[ad_1]

MBPROJEKT_Maciej_Bledowski/iStock via Getty Images

Investment Thesis

Small and mid-caps have outperformed large-caps for the past 90 years. However, these two categories have frequently lost momentum over shorter time periods, particularly during economic downturns. Their valuation currently is close to the historical lows of 2008 and 2020, and many value investors are now wondering if it’s a good time to buy or not. I personally suspect these stocks aren’t as cheap on a cyclically adjusted basis, and I expect profit margins to decrease over the next couple of months as part of the business cycle. On top of that, the prospects of a recession in the U.S. have increased considerably over the last couple of months, putting further pressure on the performance of small and mid-caps going forward.

Strategy Details

The Vanguard Extended Market Index Fund ETF (NYSEARCA:VXF) tracks the performance of the Standard & Poor’s Completion Index. This fund provides exposure to a broadly diversified basket of stocks of small and mid-size U.S. companies not included in the S&P 500 Index.

If you want to learn more about the strategy, please click here.

Portfolio Composition

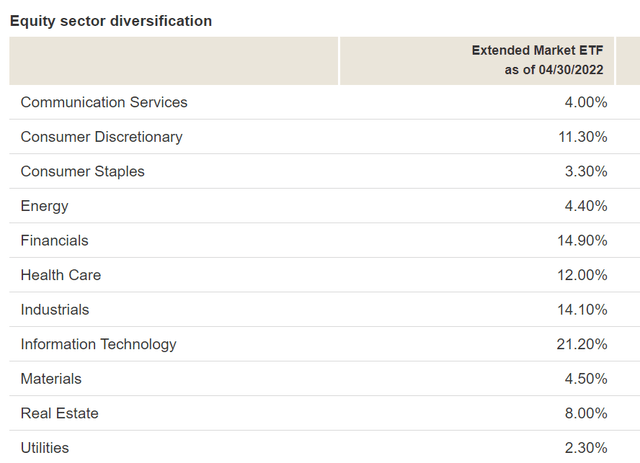

From the sector allocation chart below, we can see the index places a high weight on the Information Technology sector (representing around 21% of the index), followed by Financials (accounting for 15%) and industrials (representing about 14%). The largest three sectors have a combined allocation of approximately 50%. In terms of geographical allocation, this ETF (exchange-traded fund) invests exclusively in the US.

Vanguard

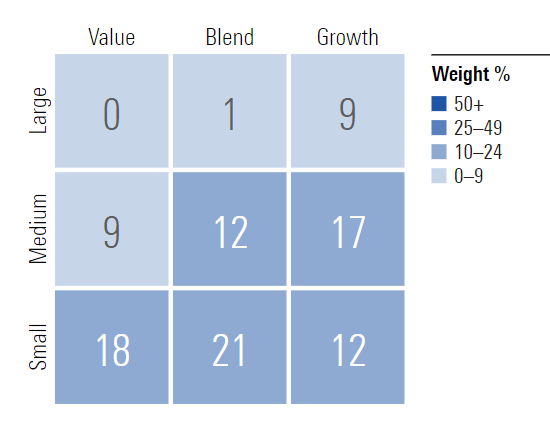

~18% of the portfolio is invested in small-cap value issuers, characterized as small-sized companies where value characteristics such as low P/E and P/B ratios predominate. Small-cap issuers are generally defined as companies with a market capitalization below $2 billion. Given the fact that approximately 90% of the portfolio is invested in small and mid-cap stocks, you should expect to have higher volatility than if you hold a basket of large caps or blue chips. That said, small and mid-caps have the potential to grow at a faster rate and have historically outperformed large caps.

Morningstar

The fund is currently invested in 3,686 different stocks. The top ten holdings account for ~7% of the portfolio, with no single stock weighting more than ~1%. VXF is very well-diversified in my opinion and has a low level of unsystematic risk as a result.

