[ad_1]

Jenhung Huang/iStock via Getty Images

It has been over a year since I covered the iShares International Dividend Growth ETF (BATS:IGRO), so it seems an update is long overdue.

To begin with, IGRO is one of the myriads of options to express a bullish opinion on international stocks, while also enjoying a sustainable and gradually growing income stream (there are nuances that will be addressed below in the article).

The smart-beta Morningstar Global ex-US Dividend Growth Index lies at the crux of its investment strategy. Its methodology is based on a few screens designed to filter out low-quality companies incapable of increasing dividends consistently.

The first quasi-quality screen is based on the yield. Morningstar excludes the top 10% highest-yielding stocks in the universe, likely to lower the chance of potential yield traps qualifying for inclusion. I call it ‘quasi-quality’ since it is not based on FCF, net income, EBITDA, debt trends, etc. and it simply treats the yield as an indicator of possible financial distress. Though an elevated yield does not necessarily signal a company is in poor financial condition, a too-low valuation might be indicative of deteriorating fundamentals and investor skepticism caused by it. However, as I said in the previous article, I am still of the opinion that punishing the cheapest companies as illustrated by the yield is unnecessary and using more sophisticated screens to identify players with a high risk of a dividend cut makes much more sense.

By “dividend growth,” in this case, Morningstar means at least five years of consecutive DPS increases. There are exceptions. A current constituent would keep its place in the index in case it skipped a dividend hike but repurchased shares and did not cut the DPS. Additionally, the consensus earnings forecast must be positive and the forward EPS-based payout ratio must be south of 75%. More details can be found in the construction rules document.

How the portfolio has changed since April 2021

The index underwent its routine reconstitution in December 2021, and the IGRO portfolio was adjusted as a consequence. A detailed look at which constituents were shown the door and which were added, with the rationale behind decisions, can be found in the following document provided by Morningstar.

As of June 24, the fund was long 397 equities compared to 393 in April 2021. I would like to pay special attention to the following additions:

- Roche Holding (OTCQX:RHHBY), a Swiss healthcare heavyweight with a yield close to 3%. Roche is now occupying second place in the portfolio, with a weight of over 3%.

- Sumitomo Mitsui Financial Group (SMFG) (Tokyo ticker 8316), with a yield marginally north of 5% and a ~1.7% weight in the fund. The reconstitution report shows that in 2020 it failed the dividend yield test (the one I dislike) but managed to qualify in 2021.

- 3.5%-yielding Nintendo Co. (OTCPK:NTDOY) (Tokyo ticker 7974), as it finally achieved a 5-year dividend growth streak.

The key deletions are:

- Siemens (OTCPK:SIEGY) (Frankfurt ticker SIE) failed to deliver on dividend growth and was ousted. Its share price has been slipping almost incessantly in Frankfurt this year, losing over 33%, with the economic slowdown fears in the mix. So the decision to remove it from the IGRO holdings has certainly boded well for returns in 2022 to date.

- By the same token, Allianz (OTCPK:ALIZF) (Xetra ticker ALV) lost its place in the ETF portfolio. Allianz was less afflicted by the bear party in Frankfurt this year, though it has also not emerged unscathed, with the price declining by ~13.7%.

- Bank of Montreal’s (BMO) dividend stopped growing, and it was removed from IGRO. This year, BMO’s price has fallen by ~12.3%.

In terms of sectors, the key development is that healthcare is now the second-largest allocation (13.8%) after financials (with 24.3% weight) as consumer staples retreated to the third position (12.6%).

Turning to changes in the country exposure, in the current iteration, the portfolio is Japan-heavy, with approximately 19.4% of the net assets allocated. In April last year, the Canadian equities had a similar weight but now moved to the second place with ~18.7%. Switzerland has climbed to the third place (almost 12% now) displacing the UK (10.6%). In fairness, I would not say that reconstitution and capital appreciation/depreciation resulted in a tectonic shift, as countries’ weights rose/declined marginally. Please take notice that the index limits every individual country’s weight to 20% as said on page 3 of the construction rules.

