[ad_1]

Torsten Asmus/iStock via Getty Images

Thesis

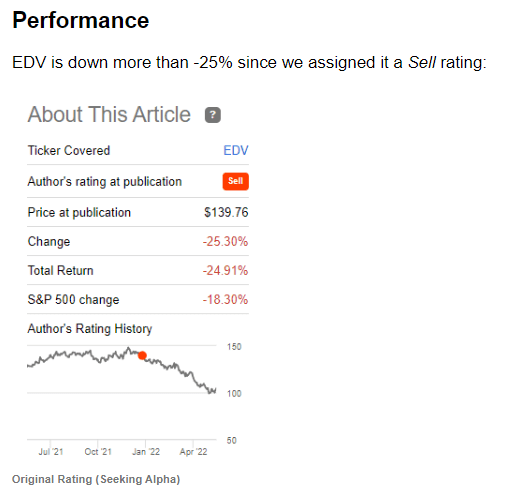

We wrote about the Vanguard Extended Duration Treasury ETF (NYSEARCA:EDV) several times this year. We started the coverage earlier in the year with a Sell rating which provided outsized profits:

Original Sell Rating (Seeking Alpha)

As yields hit decade-long highs we moved to Hold on the name, given the lack of upside potential on an outright short trade. We are now in a position where we feel an investor should start considering layering in a long position with a clear-cut stepping-yield target in mind. With 30-year yields having almost touched their 2018 highs of 3.46% and now sitting at 3.14%, an investor needs to set a range target to start layering in exposure to the fund and rates duration.

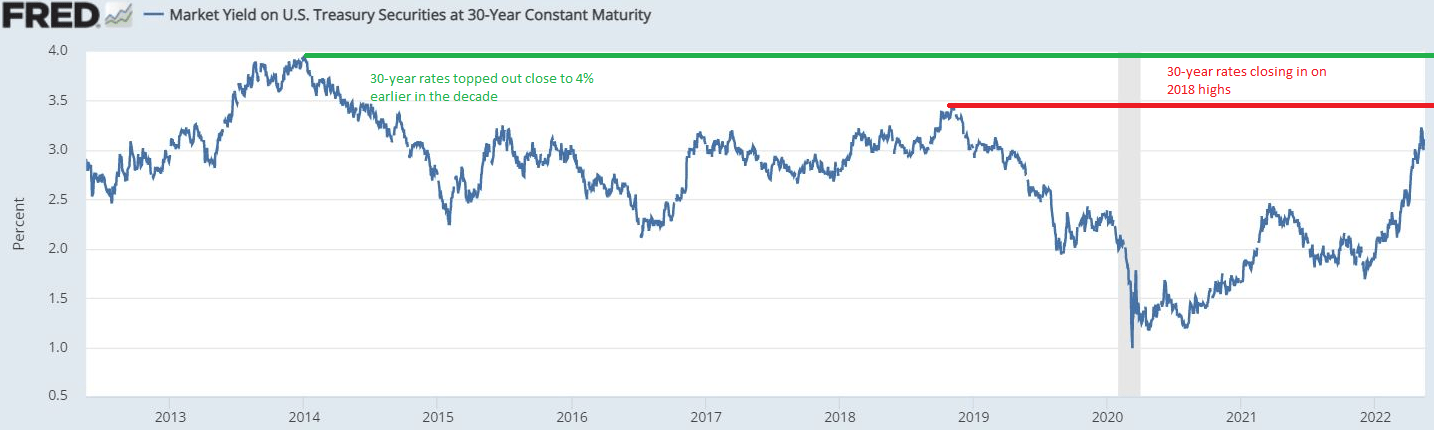

With inflation as the main Fed concern, but a decelerating economy, it looks like the Fed is going to hike rates into a softening economy and basically push the U.S. into a mild recession in order to decrease the demand side of the inflation equation. The Fed cannot produce oil or agricultural commodities, nor refine petrol into gasoline to dampen inflation, therefore it is going to hit the demand side via tighter financial conditions and a higher unemployment rate. This is ultimately going to translate into a lower GDP figure, lower ISMs and eventually lower rates. After a technical recession, the Fed will not be able to raise rates anymore, the most aggressive stance it could take is to pause. We feel the Fed will need to cut rates in 2023 at some point. That means that the time to buy EDV is in 2022, and while we cannot say with certainty when long dated yields will peak, we can certainly set a viable yield range where to purchase EDV. That range in our mind is 3% to 4%, following the peaks that were observed in long dated rates in the past decade:

30-Year yields (The Fed)

We are therefore thinking that a retail investor who wants exposure to long dated rates set a target yield ladder and start purchasing small chunks when long dated yields are in that range.

