[ad_1]

designer491/iStock via Getty Images

As of the close of business on Friday the 13th of May, the S&P 500 was down nearly 800 points from its all-time closing high reached in January of this year. This is a drop of approximately 16%. There are concerns over inflation, supply shortages in baby formula, and the possibility of power outages in Texas before the really oppressive heat of summer even begins to hit. Housing prices have gone up rapidly, but so have interest rates as the Federal Reserve attempts to rein in inflation that’s near 40-year highs. Gas prices are also at record levels.

Many people are starting to get fearful. According to Warren Buffett, it might be about time to get greedy. Regardless, if you’re several years from retirement, you’ll want to stay invested, especially if you have money in mutual funds or ETFs. These provide a high level of diversification, and it’s highly unlikely you’ll lose all of your money.

Not only is it a good idea to stay invested unless you absolutely need to free up some cash immediately, it’s also a good idea to continue putting money to work in the market. A bear market means stocks are on sale. People who were willing to buy when the Dow Jones was pushing 37,000 are less likely to buy when it’s around 32,000, but that shouldn’t be the case. It might go down more, but that would be an even better buying opportunity.

If you’re looking to lock in some solid income, now might be the perfect time to look at preferred stocks. A solid preferred stock ETF like Invesco Preferred Portfolio ETF (NYSEARCA:PGX) can offer a strong dividend yield while also providing a high level of diversification.

Dividends Provide Buying Power

Dividends that stay stable or increase over time provide buying power for more investments when the market is down. As long as investors keep reinvesting those dividends they don’t need for living expenses, they can buy additional shares at a discount when the market is down. Those additional shares will earn dividends and speed up the power of compounding. Over a few years, or better yet, decades, the dividend snowball should really start to pick up speed and provide a veritable fire hose of cash. Purchases made in down markets are the best way to make money over the long run.

Preferred Shares Provide Solid Yields

Warren Buffett is perhaps best known for the killing he’s made on Coca-Cola (KO) and other attractively priced common shares. However, he’s not opposed to buying preferred shares when he sees a good opportunity.

Preferred shares tend to provide higher dividend yields than the S&P 500 (SPY) or one of the high-yield ETFs like Vanguard’s High Dividend Yield Fund (VYM). Not only do they provide relatively high yields, the dividends are preferred. In other words, if you own the shares, you are entitled to dividends before common shareholders. Companies have to pay dividends out to their preferred shareholders first, and they have to make up missed dividends before their can pay common shareholders.

This means that dividends from preferred stock can at times be more stable than dividends from common shares. Preferred dividends are the last to get cut or eliminated. There is a downside that comes with the better guarantee on relatively high dividends. That is tied to the upside potential. Preferred stocks tend to trade over a relatively narrow range. This means that there is no home run to be hit like Buffett’s experience with Coca-Cola.

Recent Performance

Preferred Shares have plunged in price this year, along with other assets. Invesco’s Preferred ETF, a leading ETF that holds a basket of preferred issues, has dropped from around $15 per share around the beginning of the year to $12.24 as of the market close on May 13, although it briefly dropped below $12 in recent days. This is a drop of around 20%, and those that already held the shares saw their net worth drop. However, the dividend per share has actually increased slightly over the past few months after generally decreasing in recent years. It is currently $0.057 per share, up from a recent low of $0.56 as recently as January. PGX pays its dividend on a monthly basis, so those who are looking to build up a portfolio with a monthly income stream can benefit from this ETF.

The yield on PGX had dropped below 5% when the price was $15. Now it is at 5.81% (as of 5/13/2020). Some preferred issues will offer higher dividends, while others will offer less, but this is the overall yield for this particular ETF. This is below inflation currently, but higher interest rates are intended to slow inflation, and they successfully did so in the early 1980s, albeit with a severe recession.

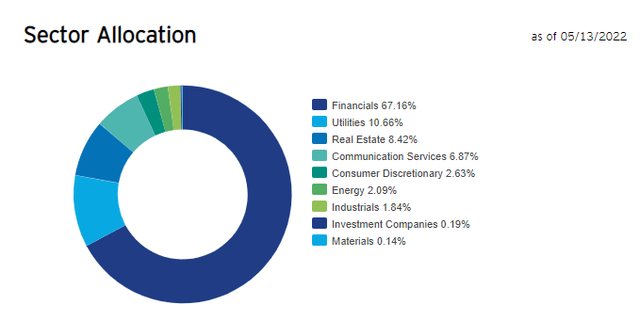

The top 10 holdings in PGX are financial stocks, with the exception of an issue from AT&T (T). These are from well-known banks like Citigroup (C), JPMorgan (JPM) and Wells Fargo (WFC). Indeed, slightly more than two-thirds of the fund is made up of preferred stocks tied to financial institutions. Another 18% is tied up in utilities and real estate.

PGX Sector Allocation (Invesco’s Product Page)

Possible Risks

Prices on preferred shares tend to drop when interest rates rise. This is similar to the price action on bonds. However, those who buy when the price is down will likely be able to lock in a higher yield on their investments. The price could drop further in the short run, as the Federal Reserve anticipates continuing to raise rates over the next few months after a couple of years of near-zero rates. This means that higher yields could be on the horizon while prices could drop even more.

Conclusion

The current downturn in stock prices has started to put some assets on sale. They could continue to go down, but attempting to time the market is a fool’s errand. Among the assets that have dropped in price are preferred stocks. The Invesco Preferred Shares ETF has dropped around 20%. Over the past 12 years or so, shares have traded in a narrow range that has generally been between $13 and $15, so this could be an unusual buying opportunity.

The current market could provide an opportunity for income-focused investors to lock in a higher dividend yield on investments that promise a fixed rate. Of course, it is widely expected that the Federal Reserve will continue to raise interest rates in the short term. This could lead to even lower prices with higher yields. Therefore, it might be beneficial to ease into a position and add shares if the price drops further.

[ad_2]

Source links Google News