[ad_1]

GlobalStock/iStock via Getty Images

As S&P 500 fell into a bear market and tech-heavy NASDAQ lost nearly 30% of its value, it might be the right time to invest in non-cyclical and recession-resistant ETFs such as Vanguard Consumer Staples ETF (NYSEARCA:VDC). The consumer staples sector is expected to do well in bear or recessionary periods because it includes companies that offer essential goods people purchase no matter what may happen to economies. Moreover, holding a position in the consumer staples sector provides stability to a portfolio, as companies operating in this sector offer healthy dividends and steady share price increases in any market condition.

Why It’s Good Time to Bet on Consumer Staples?

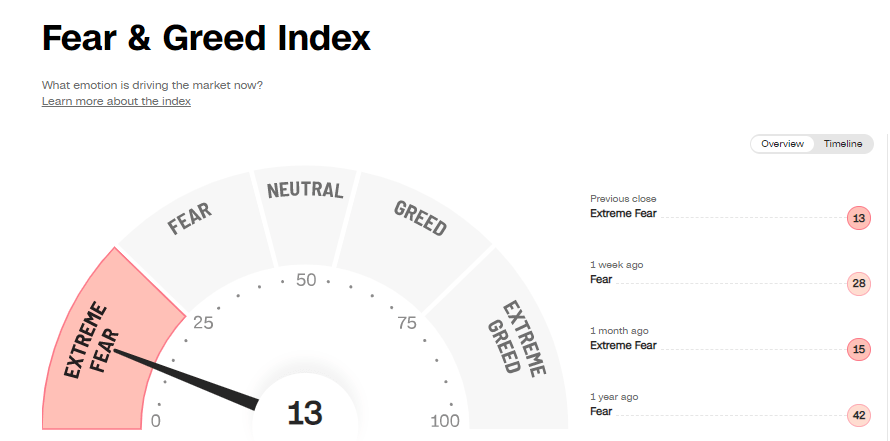

Investor sentiment (CNN.com)

Despite substantial losses since the beginning of this year, market participants aren’t optimistic about the market bottoming yet, which is also reflected in the fear & greed index score of 13. Investors look extremely fearful because of record inflation and faster-than-expected monetary tightening which many believe is paving the way for recession. The US economy contracted in the first quarter of 2022, while data and forecasts indicate a substantial contraction in the following quarters. The market conditions are challenging for almost all of the S&P 500 sectors, but especially for those operating in high-growth sectors such as consumer discretionary, real estate, and information technology. Currently, five out of 11 sectors are in a bear market, while industrials, health care, materials, and utilities are also in the red but managed to beat the broader market index. Industrial and material sectors might also soon fall into a bear market as high-interest rates and slowing business and infrastructure-related activities would cut their demand.