The same view on yields is shared by famed investor Michael Burry from the “Big Short”:

Burry Quote (NY Post)

To that end, when 30-year yields are below 3.4% an investor can start purchasing small chunks. Yields between 3.4% and 3.7% would signal medium positions to be entered, while yields above 3.7% would be conducive of larger purchases. Small chunks would be 1-5% of the ultimate target position, medium positions would be 5-10% of the ultimate target, while large positions would be 10-20% of the end target position. We favor a layered approach into Buying EDV because we are unsure when yields are going to peak but we are fairly certain that 2022 will see a peak in yields when compared to the following years.

What are STRIPS?

As mentioned above STRIPS is an acronym for Separate Trading of Registered Interest and Principal of Securities. What this means is that historically investors looking at Treasury securities decided that only certain aspects were appealing to some of their needs (i.e. only the interest component or only the principal component) and decided to strip the original Treasury security into underlying cash-flows with their own identifiers. Basically, STRIPS let investors hold and trade the individual interest and principal components of eligible Treasury notes and bonds as separate securities. As an example, a Treasury bond with 10 years remaining to maturity consists of a single principal payment, due at maturity, and 20 interest payments, one every six months over 10 years. When this note is converted to STRIPS form, each of the 20 interest payments and the principal payment becomes a separate security.

Holdings

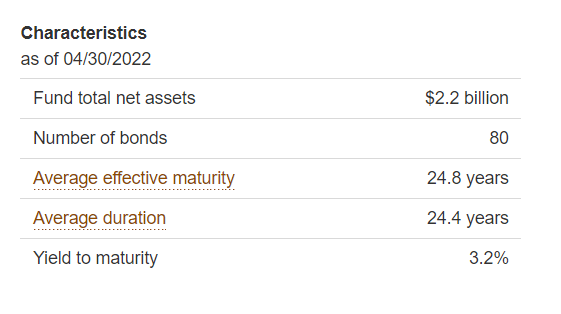

The portfolio contains only 80 bonds, but has a very long duration:

Characteristics (Fund Fact Sheet)

We can see from the fund fact sheet that the STRIPS composition allows the portfolio managers to create a very long dated portfolio with an approximate 25-year duration.

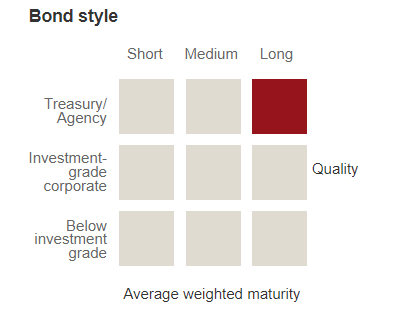

The fund falls in the long-dated treasury bucket as quantified by Morningstar:

Bond Style (Fund Fact Sheet)

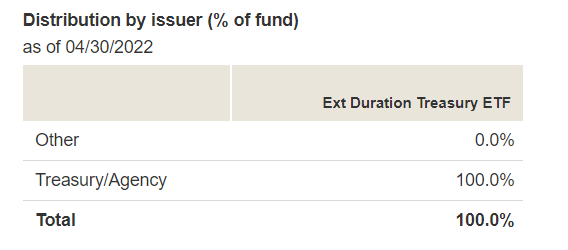

The portfolio is composed entirely of risk-free securities:

Composition (fund)

The driving factor for the fund is composed of rates exclusively since there is no credit risk in the underlying treasury securities.

Conclusion

EDV is a long duration Treasury STRIP securities vehicle. The fund is down more than -27% year to date given the violent rise in long dated rates. With a Federal Reserve set to aggressively fight inflation even into a decelerating economy we feel that 2022 will see a peak in long dated rates. We feel the Fed is compelled to still be aggressive in the short end but will be forced to pause and reverse course as the economy contracts. While we are not certain what the peak in long dated rates will be, we feel a target range of 3% to 4% would correctly capture the move left in rates. We favor a layered approach into Buying EDV with a position segregation as outlined in our Thesis section.

[ad_2]

Source links Google News