[ad_1]

Khanchit Khirisutchalual

Published on the Value Lab 24/8/22

The iShares S&P/TSX Capped REIT Index ETF (XRE:CA) has a lot of idiosyncratic ideas. It is not just a general and vanilla REIT play on one part of the real estate market or another. Its ideas are peculiar, somewhat risky, and should be studied individually. We like this ETF a lot because REITs are good for the current environment and there is a value angle here (less of a yield angle). But because the investment cases are quite sharp on some of the main holdings, we think investors are better off not buying the ETF and buying the individual holdings instead, knowing what you own rather than relying too much on diversification.

The XRE:CA Breakdown

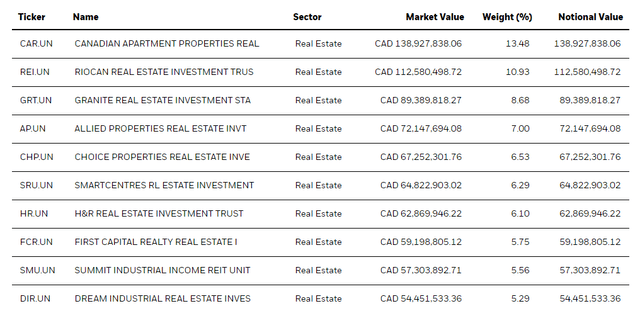

There aren’t that many holdings in this ETF with just 19. Indeed, you wouldn’t be able to find this many weird REITs. The first 3 already account for more than 30% of the REIT’s allocations.

Holdings XRE (Blackrock.com)

Thankfully, other authors on Seeking Alpha have looked into some of these stocks so that we can more easily form an opinion on XRE. The first holding at 13% is Canadian Apartment Properties REIT (OTC:CDPYF). This one is the more normal of the first three. It owns multifamily properties. About 15% of the NOI comes from Europe through a holdings in ERES REIT which owns properties in major student cities in Holland as well as Amsterdam, but also in some provincial markets as well. The rest of the income comes from Canada, primarily Ontario, but also a bit of Quebec and a similar amount in BC. It also owns a stake in an Irish REIT which accounts for about 2% of its market cap. All those Irish properties are in Dublin, and those markets are record hot right now. All of the Canadian markets have been racing for years now, but they have come down on higher rates from March peaks by about 10%, pretty significant for the real estate asset class. The prospects are pretty modest in the main Canadian markets due to rent caps to protect tenants, but the markets are relatively solid thanks to the multifamily exposure, which is a RE class that really doesn’t invite much worry. CDPFY is well financed and at good rates. It is a solid anchor.

The weirder REIT is next, which is the RioCan REIT (OTCPK:RIOCF). it is undergoing a transformation of a pretty dislikable retail portfolio. Moreover, it has very a very major debt load. Its angle is that it is trying to convert those properties to be able to meet more desirable use cases, primarily trying to appeal to more resilient retail businesses or converting them to mixed use buildings and offering up office space. Most of its income is from large Canadian cities. The multiple is getting into the low teens, now even a tween, but it is a relatively aggressive exposure. We like it, but not sure ETF investors want to be sandbagged by anything bad happening here, since its value is likely hinging on some asset rotation expectations and successful development when redevelopment is tough. Also rates are scary for it.

Finally there is Granite REIT (GRP.U). This is a specialty REIT that owns logistics facilities. Like Prologis (PLD), this thing is pretty rock-solid both in the near term but also secularly.

Conclusions

We like REITs for the current environment. They perform well when the going gets tough, and they also perform well right after when things start to look up. This has been the case historically at least, but it gels with the notion that hard assets are good in harder times, especially now where cash is still trash on account of inflation, even though most everything is trash now too. REIT ETFs are sometimes a bit redundant because REITs are already portfolios, so why diversify even more. Diversification is one of the many things that experiences diminishing returns, and it does so quite rapidly. In this case, ETF investors might be interested in this essentially Canadian REIT. But already in the first 30% of allocations, we have some peculiarities. The first depends somewhat on non-operating(ish) holdings that it owns through public markets. The second is going through redevelopment. And the third is a specialty exposure. There is likely more strange holdings that carry some weight in this ETF. Since the angles are quite aggressive, as in the second case, investors considering XRE should be wary to know what they own. At that point, why bother investing in an ETF though? Just buy the holdings that you’ve researched. They’re real estate portfolios anyway.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Source links Google News