[ad_1]

Funtay/iStock via Getty Images

The iShares U.S. Oil & Gas Exploration & Production ETF (BATS:IEO) provides targeted exposure to one of the best performing industries in the market. Indeed, with the recent strength in the price of oil at a decade high, the fund has returned 45% year to date. We highlight IEO’s relatively unique portfolio composition with a record of outperforming several alternative energy sector ETFs. We are bullish on IEO which is well-positioned to benefit from further momentum in energy prices supporting a positive outlook through 2022.

What is the IEO ETF

IEO technically tracks the “Dow Jones U.S. Select Oil Exploration & Production Index”. Importantly, the fund and underlying index only include U.S. domestic E&P companies while also excluding the integrated oil “majors”. IEO with AUM currently around $900 million stands out with a market-cap-weighted methodology that is in contrast to the more widely followed SPDR S&P Oil & Gas Exploration & Production ETF (XOP) which has an equal-weighted methodology but otherwise similar profile.

iShares

Going through IEO’s top holdings, the fund is concentrated in ConocoPhillips (COP), EOG Resources, Inc. (EOG), and Pioneer Natural Resources Co. (PXD) which together represent 33% of the fund. The XOP ETF holds these same stocks but takes a more balanced approach with each position averaging around 2.5% of the portfolio.

Seeking Alpha

There is a case to be made that XOP has better diversification with a broader portfolio being less “top-heavy”. At the same time, the market-cap-weighted strategy of IEO is tilted more towards the large caps which typically have stronger fundamentals and are recognized as being lower risk compared to the junior explorers and small-cap names.

In a market environment defined by strong momentum in energy prices, like what we’ve seen over the past year, it can be expected that the small-caps and higher-beta oil stocks should outperform to the upside. On the other hand, when the market turns with a more bearish sentiment, IEO should have an advantage over XOP with its less volatile large-cap tilt.

IEO Performance

What’s interesting here is that even with the exceptional strength in the energy sector, IEO managed to climb slightly ahead this year with 44.5% total return compared to 44% from XOP. As a general theme, the higher price of oil and gas translates into higher cash flow and earnings for producers in the portfolio as a positive tailwind for the group. The fund’s current concentration in ConocoPhillips has contributed to the gains with the stock itself returning around 45% this year.

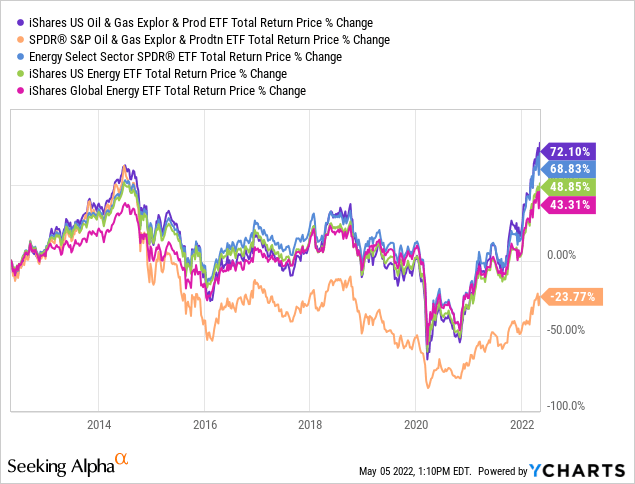

As mentioned, this outperformance in IEO extends over a longer time frame and also against other widely-followed energy sector equity ETFs. Over the past year, IEO has returned 79% compared to 71% in XOP, and 66% from the Energy Select Sector SPDR ETF (XLE) which tracks the energy stocks just within the S&P 500 (SPY).

Furthermore, IEO is also ahead of the iShares U.S. Energy ETF (IYE) which returned 63% over the past year. In this case, IYE from the same fund family as IEO has a broader strategy that includes the mega-cap integrated names like Exxon Mobil Corp. (XOM) along with equipment and service providers. This latter group has underperformed during the ongoing bull market. We also include the iShares Global Energy ETF (IXC) with a narrower 54% return over the past year that has exposure to foreign energy companies. Simply put, IEO has been in the sweet spot.

It’s also impressive that IEO has the highest total return in the group in the last 10-years, up 72% which beats out XLE at 69%, and well ahead of IYE at 49%. Notably, XOP has a negative 24% return over this period highlighting the higher risk profile of its equal-weighted methodology that has a tilt towards small caps.

IEO Price Forecast

Our take is that there is enough data here to conclude that IEO is a high-quality fund with the strategy proving itself to work across different market cycles. The capitalization-based weighting means that the holdings will be rebalanced as the composition of the sector changes with the best performing oil & gas exploration and production companies gaining importance within the portfolio. The large-cap tilt in IEO compared to XOP appears to make a difference by limiting exposure to the riskiest stocks that likely have the most downside in a potential bear market.

Seeking Alpha

In terms of the outlook for the price of oil (USO), what we’ve seen over the last few months is a consolidation of gains with WTI crude holding above the psychologically important $100 price per barrel level. Starting the year at around $75, the price of WTI crude briefly rallied as high as $130/bbl on the initial Russia-Ukraine invasion headlines.

Beyond tight global supply chain conditions in the global post-pandemic recovery, the conflict in Eastern Europe, including sanctions on Russian oil by some countries, has added an additional layer of disruption to global trade as a major tailwind for higher prices.

finviz

While the current price of oil is already very positive for the underlying stocks in the IEO ETF, we believe a leg higher in crude can add more momentum to the group. We see three different scenarios that can ultimately send the price of oil back to the cycle peak and even higher.

- One of the most bullish scenarios where we can talk about oil at +$200bbl would be an escalation of the Russia-Ukraine crisis. No one wants it to happen, but all it takes is one headline about NATO getting more involved and a Russian retaliation outside of Ukraine would represent a whole new ballgame.

- There is also a “goldilocks” scenario. Let’s assume, we get a resolution to the conflict or even just easing tensions. This could set up a boost in global economic optimism that would add to energy demand into a new wave of stronger growth and higher energy prices.

- Taking a more middle ground, there is an understanding the upcoming summer months in the Northern Hemisphere will capture a post-pandemic travel boom that will keep energy demand resilient. Our thinking here is that this should outweigh the challenging near-term macro headwinds.

Final Thoughts

Putting it all together, there are several reasons to stay bullish on the IEO ETF. While the pace of the rally observed over the past year likely won’t be repeated, we expect the energy sector stocks to continue outperforming. The fund is a good option to capture the high-level trends as a core portfolio holding or on a tactical basis.

To be clear, there are risks with some growing concerns of a broader global economic slowdown. Any indication of a consumer spending collapse or sharply weaker global trade metrics would open the door for a deeper correction in the price of oil. Our take is that as long crude oil remains above $85/bbl the correct position is to stay bullish.

[ad_2]

Source links Google News