[ad_1]

gesrey

I will start off by saying that I am a fan of covered-call ETFs as vehicles for income investments. I will put my opinion aside and provide a numbers-driven approach to evaluating the Global X Russell 2000 Covered Call ETF (NYSEARCA:RYLD), Global X S&P Covered Call ETF (XYLD), and the Global X Nasdaq 100 Covered Call ETF (QYLD). I am a shareholder in these 3 funds, and I own much more QYLD than RYLD and XYLD. Covered-call funds have become more popular over the past several years, and the net assets of QYLD, RYLD, and XYLD continue to grow. Suppose you’re invested in these ETFs or have been interested in seeing what an investment in them would look like. In that case, I am going strictly by the numbers to illustrate how an investment of 100 shares would have fared if you made the purchase at the beginning of 2021 or at the beginning of 2022.

Looking at RYLD, QYLD, and XYLD since the beginning of 2021.

I will be using the share price of each fund on 1/4/21 to determine what the initial investment would be. All of the share prices throughout the tables are taken from Seeking Alpha, and all of the distributions are coming directly from the Global X site. Since these investments are vehicles for income, I will make the comparison tables for RYLD, QYLD, and XYLD as if the monthly distributions are being taken as income.

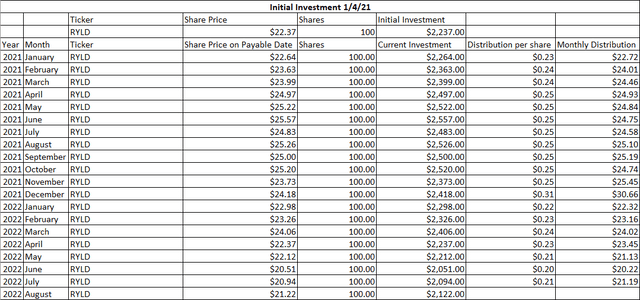

Global X Russell 2000 Covered Call ETF

On 1/4/21, RYLD traded at $22.37 per share, so an investment of 100 would have cost $2,237. Shares of RYLD are currently trading at $21.22, which would have created a -5.14% (-$115) return on your initial investment. Since 1/4/21, 19 distributions have been paid, and RYLD would have generated $456.92 in income. When factoring in distributions, there would be a 20.43% yield on investment, a net profit after deducting the capital depreciation from income generated of $341.92, and a total ROI of 15.28%.

Steven Fiorillo, Global X, Seeking Alpha

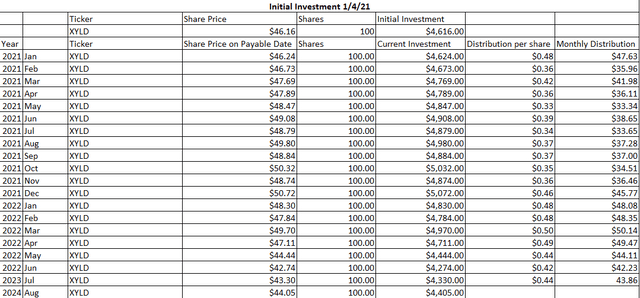

On 1/4/21, XYLD traded at $46.16 per share, so an investment of 100 shares would have cost $4,616. Shares of XYLD are currently trading at $44.05, which would have created a -4.57% (-$211) return on your initial investment. Since 1/4/21, 19 distributions have been paid, and XYLD would have generated $784.59 in income. When factoring in distributions, there would be a 17% yield on investment, a net profit after deducting the capital depreciation from income generated of $573.59, and a total ROI of 12.43%.

Steven Fiorillo, Global X, Seeking Alpha

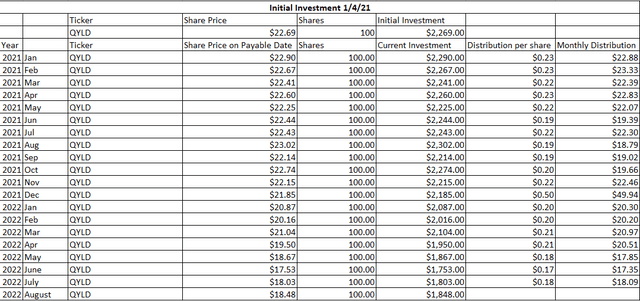

On 1/4/21, QYLD traded at $22.69 per share, so an investment of 100 shares would have cost $2,269. Shares of QYLD are currently trading at $18.48, which would have created a -18.55% (-$421) return on your initial investment. Since 1/4/21, 19 distributions have been paid, and QYLD would have generated $420.33 in income. When factoring in distributions, there would be an 18.52% yield on investment, a net profit after deducting the capital depreciation from income generated of -$0.67, and a total ROI of -0.03%.