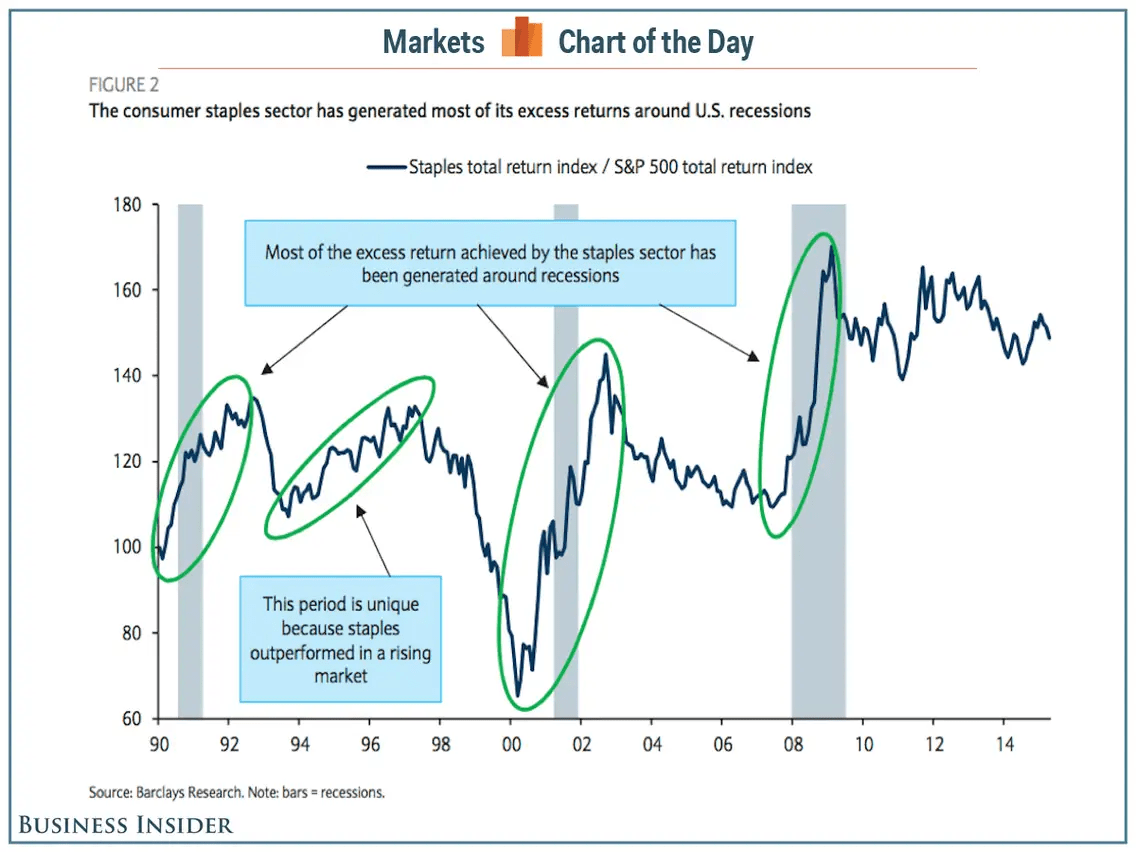

Consumer staples performance in recession (Business Insider)

When economies enter a recession or bear market, consumer staples tend to outperform the rest of the market. A recession would not stop companies in the consumer staples sector with strong balance sheets, extensive footprints, and healthy cash flows from generating market-beating performance. From 1990 to 2015, the consumer staples sector has outperformed the S&P 500 by 49%, with most of the outperformance occurring during three recessions including 1990-93, 200-03, and 2008-09. Consumer staples stocks have also outperformed the broader market index in 2020 when markets were hit harder by the COVID-driven recession.

How Long the Bear Market Lasts?

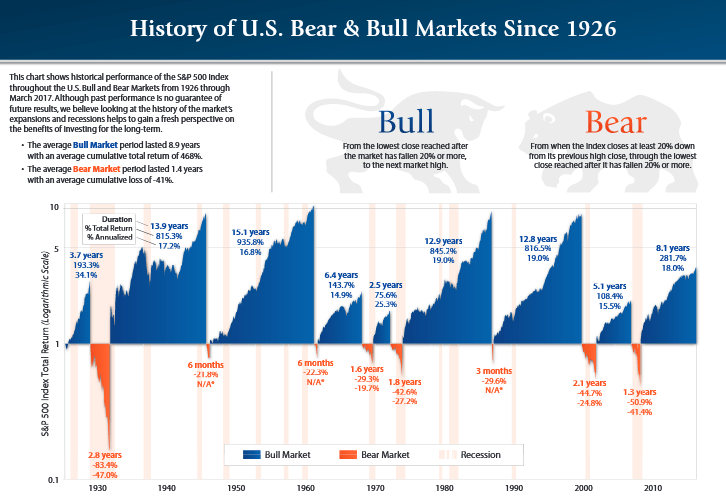

History of US bull and bear market (raymondjames.com)

Another factor that investors should consider when adjusting portfolios is how long the current bear market trend will last. This is because consumer staples do well in tough economic times because investors shift their focus to defensive stocks, which results in higher volumes and demand for their shares.

Well, it’s quite hard to predict the duration of a bear market or recession, but historically, bear markets lingered on average for 1.4 years, and recessions lasted on average about 11 months since the second world war. The current bear market is now in its sixth month as markets have been falling since the beginning of this year. If historical patterns are followed, the current bear market should end in the second quarter of 2023.

