[ad_1]

photoschmidt

Investment thesis: The broad-based selloff in stocks and other assets so far this year is starting to shape into the early beginnings of a buying opportunity. The growing challenge is figuring out which of the sold-off assets are an investment opportunity, given the emerging picture of the end of the post-WW2 era and the beginning of a new one, which is yet to fully take shape. By focusing on the Vanguard FTSE Europe ETF (NYSEARCA:VGK), as a case study, I want to highlight the reasons why the broader EU is likely to be a poor investment opportunity.

The latest piece of bad news from the EU economy, namely Germany experiencing its first monthly trade deficit since 1991 may not register as a reason to be alarmed by the broader market. It is seen as a temporary situation, mostly caused by high energy prices. If one looks closer at the implications, as well as some other accompanying data points, it is in fact perhaps the most negative sign for the EU economy so far this year.

It amounts to a sizable part of a larger puzzle that suggests the EU’s industrial core is failing, under the pressure of the fallout from the economic war with Russia. The rupture in economic relations with Russia takes on an ever-more permanent shape, while efforts to get major energy exporters from the Middle East to fill the void are being dashed.

As it turns out, everyone is more interested in positioning for the growing Asian energy market. Combined with other factors, like Russia’s growing reluctance to accept euros for its exports across the world, as well as the wider picture of the EU economy suggests that the euro currency is likely to perform extremely poorly in the next year or two, against the dollar. In the longer term, it may become entirely unviable. The EU economy will see a massive deterioration in the process. Investors should be weary in considering exposing themselves to the EU market directly or indirectly.

About the Vanguard FTSE Europe ETF

The reason why I chose this exchange-traded fund (“ETF”) in particular as a case study is because it offers very broad exposure to the Western EU economic core, with all sectors of the economy well-represented. Before I briefly introduce the ETF’s basic profile, I want to highlight a somewhat recent article published on Seeking Alpha on this ETF, which takes the view that the Vanguard FTSE Europe ETF is a buy. Though I disagree, I also want to encourage readers to explore opposing perspectives. The article highlights the fact that the ETF is trading at a significant discount compared with the Vanguard S&P 500 (VOO). The overall thesis seems to be that even in the face of somewhat poor economic prospects in the EU, many European companies have been doing alright in terms of their overall performance and can be up to the challenges of the future.

My overall view is that most European companies are set to suffer as shortages most notably in energy amplify, as the Ukraine war drags on. At the moment, natural gas supplies are at the forefront of worries. As we approach the end of the year, assuming that the EU will go through with its ban on Russian oil, a continent-wide shortfall in liquid fuel supplies may emerge in the coming winter, in addition to the potential shortfall in natural gas supplies. Industrial disruptions may cause a cascading effect, where certain shortfalls may lead to other shortfalls along the EU’s complex industrial supply chain.

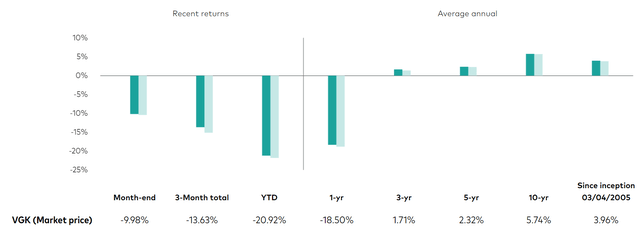

Vanguard FTSE Europe ETF investment returns (Vanguard)

As the chart above suggests, there has already been a substantial correction in the share price of the ETF this year. In my personal view, the selloff in no way prices in the possible outcome of a worst-case scenario, where the EU will not only experience a severe energy shortage this coming winter but perhaps a few decades of energy insecurity going forward, as its relationship with what has been by far its most important energy provider is unraveling very fast, with permanent consequences.

Looking at some of the top stocks that make up the fund, it is hard to argue how any of them can successfully thrive if the worst-case scenario, which is growing more likely to occur with every day that passes, plays out.

Vanguard FTSE Europe ETF top four holdings (Vanguard)

Nestlé S.A. (OTCPK:NSRGY, OTCPK:NSRGF), for instance, is dependent on the full proper functioning of Europe’s supply chains for its operations throughout the continent. In the event that industrial operations are halted in order to preserve natural gas in the winter, there is no way that it will be able to continue producing its wide-ranging array of goods. Some may argue that since it is in the food business it would be exempt from energy rationing, but most of its food products are not essential food products, so it may not be the case. Even if it will not be asked to stop operations in order to conserve natural gas, it may find it hard to secure affordable transportation next year, if Europe will see liquid fuel shortages, after the Russian oil ban kicks in.

Roche (OTCQX:RHHBY, OTCQX:RHHBF) might seem like a decent defensive stock in case of harsh energy shortages in Europe. If we examine its supply chain vulnerabilities, it becomes more evident that it may not be the case. In the event that the EU petrochemicals industry is hit with a lack of natural gas or oil, specialty chemicals, that are often derived from wider industrial activities can be impacted. Both the diagnostics as well as pharmaceutical products can see a potential impact as a result of wider industry disruptions, as well as potential transport issues down the line.