Steven Fiorillo, Global X, Seeking Alpha

I went back to the beginning of 2021, so there was a larger subset of data and because these funds were gaining a lot of traction. Based on my findings RYLD would have been the better investment choice as it had the largest ROI and the largest yield on investment. XYLD would have taken 2nd place and the most popular fund of the 3, QYLD isn’t even close.

|

Total ROI and Statistics for RYLD, XYLD, and QYLD |

|||

|

RYLD |

XYLD |

QYLD |

|

|

Initial Investment |

$2,237.00 |

$4,616.00 |

$2,269.00 |

|

Current Investment |

$2,122.00 |

$4,405.00 |

$1,848.00 |

|

Profit |

-$115.00 |

-$211.00 |

-$421.00 |

|

Initial Investment ROI |

-5.14% |

-4.57% |

-18.55% |

|

Current Distributions Paid |

$456.92 |

$784.59 |

$420.33 |

|

Yield on Investment |

20.43% |

17.00% |

18.52% |

|

Total Profit |

$341.92 |

$573.59 |

-$0.67 |

|

Total ROI |

15.28% |

12.43% |

-0.03% |

|

Total ROI and Statistics for RYLD, XYLD, and QYLD |

|||

|

RYLD |

XYLD |

QYLD |

|

|

Initial Investment |

$2,237.00 |

$4,616.00 |

$2,269.00 |

|

Current Investment |

$2,122.00 |

$4,405.00 |

$1,848.00 |

|

Profit |

-$115.00 |

-$211.00 |

-$421.00 |

|

Initial Investment ROI |

-5.14% |

-4.57% |

-18.55% |

|

Current Distributions Paid |

$456.92 |

$784.59 |

$420.33 |

|

Yield on Investment |

20.43% |

17.00% |

18.52% |

|

Total Profit |

$341.92 |

$573.59 |

-$0.67 |

|

Total ROI |

15.28% |

12.43% |

-0.03% |

What about if you had invested at the beginning of 2022? Would the same outcome have occurred?

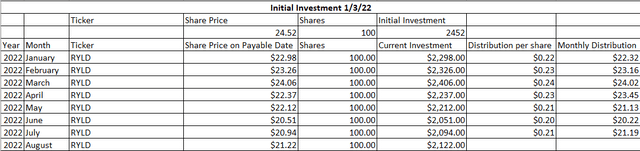

On 1/3/22, RYLD traded at $24.52, so an initial investment of 100 shares would have cost $2,452. RYLD is trading at $21.22, which would have made your initial investment decreased by -$330 (-13.46%). YTD, there have been 7 distributions paid, and RYLD has generated $155.49 in monthly income. Overall, the current yield on investment is 6.34%, and when the capital depreciation and income generated are netted out, the total ROI is -$174.51 (-7.12%).

Steven Fiorillo, Global X, Seeking Alpha

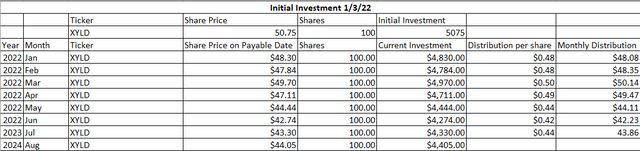

On 1/3/22, XYLD traded at $50.75, so an initial investment of 100 shares would have cost $5,075. XYLD is trading at $44.05, which would have made your initial investment decreased by -$670 (-13.20%). YTD, there have been 7 distributions paid, and XYLD has generated $372.01 in monthly income. Overall, the current yield on investment is 7.33%, and when the capital deprecation and income generated are netted out, the total ROI is -$297.99 (-5.87%).

