[ad_1]

Justin Paget/DigitalVision via Getty Images

Investment Thesis

Investing in clean energy is a hot topic nowadays and rightfully so. With oil prices at a decade high, policymakers are increasingly pushing the green energy agenda in order to replace traditional sources of energy. The main reason investors are interested in the clean energy sector goes beyond the promise of a higher yield though. According to Fatih Birol, executive director of the International Energy Agency, clean energy spending must triple in the next decade in order to meet the target of net-zero greenhouse gas emissions by 2050. As a result, the high demand for clean energy solutions makes ETFs investing in this space an interesting hunting ground.

That said, investors shouldn’t overlook valuations, especially in a rising rate environment. Clean energy stocks generally trade at over 20x earnings, which is extremely expensive when financial conditions are tightening. As a result, I believe it is prudent to wait until we have a meaningful correction and valuations revert to reasonable levels.

Strategy Details

The Invesco WilderHill Clean Energy Portfolio ETF (NYSEARCA:PBW) tracks the investment results of the WilderHill Clean Energy Index. The index is composed of stocks of companies that are publicly traded in the United States and engaged in the business of advancement of cleaner energy and conservation.

If you want to learn more about the strategy, please click here.

Portfolio Composition

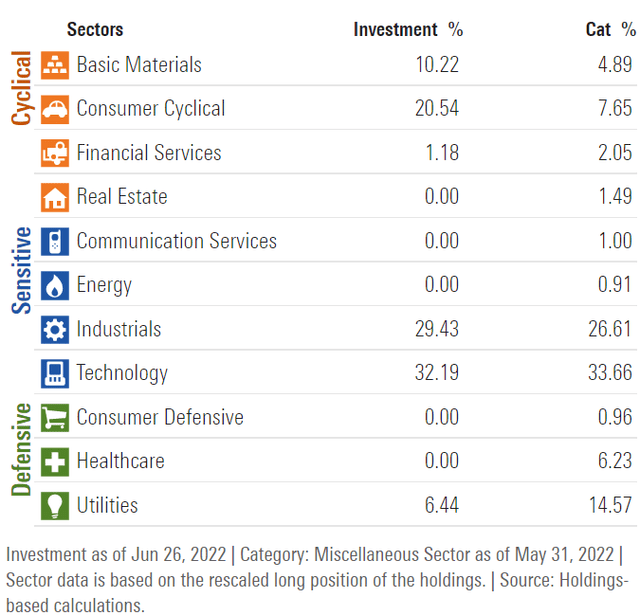

The index invests ~32% of total assets in Technology stocks, followed by the Industrials (29%) and Consumer Cyclical stocks (~21%). The largest three categories have a combined allocation of approximately 82.2%.

Morningstar

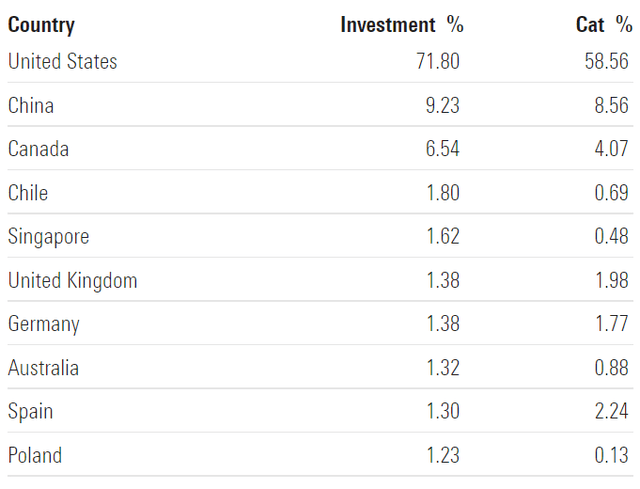

In terms of geographical allocation, the top 10 countries represent nearly 98% of the portfolio. The U.S. accounts for 72%, whereas other countries such as Germany seem to be underrepresented given the low weight (only a ~1.4% allocation to Germany).

