[ad_1]

Sezeryadigar

This dividend exchange-traded fund (“ETF”) article series aims at evaluating products regarding the relative past performance of their strategies and quality metrics of their current portfolios. As holdings and their weights change over time, I may update reviews when necessary.

FVD strategy and portfolio

The First Trust Value Line® Dividend Index Fund (NYSEARCA:FVD) has been tracking the Value Line Dividend Index since 08/19/2003. FVD has 193 holdings, a distribution yield of 1.86%, and a total expense ratio of 0.67%. It pays quarterly dividends.

To be eligible, companies must be listed in the U.S., have more than $ 1 billion in market capitalization, a higher dividend yield than the S&P 500 (SPY), and a good Value Line Safety RankingTM. Investment companies and limited partnerships are excluded. The fund seeks to rebalance holdings in equal weight every month.

As described on Value Line website, the safety rank takes into account technical and fundamental factors:

The Value Line Safety Rank measures the total risk of a stock relative to the approximately 1,700 other stocks. It is derived from a stock’s Price Stability rank and from the Financial Strength rating of a company, both shown in the lower right hand corner of each page in Ratings & Reports. Safety ranks are also given on a scale from 1 (Safest) to 5 (Riskiest).

FVD holds mostly U.S. companies (91.9%), and it also invests in Canada (7.1%), the U.K. (2.6%) and Switzerland (2.1%). Other countries are below 1%. A bit more than half of the portfolio is in large companies (53%). The weight of mid-caps is significant (32%).

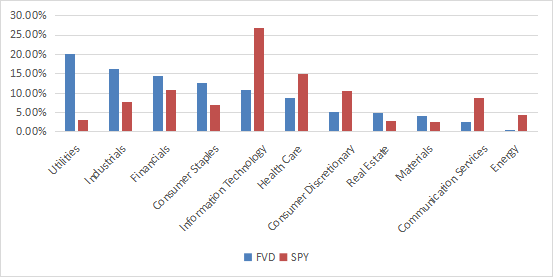

The top 3 sectors are utilities (20%), industrials (16.3%) and financials (14.3%). Compared to the S&P 500, FVD overweights these three sectors, and also consumer staples, real estate and materials. It underweights technology, communication, consumer discretionary, healthcare and energy. No sector weighs more than 20%. Sector composition may change over time.

Sector weights (chart: author: data: Fidelity)

Constituents are frequently rebalanced in equal weight, but position sizes may drift with price action. The next table lists the top 10 holdings as of writing. No holding weights more than 0.6% of asset value, so risks related to individual stocks are very low.

|

Ticker |

Name |

Weight% |

EPS growth %TTM |

P/E TTM |

P/E fwd |

Yield% |

|

CLX |

Clorox Co |

0.57% |

-48.72 |

38.35 |

34.47 |

3.28 |

|

AWR |

American States Water Co |

0.56% |

-2.63 |

34.12 |

31.68 |

1.78 |

|

ERIE |

Erie Indemnity Co |

0.56% |

-4.61 |

35.16 |

32.68 |

2.27 |

|

GIS |

General Mills Inc. |

0.56% |

16.97 |

17.09 |

18.90 |

2.86 |

|

NEE |

NextEra Energy Inc |

0.56% |

-65.14 |

108.96 |

28.10 |

2.12 |

|

PFE |

Pfizer Inc |

0.56% |

121.74 |

12.20 |

8.08 |

3.01 |

|

ARE |

Alexandria Real Estate Equities Inc. |

0.55% |

-51.60 |

52.51 |

127.59 |

3.23 |

|

BR |

Broadridge Financial Solutions Inc |

0.55% |

5.82 |

32.04 |

23.17 |

1.71 |

|

DRE |

Duke Realty Corp |

0.55% |

179.31 |

21.37 |

50.84 |

1.96 |

|

SON |

Sonoco Products Co |

0.55% |

-119.84 |

N/A |

10.51 |

3.39 |

Past performance

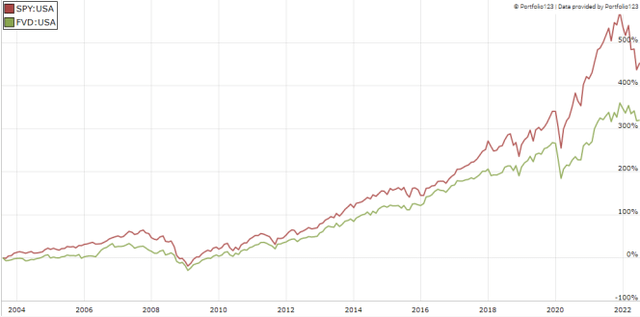

Since inception in August 2003, FVD has underperformed SPY and the equal-weight S&P 500 (RSP) in annualized return and risk-adjusted return (Sharpe ratio).

