[ad_1]

adrian825

The latest selling episode in the markets – which feels like about the 900th such episode this year – has crushed high-growth/high-valuation sectors once again. Perhaps no one sector better exemplifies both of those traits than semiconductors, and as I’ve said here before, it’s one of the reasons I like to trade semiconductors. You get big, trendy moves in both directions, so trading opportunities abound. Those opportunities have been firmly in one direction for the past week as the euphoria of the NVIDIA (NVDA) earnings rally fizzled after one day. Then, of course, came the news this week that NVIDIA in particular is facing a ban on selling certain products to China and Russia. It’s been rough, but it won’t last forever.

For those looking for a volatile way to venture into trading the semiconductors on the long side, my favorite name to trade is the Direxion Daily Semiconductor 3x Bull Shares ETF (NYSEARCA:SOXL). The ETF does a nice job of tracking the performance of the semi index, but at a 3X daily rate. That means there’s a lot of juice to the upside, but you have to be careful because that juice applies to the downside as well. Indeed, the ETF is more than 80% off its 2022 high.

However, if you time entries ahead of multi-week or multi-month moves in the semis, SOXL is just about the best way I can think of to take advantage.

What is SOXL?

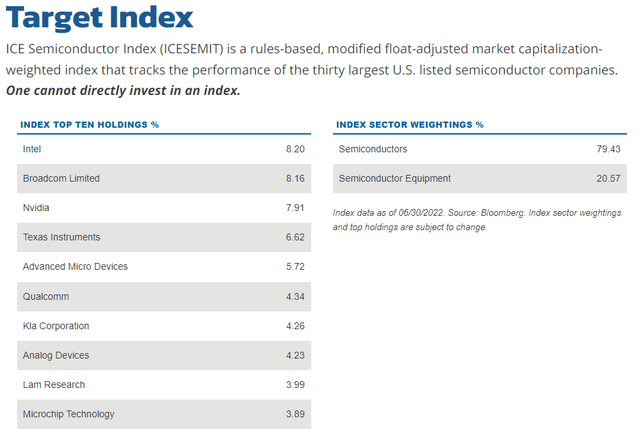

SOXL is a way to gain exposure to the ICE Semiconductor Index, which you cannot trade directly. You can read about the index here if you’re so inclined.

Index factsheet

Essentially, the ICESEMIT is a float-adjusted market-cap-weighted index that tracks the 30 largest US-listed semiconductor companies. In other words, the index is a good tracker for the industry as it has a wide variety of companies from the semiconductor industry and the largest ones at that. If you’re looking for a non-leveraged ETF that tracks this index pretty well, I would suggest you check out SOXX.

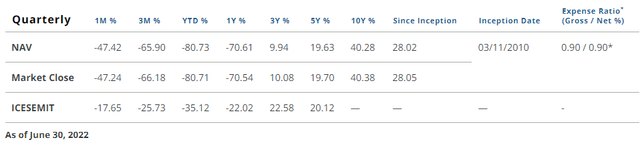

Back to SOXL though, we can see below the short-term performance of the ETF very closely tracks 3X the index, so on that basis, the ETF is doing its job quite well.

Fund factsheet

Trailing returns for just about any period are negative because, well, 2022, but the bottom line is that if you’re looking to gain broad semi exposure, this is the best leveraged way I’ve found.

If leverage isn’t for you, one way you can use leveraged products like SOXL is just to be capital-efficient. For instance, if your normal position size is $3,000, instead of buying $3,000 of SOXX, you can buy $1,000 of SOXL and get essentially the same exposure. Just because a product is leveraged doesn’t mean you have to be irresponsible; these can be great tools to be efficient with your capital, in addition to using it to make big bets one way or the other. There is tracking error over long periods, but it’s a 3X leveraged trading vehicle, so that’s to be expected. Use it responsibly and it’s a great tool.

An ugly chart, but reason for optimism

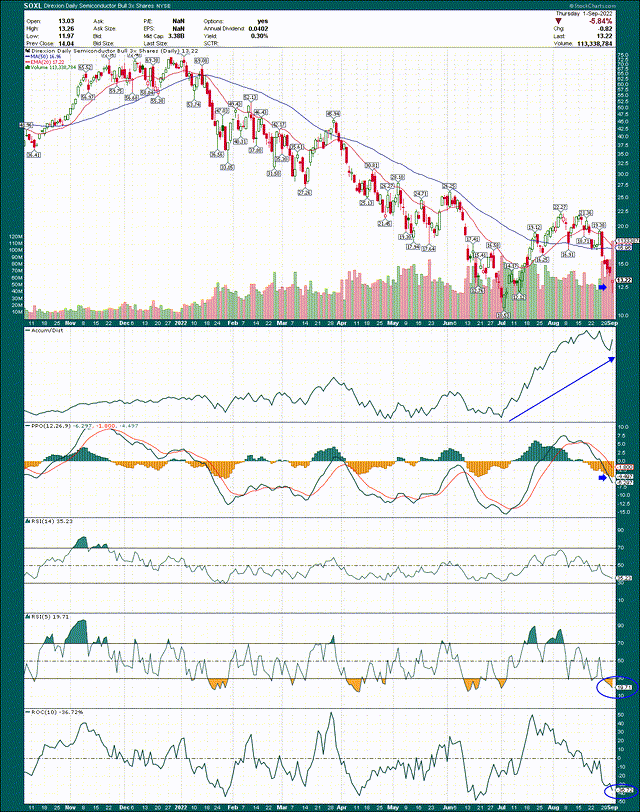

So, without further ado, let’s take a look at the current state of SOXL by starting with the daily chart.