Morningstar

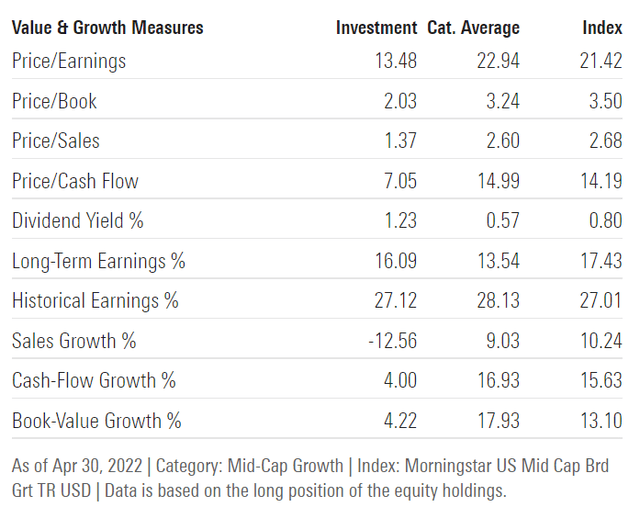

Since we are dealing with equities, one important characteristic is the portfolio’s valuation. According to data from Morningstar, VXF trades at a price-to-book ratio of ~2 and at has a price-to-earnings (“P/E”) ratio of ~13.5. These multiples are lower than what you would be paying to acquire a plain-vanilla S&P 500 ETF, which trades right now at ~18x earnings and has a price-to-book ratio of ~3.4.

Morningstar

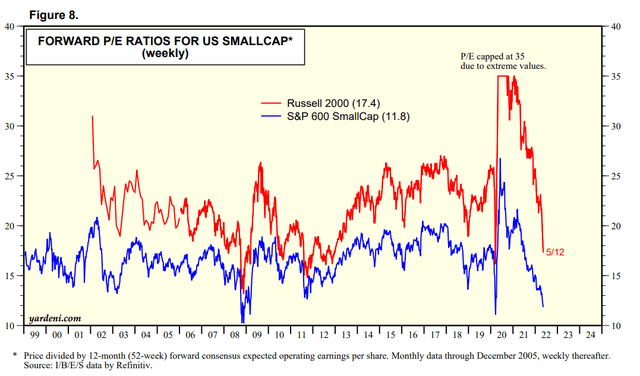

Forward P/E multiples have come down significantly in the last couple of months as illustrated below. The market is now more concerned about quantitative tightening and the risk of a recession, which explains the sell-off. While I definitely think VXF offers more value now than a few months ago, profit margins are still at a record high. If you believe inflation will end up pressuring margins, the forward P/E is probably higher on a cyclically adjusted basis, meaning there could be more downside risk from the current level from many small- and mid-cap names.

Yardeni

Is This ETF Right for Me?

I have compared VXF’s price performance against the iShares Russell 2000 ETF (IWM) over the last 5 years to assess which one was a better investment. Over that period, VXF outperformed IWM by an ~8.6 percentage points margin. To put VXF’s results into perspective, a $100 investment 5 years ago in this ETF would now be worth ~$141.38. This represents a compound annual growth rate of ~7.2%, excluding dividends, which is an average absolute return in my opinion.

Refintiv Eikon

If we take a step back and look at the 10-year price returns, the results don’t change much. VXF came on top once again, outperforming IWM since Q1 2019.

Going forward, I think investors need to pay close attention to the state of the economy. Any negative economic data is likely to increase volatility and accentuate drawdowns over the next couple of months. However, I think this ETF can provide valuable exposure to small and mid-cap stocks over the long term and can be used as a diversification tool to boost returns once the economy has stabilized.

Refintiv Eikon

Key Takeaways

VXF provides exposure to a diversified basket of small and mid-size U.S. stocks that are not included in the S&P 500 Index. These stocks can be extremely volatile during economic downturns and they can have significant drawdowns. Since the likelihood of a U.S. recession has increased, investors should be aware that volatility is unlikely to go away over the next 12 months. On top of that, I believe that a buy-every-dip mentality can prove to be costly in this market environment unless we see real capitulation. Over the long term, I believe that VXF can be used to get exposure to small and mid-cap stocks and enhance returns, especially if we have a booming economy.

[ad_2]

Source links Google News