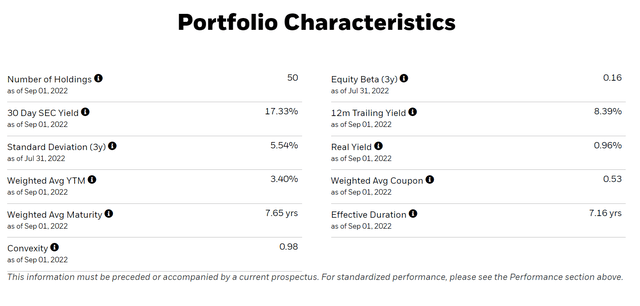

The portfolio holdings of the TIP ETF is 99.75% invested in U.S. TIPS, with the remaining invested in cash for cash flow management purposes. The fund holds more than 50 different issues of TIPS, with an average weighted maturity of 7.65 years and effective duration of 7.16 years (Figure 1).

Figure 1 – TIP overview (ishares.com)

Returns

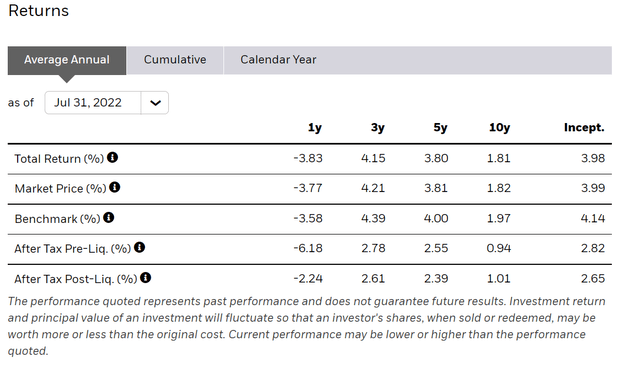

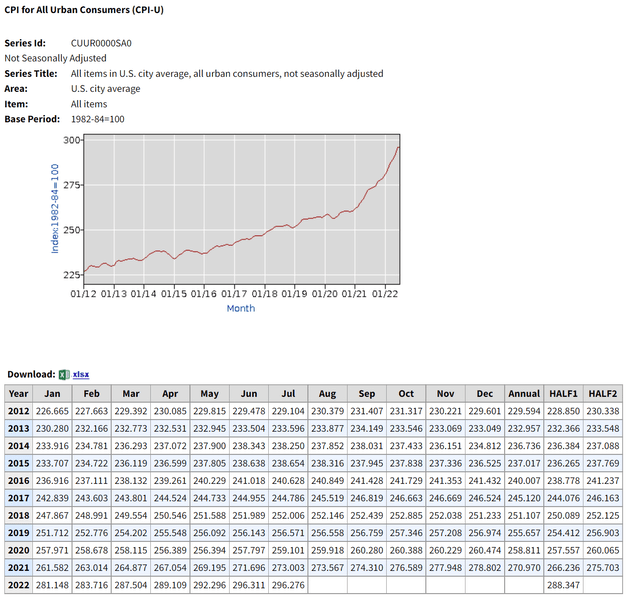

TIP has generated 5 year average returns of 3.8% and 10 year average returns of 1.8% (Figure 2). Note that the CPI Index has compounded at 3.8% over the past 5 years and 2.5% over the past 10 years (Figure 3), so the TIP ETF has underperformed inflation over the long term.

Figure 2 – TIP average annual returns (ishares.com) Figure 3 – CPI Index Values (data.bls.gov)

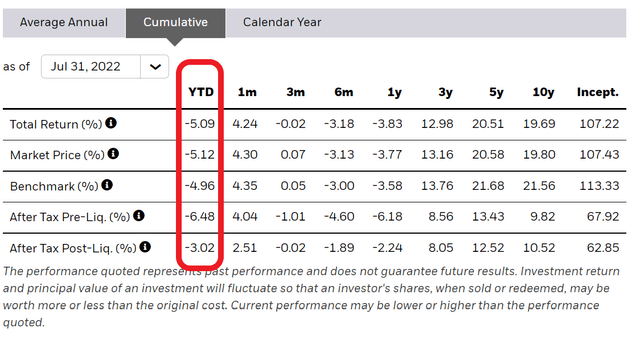

YTD, the TIP ETF is down 5.1% (Figure 4).