Steven Fiorillo, Global X, Seeking Alpha

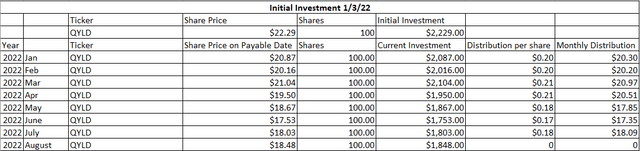

On 1/3/22, QYLD traded at $22.29, so an initial investment of 100 shares would have cost $2,229. QYLD is trading at $18.48, which would have made your initial investment decreased by -$381 (-17.09%). YTD, there have been 7 distributions paid, and QYLD has generated $135.27 in monthly income. Overall, the current yield on investment is 6.07%, and when the capital deprecation and income generated are netted out, the total ROI is -$245.73 (-11.02%).

Steven Fiorillo, Global X, Seeking Alpha

Looking at just 2022 alone, XYLD and RYLD were neck and neck, with XYLD coming out ahead by a slim margin. XYLD would have had an initial investment ROI of -13.2% compared to -13.46% for RYLD, and its yield on investment would be 6.43% compared to 6.34% for RYLD. In 2022, QYLD comes up short once again.

|

Total ROI and Statistics for RYLD, XYLD, and QYLD |

|||

|

RYLD |

XYLD |

QYLD |

|

|

Initial Investment |

$2,452.00 |

$5,075.00 |

$2,229.00 |

|

Current Investment |

$2,122.00 |

$4,405.00 |

$1,848.00 |

|

Profit |

-$330.00 |

-$670.00 |

-$381.00 |

|

Initial Investment ROI |

-13.46% |

-13.20% |

-17.09% |

|

Current Distributions Paid |

$155.49 |

$326.24 |

$135.27 |

|

Yield on Investment |

6.34% |

6.43% |

6.07% |

|

Total Profit |

-$174.51 |

-$343.76 |

-$245.73 |

|

Total ROI |

-7.12% |

-6.77% |

-11.02% |

Looking at RYLD since its inception

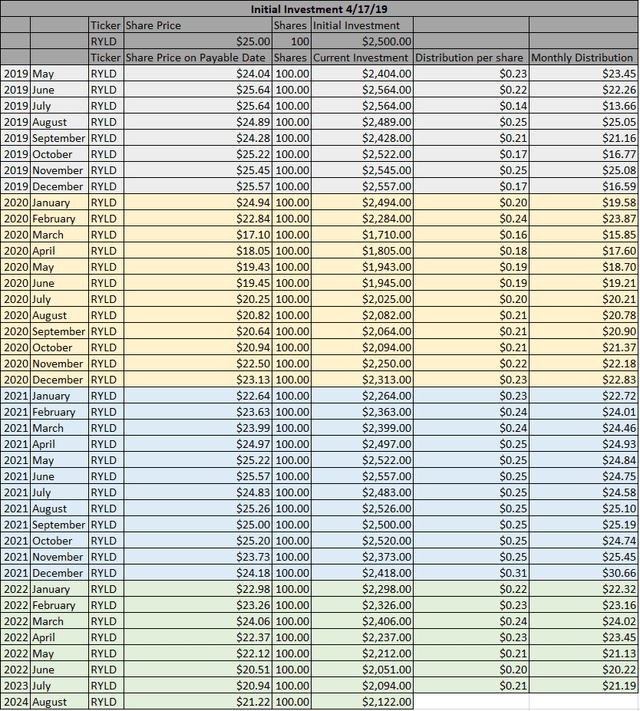

Based on the numbers since 2021, RYLD has been the better investment. RYLD went public on 4/17/19 for $25 per share. Since then, RYLD has paid 39 consecutive distributions without missing a single month. RYLD has established a long track record of distribution income from its Covered-Call strategy to investors. Since May of 2019, RYLD has paid $8.64 per share in distributions, which is an investment yield of 34.56% on its initial $25 share price. I am now going to compare RYLD against RYLD on the premise of taking the income as monthly distributions or reinvesting the income.

