[ad_1]

Disruption Taking Off

AntonioSolano/iStock via Getty Images

The Disruption of ARKK

The ARK Innovation Fund (NYSEARCA:ARKK) is ARK Investment Management‘s flagship ETF with over $7.8 billion in assets under management. ARKK‘s fund objective is to invest in companies that capture the theme of disruptive innovation. What exactly is “disruptive innovation“? ARK defines disruptive innovation as the introduction of a technologically enabled new product or service that potentially changes the way the world works. Companies held in the ETF rely on or benefit from the development of new products or services, technological improvements, and advancements in scientific research relating to the areas of DNA technologies and Genomics, Automation, Robotics, and Energy Storage, Artificial Intelligence and the Next Generation Internet, and Fintech Innovation.

To ARK‘s credit, founder Cathie Wood has built an amazing research and investment platform tied to disruptive innovation. ARK‘s BIG IDEAS report, which began publishing in 2017, provides great insights into the firm‘s thinking, offering transparent insights into their active investment process. After a successful career as a hedge fund manager, co-founding NYC-based, Tupelo Capital Management, she moved on to joining AllianceBernstein as their Chief Investment Officer in 2001, where she worked for 12 years, managing $5 billion.

In 2014, after her idea for actively managed exchange-traded funds based on disruptive innovation was deemed too risky by her firm, Wood left the company and founded ARK Invest. The company is named after the Ark of the Covenant from the Bible. Interestingly, ARK’s first four ETFs were seeded with capital from Bill Hwang of Archegos Capital Management infamy. Today, after declining from a peak asset level of over $50 billion as a firm, ARK Investments manages a little under $20 billion today.

But the outsized gains that turned Cathie Wood into one of the most successful active managers in the ETF space have evaporated. Indeed, ARKK has given up all its outperformance relative to the S&P 500 Index, thanks to the recent tech meltdown in the markets as investors have shed high-priced growth stocks in an environment of rising interest rates and inflation. Since its inception in October 2014, ARKK is up 110% on a total return basis vs. 125% for the S&P 500 Index. Perhaps a better comparison is relative to the NASDAQ 100 (QQQ) which it trails by 81% (+206%) over the same time period through 5/13/2022 according to Bloomberg.

Bloomberg

Despite the ETF‘s recent lackluster performance and 75 bps expense ratio, ARKK still has plenty of fans and has actually gained net inflows this year.

That is not to say it has not faced criticism. In fact, a short version of ARKK, the Tuttle Capital Short Innovation Fund (SARK) which launched back in November of 2021, has delivered strong performance and asset attention. SARK‘s inception to date performance is up 137% versus ARKK‘s negative 67% result since 11/9/2021. On the other side of the coin, AXS launched a 2X levered version of ARKK this month (TARK).

Stock Selection vs. Deselection

While tech stocks have been the victim of a sell-off, I think most would argue the theme of disruptive innovation is alive and well for long-term investors. So perhaps ARKK‘s method of active, concentrated stock-picking in the segment is not the best method of capturing alpha relative to the overall market?

GraniteShares XOUT US Large Cap ETF (NYSEARCA:XOUT) is also focused on the theme of technological disruption, but rather than focus on stock selection, its investment process and that of its underlying rule-based, passive index, is to identify the companies that are being disrupted, and eliminate, or XOUT, them. As described in the ETF‘s literature, XOUT flips the investment paradigm. Instead of trying to pick potential winners, it excludes stocks vulnerable to secular decline. Recognizing that companies face a continuous threat from technology innovation and need to react quickly to survive, the XOUT strategy specifically aims to exclude companies that are the least prepared to react to disruption.

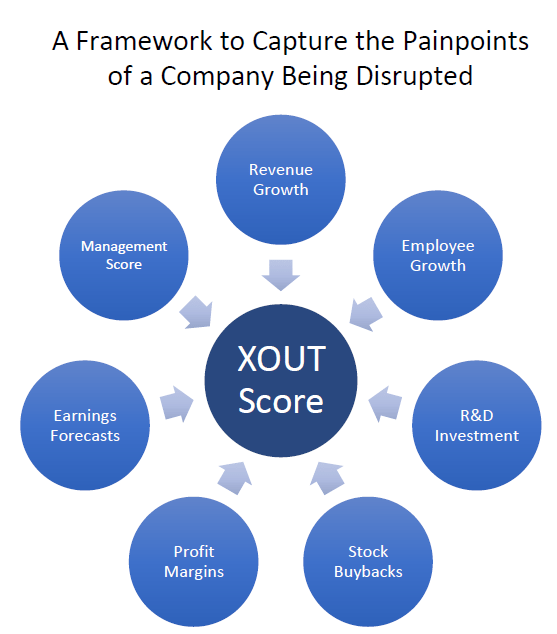

While most investment products are focused on picking winners, XOUT is trying to eliminate the losers, the weakest companies based on 7 quantitative factors that test a company‘s ability to grow, invest, and generate profits. By eliminating the bottom 250 losers in the market index, more weight is given to the top 250 potential winners.

As depicted in the image below, the framework screens on simple metrics to capture the “pain points of disruption“, such as whether a company can hire, invest back in itself, and/or profitably grow its revenues.

