[ad_1]

Ladanifer

The US Federal Reserve is pulling out all the stops in battling inflation, the insidious economic condition that causes prices of all goods and services to rise. The latest June consumer price index data showed that inflation rose to its highest level in over four decades since November 1981. The June producer price index rose even more, up 11.3% on a year-on-year basis. While core CPI and PPI, excluding food and energy prices, remain on either side of 6%, the inflation data is far above the current Fed Funds Rate band of 1.50% to 1.75%.

The US central bank will increase the Fed Funds Rate by at least 75 basis points at the July meeting, with some analysts expecting an even more aggressive 1% increase in the short-term interest rate. Meanwhile, even at the 2.50% to 2.75% level, the rate will remain less than half the level of the latest core inflation data.

The Fed’s monetary policy toolbox can influence the economy’s demand side, but supply side issues causing food and energy prices to soar are another story. The war in Ukraine threw the Fed a curveball, as Russia and Ukraine are Europe’s breadbasket and critical exporters of agricultural commodities and fertilizers. Meanwhile, Russia is a leading traditional energy producer, exporting oil, gas, and coal worldwide, with Europe depending on Russian supplies. While core US inflation data does not include food and energy, the commodities impact the core reading as they provide nutrition and power. Food and energy are inputs in all goods and services prices.

In the US and worldwide, gasoline powers most automobiles. Gasoline is an oil product that trades on the CME’s NYMEX division. The United States Gasoline ETF product (NYSEARCA:UGA) follows the gasoline futures price higher and lower.

Gasoline And Gasoline Refining Spreads Are Elevated

NYMEX gasoline futures prices retreated from the recent all-time highs, but remained at the highest level since 2013.

Annual chart of NYMEX Gasoline Prices (CQG)

The annual chart highlights the rise to $4.3260 in June 2022. Gasoline futures prices corrected, falling to the $3.2132 per gallon wholesale level on Friday, July 15. The drop of over $1 per gallon still left gasoline at a nine-year-high.

Meanwhile, gasoline crack spreads reflect the cost of refining a barrel of crude oil into the fuel, and serve as a real-time indicator of gasoline demand and refining margins.

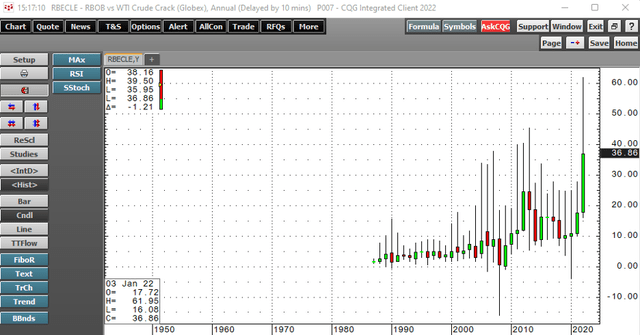

Annual Chart of Gasoline Refining Spreads (CQG)

The annual chart illustrates the record high in the gasoline crack spread at $61.95 per barrel in June 2022. At $36.86 per barrel on July 15, the gasoline crack spread was at the highest price since early 2013.

The US Tries To Push Gasoline Prices Lower

President Joe Biden ran on a platform supporting replacing fossil fuels with alternative and renewable energy sources to address climate change. Many Democrats believe that this issue is an existential threat to humanity. Meanwhile, hydrocarbons continue to power the US and the world.

The war in Ukraine, sanctions on Russia, and Russian retaliation pushed gasoline and distillate prices to all-time highs in 2022. The war and deteriorating relations with Russia threw the US administration’s energy policy an unexpected curveball. Over the past months, the administration has attempted to push gasoline prices lower by:

- The US is releasing unprecedented crude oil from the US Strategic Petroleum Reserve. According to the US Energy Information Administration, there were 485.1 million barrels of crude oil in the US SPR as of July 8, the lowest level since 1985. The administration has authorized the release of one million barrels daily through October 2022.

- President Biden just returned from Saudi Arabia, where he encouraged the world’s leading oil producer to increase production to fill the void created by lower Russian output and exports to the US, Europe, and “unfriendly” countries supporting Ukraine in fending off the Russian aggression.

- The administration has been jawboning at US oil companies, refineries, and even filling station owners, encouraging them to lower prices as a “patriotic” act in the current environment.

The administration continues to walk a fine line between pushing gasoline prices lower as the midterm elections in November approach and furthering its pledge to address climate change.

Three Reasons For Higher Prices

While the gasoline price has dropped over $1 per gallon wholesale from the June 2022 record high, at least three factors could push prices higher over the coming weeks and months:

- While the President has turned to the Saudis and OPEC for help with oil prices, he has not done the same with US oil companies with reserves in Texas, Oklahoma, Alaska, and other oil-rich domestic areas.

