[ad_1]

Marco Bello/Getty Images News

The ARK Innovation ETF (NYSEARCA:ARKK), Cathie Wood’s flagship investment fund, is plunging from low to low as the tech bubble bursts.

What’s more, one of ARK Innovation ETF’s flagship positions, Teladoc Health Inc. (TDOC), has plummeted in value after the company reported its first-quarter results and lowered its sales forecast. The Teladoc Health saga exemplifies the dangers of managing highly concentrated portfolios that are overweight in high-multiple stocks.

It would be a mistake to believe that the ARKK Innovation ETF has bottomed out because investors are no longer willing to pay exorbitant sales multiples for unprofitable companies like Teladoc Health.

Cathie Wood’s Latest Problem

More than any other fund, Cathie Wood’s ARK Innovation ETF mirrored the excesses of the technology stock boom during the pandemic. In my previous article, “The Death of Thematic Investing,” I alluded to the risks associated with thematic investment strategies.

The ARK Innovation Fund invests heavily in companies with disruptive qualities in their respective industries and “seeks long-term growth of capital by investing under normal circumstances primarily (at least 65% of its assets) in domestic and foreign equity securities”. To achieve these investment objectives, the fund is taking highly concentrated positions in companies ranging from electric-vehicle manufacturers to videoconferencing platforms and financial technology start-ups.

This investment strategy paid off big time during the pandemic, when investors reevaluated the entire stock market and shifted investments into growth sectors like electric-vehicles or companies running video-conferencing platforms. Tesla (TSLA), for example, is still the ARK Innovation ETF’s largest portfolio holding, accounting for approximately 9% of the total. This aggressive concentration served the fund well during the pandemic, but investors have recently learned that this strategy is a double-edged sword.

On Thursday, Teladoc Health reported 1Q-22 earnings, and the company’s stock plummeted by nearly half before closing the day with a 40% loss.

Teladoc Health is a pioneer in the virtual care field, providing patients with affordable 24/7 access to their doctors. This business model clearly worked extremely well during the Covid-19 pandemic. The issue here is that the pandemic has ended, and the company has just lowered its forecast for 2022 due to rising inflation and a slowdown in sales.

Teladoc Health’s management expects sales of $2.40-$2.50 billion in 2022, down from $2.55-2.65 billion in the previous forecast released in February. In addition, the company expects to remain unprofitable in 2022.

Ark Innovation Fund 2022 Guidance (Ark Innovation Fund)

Teladoc Health’s stock price down more than 80% since peaking at $189.65 during the pandemic.

TDOC Share Price (Finviz)

Why is this Cathie Wood’s problem?

Because the ARK Innovation ETF was and still is heavily overweight Teladoc Health. With a total value of $803 million and a portfolio weighting of 6.67%, it was a top-three holding for the fund at the start of April.

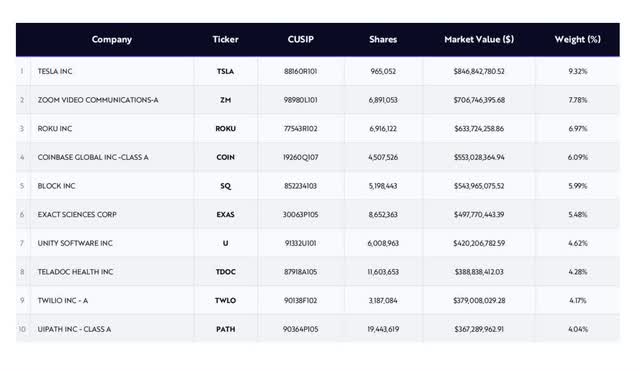

Following yesterday’s crash, Teladoc Health fell to eighth place (weighted at 4.28%) with a market capitalization of only $389 million. Cathie Wood’s flagship funded project appears to have added more Teladoc on the drop.

Ark’s Top 10 Holdings (Ark Innovation Fund)

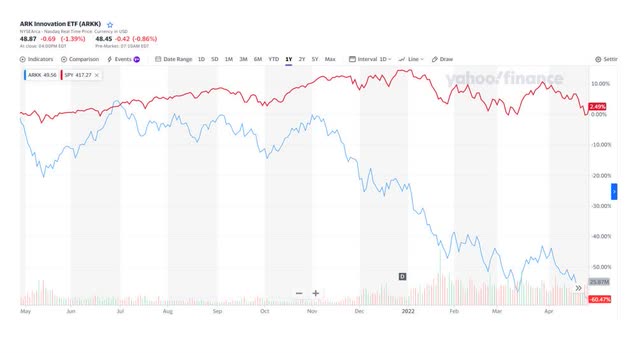

The Teladoc Health crash isn’t exactly helping the ARK Innovation ETF’s position. The ARK Innovation ETF has significantly underperformed the S&P 500 stock index: while the S&P 500 is still up 2.49% year to date, the value of Cathie Wood’s flagship fund has dropped through the floor.

With a minus 60.5% investment return, an investment in the S&P 500 would have been a much wiser choice. The price of an ARKK share has dropped by 48% year to date.

ARKK Versus S&P500 (Yahoo Finance)

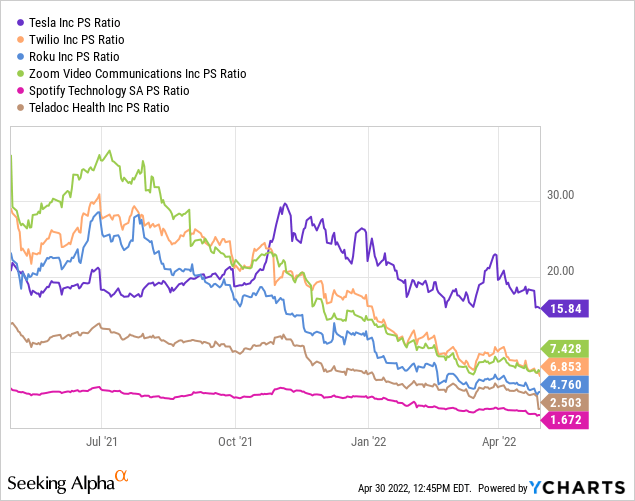

ARKK ETF – More Downside Is Likely As Valuations Remain Inflated

Cathie Wood’s ARK Innovation ETF is still overweight a few companies, and as the pandemic chapter closes, valuation losses may mount. The majority of overweight positions in the ARK Innovation ETF remain overpriced and trade at out-of-this-world sales multiples. The high multiples that remain in the ARK Innovation ETF’s portfolio expose investors to significant valuation risks, especially if capital exits the growth sector and invests elsewhere.

Additional Risks

In addition to valuation risks, the fund is vulnerable to further downgrades. Morningstar recently downgraded the ARK Innovation ETF, citing risk management concerns after the fund suffered significant net asset value losses as a result of its concentration strategy. Further valuation losses may result in additional fund outflows for the ARK Innovation ETF, forcing the fund to exit positions and incur additional losses.

My Conclusion

The Teladoc Health debacle exacerbates the ARK Innovation ETF’s underperformance issues. Having a top-three position lose nearly half of its value indicates that running concentrated investment portfolios is a risky strategy that can have disastrous consequences.

Teladoc Health’s lowered guidance for 2022 also demonstrates that the market continues to overvalue the stocks that performed well during the pandemic.

Even though Teladoc Health is just the most recent example of a deflating bubble in technology stocks, it demonstrates that the ARK Innovation ETF is likely to continue to suffer in the future.

[ad_2]

Source links Google News