ASML Holding N.V. (ASML) can see an increase in energy-related costs, same as all the other companies that are based and have significant operations in Europe. In addition to that, it is faced with a growing list of restrictions on its sales to nations that would otherwise purchase its products. With these sales restrictions in place, there is always a chance that it can lead to the emergence of competing companies, especially in China, where there is a feverish effort being made to close the tech gap.

Shell plc (SHEL, OTCPK:RYDAF) might be thought of as a company that could potentially benefit from higher oil & gas prices. On the other side of the equation, there is the risk that it can see many of its gas stations in Europe run dry, and its refineries can be squeezed by excessively high input prices, both in terms of crude oil it has to purchase, as well as other costs, such as electricity prices and so on. There is a chance that these costs might actually cancel out the profits that Shell will earn from LNG and its upstream operations. It is nevertheless perhaps one of the best-positioned companies of the top four represented in this ETF.

The reality is that it is hard to fathom how European companies can thrive within the context of astronomically high energy prices, energy insecurity, a growing path of sanctions & restrictions in relation to major economies of the world, like China, Russia & Iran, as well as other problems, mostly internal in nature. Yes, exports to the U.S. help, but with American consumers also starting to struggle, it is unclear whether it can continue to be a growing market for EU goods. Many of these companies have international exposure, with sales and production facilities all over the world, which is the only bright spot for European business.

The Euro area is experiencing a widening trade deficit gap

The German trade surplus issue has been a subject of much debate and political rhetoric in the past few years. There is a good reason for it. Since the euro currency was adopted, Germany’s trade surplus ballooned. Germany’s economic strength was seen as the saving grace of the euro currency project, even as countries like Italy, Greece, and Spain started to struggle last decade.

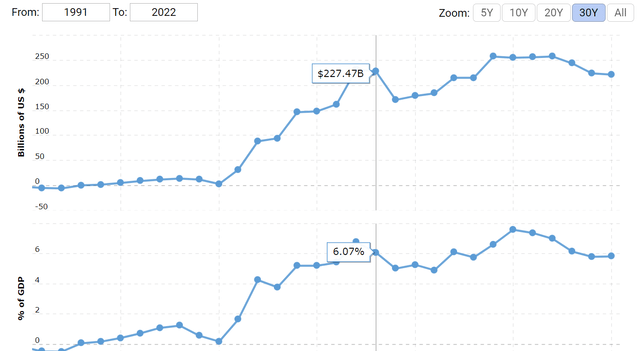

Germany yearly trade surplus (Macrotrends)

The recent deficit is mostly blamed on the surging price of energy imports. EU trade data however suggests that there has been no jump in import growth in the past few months. It is very likely that the EU has been paying more for energy imports, but it has been seeing far less robust growth in other import growth. According to Eurostat the value of imported energy is up by 146% in the past year, while the value of imported manufactured goods is up by 29%. Export growth on the other hand has been slowing down in the past few months, which is the more worrying trend in my view.

EU imports & exports growth (Eurostat)

The fact that import growth rates are mostly sustained at a higher pace by rising energy prices, means that EU exports are automatically made more expensive, because of higher energy input costs. Higher product costs will make most EU exports uncompetitive. The trade gap will only rise until the euro adjusts in order to bring the EU economy back into balance. The problem with reaching that balance will be that the weaker the euro gets, the more expensive energy imports will become in euro terms. Given that the EU is likely to suffer from high energy prices and energy supply instability for the foreseeable future, the factor that is the main cause of the widening trade gap will not dissipate, therefore there is nowhere for the euro to go but further down. The recent announcement of the first monthly trade deficit in decades by Germany is just a symptom of the intensification of this problem.

Euro currency faces multiple headwinds

The factor I identified and explained so far, namely rising energy costs, is the main factor that caused the widening EU trade gap, not only because of the higher costs of energy imports but also because those higher costs make EU goods more expensive to produce is a major headache for the EU economy. The euro is set to suffer as a result, as I pointed out, given that it is caught in a vicious cycle, where it is set to adjust lower in order to rebalance trade, even as its weakening will worsen the trade balance, due to higher energy import costs in euro terms. There are however many other negative factors impacting the current strength level of the euro, as well as its future prospects.

The main flaw of the euro explained in an abbreviated version is that it brings together too many states, with too many different needs, without a corresponding fiscal mechanism in place to help smooth out the resulting problems. Many root causes have to do with the fact that countries like Germany are home to many global brands, which will benefit from a euro currency that is perpetually weaker than what the euro would be if it were to exclusively reflect Germany’s economy. Italy on the other hand, with mostly regional brands anchoring its economy perpetually, suffers from having a euro currency that is too strong to allow its industries to make headway on the global market. Thus, Germany is caught in a virtuous cycle, while Italy in a vicious one, with no way to get out.

