[ad_1]

Dilok Klaisataporn

(This article was co-produced with Hoya Capital Real Estate)

Introduction

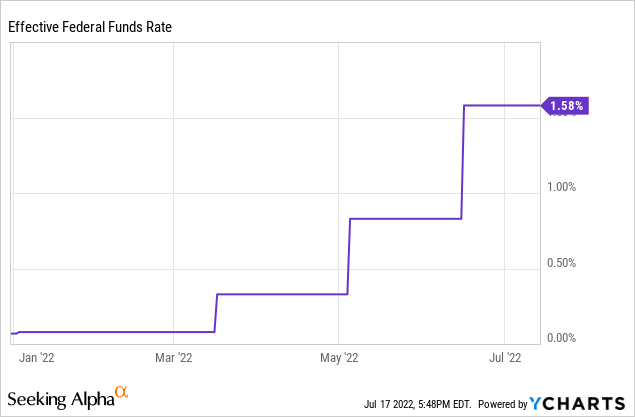

With inflation topping 9% in June, the speculation is how much will the Federal Open Market Committee, or FOMC, raise the Federal Funds Rate at its July meeting; maybe even 100bps after June’s inflation numbers!

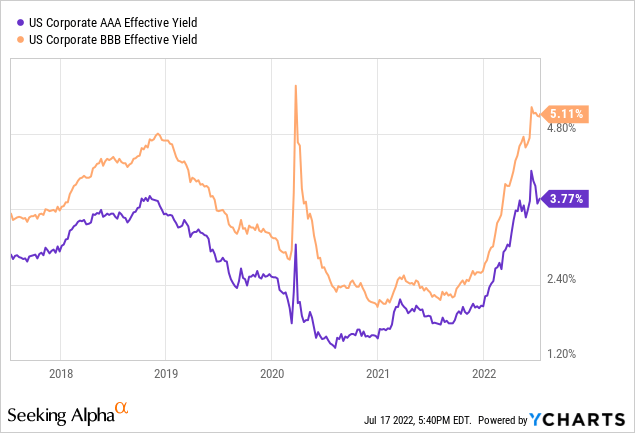

The next chart shows how much the AAA and BBB effective yields on corporate bonds have moved since the Fed starting raising rates in 2022 as inflation moved beyond “transitory”.

Investors trying to protect their Fixed Income allocation can move into CDs, who have seen their rates finally climb above next-to-nothing, though still miniscule compared to inflation. US Treasury I-Bonds are beating inflation but investment caps prevent them from becoming a meaningful percent of a large portfolio; plus there are liquidity issues. Thus short-duration ETFs like the Vanguard Ultra-Short Bond ETF (BATS:VUSB), have attracted assets over the past year. That said, and even with its Forward yield near 1.5%, investors should consider short-term CDs which are yielding even more.

Exploring the Vanguard Ultra-Short Bond ETF

Seeking Alpha describes this ETF as:

The fund invests in the fixed income markets. It primarily invests in high-quality securities that are rated A3 or better and medium-quality securities that are rated Baa1, Baa2, or Baa3 by Moody’s Investors Service, Inc. The fund seeks to invest in securities with maturity of 0-2 years. The fund employs fundamental analysis with bottom-up and top-down security picking approach to create its portfolio. The VUSB ETF was formed on April 5, 2021.

Source: seekingalpha.com VUSB

Vanguard provides this investment risk warning for VUSB buyers:

Although short-term bond funds tend to have a higher yield than money market funds, their share price fluctuates. Because the Ultra-Short Bond ETF will subject investors to principal risk, the fund shouldn’t be viewed as a substitute for a money market fund. Additionally, increases in interest rates can cause the prices of the bonds in the portfolio, and thus the fund’s share price, to decrease.

Source: investor.vanguard.com VUSB

VUSB has $1.75b in assets and incurs 10bps in fees from Vanguard. The 12-month yield is .56%, but payouts have been growing. VUSB’s SEC yield is 2.98%.