|

Total Return |

Annual.Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

FVD |

319.99% |

7.90% |

-52.05% |

0.55 |

13.39% |

|

SPY |

461.64% |

9.57% |

-55.42% |

0.6 |

14.76% |

|

RSP |

520.27% |

10.15% |

-59.90% |

0.57 |

17.05% |

The next chart compares FVD and SPY since FVD inception. FVD has underperformed in the long run.

FVD vs. SPY since inception (Portfolio123)

However, FVD has beaten SPY in the last 12 months:

FVD vs. SPY last 12 months (Portfolio123)

In previous articles, I have shown how three factors may help cut the risk in a dividend portfolio: Return on Assets, Piotroski F-score, and Altman Z-score.

The next table compares FVD with a subset of the S&P 500: stocks with an above-average dividend yield, an above-average ROA, a good Altman Z-score, a good Piotroski F-score and a sustainable payout ratio. The subset is rebalanced annually to make it comparable with a passive index.

|

Total Return |

Annual.Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

FVD |

319.99% |

7.90% |

-52.05% |

0.55 |

13.39% |

|

Dividend & quality subset |

802.76% |

12.36% |

-43.61% |

0.8 |

14.28% |

Past performance is not a guarantee of future returns. Data Source: Portfolio123

FVD underperforms the dividend quality subset by 4.46 percentage points in annualized return. However, the ETF performance is real and this subset is hypothetical. My core portfolio holds 14 stocks selected in this subset (more info at the end of this post).

Scanning FVD portfolio

FVD is cheaper than SPY regarding the usual valuation ratios, but the difference is moderate (see next table).

|

FVD |

SPY |

|

|

Price/Earnings TTM |

17.47 |

18.43 |

|

Price/Book |

2.55 |

3.53 |

|

Price/Sales |

2.02 |

2.37 |

|

Price/Cash Flow |

13.77 |

14.38 |

I have scanned holdings with the quality metrics described in the previous paragraph. I consider that risky stocks are companies with at least 2 red flags among: bad Piotroski score, negative ROA, unsustainable payout ratio, bad or dubious Altman Z-score, excluding financials and real estate where these metrics are less relevant. With these assumptions, 18 stocks out of 193 are risky and they weigh about 10% of asset value, which is acceptable.

Based on my calculation, the aggregate return on assets, Altman Z-score and Piotroski F-score are a bit below the S&P 500 values. These metrics point to a portfolio quality similar to the benchmark.

|

FVD |

SPY |

|

|

Altman Z-score |

2.91 |

3.29 |

|

Piotroski F-score |

5.83 |

6.15 |

|

ROA% TTM |

7.22 |

7.95 |

Takeaway

FVD holds 193 dividend-paying stocks in equal weight. Constituents are screened with a safety ranking system based on technical and fundamental factors. The heaviest sectors in the portfolio are utilities, industrials, financials and consumer staples. Sector composition and the equal-weight methodology make it more balanced and diversified than SPY. Aggregate valuation and quality metrics are close to the benchmark.

Past performance is underwhelming: FVD has lagged SPY by 1.7 percentage point in annualized return since inception. However, it shows a slightly lower risk measured in maximum drawdown and standard deviation of monthly returns (volatility). It means that the Value Line Safety Ranking works and may offer some capital protection in bear markets, as it recently did. FVD has been more resilient than SPY in 2022. For transparency, a dividend-oriented part of my equity investments is split between a passive ETF allocation (FVD is not part of it) and my actively managed Stability portfolio (14 stocks), disclosed and updated in Quantitative Risk & Value.

[ad_2]

Source links Google News