[ad_1]

MF3d

As most all of you know, cybersecurity is no longer a discretionary expense. Governments, businesses large-n-small, and consumers all require protection from the rogue state actors – as well as individual hackers and groups – that are trying to compromise their cyber-operations. Just today it was reported that a whistleblower who used to be the head of security at Twitter (TWTR) alleged the company “has major security problems that pose a threat to its own users’ personal information, to company shareholders, to national security, and to democracy.” Twitter has downplayed the allegations, but we all remember when President Biden, Elon Musk, Bill Gates, and Warren Buffett’s Twitter accounts were hacked back in 2020. The point is that no one, no company, and no government is immune from cybersecurity threats. That being the case, investors should consider allocating some capital to the fast growing cybersecurity sector. Today I will take a look at the ETMG Cybersecurity ETF (NYSEARCA:HACK) to see if it is a good option for diversified exposure to the sector.

Investment Thesis

Fortune Business Insights estimates the global cybersecurity market will grow at a 13.4% CAGR through 2029 and will exceed $376 billion at the end of that time frame. Growth will be driven by the proliferation of E-commerce platforms as companies and governments continue to embrace the digital transformation. All the links of the digital world – high-speed networking, cloud-computing, data centers, AI/ML, blockchain, etc. – need end-to-end cybersecurity protection. Read more about growing cybersecurity threats here.

The cybersecurity sector is fertile ground for investors so today I will take a close look at the HACK ETF to see how it has positioned investors for success going forward.

Top-10 Holdings

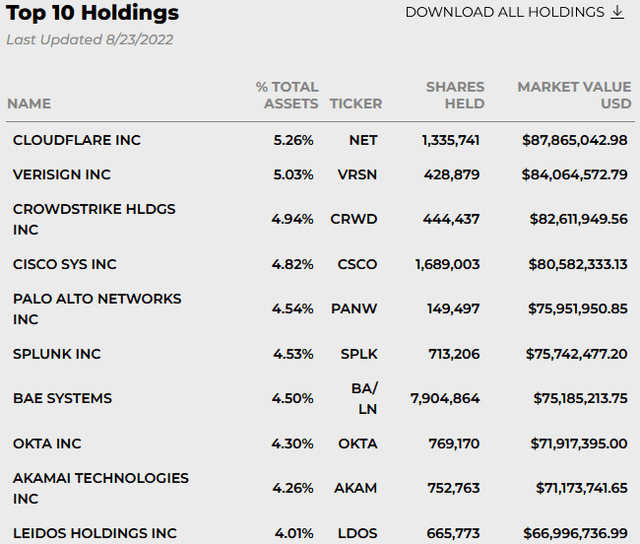

The top-10 holdings in the HACK ETF are shown below and equate to what I would generally consider to be a moderately-diversified 46% of the entire 63-company portfolio.

ETFMG

Source: ETFMG HACK Webpage

HACK’s #1 holding is Cloudflare (NET) with a 5.3% weight. NET surged 26% earlier this month on strong earnings (revenue up 54% yoy) and upbeat guidance wherein even the low-end of FY22 revenue guidance ($968 million) was well above consensus estimates of $958.7 million. NET is still in its growth phase and as a result continues to trade at a sky-high valuation of 2,000x forward earnings as the company chases revenue growth and puts less emphasis on actual bottom-line earnings.

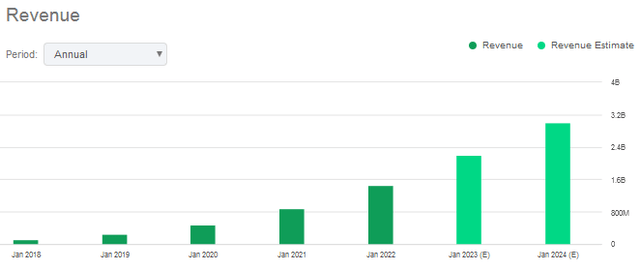

CrowdStrike (CRWD) is the #3 holding with a 4.9% weight. CRWD is generally regarded as one of the leading cybersecurity providers, but is down 21% this year despite its strong track-record of ramped-up revenue growth:

Seeking Alpha

CRWD has a market-cap of $42 billion and a forward P/E=154x. CrowdStrike is a “highest conviction” pick at UBS with a $240 price target supported by the opinion that CRWD has “A track record of strong execution, an expanding core end-market, and underappreciated profitability keep us constructive on shares.” The stock is currently trading at $192.67.