- After departing Saudi Arabia, officials from the country told reporters the Saudis would continue to work with the international oil cartel and only increase or decrease output based on the global supply and demand fundamentals. The Saudis did not expressly agree to ramp up output based on the US requests.

- Russia, a leading oil, gas, and coal producer, will likely continue to use fossil fuels as a weapon against the US and Europe, responding to sanctions and support for Ukraine. Russia has significant influence over OPEC production policy, as it has cooperated with the cartel since at least 2016.

Meanwhile, the US is exporting millions of crude oil barrels away from its shores. While the SPR is for domestic use during emergencies, at least some of the releases have gone to China and India, two countries that continue to import Russian energy at discount prices.

Chinese oil demand has declined because of COVID-19 lockdowns. When China emerges from the virus’s threat, the potential for a demand spike will increase, pushing oil prices higher.

Economics And Geopolitics Point Higher

On February 4, 2022, China’s President Xi and Russian leader Vladimir Putin shook hands on a massive trade agreement and a “no-limits” support alliance. Twenty days later, Russian troops crossed the border into Ukraine. Many political analysts believe China is closely watching the developments and planning for a forced reunification with Taiwan. Chinese support for Russia is a quid pro quo for Russian support for China.

The “no-limits” alliance created a bifurcation between the world’s nuclear powers, with the US and Europe on the other side. OPEC, India, Brazil, and other leading economies are caught in the middle of a bifurcated nuclear world with significant trade ramifications.

The late Marc Rich, a fugitive from US justice and one of the world’s most notorious oil traders, once called petroleum the blood that flows through the world’s veins. Despite the plans to move away from fossil fuels, oil remains the most significant energy source worldwide. It is now a political tool for producers like Russia facing sanctions from the US and Europe.

Markets across all asset classes move higher and lower based on the economic and geopolitical landscape. In 2022, inflation, the growing odds of a recession, and pandemic-related supply chain issues continue to plague the global economy. High oil and oil product prices only exacerbate the economic challenges. Meanwhile, the geopolitical dynamics are a mess, with tensions rising to the highest level since World War II.

The bottom line is economics and politics support higher oil prices in mid-2022.

The UGA Is The Gasoline ETF Product

The over one dollar drop in wholesale gasoline prices could be a temporary respite from the levels seen only a few weeks ago. Filling our tanks with gasoline now on sale at below $5 per gallon could seem like a bargain over the coming months.

Meanwhile, with stocks and bonds in bearish trends and many other markets following, identifying assets that will appreciate has been challenging. Gasoline could be one market that has upside potential after the recent correction. Bull markets rarely move in straight lines, and corrections can be brutal. NYMEX gasoline futures dropped from $4.3260 in June to $3.2132 on July 15, an over 25.7% decline in a few short weeks.

The most direct route for a risk position in the gasoline market is via the futures and futures options on the CME’s NYMEX division. The United States Gasoline ETF product (UGA) provides an alternative for those looking to participate in the gasoline market without venturing into the futures arena.

UGA is a liquid ETF with over $119 million in assets under management and an average of 121,895 shares changing hands daily. UGA charges a 1.02% management fee.

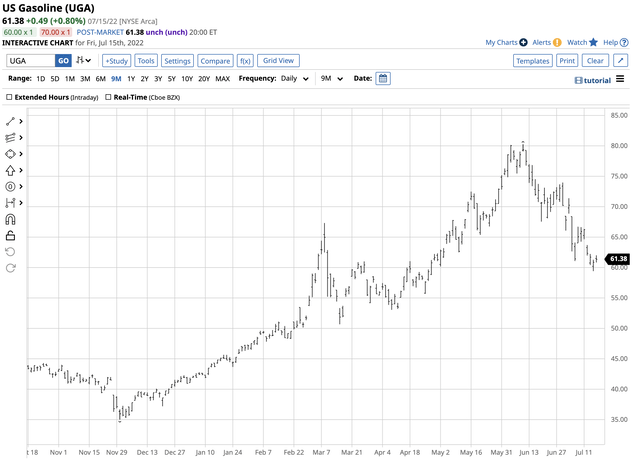

Short-term chart of the UGA ETF Product (Barchart)

UGA declined from $80.29 on June 9 to $61.38 per share on July 15 or 23.6%. UGA has done an excellent job tracking nearby gasoline futures on the up and downside over the past months. The decline in the gasoline futures arena could be short-lived, as compelling reasons could lead to higher highs and new all-time peaks in 2022 and 2023. I favor the long side in the UGA ETF, leaving plenty of room to add on further declines. It is impossible to pick bottoms during corrections, but the factors supporting higher gasoline and oil prices continue to favor the upside.

[ad_2]

Source links Google News