Figure 4 – TIP YTD returns (ishares.com)

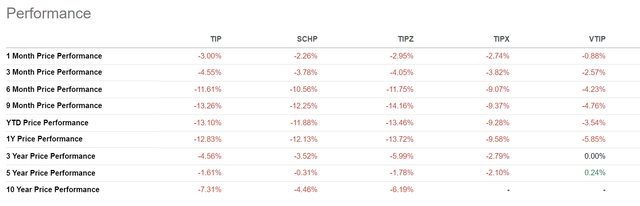

Comparing across the different TIPS-focused ETFs, the TIP ETF performs roughly the same as its peers like the SCHP and TIPZ (Figure 5). All TIPS-focused funds have declined YTD on a price and NAV basis.

Figure 5 – TIP vs. peers (Seeking Alpha)

Distribution & Yield

Where TIPS-focused ETF funds really shine is in their distribution yield. Recall that TIPS pay a coupon that adjusts with inflation. This means that the investment income earned by these funds also adjust with inflation, and the funds pay it out to investors.

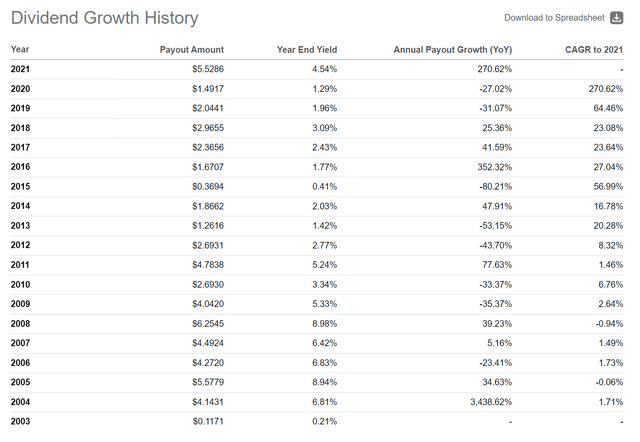

From Seeking Alpha, we see that the TIP ETF’s distribution has really ramped up in 2021 and 2022 YTD (Figure 6 and 7). 2021’s distribution jumped 270% YoY to $5.53 / share, and so far in 2022, TIP has paid or declared $6.93 / share.

Figure 6 – TIP distribution history (Seeking Alpha) Figure 7 – TIP YTD distribution (Seeking Alpha)

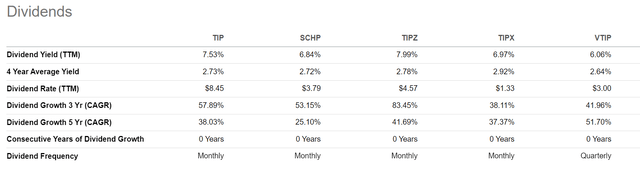

Comparing between the TIP ETF and its peers, we see that the distribution yields are also very similar. TIP has a LTM dividend yield of 7.5%, while SCHP is 6.8% and TIPZ is 8.0%.

Figure 8 – TIP yield vs. peers (Seeking Alpha)

Fees

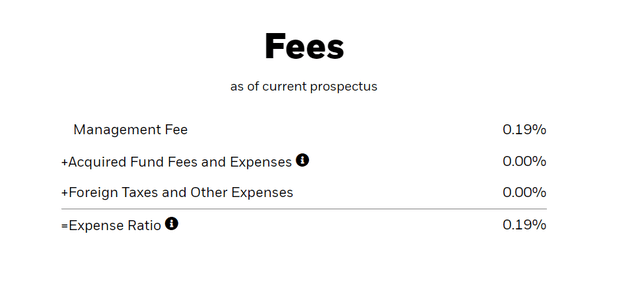

On an absolute basis, TIP is a fairly low-cost fund, with an expense ratio of only 0.19% (Figure 9).

Figure 9 – TIP expense ratio (ishares.com)

However, versus peers like SCHP and VTIP, the TIP ETF is relatively high cost (Figure 10).

Figure 10 – TIP vs. peers fees (Seeking Alpha)

Inflation Protection May Not Apply On A Fund

Astute readers will notice from Figure 4 above that the TIP ETF is down 5.1% YTD to July 31st, despite paying $4.34 / share in distribution (3.4% of 2021 YE NAV of $128.95). This compares poorly with the July headline CPI inflation rate of 8.5%. How is a fund of ‘inflation-protected’ securities down YTD when inflation is soaring? What is going on?