Since the current bear market is driven by concerns about recession, inflation, and high-interest rates, I anticipate a rebound once the uncertainty surrounding those issues has been removed. However, it appears that uncertainty regarding economic and interest rates will extend into the second half of 2022 as no one, including the Fed, is certain about the future. Uncertainty was reflected clearly last week when the Fed surprised investors by jacking up rates to 0.75 basis points compared to the original strategy of making 0.50 basis points increase.

Why do Investors Choose Vanguard Consumer Staples ETF?

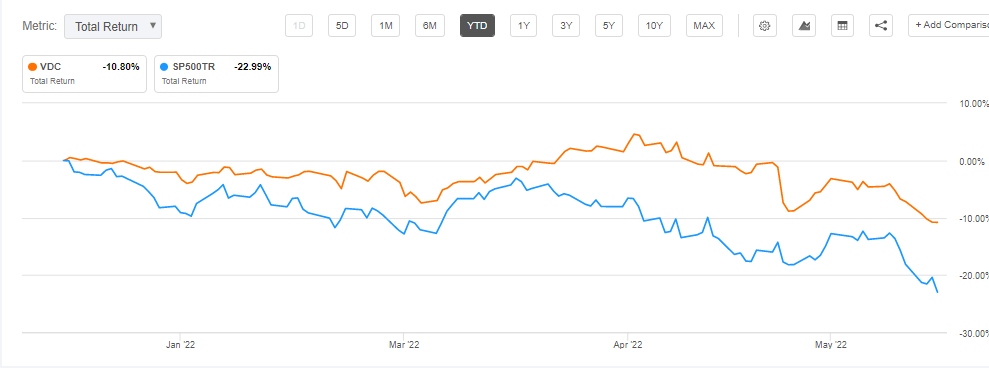

VDC total returns vs. SP 500 (Seeking Alpha)

With volatility likely to accelerate in the months ahead, investing in the consumer staples sector through ETFs like Vanguard Consumer Staples ETF makes sense. This strategy would not only lower the risk associated with a single stock but would also offer a way to capitalize on the performance of the entire sector. So far in 2022, VDC’s returns have outperformed the broader market index. Its outperformance is attributed to a well-diversified stock portfolio that includes defensive stocks.

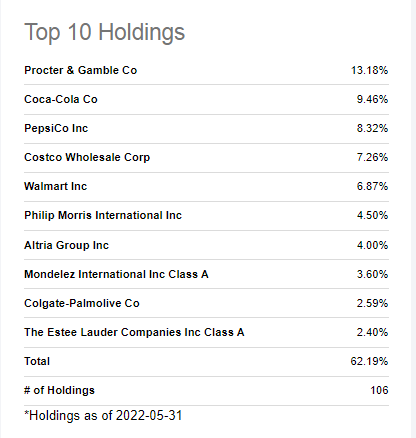

Top 10 stock holdings (Seeking Alpha)

Out of the top 10 stock holdings, which make up 62% of the portfolio, five are classified as dividend aristocrats, while the rest have long dividend growth history. Philip Morris (PM) increased its dividend for 13 consecutive years and Altria Group (MO) for 18 consecutive years. Further, all of VDC’s top consumer staples holdings are large-cap companies with strong balance sheets and brand recognition.

In addition to VDC’s potential to outperform S&P 500 in recessions and bear markets, it also seems like a good pick for the long term. This is because its portfolio holdings have the potential to generate steady share price returns and dividend increases in both bullish and bearish market environments. The dividend yield of 2.28% for VDC is higher than the S&P 500’s yield of 1.49%. VDC has paid dividends every year for the past 16 years. In addition to dividends, VDC offers steady share price appreciation in the long run. A total return of 162% over the last 10 years, including dividends and price gains, is pretty good considering the low volatility attached to its portfolio.

In Conclusion

A consumer staples-focused ETF like VDC is likely to boost portfolio stability in uncertain market conditions. The ETF has performed well so far, and if markets continue to follow historical trends, it has significant upside potential in the months to come. A low expense ratio of 0.10%, a high dividend yield, and the potential for steady returns also make it a perfect long-term investment.

[ad_2]

Source links Google News