GraniteShares

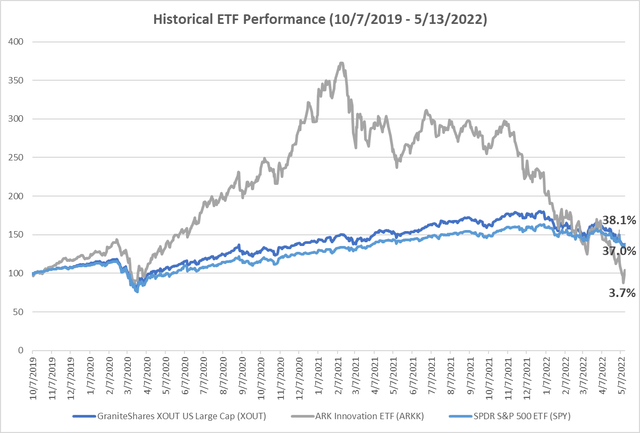

While the XOUT ETF is not as famous as its peer ARKK, sitting with approximately $100 million in assets, its performance has been much better at capturing disruptive innovation. Since XOUT‘s launch on October 7, 2019, it has handily beaten ARKK, up 38% on a cumulative total return basis versus ARKK‘s 3.7%, and outpaced the SPDR S&P 500 ETF (SPY) 37% as well. XOUT‘s expense ratio is also a more palatable 60 bps versus ARKK‘s 75 bps.

Bloomberg, EQM Indexes

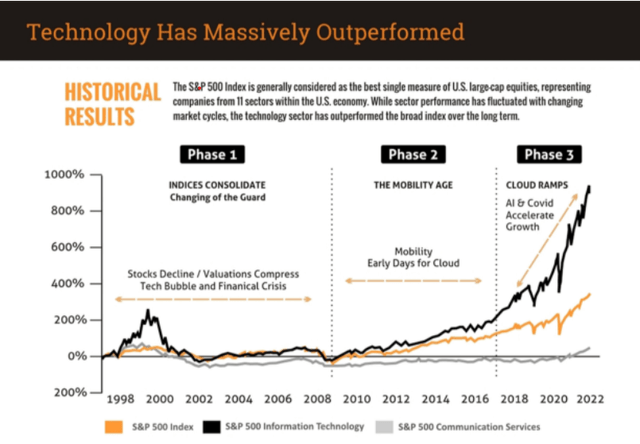

Despite recent headwinds, there is plenty of evidence in support of technological disruption as an investment strategy regardless of the interest rate and inflation trends. As you can see in the graphic below, while sector performance has fluctuated with changing market cycles, technology has historically massively outperformed the market over the long-term.

CFRA, S&P Global Market Intelligence

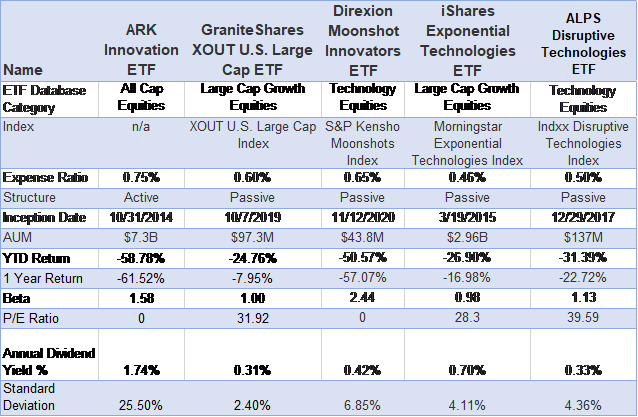

Is the best way to identify disruption by stock selection or deselection? Let‘s look at XOUT relative to some of the other ETF peers in the space.

ETF Database

Besides exhibiting better performance than its Disruptive Tech ETF peers, XOUT offers a smoother ride with a Beta of 1.0 and the lowest standard deviation of only 2.4%. For investors looking for a better way to play the disruptive technology theme, XOUT may offer a nice alternative with its broader diversification, passive rules-based, deselection approach.

If ARKK is a sinking ship, maybe XOUT will become a rising star?!

Disclosure

EQM Indexes assisted in the creation of the XOUT U.S Large Cap Index (XOUTTR) tracked by the GraniteShares XOUT U.S. Large Cap ETF. EQM Indexes does not sponsor, endorse, sell, promote or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. EQM Indexes makes no assurance that investment products based on the Index will accurately track index performance or provide positive investment returns. EQM Indexes is not an investment advisor, and makes no representation regarding the advisability of investing in any such investment fund or other investment vehicle. A decision to invest in any such investment fund or other investment vehicle should not be made in reliance on any of the statements set forth on this website. Prospective investors are advised to make an investment in any such fund or other vehicle only after carefully considering the risks associated with investing in such funds, as detailed in an offering memorandum or similar document that is prepared by or on behalf of the issuer of the investment fund or other vehicle. Inclusion of a security within an index is not a recommendation by EQM Indexes to buy, sell, or hold such security, nor is it considered to be investment advice. It is not possible to invest in an index.

[ad_2]

Source links Google News