Holdings review

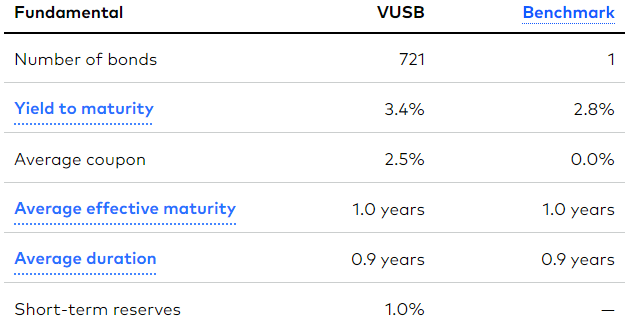

Vanguard provides the following portfolio characteristics for VUSB.

investor.vanguard.com VUSB

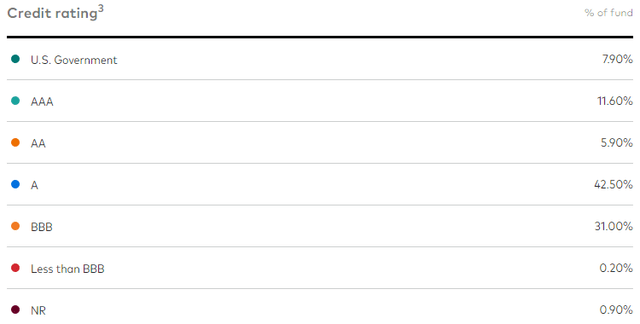

With an average coupon of 2.5%, the ETF’s yield should show improvements going forward. The short maturity allows for rapid turnover, which is good when rates are rising. With the YTM higher than the WAC, there is potential price appreciation as bonds mature. The ETF holds almost only investment-grade bonds, though most are rated in the lower categories of that classification.

investor.vanguard.com VUSB

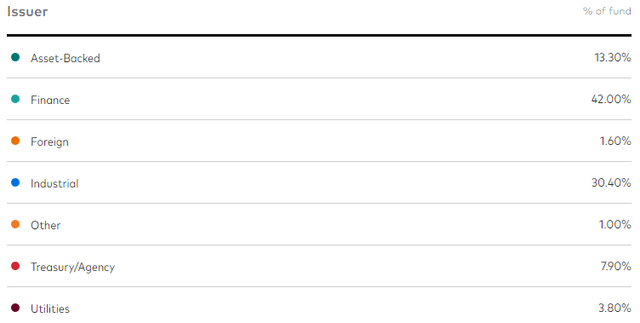

With Corporates being 63% of the portfolio, the Issuer allocations shows almost half of those bonds were issued by Industrial companies, and the majority of the rest by Financial ones. Another site shows VUSB with a 20% allocation to foreign bonds, so not sure why here it is under 2%, unless they are included under the other categories.

investor.vanguard.com VUSB

Almost 60% of the portfolio matures within one year, most of the rest within the 1-2 year period.

Top 20 holdings

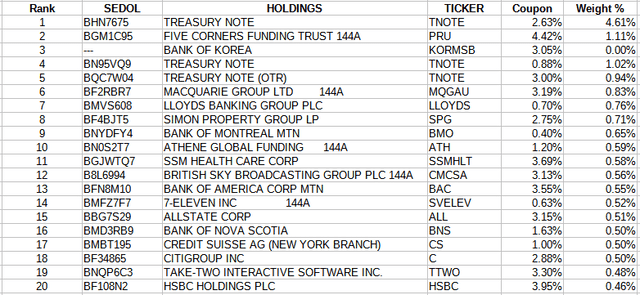

vanguard.com; compiled by Author

The Top 10 equates to 12.3% of the holdings; the Top 20, 17.5%. Vanguard lists two T-Bills and a Liquidity fund as ST Reserve assets with a combined weight of 16.6%. VUSB is also short (61 contracts) the US 5YR NOTE SEP 22, and long (305 contracts) on the US 2YR NOTE SEP 22. Without coupon data in the holdings export version, I was not able to calculate an accurate average bond price as VUSB could own zero-coupon bonds.

Distribution review

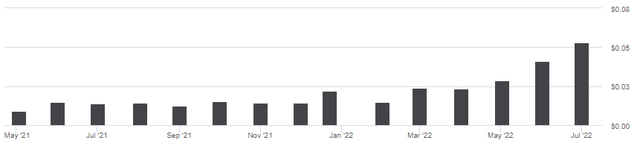

seekingalpha.com VUSB DVDs

After a slight drop in April, the payout has risen three straight months, with the latest payment yielding an annualized yield of 1.3%.