Morningstar

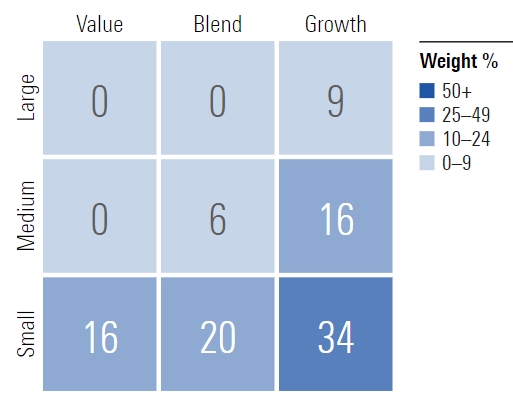

~34% of the portfolio is invested in small-cap growth stocks, characterized as small-sized companies where growth characteristics predominate. Small-cap issuers are generally defined as companies with a market capitalization below $2 billion. The second-largest allocation is in small-cap “blend” stocks, which account for 20% of the portfolio. I personally like the fact that over 70% of assets are invested in small-caps which generally tend to grow at a higher rate than large-cap issuers.

That said, investors need to be aware that small caps are generally more volatile, especially in times of economic uncertainty. Therefore, allocating money to PBW could potentially increase the overall volatility of your portfolio.

Morningstar

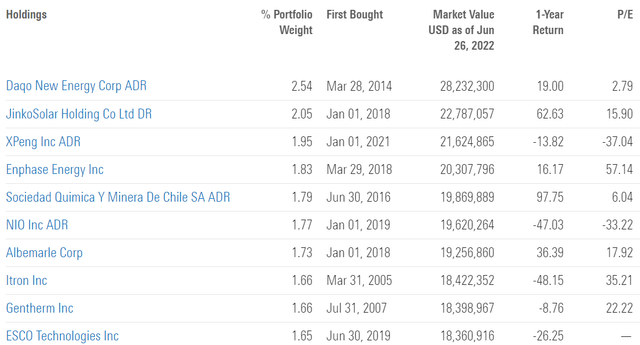

PBW is currently invested in 78 different stocks. The top 10 holdings account for ~19% of the portfolio, with no single stock weighting more than 3%. In my opinion, PBW is well-diversified and has a low level of unsystematic risk.

Morningstar

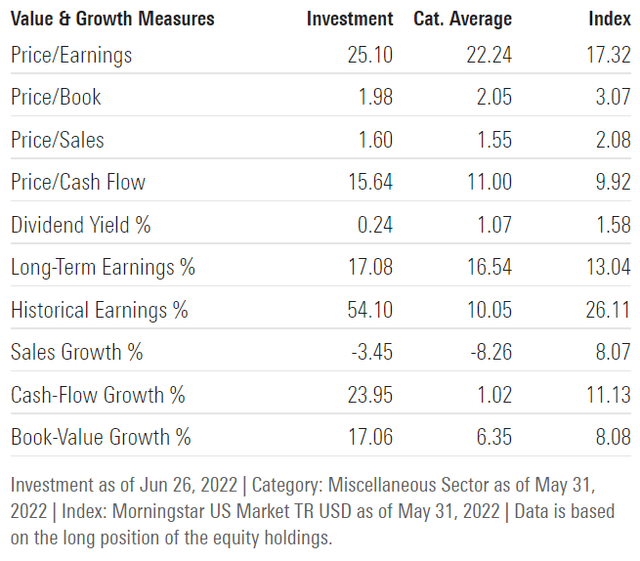

Since we are dealing with equities, one important characteristic is the portfolio’s valuation. According to data from Morningstar, PBW trades at nearly 3x book value and 25x earnings. It doesn’t surprise me that PBW trades at over 20x earnings since valuations across the board in the clean energy sector are stretched. However, owning high multiple stocks when rates are rising is a risky bet since rate hikes act like gravity on valuations.