StockCharts

I’ve kept the annotations simple here because the idea behind buying SOXL in today’s market is that semiconductors are oversold, and it’s pretty evident SOXL is oversold. Of course, that does not mean it cannot become more oversold, because it certainly can. However, buying at times such as these increases our odds of success. And given there are no guarantees in investing, increasing your odds of success is all you can hope to achieve.

Why do I think SOXL has upside risk from here? The selloff in semis has been particularly swift and brutal since the selling began a week ago. The ETF hit $19.38 last Thursday, and in the five trading days since, has plummeted to close at $13.22 yesterday. That’s a 30%+ decline in the space of five days, so that’s why I said above the moves are huge in this thing. Before you take any positions in SOXL, know your game plan to stop out if things go against you. If not, you could end up holding some very heavy bags because this is NOT a buy-and-hold ETF for long periods of time. If you’re wrong, just take your loss and get out.

Back to the chart, the accumulation/distribution line has actually soared during this last selling episode, which is quite encouraging. It means the intraday dips are being bought, and while that’s not enough reason on its own to buy, it’s a very nice feather in the cap of the bulls.

The PPO has fallen well below the centerline, which is not what I want to see, but the histogram on the PPO – which is simply the difference between the shorter-term line and the longer-term line – is showing signs of momentum exhaustion to the downside. That, like our other indicators, increases the odds the selling is at or near an exhaustion point.

The 14-day RSI has not reached oversold conditions, which is another good sign since securities that sell off enough for the 14-day RSI to reach oversold are generally in steep bear markets. The 5-day RSI, which is much shorter-term, is oversold so again, increasing the odds we get a bounce.

Finally, the candle from yesterday was quite bullish. The ETF fell very sharply in the morning (along with just about everything else), before rallying nearly as sharply in the afternoon. This kind of reversing candle can often portend the end of a trend, which would be most welcomed for SOXL at this point.

None of this guarantees us that SOXL is going to bounce. In fact, it could go to $11, or $10, or $8. However, the confluence of these factors greatly increases the odds that SOXL gets a bounce from here. This is the methodology I use with subscribers of my service, and in my own trading.

Outlook for the sector

Fundamentally, I think the semiconductors as an industry will do just fine over the long term. The group today has trough valuations, robust revenue expectations on strong, ever-expanding demand, and we’re still facing shortages in a lot of cases. In other words, I don’t think the industry has been harmed, and that this harm is the reason the stocks of the group continue to fall. Rather, we have fears of a recession and enormous declines in equity risk premiums that have driven valuations lower. Those factors are temporary, whereas a broken industry isn’t.

Thus, if you’re a long-term investor, I see bargains in the sector. But to be clear, you have to be very patient to buy-and-hold semiconductor stocks, because they make big moves in both directions. My long-term view also doesn’t mean we cannot see more lower lows; that’s certainly a possibility if this selloff morphs into a full panic. We aren’t there, and hopefully, we won’t be, but that’s a possibility.

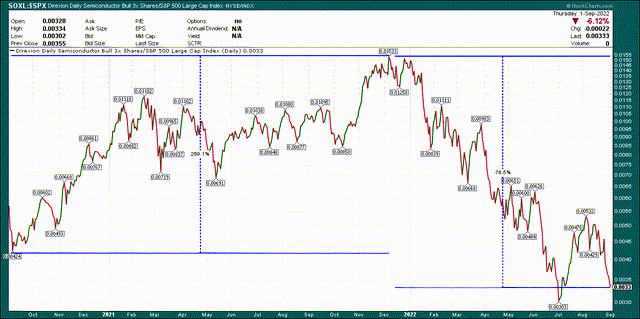

Let’s now look at the relative price action of SOXL against the S&P 500, which I’ve plotted for two years below.

StockCharts (relative strength)

The allure (and danger) of SOXL can be seen here with two very distinct phases. In the first half of this chart, semis outperformed greatly as estimates for earnings rose and valuations soared. SOXL outperformed the SPX by 260% during this period. However, since the relative high in late 2021, SOXL has underperformed by 79%. This is why I said you cannot just hold and hope for a rebound if you’re wrong; you could end up losing an enormous amount of your money.

Now, what I’m watching here, in addition to the daily chart we looked at above, is whether SOXL (or SOXX, if you prefer) makes a new relative low to the SPX. If this is the bottom of the selling this time around, and we get a higher relative low, that’s yet another signal that the selling for the semis is at or near an end.

The semis have been awful this year, but at some point, they will turn and outperform again. We’re not there yet, but the current setup in the group may just be that catalyst. I think the risk is skewed to the upside from here, but please be prudent with position sizes and stop loss management.

[ad_2]

Source links Google News