[ad_1]

MPMPStudio/iStock Editorial via Getty Images

The consumer discretionary sector is really feeling under the weather this year. Inflation, supply chain problems, lockdowns and the war in Ukraine make companies cut their full-year profitability guidance as consumer confidence hits new lows.

Although the companies in the sector work in an uncertain environment right now, it might be a good time to buy a whole sector as investors’ attitudes towards China can change.

Consumer Discretionary ETF

The best way to bet on a whole sector is to buy an ETF since it is a low-risk investment with a low cost.

The largest consumer discretionary fund in terms of assets under management is Consumer Discretionary Select Sector SPDR ETF (NYSEARCA:XLY). XLY is an exchange-traded fund that tracks S&P 500 Consumer Discretionary Index. The fund has more than $14.5 billion in AUM. The fund was launched in December 1998 by one of the leading companies in the global asset management market – State Street Global Advisors. At the moment, the fund includes 61 companies.

China Factor

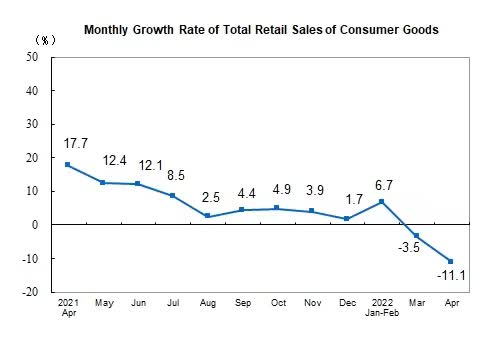

Chinese Premier Li Keqiang said at a conference with representatives of regional authorities in May that the Chinese economy faced stronger difficulties in some areas than in 2020. As experts suggest, this statement signals that the government’s goal of 5.5% growth in Chinese GDP in 2022 may be elusive. Retail sales in the country fell 11.1% YoY to $440 billion in April, worse than the market forecast, which suggested a decline of 6.1%.

The data showed an acceleration in the decline in the main indicators of the Chinese economy in April against the backdrop of the ongoing lockdown in Shanghai, with a population of about 24 million people, since March 28, and with restrictive measures in other regions, including the capital Beijing. This directly affected production, consumption, logistics, foreign trade, and construction.

Nevertheless, Fu Linghui, a spokesman for the Statistical Bureau, is confident that the decline is short-term, and the grounds for long-term growth remain.

stats.gov.cn

Premier Li Keqiang urged the authorities to work hard to reduce unemployment and boost economic growth in the second quarter. The tone of the conference led by Premier Li Keqiang could herald a wave of coronavirus easing and measures to support the economy. For example, the administration of Shanghai has already announced the start from June 1 of relief on the lockdown introduced at the end of March, which affected 25 million residents. The city plans to restore the normal course of production and life by mid-June. Also, a spokesman for the Chinese Ministry of Commerce, Shu Jueting, said that his department will adopt a package of measures to support domestic consumption. Earlier, some regional authorities announced local support measures. For example, authorities in Shenzhen, China’s major technology hub, announced the issuance of electronic coupons and coupons totaling $77 million to the public ahead of Labor Day to support consumer spending and encourage people not to move around during the holidays.

At the end of May, the Shanghai authorities adopted a package of measures to accelerate economic recovery. In addition to allowing work to resume without the need for a special permit, the administration has made several decisions on subsidies and benefits. There are tax deferrals and wage subsidies for companies engaged in catering, retail, tourism, etc., subsidies for utility costs for a number of companies, subsidies for the development of the film industry and other creative industries, tourism and sports among the measures taken.

The Chinese authorities are also expected to support the automotive industry from June through the issuance of subsidies and tax cuts on the purchase of cars in rural areas. Car sales in China fell 48% YoY to 1.18 million units in April, according to the China Association of Automobile Manufacturers.

XLY Companies in China

China’s zero-tolerance COVID-19 policy has affected American consumer discretionary companies in many ways.