The #4 pick with a 4.8% weight is Cisco Systems (CSCO). Cisco recently announced a very strong earnings report as the company rebounded from supply-chain issue to meet pent-up demand for its products and cybersecurity solutions. Cisco yields 3.1% and trades at a forward P/E of only 13.5x. Cisco can be considered the “value” play within the cybersecurity sector.

Palo Alto (PANW) is the #5 holding with a 4.5% weight. Last month, I reported on Seeking Alpha that PANW operates what is Arguably The Planet’s #1 Cybersecurity Ecosystem. Indeed, yesterday Palo Alto blew away Q4 estimates on both the top- and bottom-lines and announced a 3-1 stock split. At pixel time, the stock is currently trading up $56.64/share (+11%). Champagne corks are popping in Palo Alto, California.

The #8 holding is Okta (OKTA), a fast growing yet still unprofitable company. The stock is down nearly 60% over the past year as unprofitable high-growth companies just got hammered by the bear-market. Yet I find OKTA stock to be an opportunity for investors willing to take on a speculative growth stock (see OKTA: A Winning Cybersecurity Opportunity).

Akamai (AKAM) is the #9 holding with a 4.3% weight. AKAM has been a bit of a disappointment in my opinion as its strong cybersecurity growth is not enough to overcome fundamental challenges to its legacy business (see AKAM: Deteriorating CDN Business & FX Headwinds, Sell).

Performance

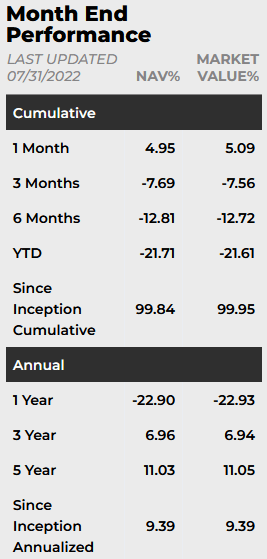

The performance track-record of the HACK ETF is shown below:

ETFMG

As can be seen from the graphic, and not unsurprisingly, the high-valued cybersecurity growth stocks have been hard-hit in the 2022 bear market and HACK is no exception: the ETF is down over 20% YTD.

