[ad_1]

Sezeryadigar/E+ via Getty Images

There’s a lot to think about in the markets with rates rising, inflation persisting and geopolitical conflict brewing. We’ve discussed on several occasions our house view on the economy, and it would be worth spelling out here for ETF investors, where it informs all our equity considerations at this point in time, including the choice between value ETFs, growth ETFs like the Vanguard Growth ETF (NYSEARCA:VUG), and an index-like fund such as Vanguard Total Stock Market ETF (NYSEARCA:VTI).

The Economic Angle

Inflation is supply driven, but expectation effects can make it persist without there being a need for fundamental issues in aggregate supply and demand, so the publicity and complaining about inflation by consumers, employees and companies needs to be met by immediate action where excess demand will be curtailed by rate hikes. The market is probably expecting only moderate rate hikes, especially as the Ukraine war creates even more economic uncertainty, but with the dislocation of service revenues being as severe as it is and the excess demand for goods being what it is, rate increases to 6% might be necessary, but only for a short time. However, it’ll be long enough to hurt markets and long enough to demonstrate the effects of these sorts of rate hikes on consumer pocketbooks. Things might get very volatile if rate hikes go much higher than expected, and we’d suggest investors to prepare a portfolio with the possibility of genuine economic angst firmly in mind.

Are VUG And VTI Good Long-Term Investments?

Let’s look at two stalwart options that would give conservative investors exposure in Blue-Chip America. On one hand you have VTI, which is an ETF that is more or less a mimic of the overall market. On the other hand, you have VUG, which has many of the same holdings, however weighs towards the different options to a very different degree. Both are staunch American bets, which will follow the trajectory of the American economy in what we continue to believe is a pretty good long-term bet on the basis of technological supremacy as the persisting seat of innovation. However, in their quite key differences, we believe that while both are good long-term investments, VUG wins out by a pretty substantial margin.

How Are VUG And VTI Different?

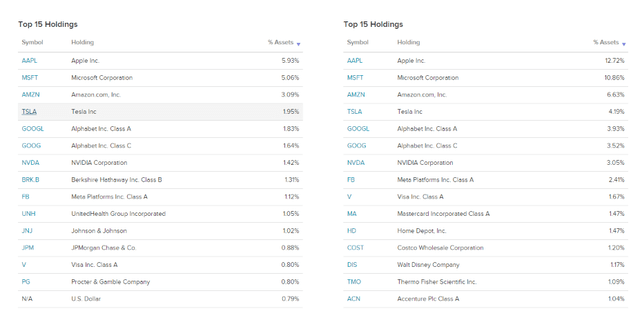

Taking a list of their holdings, there are many similarities in the order of priority given to some of America’s best known companies.

VTI (L) and VUG (R) Holdings (ETFDB.com)

The market cap based weightings of VTI reflect the order of choices also in VUG, where tech and capitalisation correlate highly. However, the skew is immediately evident in VUG, which takes much more concentrated bets on the major tech companies in the US. The sector differences are also quite apparent and relate again to the skew we see in the allocations.

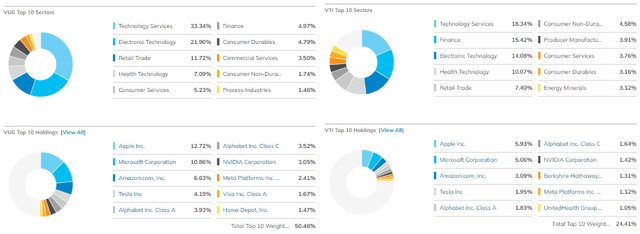

Sector Allocations VUG (L) and VTI (R) (ETF.com)

The big difference is the financial sector allocations, and this is one of the things that penalizes VTI. The financial sector is broadly dominated by two types of companies, financial advisors that have been buoyed by the M&A boom which is already reversing, or banks which due to years of monetary accommodation have bad duration gaps and depend more on fee based income which depends on commerce volumes. Neither of these types of companies are well poised for a higher rate environment, and retail banks especially are pretty uninteresting businesses from and industry structure and secular point of view.

VUG has an unimportant allocation to finance, with the vast majority of its allocations unsurprisingly in tech service and pure tech companies. Why do we like this exposure better? First of all, the cycles for investing in tech are less sensitive to economic cycles, because they are in part dictated by a persistent need to increase efficiency through technology. In general, disruptive products or essential exposures will be much more resilient to economic downturn and will be able to find more clients even when the pie shrinks merely by flexing their importance to the marketplace. Furthermore, the biggest exposures that drive these sector allocations for VUG are in companies that have essentially become life institutions, and whose products are so entrenched that they offer great resilience to economic turbulence and offer a major reinvestment platform to compound returns. Apple (AAPL), Microsoft (MSFT) and Amazon (AMZN) monopolise through excellence, with a manufactured trust-busting effort being the main concern for these companies.

VTI and VUG Key Metrics

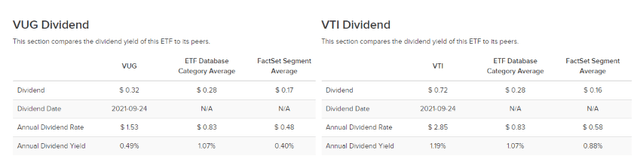

The key headline metrics to consider for the Vanguard Growth ETF and the Total Stock Market ETF are dividend yields and expense rations. Starting with expense ratios, VUG is at 0.04%, only 0.01% ahead of VTI at 0.03%. But the index-like status of VTI becomes more apparent in the dividend yield where the dividend is 1.19% versus 0.49% for the VUG, reflecting its lesser exposure to growth companies which will nourish growth opportunities rather than distribute retained earnings.

Dividend Yields VUG and VTI (ETFDB.com)

The key metrics are unsurprising, and simply reflect the different exposure to growth where VUG, as suggested by the name Vanguard Growth ETF, is going to be more exposed. While you may have a preference for yield, investors should keep in mind that the correctness of the exposures to the likely economic scenarios is more important than yield when choosing between these two ETFs, and if yield is a priority, one should consider equities that pack more of a punch in terms of dividends.

Is VTI or VUG The Better Buy?

We think that with rate hikes ongoing, the consumer wallet could be quite substantially impacted, and less stalwart companies are not necessary to diversify into. We’d rather focus on the best that the US has to offer in greater proportion to mitigate economic risk.

Another way to think about it is that the current economic regime of low rates, which has gone on for the last decade, is coming to an end due to real constraints on supply and fundamental changes in market dynamic including and not limited to labour. The regime has changed, and an ETF that weighs according to the old regime of market value like the VTI is probably less suitable on this principle compared to an ETF that makes a higher conviction stand in one sector over another. Growth is a fair place to be when commodity rallies are extended, and the best on dominance and disruption can transcend temporary economic woes, which should be the objective of the longer term investor. With the status quo likely to be changed up, and with change very possible in the fringe of the markets, you’d rather hold the highest quality stuff on offer like the tech giants through a very efficient ETF like VUG. So we crown it the winner between the two.

[ad_2]

Source links Google News