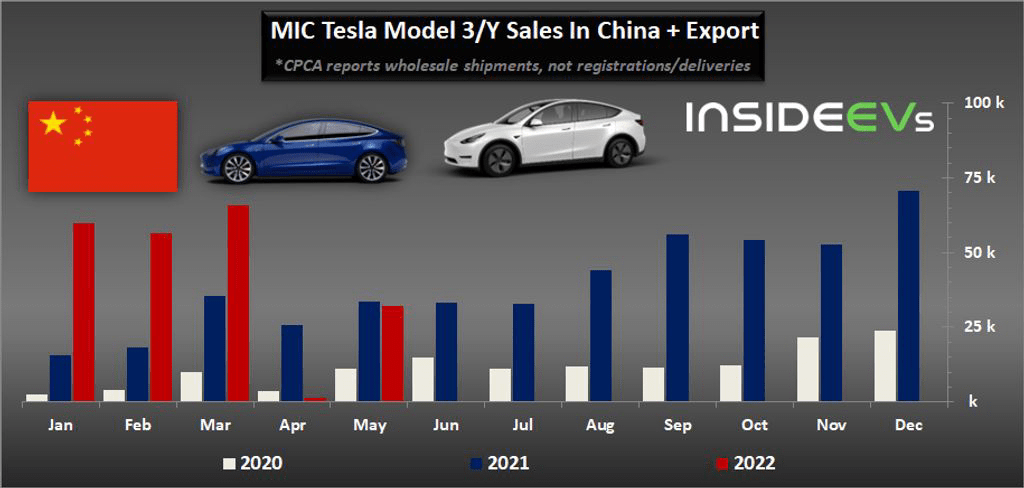

Tesla (TSLA) is the second biggest XLY holding with a 17.65% weight in the portfolio (as of 06/15/22). The company had a tremendous first quarter of 2022. Revenue from electric vehicles was $16.86 billion, up 87% from the same period in 2021. Gross profit increased by a record 32.9% to $5.54 billion. Revenue growth was driven by an increase in the number of Tesla vehicles delivered and an increase in the average selling price. EV unit sales were down 98%, however, in April as Tesla faced lockdowns. In May, the company saw sales rebounding as consumer activity in China started to recover.

Tesla is very sensitive to China situation since its sales in the country account for about 18% of total revenue.

Tesla unit sales in China (InsideEVs)

In the first quarter, comparable sales of McDonald’s (MCD) (third-largest holding in the fund) restaurants in China declined (the company did not disclose details) due to partial closures. At the same time, the management of the chain noted that out of the 800 openings of new outlets planned for the whole of 2022 in China, 250 outlets managed to open in the first quarter, “as planned”, but stated that due to lockdowns, it may be necessary to revise the schedule for the rest of the year.

Nike (NKE) also has problems in China. In the third financial quarter, which ended on February 28, revenue amounted to $10.9 billion (+5% YoY). Sales decreased in Greater China (-5% YoY). Footwear production is mainly in Vietnam (51%), Indonesia (24%) and China (21%), while apparel production is in Vietnam (30%), China (19%), Cambodia (12%) and Indonesia (less than 12%). COVID-19 outbreaks or other force majeure in China and other countries that produce most of the products could have hurt Nike’s financial performance.

Greater China accounts for 20% of Nike’s total sales.

The Chinese market is very important to Consumer Discretionary companies as it is really big and provides the highest growth rates.

Conclusion

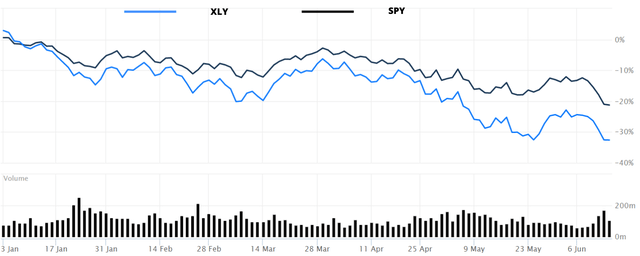

XLY is down 34% YTD, while S&P 500 is down 22% YTD.

XLY vs SPY YTD (WSJ)

The companies in the consumer discretionary sector are facing big problems in the big Chinese market. However, as we can see, there are signals that the situation is improving, and it might be a good time to buy the dip as investors will look close to China and positive news will quickly lead to a revaluation of such companies by the market.

Having said that, I believe that XLY is a buy right now.

[ad_2]

Source links Google News