Steven Fiorillo, Global X, Seeking Alpha

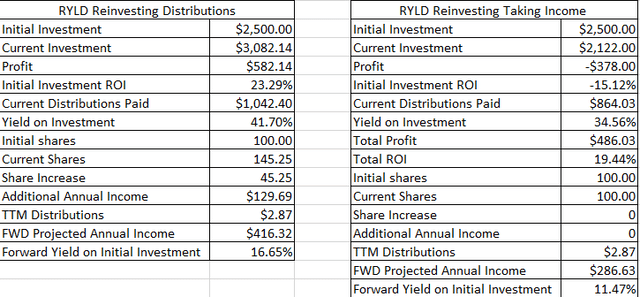

I separated the years by color to make it easier to keep everything lined up. An initial investment of 100 shares would have cost $2,500. If you had decided to take the monthly distributions, you would have generated $864.03 in income since its inception. This would be a 34.56% yield on investment. The initial investment in RYLD would have declined by -$378 (-15.12%) as shares are trading at $21.22. After the distributions are netted against the capital depreciation, this investment would have generated $486.03 in profit for an ROI of 19.44%. Over the trailing twelve months (TTM), RYLD has produced $2.87 in distributions. The projected forward annual income would be $286.63 or 11.47% on the initial investment of $2,500.

Steven Fiorillo, Global X, Seeking Alpha

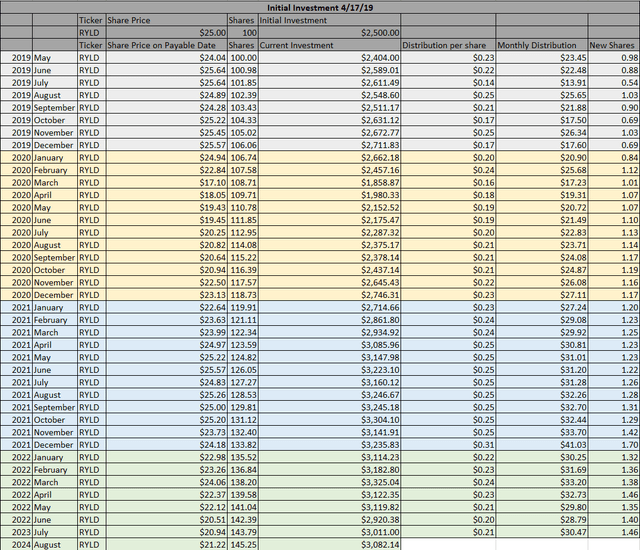

The numbers changed significantly by reinvesting the distributions. I added a new column and projected how many new shares the monthly distributions would generate, then factored in the purchase price on the day of the distribution and reinvested them over the past 39 months. By reinvesting the distributions, purchasing 100 shares of RYLD would have generated $1,042.40 in distributable income over the past 39 months. Your initial 100 shares would have grown to 145.25, and the current investment would be worth $3,082.14. This is a 41.7% yield on investment, and the total ROI is 23.29%, as there is $582.14 of profit in the overall investment. Based on the TTM distributions of $2.87 per share, the additional 45.25 shares will generate an additional $129.69 in forward annual income. The forward annual income for this investment would be $416.32, which is a forward yield of 16.65% based on the TTM distributions.

Steven Fiorillo, Global X, Seeking Alpha

Either way, RYLD has been a profitable investment since its inception. At the same time, RYLD is more common as an income investment; if you can reinvest the distributions for a period of time, the future stream of income will increase significantly. Without adding additional seed capital, you’re getting an additional 5.19% yield on invested capital from reinvesting the distributions.

Conclusion

As I stated at the beginning of the article, I am a fan of covered-call ETFs for income generation purposes. To me, RYLD looks like the most appealing fund of the 3 from Global X, and while there is a 4th that focuses on the Dow, there isn’t enough data on it for me to add it into the comparison. Personally, I am reinvesting the distributions, and as the data shows, the future income stream grows significantly over time if you’re able to. While QYLD is the more popular fund by net assets, and I own much more of it than RYLD, I believe, based on prior data, that RYLD has been the best covered-call fund to invest in, and if I was going to do it again, I would have allocated more capital toward RYLD than QYLD.

[ad_2]

Source links Google News