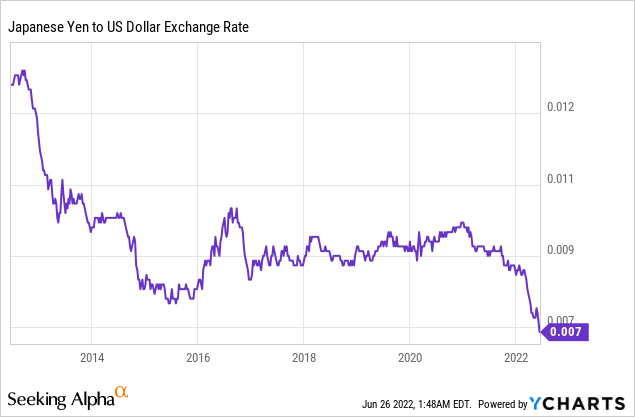

Yes, it goes without saying that the performance of the yen, a currency with an earned reputation as a safe-haven asset, has been utmostly dismal. It has touched a 24-year low vs. the USD just recently.

As I warned in January, the conditions for the Japanese currency were totally unfavorable, as the U.S. was on track to kick off the long-overdue removal of excess liquidity, while the Bank of Japan was completely content with the macro developments in the country, with no plans to turn hawkish. And as the BoJ is in no hurry to increase rates given inflation remains moderate, I believe the mild downside risk still exists.

My dear readers who do remember my takes on the CHF will likely note here that large exposure to Switzerland (close to 12%) also should be a drag on IGRO’s performance. Before the SNB’s decision to hike the interest rates that came out of the blue that would have certainly been the case. Now, when the central bank has joined the rest of the developed economies that have abandoned the ultra-accommodative monetary policy, the outlook is a bit rosier, though the depreciation risk has not evaporated completely.

Remarks on distributions growth: not as consistent as desired

Has IGRO been delivering on dividend growth? Let me share a few quick observations.

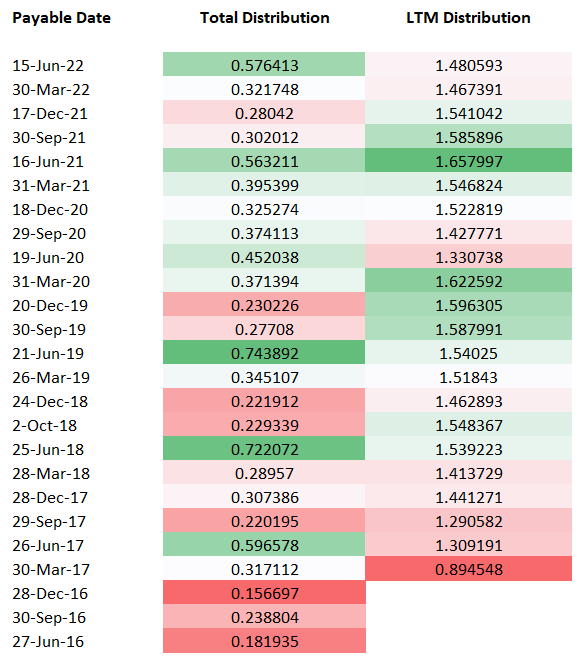

IGRO’s distribution history is relatively short as the fund was incepted in May 2016. Since then, it has made 25 distributions, with the most recent (~$0.576) paid on June 15. What ~$0.576 means in context? Well, this is one of the highest amounts since inception. However, a seasonal pattern can be observed. Every June, IGRO’s dividend goes up meaningfully compared to March. Please take a look at the table below:

Created by the author using data from the fund

But what about the last twelve months’ distributions?

The table shows that the picture is less rosy. In fact, the highest LTM distributions were made in late 2019 and early 2020, then the coronavirus recession took its toll. In 2021, there were signs of DPS growth resuming as it had touched the highest level since 2016, but it was short-lived and the dividend retreated to the 2018 and 2020 levels afterwards.