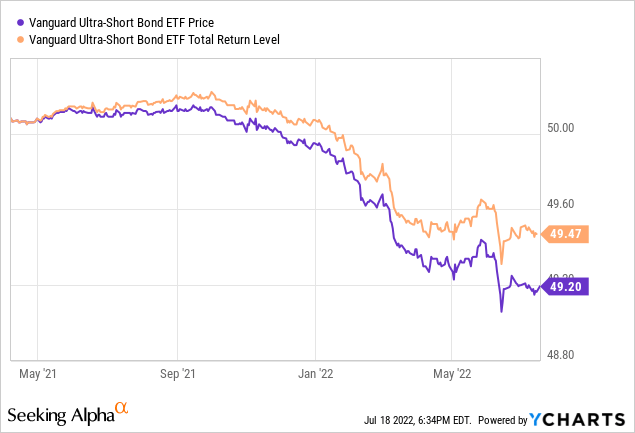

Performance review

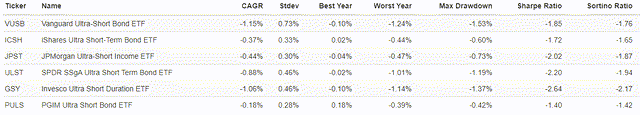

So much for short-duration ETFs protecting an investor’s assets! While this is better than funds with longer durations, as is shown next, VUSB trailed similar funds too.

Fund comparisons

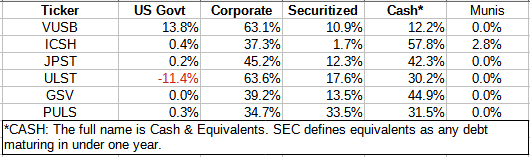

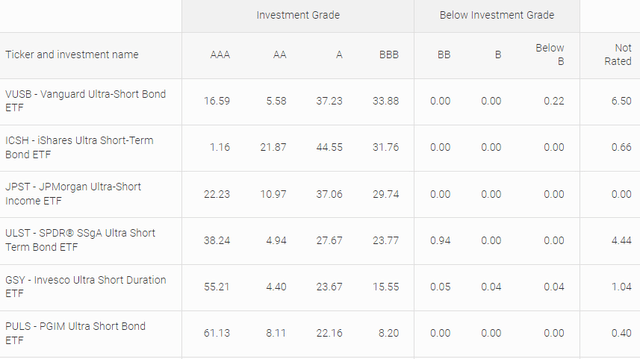

Once an investor has decided they want to add a short-duration fund, comparing funds is the next step. Seeking Alpha’s Peers function or search engines are a good place to start. I found some and narrowed the list to these funds to see how they have performed compared to VUSB. Asset allocations and credit ratings are important when comparing Fixed Income funds. Some match VUSB better than others. The high-level asset allocations are:

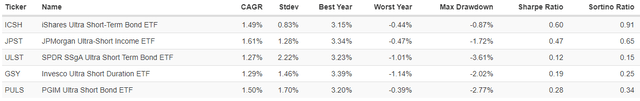

Seeking Alpha ticker home pages; compiled by Author am.jpmorgan.com/tools/dt-ic/comparison PortfolioVisualizer.com 6/30/22

Since VUSB’s start in May of 2021, it has lagged the performance of all five competing funds. It also had the worst StdDev value.

Portfolio strategy

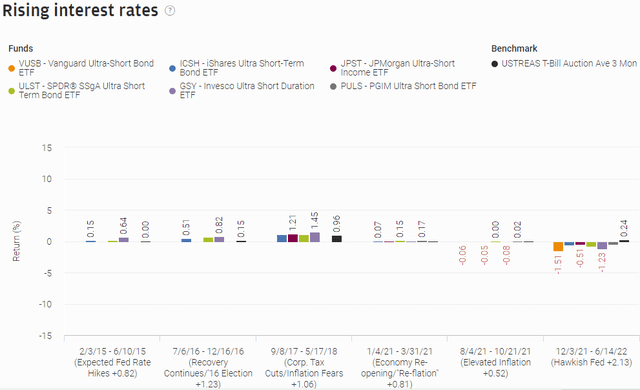

While the above only shows data since May of 2021, the following, except for VUSB, show more history for the other funds during periods like today.

am.jpmorgan.com/tools/dt-ic/comparison

VUSB only existed for the last data set and so far is showing the poorest results. Notice all five of the older funds did better in past periods than the most recent two. Maybe the past is less reliable or the fact inflation is much worse this time is playing a part.

To get longer results, I removed VUSB and reran the PortfolioVisualizer screen, this time with data back to 2018.

PortfolioVisualizer.com

Based on asset allocation matchup to VUSB, more history doesn’t support owning VUSB as the fund with the closest corporate weighting, SPDR SSGA Ultra Short Term Bond ETF (ULST) did the poorest. That said, the next closest, the JPMorgan Ultra-Short Income ETF (JPST) did the best. Of course, those are today’s allocations which could differ greatly from the past.

With 6-mo CDs yielding 2.5% and 1-yr ones at 3%, investor who know they won’t need to touch these funds, nor are holding to buy other asset types, should consider the safer choice (and currently higher yielding one) and use CDs for part of their short-term fixed income allocation.

[ad_2]

Source links Google News