[ad_1]

spooh/E+ via Getty Images

iShares MSCI Poland Capped ETF (NYSEARCA:EPOL) is an exchange-traded fund that seeks to replicate the performance of its chosen benchmark index, the MSCI Poland IMI 25/50 Index. The index caps large positions, but otherwise invests in Polish equities across all market-cap segments. However, the benchmark only has 38 constituents, as the Polish equity market is relatively small. iShares reported that EPOL had only 35 holdings as of June 2, 2022, with $193.25 million of assets under management, and a relatively high expense ratio of 0.57%.

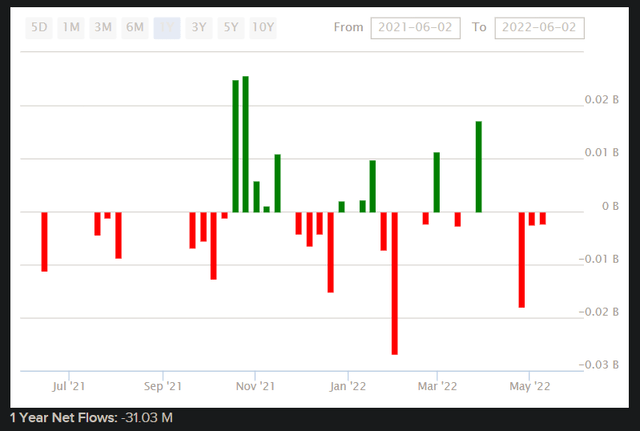

I would have expected stronger outflows, however outflows over the past year have only been $31 million of so (see chart below) on a net basis, or $44 million over the past six months (again, on a net basis).

ETFDB.com

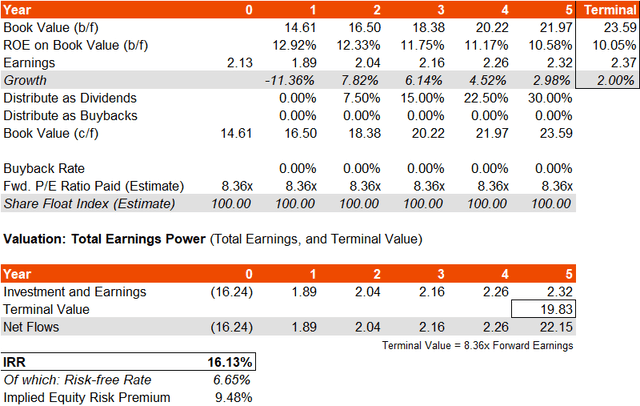

EPOL is down on the year too in terms of price (iShares’ figure is -21% YTD), not least because of Poland’s proximity to Ukraine and the escalation of the Russo-Ukrainian War. However, the broader global equity market has also sold off this year. Earnings growth projections for EPOL are, in any case, now low. Morningstar have a consensus estimate for the next three to five years of 3.61% on average. The forward price/earnings ratio is 6.67x per the same data source, as compared to MSCI’s non-capped Poland Index of 8.36x (the capped version does not offer financial data). I will base my estimates off the Poland Index although some adverse variation will be needed to experiment in case these figures turn out to be optimistic for EPOL. Both indices track each other very closely though over time, so differences are likely to be small.

The trailing distribution rate (of earnings into dividends) is circa 23% but given the forecasted drop in earnings over the next twelve months (per the MSCI Poland Index), I am going to assume no dividends to begin with, and then allow it to creep back to 30% over the course of five years. I will assume no buybacks and gauge EPOL on its underlying earnings power only.

With a forward implied ROE of almost 13%, even if we tail this off to 10% by around year six (2% earnings growth as a floor), even with the current 6.65% Polish 10-year (a high regional “risk-free rate”), the implied IRR is as much as 16.13%. My projections fall underneath the rate of earnings growth implied by Morningstar’s consensus, at 0.47% on average over the next three years, or 1.77% over the next five years. I am keeping the forward price/earnings ratio constant too, which is quite low (unfavorable) itself at just 8.36x.

Author’s Calculations

Going back to experimentation, I would say this kind of earnings stream is conservative, as it assumes that EPOL’s portfolio only returns to its present-day trailing earnings power by about year three, and even then grows that base at a 2-4.5% clip per annum (2% from the terminal year thereafter). Still, if we keep the distribution rate (for dividends) constant at 23% instead of dropping it and returning it to 30% by year five, our IRR does fall a little bit to 14.86% (this is because less retained earnings means lower earnings if we base our earnings on expected returns on equity; lower equity means lower earnings, if ROE assumptions are kept constant). Still, the implied ERP here is still 8.21%, or 5.59% if adjusted for beta of 1.47x.

My best guess for total returns for EPOL is probably in the range of 14-16% per annum from present prices. That is without any earnings multiple expansion too. But I think earnings multiple expansion is weak unless long-term rates decline. For instance, if we divide 1 by the sum of an adjusted equity risk premium of 6.75% (4.5% base ERP x 1.5x notional beta) and a risk-free rate of 6.65% (the current Polish 10-year), and subtract out a notional 2% terminal growth rate, you get a forward earnings multiple in the terminal year of about 8.77x, which is only modestly higher than MSCI Poland’s 8.36x forward multiple at present.

EPOL is probably trading at around fair value, but only at the edges of the ERP boundaries (i.e., it is trading as if there is high risk aversion at the moment, which is true). When risk sentiment strengthens, I don’t see why EPOL would necessarily out-perform other major markets. EPOL is more of a bet on a de-escalation of the Russo-Ukrainian War and/or lower-than-expected euro area inflation. However, due to the unpredictability of both these inputs, I would suggest remaining neutral on Polish equities at present.

[ad_2]

Source links Google News