Morningstar

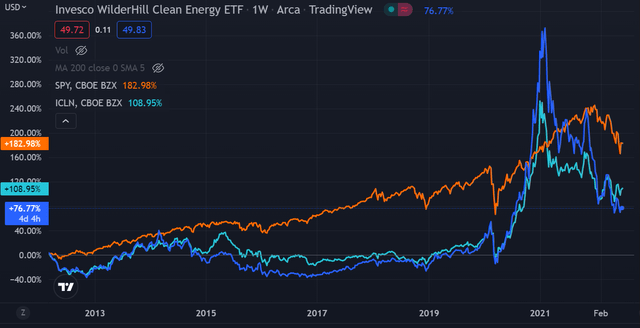

On top of that, I think it’s important for investors to get some historical perspective on how PBW performed in past cycles. As we can see, investors’ interest in this sector isn’t something new, and there were multiple episodes when they have driven prices to unsustainable levels. The 2013-2014 time period is very relevant in my opinion as clean energy was a very hot sector back then. Over the course of a few months, PBW grew by ~90% to untenable levels, before falling by 50% over the next 3 years. While we are now far from the November 2021 peak, I believe the bubble in clean energy stocks isn’t yet over, and I expect further selling in the months ahead.

TrandingView

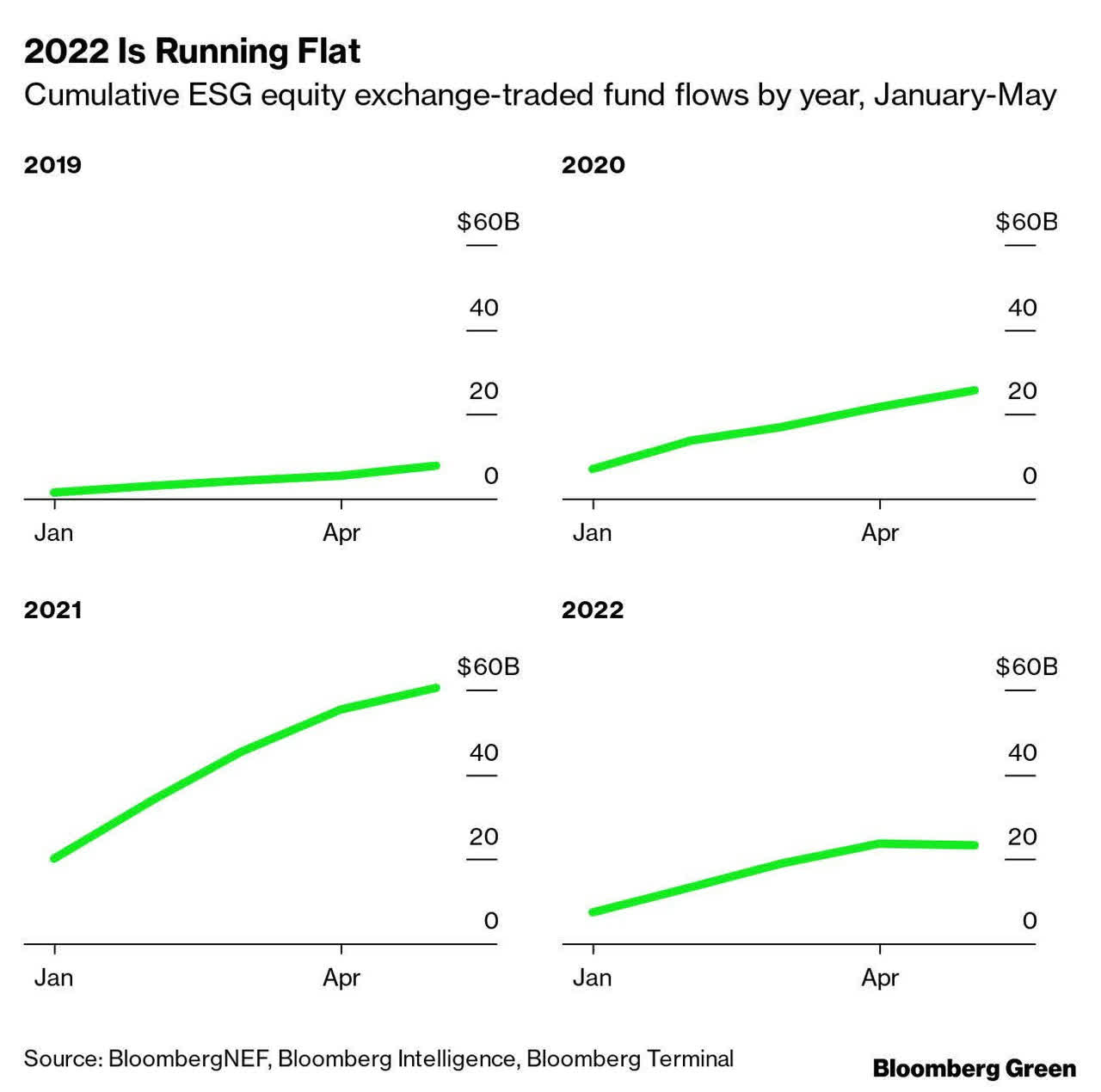

Declining interest in the sector could potentially reinforce some of the trends we are seeing today. ESG ETFs flows are running flat since April, which marks a shit compared to prior years. I believe the ESG investing theme is being overshadowed at the moment by growing concerns related to inflation, recession, and political uncertainties.

Bloomberg

Is This ETF Right for Me?

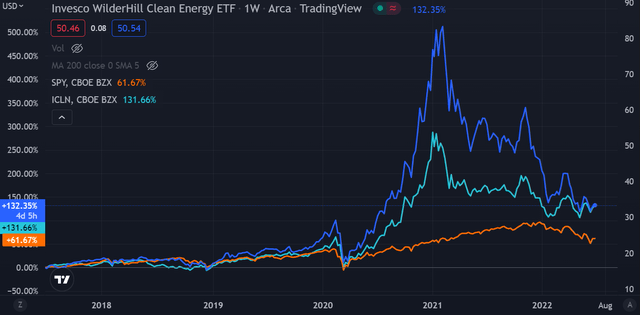

I have compared below PBW’s price performance against the SPDR S&P 500 Trust ETF (SPY) and the iShares S&P Global Clean Energy Index ETF (ICLN) over the last 5 years to assess which one was a better investment. Over that period, clean energy strategies clearly outperformed the U.S. stock market. It’s interesting to note that while PBW and ICLN came to a whooping ~130% after 5 years, PBW was doing much better at the top back in early 2021. To put PBW’s returns into perspective, a $100 investment in this fund 5 years ago would now be worth $232.35. This represents a compound annual growth rate of ~18.4%, which is an excellent absolute return.

TradingView

If we take a step back and look at the 10-year returns, the results paint a totally different picture. SPY came on top once again after being outperformed from 2020 until mid-2021. As previously mentioned, I think clean energy stocks are still trading at lofty valuations, and they don’t provide a good margin of safety at the moment. Thinking about downside risk is extremely important in this market environment and I believe investors would be better off avoiding this sector for the time being until valuations revert to attractive levels.

TradingView

Key Takeaways

PBW provides exposure to companies that are publicly traded in the United States and engaged in the advancement of cleaner energy and conservation. The fund is well-diversified both across issuers and sectors. While it’s understandable why investors are drawn to the clean energy theme given the positive growth prospects of the sector, I believe we shouldn’t overlook valuations in a rising-rate environment. PBW still trades at over 20x earnings despite financial conditions tightening, leaving no margin of safety for potential buyers at these levels. I ultimately expect this fund to trade lower in the coming months when valuations across the board will return to more reasonable levels.

[ad_2]

Source links Google News