[ad_1]

KanawatTH/iStock via Getty Images

The intense selling we’ve seen in the first half of this year has created opportunities in a lot of places. The massive declines in tech and growth-oriented stocks have somewhat overshadowed the fact that, for income investors, yields have moved a lot higher in the past six months as share prices have plummeted. After more than a decade of dividend stocks performing very strongly with rock bottom interest rates, they too have come back to earth somewhat.

Dividends and tech aren’t generally owned by the same sort of investor, but that’s exactly the sort of investor that would own the Global X Funds – Global X NASDAQ 100 Covered Call ETF (NASDAQ:QYLD). I’ve covered this ETF before because it’s actually a great solution for investors that are risk-averse, or just want strong income each month rather than capital appreciation.

But it’s been a while since I’ve covered it, so in this article, we’ll do a refresher of what it is, why it’s been a relative outperformer this year, and what to do with it now.

What is QYLD?

QYLD is an ETF from Global X Funds that attempts to track the CBOE Nasdaq-100 BuyWrite V2 Index. This is a theoretical portfolio of the Nasdaq 100 stocks that holds the shares of each company, and then sells calls against those positions to generate income. The calls sold are one month out and are held until one day prior to expiration when they are liquidated and rolled forward.

This is a common strategy for income investors and certainly one I’ve used variations of in my own trading before. This is particularly attractive when implied volatility is high, as it has been for all of 2022, as option premiums soar.

Now, why would someone want to own QYLD?

Fund Factsheet

It’s attractive because selling calls against your positions can be time-consuming and expensive, depending upon your broker and how you go about executing the sales. QYLD does this for you in a seamless, hands-off way. In that way alone, it offers significant value. However, it also distributes cash to holders each month, rather than quarterly, so you can either use that money for expenses, or reinvest. In addition, QYLD always has a very high distribution yield. It has been around 12% annually for a long time at this point, and that’s where it is today.

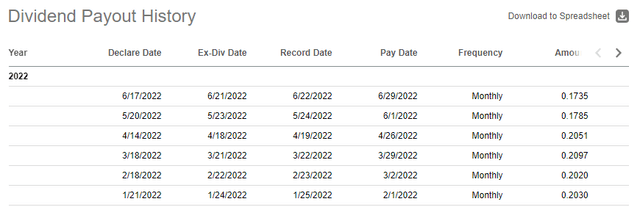

Below, we can see the distribution history of QYLD for 2022, noting the past two months have seen lower distributions.

Seeking Alpha

Income ETFs like QYLD tend to have fluctuating distributions, but even if we just take the past two months and average them, then multiply by 6 to annualize, we’re still looking at a 12% yield going forward. You’d be hard-pressed to find anything yielding 12% and that’s why QYLD is so attractive. If you are focused solely on income and don’t mind price fluctuations, I’m not sure I have a better suggestion than QYLD. However, as we’ll see in a bit, I think the time to own QYLD has passed for all but the most ardent income investors.

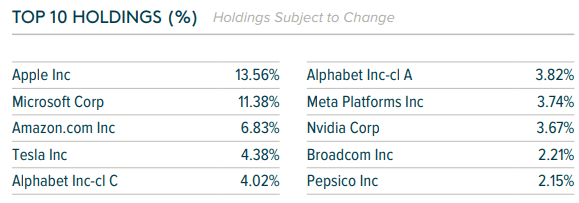

Before we get to that, however, here’s a refreshed look at the stocks QYLD holds, which includes names that surprise nobody given it’s a tech-focused ETF.

Fund Factsheet

Apple (AAPL) and Microsoft (MSFT) are about one-quarter of the ETF, with Alphabet (GOOG) (GOOGL) next up at about 8%, and so on. I firmly believe in most of the names on this list in terms of rebounding into next year, which also means I think QYLD is likely to go higher. However, if you agree with that assessment, QYLD is far from the best way to take full advantage.

In other words, I think the best time to own QYLD was back at the end of last year, but the time is right to swap out for just owning growth-oriented stocks.