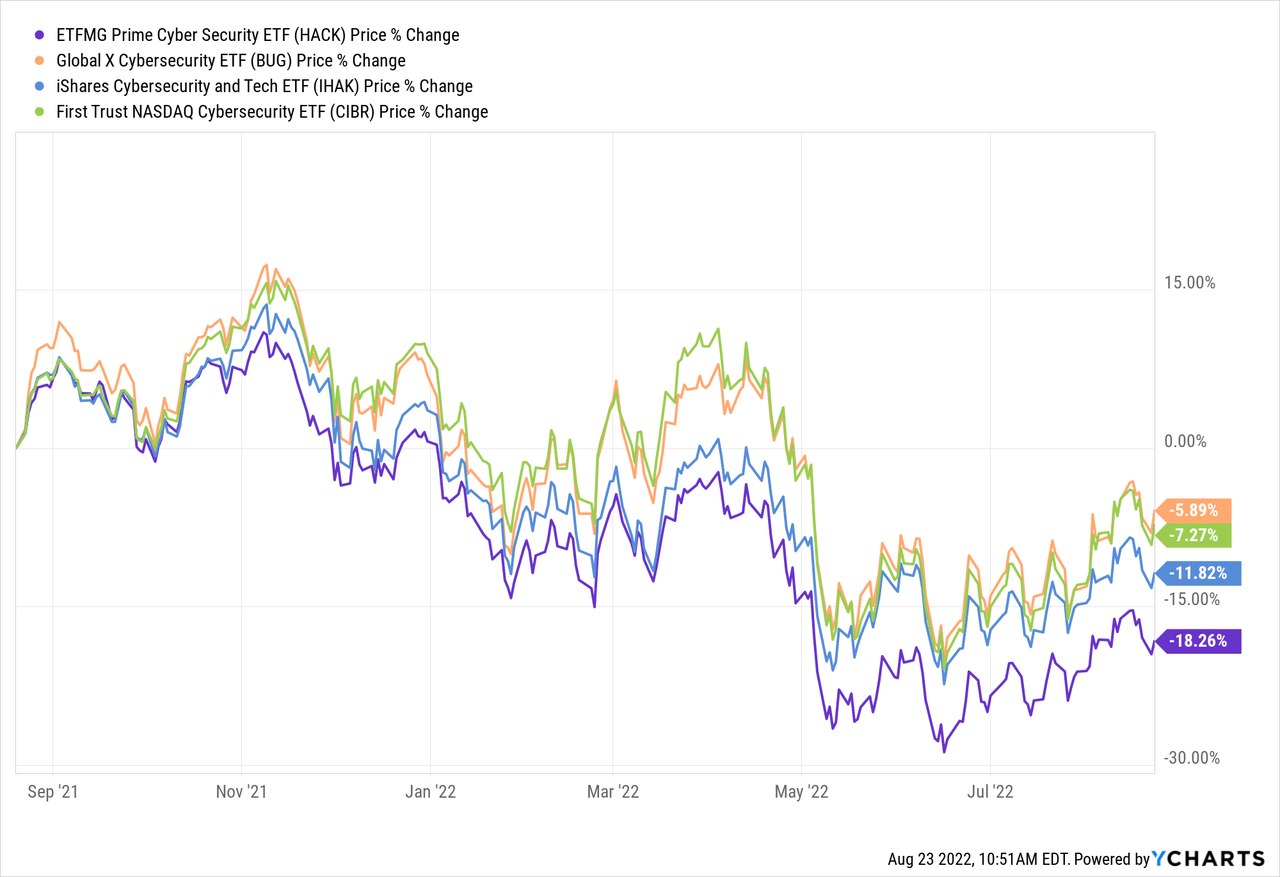

The longer-term 5-year track record is a bit better with an average annualized return of 11.1%. However, over the past year and in relation to its peers the Global X Cybersecurity ETF (BUG), the iShares Cybersecurity ETF (IHAK), and the First Trust Cybersecurity ETF (CIBR), HACK has been the stand-out laggard of the group:

As can be seen in the graphic, the BUG ETF has been the leader of the group (see BUG: No Stopping The Top Cybersecurity Companies).