What is going on is that while individual TIPS have their principal and coupons adjusted to the CPI Index, as a portfolio, the fund is subject to interest rate risk just like other bond funds. Notice from figure 1, the TIP ETF portfolio has an effective duration of 7.16 years. This means for a 1% increase in interest rates, the portfolio is expected to lose 7.16% in value. As interest rates have risen this year in response to soaring inflation, the TIP ETF’s NAV has declined. To the end of July, TIP’s NAV has declined 8.5% to $118.03, which has more than offset the distribution paid.

A similar analysis can be performed on the other TIPS-focused funds. For example, SCHP has declined 7.9% YTD on a NAV basis while it has paid $1.88 / share in distribution (3.0% yield on 2021 YE NAV of $62.83), for a total return of -4.9% YTD.

Pair Trade May Be The Answer

Is there a solution to the duration issue? The short answer is yes, there is potentially another way to benefit from the inflation protection of TIPS without the duration risk. However, readers need to understand the following discussion is for educational purposes only, and may not be achievable in practice (i.e. there may be no securities available for borrow or the fees to borrow the securities may outweigh the benefit).

One potential solution to the problem above is to hold the TIPS-focused fund like the TIP ETF, hedged with a short position in the iShares 7 – 10 Year Treasury Bond ETF (IEF) or some similar ETF. The IEF ETF is a $23 billion AUM ETF with an effective duration of 7.9 years. Assuming the two positions are notionally hedged (i.e. own $100 of TIP and short $100 of IEF), the pair trade could have generated a positive 3% return to July 31, before any fees (Figure 11).

Figure 11 – Theoretical pair trade between TIP and IEF (Author created with price chart from stockcharts.com)

Similarly, a pair between SCHP and IEF could have generated 3.2% (Figure 12). While a pair between TIPZ and IEF could have generated 2.4%.

Figure 12 – Theoretical pair between SCHP and IEF (Author created with price chart form stockcharts.com)

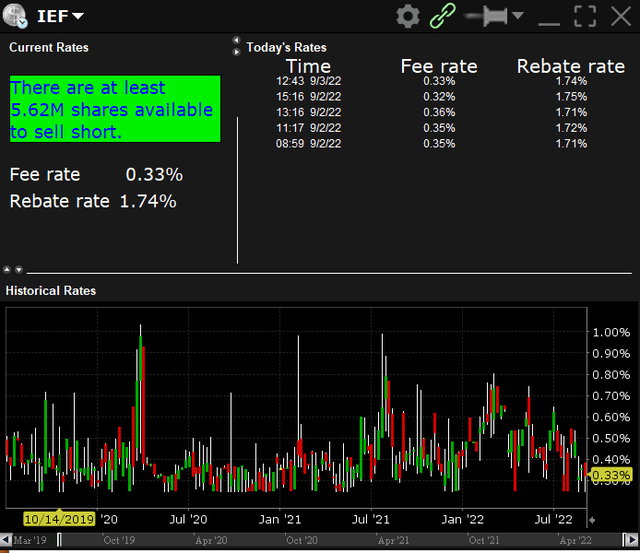

Of course the pair trade assume investors are comfortable shorting, and can find a borrow on the IEF ETF. Currently, the IEF is readily available to short on Interactive Brokers at a 0.33% annualized fee rate, but note the borrow rate has been as high as 1% historically (Figure 13).

Figure 13 – Current borrow rate on IEF (Interactive Brokers)

Conclusion

With inflation soaring, investors may wish to seek the safety Treasury Inflation-Protected Securities through TIPS-focused ETF funds like the TIP ETF. While individual TIPS may be protected from inflation with adjustments in its principal and coupons to the CPI Index, investors are reminded that a fund of TIPS like the TIP ETF still suffers from duration risk, which has led to a 5.1% YTD loss for the TIP ETF and 4.9% YTD loss for the SCHP ETF. One possible solution may be to hold the TIPS-focused ETF as a pair trade against a medium-term treasury bond ETF like the IEF.

[ad_2]

Source links Google News