The case for swapping out of QYLD

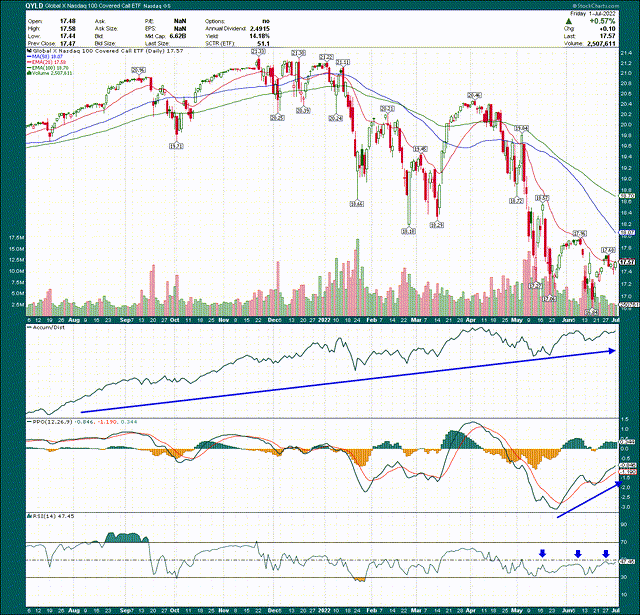

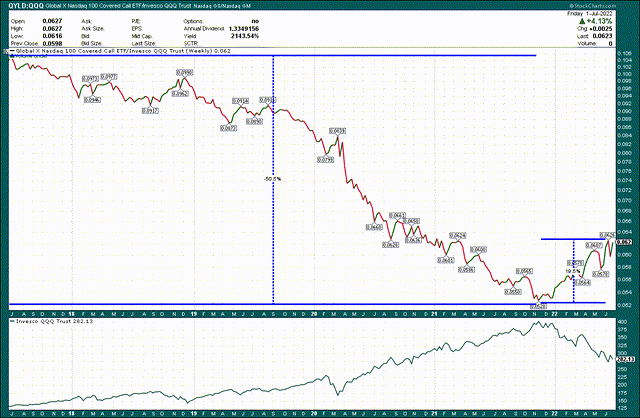

Let’s look at a chart of QYLD to get an idea of how it has performed this year.

StockCharts

We can see the chart looks pretty ugly, but in comparison to the indices themselves, this isn’t half bad. Covered call ETFs should outperform during bearish periods and underperform during bullish periods. For what it’s worth, sideways consolidations should see covered call ETFs outperform as well, but it’s been a while since we saw one of those.

At any rate, we can see this chart has a similar look to the QQQ, but the magnitudes are smaller. That’s the difference in just owning stocks versus selling calls against them, and QYLD has shown up nicely during this bear market.

I’ll note the accumulation/distribution line looks great, reaching new highs while price flounders. In addition, the PPO has moved sharply higher during this consolidation, another good sign of seller exhaustion. The 14-day RSI has some work to do in terms of cresting the centerline, but other than that, QYLD looks good for a potential bottom.

Now, I mentioned when QYLD should outperform and underperform, so let’s take a look at QYLD versus the QQQ, excluding dividends, to get an idea of bull versus bear market performance. This is a 5-year weekly chart that encompasses the big bull run we had as well as 2022’s bear market.

StockCharts

The four-plus years prior to the start of 2022 shows the tremendous outperformance of QQQ against QYLD, and given the bull market conditions, that’s no surprise. From a pure price perspective, holding QYLD and not QQQ would have cost you about 50% of underperformance. Ouch!

I’ve also drawn a different percentage change on this ratio from the start of 2022 through today, and QYLD has outperformed by about 20%. Considering you’d also have received six monthly dividends, that’s pretty strong.

I said back in January that QYLD would outperform for the foreseeable future, and that’s exactly what we’ve gotten. However, I think that trade has run its course, and it’s time to go the other way.

The reason is because I think we’ve bottomed. I told subscribers this a couple of weeks ago, and I published a public article last week to that same effect. If you believe that to be the case, and you’re interested in total returns rather than pure income, the time to swap out of QYLD is now.

The reason is because if we are entering a new bullish phase, QYLD will once again greatly underperform just owning the indices. Obviously, if you’re selling calls against your position, your upside is capped. That’s why covered call funds outperform to the downside and underperform to the upside. The time to buy QYLD was six months ago, but now, I think it’s worth taking the additional risk of just buying QQQ or whatever index fund you like instead.

Final thoughts

These periods of bearish behavior in the market don’t necessarily last that long, although it feels like an eternity if you’re watching your account value tick lower every day. I noted QYLD was a good alternative to index funds in January, and that call has worked out nicely. However, I think it’s time to pull the plug on that recommendation and swap back to uncovered positions. If I’m right that we’ve already bottomed, you don’t want to cap potential gains in the coming months.

Don’t get me wrong; if you’re income-focused, QYLD is still a great choice for a massive yield that is paid monthly. That hasn’t changed, but if you have any inclination toward total returns instead of just income, please consider pure index funds instead, as I believe we’re transitioning to the next bull market phase.

[ad_2]

Source links Google News