However, Germany’s virtuous cycle is not unbreakable. In fact, the latest trade data suggests that it just might have broken it, meaning that the euro might just have to readjust to levels more reflective of economies like Italy, and Spain than Germany’s economy until recently. We should keep in mind however that a weakening German economy will mean a further knock-on effect on the already struggling eurozone economies, which means that those economies will themselves see growing struggles, despite a weakening euro, which should help them somewhat.

The ECB is stuck on many levels, with no room to shift into a defense of the euro. Countries like Greece and Italy continue to need support in order to finance their debts. A broad-based weakening of the EU economy for the reasons mentioned above, also makes it hard for the ECB to contemplate a serious effort to defend the euro. There is therefore nothing fundamental that is currently backing the euro, aside from sentiment and institutional entrenchment in the global financial system.

The future of that institutional entrenchment of the euro within the global financial system may have suffered a significant, perhaps even terminal blow this year when the Russians stopped accepting euros for their gas exports to the EU. Since then, they also started demanding ruble payments for wheat exports. This amounts to a decline in euro-denominated transactions across the world to the tune of tens of billions of euros/year. The fact that Russia is no longer looking to accumulate euro-denominated FX reserves, due to the freezing of its central bank assets that were denominated in euros, dollars, and a number of other currencies is also a cause of concern. Russia will probably reject most euro transactions eventually for all its trade transactions. It seems intent on decoupling its economy from the Western-dominated financial system.

At the moment, all the negative fundamental trends, as well as its future prospects, are yet to truly take a heavy toll on the euro. It did see a significant decline versus the dollar in the past few months. For now, at least, the institutional entrenchment factor seems to be keeping it from going into freefall.

euro to USD exchange rate (ECB)

Germany’s economic model cracking from multiple sides, meaning that the euro will no longer be supported by a solid economic core

In order to understand the implications of the latest negative German economic data, it is important to understand the model that made Germany a euro-era economic success story, even as many countries in the South of the eurozone faltered. The most important ingredient sitting at the base of it all was the fact that Germany has many global brands that provided a strong basis for export growth. a euro currency that has been reflecting many weaker economies such as Italy’s certainly helped to keep German exports competitive. The massive trade surpluses that Germany has been running in the past two decades would have sent its national currency soaring, dampening its export growth. Being tied to the rest of the euro area prevented that from happening.

The euro currency was not the only important factor. EU enlargement allowed German companies to move just enough of their operations to lower-wage markets in its immediate vicinity to keep wage pressures at home down, while intermediate product input costs were also kept down as they were increasingly produced in Visegrad group countries or other former communist states that are close enough to viably integrate into Germany’s industrial supply chain. The economic relationship in the area can be summed up as the West providing capital, while the East provided affordable labor, as well as a significant new consumer market for that capital.

Average gross wages in the area have doubled in the past decade or so, which reduced the wage advantage that the region provided to German capital significantly. The migration of labor from East to West also slowed dramatically. Energy costs were kept in check, even as the massive reduction in coal and nuclear power use put pressure on the system. That is where Russian gas comes into play. Summing it all up, there are upwards producer price pressures that are converging. The energy price shock that started about a year ago and intensified since the war in Ukraine is just the last act along the way to a complete breakdown of the German economic model that started with the adoption of the euro currency. The damage seems permanent, with Russia aggressively pushing its energy exports East, while it also seems that EU policymakers may have overestimated their capacity to attract major energy exporters to the EU market.

Investment implications

The euro seems doomed to continue losing value for the foreseeable future. The EU consumer is being pushed to the breaking point by higher energy costs. EU exports are losing momentum as producer costs are rising very rapidly, making goods produced in the EU more expensive on the global market. The geopolitical factors that are causing a decline in euro currency demand as a reserve currency, and as a means to conduct international transactions continue to unfold. Geopolitical issues are also plaguing a growing number of international economic relations, with more and more nations facing either EU sanctions or extraterritorial sanctions imposed by the U.S.

Germany’s stunning reversal of its trade surplus situation, which just a few years ago was decried as being a major cause of EU and global trade imbalances is only a symptom of the dramatic transformation we are seeing in regard to the current shape and trajectory of the EU economy. It used to be that the euro crisis was seen as a story of two eurozone economies. The weak South, versus the solid North. With the seeming collapse of the German model that lasted since the adoption of the euro, it seems we now just have an economically weak eurozone, with few prospects for improvement, while the downside risks keep mounting.

The Vanguard FTSE Europe ETF may be down more than 20% YTD as I write this, but it is by no means a buying opportunity as a result of this year’s selloff. The only positive aspect that one could claim in regards to European companies is that they are likely to benefit from low-interest rates for the foreseeable future, given that the ECB is unlikely to aggressively tackle the inflation issue, or defend the exchange value of the euro. Low-interest rates will in no way make up for the outright horrible business environment that European companies are facing. When we are reduced to prospects of energy rationing at household and industry levels, it is hard to see a bright future for the European continent or for its businesses.

[ad_2]

Source links Google News