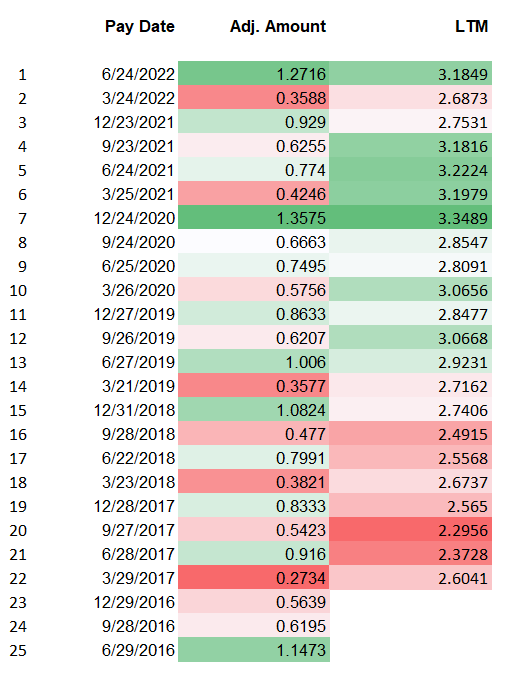

Last month, I flagged the SPDR S&P Global Dividend ETF’s (WDIV) D+ Dividend grade which was among the reasons for my skepticism. However, since then, its CAGRs have seen noticeable improvements owing to the most recent distribution being one of the highest in the last 5 years. And here is how WDIV’s LTM dividends (based on the 25 most recent distributions) compare to IGRO’s.

Created by the author using data from the fund

By looking at this table, my dear readers will notice that the LTM column is becoming gradually greener (though the March distribution was a disappointment, no doubt); this is not the case with IGRO.

The takeaway is that WDIV’s focus on the global dividend aristocrats (U.S. included), despite weaknesses discussed in the previous note, resulted in more consistent DPS improvements in the previous six years.

Final thoughts

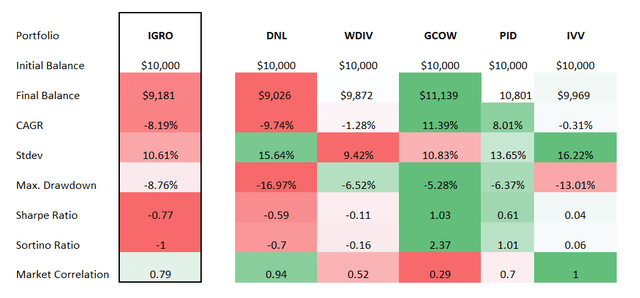

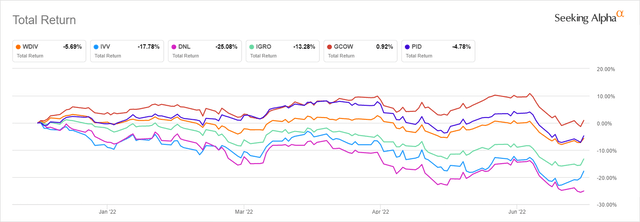

How did IGRO perform last year? From May 31, 2021, to May 31, 2022, its international quality dividend growth strategy failed to beat the iShares Core S&P 500 (IVV) though fared marginally better compared to the WisdomTree Global ex-U.S. Quality Dividend Growth Fund (DNL), which I rated as a Hold in February citing FX risks. The Pacer Global Cash Cows Dividend ETF (GCOW) is the best performer, followed by the Canada-heavy Invesco International Dividend Achievers ETF (PID).

Created by the author using data from Portfolio Visualizer

In 2022, GCOW has been a clear winner; IGRO is down in double-digits.

Seeking Alpha

I acknowledge that IGRO may be considered for the long-term dividend portfolio given a comfortable expense ratio of just 15 bps. However, the distribution growth issue and FX risks are not to be forgotten. In sum, I rate IGRO as a Hold.

[ad_2]

Source links Google News