[ad_1]

William_Potter/iStock via Getty Images

2022 has been a very tumultuous year for financial markets. Thus far, stocks and bonds have declined dramatically, causing many popular investment strategies to fail investors’ expectations. One of the clearest examples has been the rapid demise of many supposed “high-yield” investment products and assets, including junk bonds (JNK), preferred equities (PFF), and covered call ETFs such as Global X NASDAQ 100 Covered Call ETF (NASDAQ:QYLD). Generally speaking, most high yield funds are down around 15-20% this year as the combined increase in credit risk and interest rates has dramatically lowered their discounted fair value.

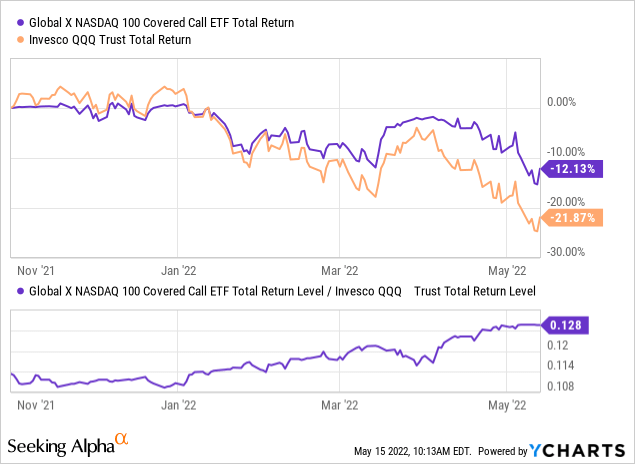

As market volatility rises, assets that “sell” volatility, such as covered call ETFs like QYLD, have particularly significant risks. Covered call ETFs can also hemorrhage principal during choppy bear markets with large bear market rallies since they have tightly capped upside (and no downside cap). At the same time, when volatility is high and the market nears its bottom, covered call ETFs such as QYLD can deliver extreme positive returns as high option premiums (i.e., a high VIX index) cause covered call yields to soar. Most often, these high option premiums can partially offset downside risk. Indeed, QYLD materially outperformed the Nasdaq 100 ETF (QQQ) during the bear market. See below:

Since the Nasdaq 100 peaked around last November, QYLD’s total losses (after dividends) have been around 12%, while the Nasdaq’s is closer to 22%. While this outperformance trend may continue, covered call ETFs can be tricky and have far less stable dividends than other high-yield assets such as corporate bonds and preferred equities. In my view, many investors may not understand these mechanics and can find themselves investing in unsuitable assets or doing so at a less proper time. As market volatility rises, QYLD could deliver even more significant outperformance than the Nasdaq 100, particularly once the market reaches its final bottom.

The Nasdaq 100 Is Likely Still Overpriced

QYLD owns the Nasdaq 100 index with direct stock ownership of each company, such as Apple (AAPL) and Microsoft (MSFT). The top risks facing the fund are the same as those facing other Nasdaq 100 funds (QQQ). This includes the fact that it is highly concentrated in a few giant technology companies, with the top four firms (Apple, Microsoft, Alphabet, and Tesla) controlling around 40% of the index. Given these firms generally have high valuations and have been declining of late, the Nasdaq 100 is not a very safe index. Although less expensive than in the recent past, the Nasdaq 100 still carries a higher weighted-average “P/E” ratio of ~26X.

Additionally, most larger technology firms have seen their revenue growth slow dramatically over the past year and have been having labor issues regarding remote work and high living costs around technology hubs. Even more, with China still in extreme despotic lockdowns, technology firms’ high dependence on China is a significant short-term (and potentially long-term) risk factor to earnings as many Chinese factories may be seeing immense production stalls today. That issue and general supply chain issues, not to mention growing social media backlash, significantly increase risks in Nasdaq 100 stocks today.

In my view, although the Nasdaq 100 is “cheaper” than it was in the past, the high potential for long-term declines in many “Big Tech” firms’ earnings means the Nasdaq 100 is still overpriced. While the Nasdaq 100 has declined more than most, rising interest rates may also contribute to excess declines, particularly if growth outlooks decline. Overall, I believe the Nasdaq 100 may decrease much more. Although QYLD has some cushioning, I do not think option premiums are high enough to offset the many downside risk factors facing mega-cap technology companies today.

How Much “Cushion” Does QYLD Have?

QYLD offers such risk protection via dividends through its call option sales. The ETF periodically sells at-the-money short-term call options on the Nasdaq 100 index. Doing so “caps” the upside potential of the fund, generating a variable premium instead. Essentially, QYLD is acting as an “upside risk” insurer. Since high downside risk also means high upside risk (for short sellers), any rise in volatility generally means a higher dividend yield for QYLD. Investors should not closely consider QYLD’s TTM dividend yield as its future yield depends entirely on where the Nasdaq’s VIX index is (which is measured using option premiums). For this reason, I believe QYLD is highly unsuitable for fixed income investors since, during volatile periods like today, its dividend can change very dramatically in either direction.

