[ad_1]

Tero Vesalainen/iStock via Getty Images

Investment Thesis

The Fidelity Blue Chip Growth ETF (BATS:FBCG) is a relatively new semi-actively managed ETF that has taken shareholders on a wild ride after its June 2020 launch. Since then, performance has been underwhelming, underperforming the passive iShares S&P 500 Growth ETF (IVW) by 7.87% through May 4, 2022. I looked into the reasons why, and it seems the fund managers have an above-average tolerance for risk, even as far as growth investing is concerned, and tend only to outperform when market sentiment is incredibly positive. Now that 2009 and 2020 are firmly in the rearview and we’re looking at higher interest rates, there’s no reason to pay a high fee for what’s likely to be poor relative performance. I’m rating FBCG as a sell, and throughout this article, I will suggest other growth alternatives for you to consider.

Performance History

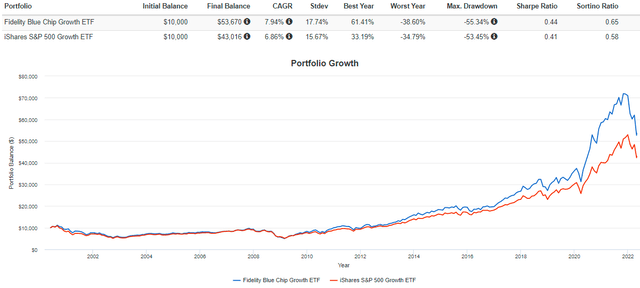

FBCG may be a new launch, but the Fidelity Blue Chip Growth Fund (FBGRX) has operated since June 2000 and follows the same strategy with the same fund managers. I’ve backfilled returns with this older ticker to highlight performance against IVW since June 2000. Overall, results are positive, showing an annualized outperformance of 1.09%, enough to offset the higher risk.

Portfolio Visualizer

A closer look at the numbers reveals how FBCG is a mediocre fund most times but substantially outperforms in just a couple select years: 2009 and 2020, in particular, when it beat by 13.82% and 28.22%. Excluding these years, FBCG underperformed by an average of 0.30% per year from 2001-to 2021. FBCG may be a good candidate for when markets bottom out, but I don’t have much confidence that’s the case. Recession risks still exist even after Fed Chairman Powell struck an optimistic tone during Wednesday’s press conference.

Strategy and Fundamentals

In a nutshell, FBCG’s strategy is to invest in well-known blue-chip companies we can’t live without. A Barron’s article profiling one of the managers, Sonu Kalra, notes how he looks for “strong free cash flow, high returns on equity, and the potential to double earnings over a three- to five-year period.”

Fidelity was one of a select number of firms in 2019 to gain approval for semi-transparent ETF offerings. Fund managers aren’t required to disclose their holdings daily, but instead offer a tracking basket to represent performance adequately. The purpose is to protect a proprietary strategy, and as of today, the basket has a 76.46% weight overlap with its actual holdings. Nevertheless, the fund published its monthly holdings report as of March 31, 2022, which I will use to assess fundamentals.

There are dozens of large-cap growth ETFs available with average expense ratios of 0.28%. Each offers different value, growth, concentration, and volatility combinations, but FBCG is an extreme case. Consider these rankings out of the 29 in my database:

- Forward price-earnings ratio: #22

- Trailing price-earnings ratio: #20

- Trailing price-cash ratio: #28

- Trailing price-sales ratio: #20

- Five-year revenue growth rate: #1

- One-year forward revenue growth rate: #1

- One-year forward EPS growth rate: #1

- Two-year market beta: #29

- Five-year market beta: #29

- % Assets In Top 10 Industries: #23

- % Assets In Top 20 Industries: #20

This high-level look suggests FBCG isn’t a worthwhile investment unless you believe the market will re-enter a phase of extreme market optimism where investors are happy to pay high premiums for high-growth stocks. Let’s look at its most recently reported top 20 holdings next.

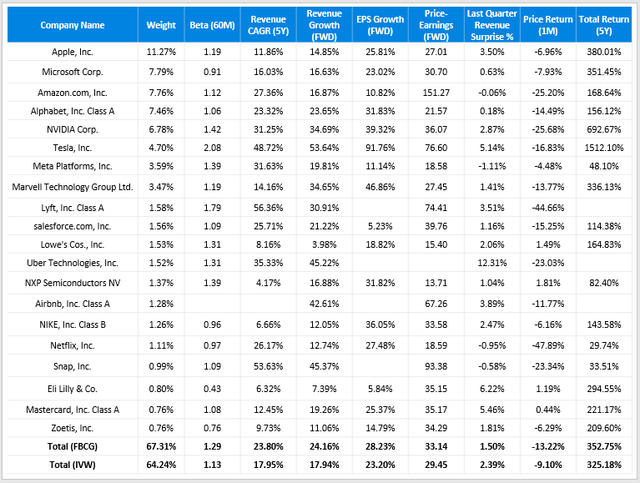

Chart: The Sunday Investor; Data: Seeking Alpha

FBCG’s top 20 holdings total 67.31%, and its top 20 industries total 87.45%. While undoubtedly concentrated, it’s par for the course for a category that includes a lot of mega-caps. To avoid this, you’ll need to drastically alter your growth objectives by choosing either the SoFi Select 500 ETF (SFY) or the Invesco S&P 500 GARP ETF (SPGP). While not explicitly stated, FBCG considers market capitalizations in its selections. However, what is unique is its five-year 1.29 market beta, which is a reflection of its constituents’ high volatility levels. The safest stocks still include some of its top holdings like Apple (AAPL), Microsoft (MSFT), and Alphabet (GOOGL, GOOG), but otherwise, there’s a lot of speculation.

Investors have largely looked past growth stocks’ extreme valuations in the previous five years. Tesla (TSLA) is up over 1,500% but still has a 76.60 forward price-earnings ratio. Amazon (AMZN) currently trades at 151.27x forward earnings, but that’s after a substantial 27% price decline and a 77% reduction in earnings estimates over the last six months. The message is clear: if a stock has a high valuation and misses on sales and earnings or provides a weak growth outlook, expect a sharp decline. According to Yardeni Research, quarterly revenue surprises midway through Q1 2022 are averaging 2.1%, its lowest level in two years. In turn, valuations are finally normalizing.

This reality is not good for aggressive growth ETFs like FBCG and its weighted-average 33.14 forward price-earnings ratio. In contrast, IVW is at 29.45, and the Invesco S&P 500 Pure Growth ETF (RPG) is currently around 27x forward earnings and has a similar level of revenue growth, earnings growth, and concentration in its top 20 industries.

Investment Recommendation

Historical returns and risk-adjusted returns show that FBCG is capable of producing alpha. However, all of its excess returns can be attributed to 2009 and 2020 when the U.S. was just exiting a recession and risk assets were heavily favored. An analysis of excess returns showed that most times, FBCG did or would have underperformed a passive alternative like IVW. Since we have not yet entered a recession, it’s not an appropriate investment.

This year, the market favors low-valued stocks and has been punishing high-growth companies that are barely exceeding (or missing) sales and earnings expectations. FBCG’s managers pick these types of high-risk stocks, and while it might work well in the long run, I think it’s a poor short-term play. Therefore, I’m rating FBCG as a sell and expect it to continue underperforming in 2022.

[ad_2]

Source links Google News