Observations

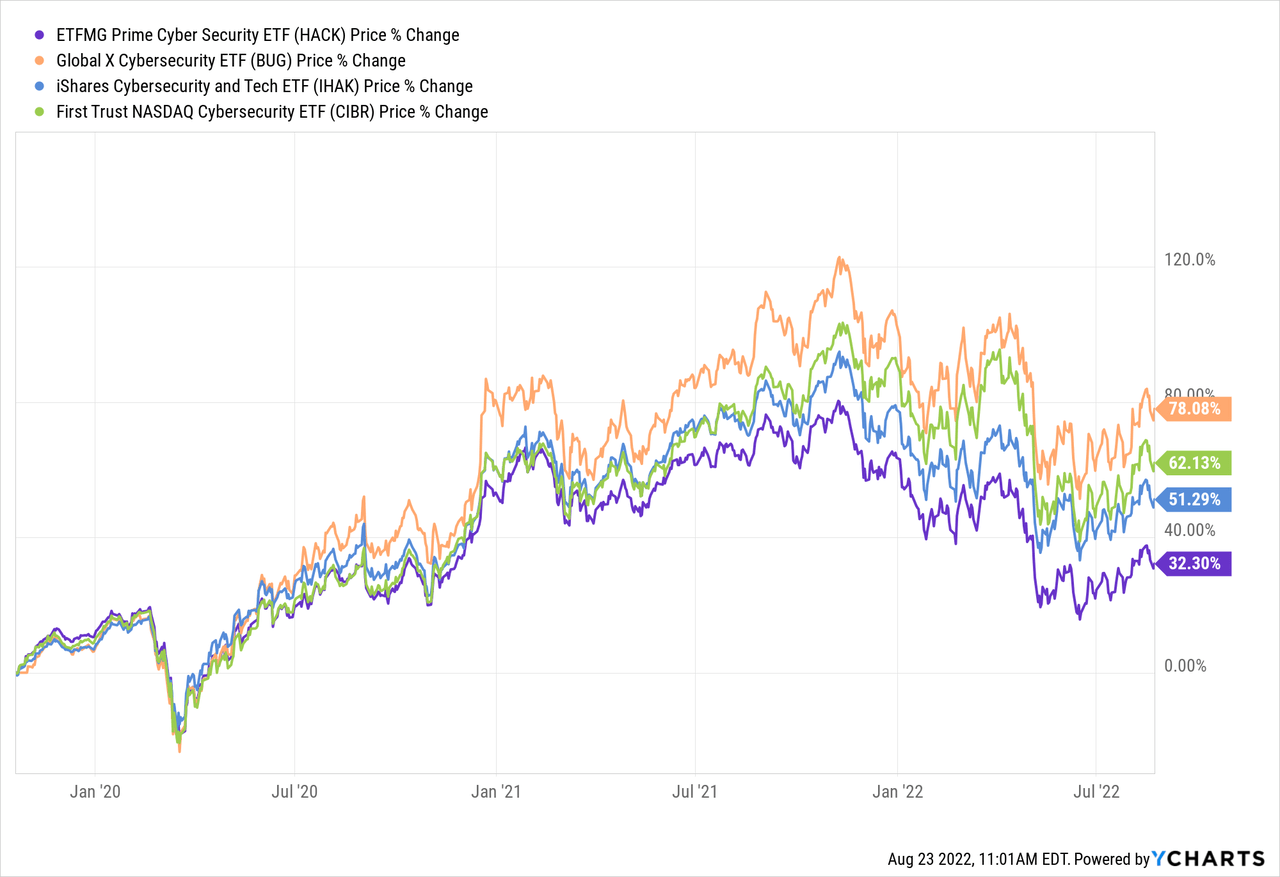

The HACK ETF appears to be “over-diversified” in my opinion. I say that because the cybersecurity sector is dominated by a relatively few number of companies that are clearly a step-above the rest. That being the case, investors should be looking for an ETF that is more concentrated and heavily weighted in those best-of-breed type companies. For instance, I’d like to see companies like Palo Alto, CrowdStrike, and Zscaler (ZS) – which is not even in HACK’s top-10 holdings – have much larger weighting within the portfolio, perhaps double their current weightings. Note that the BUG ETF has a much higher weighting in CrowdStrike, Palo Alto, and Zscaler and, as a result, performance wise is running rings around the HACK ETF.

HACK’s 0.60% expense fee is a bit on the heavy side (BUG’s expense ratio is 0.50%).

Risks

The cybersecurity sector is not immune to the overall current macro-investment environment: the lingering impacts of covid-19, high inflation, the outlook for higher interest rates, and the impact of Putin’s horrific war-of-choice on Ukraine that, along with sanctions placed on Russia by the U.S. and its Democratic & NATO allies, has effectively broken the global energy and food supply-chains. Any or all of these factors could lead to a slowing global economy and/or global recession (or worse).

Most all of the high-growth cybersecurity companies are trading at relatively high-valuation levels. If the market remains weak, these companies could continue to grow revenue at a fast clip yet the stocks could suffer multiple compression and not perform as well as expected.

Summary & Conclusion

The cybersecurity sector is a high-growth opportunity for investors as some companies are growing much faster than the overall market. That means the sector should be analyzed on a stock-by-stock basis. Obviously, Palo Alto investors are celebrating today. For a more diversified approach via an ETF, investors should look for a top-10 list that is more heavily weighted toward the best-of-breed companies. HACK isn’t that ETF. The BUG ETF is a superior choice in my opinion, although after owning it for awhile, I would prefer even BUG to more heavily weighted in its top-10 holdings.

Bottom line: if you don’t have a position in cybersecurity, pick a few individual stocks or buy a well-diversified ETF like BUG. If you already own the HACK ETF, I recommend selling it and moving the proceeds into BUG.

I’ll end with a chart comparing the returns of the leading cybersecurity ETFs since all four have existed (IHAK has only been around since June of 2019):

[ad_2]

Source links Google News