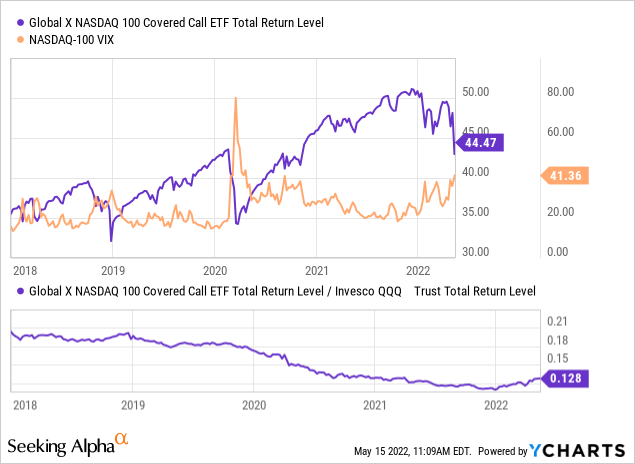

Generally, QYLD has underperformed the Nasdaq 100, though this may be changing with the new “market regime.” QYLD has capped upside while the Nasdaq 100 does not, so sustained bull markets typically mean QYLD will have a decent and stable dividend yield but will still underperform overall. This situation has been the case for most of QYLD’s existence. Also, sharp rapid crashes such as that of 2020 are not great for QYLD since option risk premiums rise so rapidly that QYLD hardly gets to sell options at high levels during the crash. However, after the crash, such as later in 2020, as option premiums remain high, QYLD can be decent as option premiums are excessively high compared to realized volatility. See below:

Today, we are seeing a different situation than in the recent past as it appears we are now in a sustained bear market. Thus far, the market is not in a rapid 2020-style crash but more of a typical long-term bear market. During such periods, QYLD is likely to outperform the Nasdaq 100 as many option-investors look to use derivative contracts to offset risk, causing option premiums to rise over realized volatility for an extended period.

Though QYLD has a TTM yield of around 12-13% today, looking at the greatly heightened Nasdaq 100 VIX index, its actual yield today is likely far higher as option premiums have risen dramatically over recent weeks. Unfortunately, it is nearly impossible to measure this as those option premiums are fluctuating so rapidly due to the current volatility. That said, as long as the Nasdaq 100 VIX remains so elevated, call option premiums will likely be very high, potentially giving QYLD a “yield” closer to 15-20% today.

Of course, there is truly no easy “free lunch” since, when option premiums are high, so too is downside risk. As mentioned earlier, the Nasdaq 100 may still have significant downside risk in front of it. If the Nasdaq crashes, QYLD will as well, and although it has some cushioning, it will almost certainly still lose money during a bear market. Even more, if there is a strong “bear market rally,” QYLD will not take part in all of those gains since its upside is capped on a short-term basis. Over time, this factor can cause QYLD’s principal to depreciate dramatically.

The only environment where QYLD will consistently outperform the Nasdaq 100 and deliver positive net returns is during a flat market. For example, if the Nasdaq 100 continues to move up and down in a “channel” without any sustained change, QYLD will earn decent yields without losses or underperformance (due to upside capping). Historically, the Nasdaq 100 is not known for remaining flat for long periods. Still, once the Nasdaq 100 reaches a bottom, QYLD may be more decent for yield-seeking investors since option premiums usually remain elevated for months after market bottoms.

The Bottom Line

Personally, I would not invest in QYLD today because I firmly believe the Nasdaq 100 has a significant downside in front of it. Of course, that is a personal view, and I imagine many readers may feel the Nasdaq 100 has reached a correctional bottom or may stay around today’s levels for some time. If you believe the Nasdaq 100 has bottomed and will soon rally to new highs, then QYLD is a worthy investment, though it may be better to buy the Nasdaq 100 as QYLD’s upside is capped.

Finally, if you believe the Nasdaq 100 has reached a bottom but will not enter a new bull market, then QYLD would be very suitable based on that view since it is very likely to outperform with strong yields and little underperformance during a choppy and trendless market. Again, I believe that the Nasdaq 100’s bear market will be sustained, but there are very fair reasons to think it could remain flat today. Most notably, the fact the Nasdaq 100’s trailing “P/E” ratio is now within “normal” levels. To me, the tumult in China and within the U.S domestic technology space will hamper the technology firm’s earnings, so I see the trailing valuation as somewhat meaningless. Even still, the situation could shift to keep technology firms’ earnings stable.

[ad_2]

Source links Google News