[ad_1]

Schroptschop/E+ via Getty Images

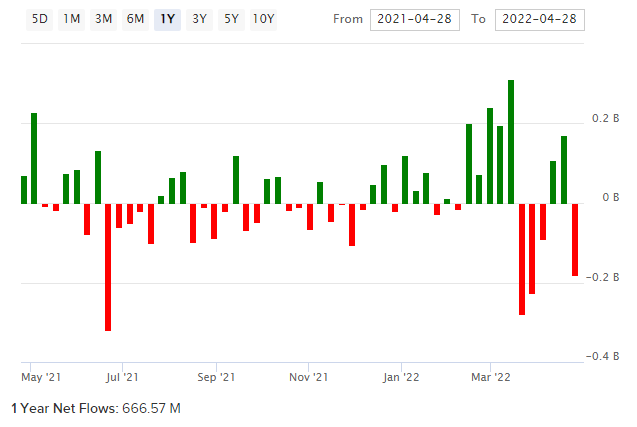

SPDR S&P Metals & Mining ETF (NYSEARCA:XME) is an exchange-traded fund offering investors exposure to “the metals & mining segment of the S&P TMI” which is comprised of various sub-industries, including “Aluminum, Coal & Consumable Fuels, Copper, Diversified Metals & Mining, Gold, Precious Metals & Minerals, Silver, and Steel”. The gross expense ratio reported by SSGA.com is 0.35%; assets under management were $3.2 billion as of April 28, 2022, and this follows a period of mostly positive inflows (see below).

ETFDB.com

Net inflows over the past year have been circa $667 million. This coincides with a bounce in commodity prices, a principal driver of higher consumer and producer price inflation. See below, for example; this is the price of the current-month futures contract for the Bloomberg Commodity Index.

TradingView.com

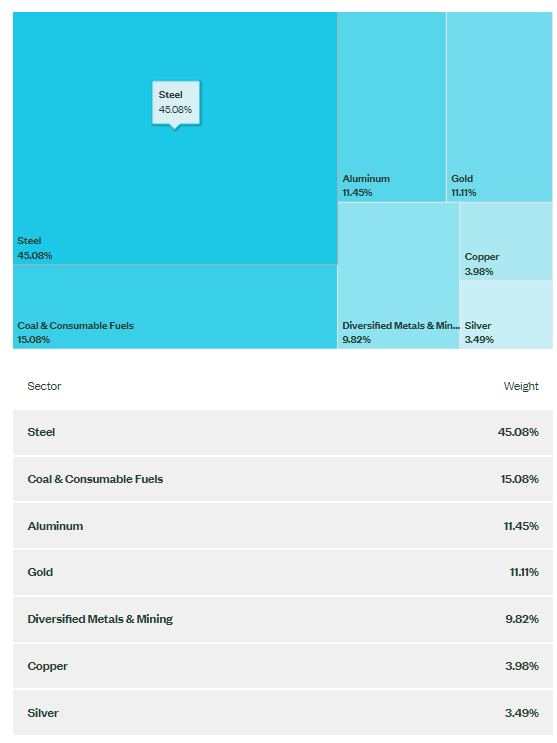

Bloomberg Commodity Index futures are over 50% higher at present when compared against the high registered immediately pre-COVID-19. The index is about a third energy, about a fifth grains, another fifth precious metals, about a sixth industrial metals, and the remaining 12% or so is a mix of soft commodities (sugar, coffee, cotton) and livestock. XME is exposed mainly to industrial metals (steel is the largest fund industry exposure).

SSGA.com

XME, over the same time frame as the Bloomberg Commodity Index futures chart I presented earlier, has risen about 87%.

TradingView.com

So, you could argue that XME probably carries a beta against broader commodity price indices in the range of 1.5-2.0x, although obviously this depends on what parts of the commodity complex are seeing the greater upward momentum from changing supply/demand dynamics.

What is particularly impressive about the rise in commodity prices is that the U.S. dollar index has also been rising. Usually a stronger dollar would make commodity prices weaker, as they are typically denominated in U.S. dollars as standard. This also typically feeds into equity prices. In this case, equities and risk assets in general have languished, but XME has held up (a kind of safe haven, a beneficiary of higher inflation).

The spread between the U.S. 10-year and the 10-year treasury inflation protected security (TIPS yield) is holding up high and firm at over 3%. This is a crude proxy for 10-year inflation expectations; crude because the market for TIPS bonds is much smaller than the broader bond market and also subject (and therefore more sensitive to) central bank intervention.

TradingView.com

In any case, markets are probably still pricing in right-tail inflationary risks, and so XME is still holding up itself as investors are redirecting funds into perceivably safer places.

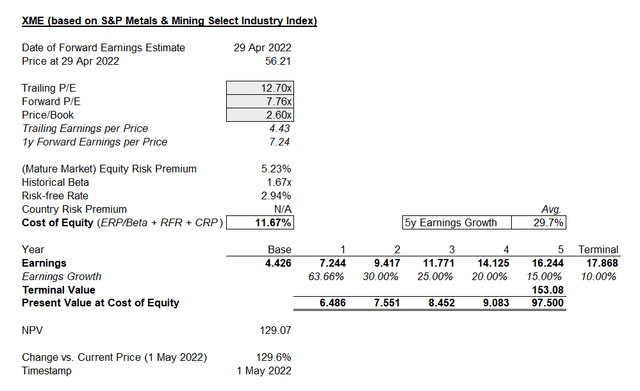

XME’s benchmark index that it seeks to replicate is the S&P Metals and Mining Select Industry Index. The most recent factsheet available for this index is as of April 29, 2022, at which point the trailing price/earnings ratio was 12.7x, and the forward price/earnings ratio was 7.76x. Price/book was 2.6x. Implied return on equity on a forward basis is therefore very high, at over 33%. These kinds of returns are probably not going to be sustainable long term, but they are strong. Three- to five-year earnings growth estimates are 37% judging from Morningstar data (for the XME portfolio).

Using this data as a starting point, XME is most likely undervalued, even if we factor in the higher level of risk in XME per historical beta of circa 1.67x.

Author’s Calculations

The valuation suggests XME should be trading at twice the current price. I have assumed five-year earnings growth (on average) of just under 30% per annum with the first year being driven by XME’s benchmark’s one-year forward projections provided earlier. The implied cost of capital is much higher than my calculated and suggested 11.67%; the valuation implies something more like 23.59%, which is exceptionally high.

If I were to roughly halve average earnings growth, to an average of 16.5% (so, 10% in year two, 8% in year three, and then 5% thereafter), the valuation would drop to an implied cost of capital of 16.16%. But this is still high, and means that XME is priced for returns of circa 15-25% within a range of earnings growth potentials that are not beyond what could be considered reasonable.

Since the U.S. dollar is already trading strongly, and commodity prices are still performing well, it would likely to take a very strong upward drive in the U.S. dollar at this point to crash commodity prices. And if USD pulls back, commodity prices are likely to hold firm, do the historically inverse correlation. Therefore, I don’t suspect commodity prices are likely to crash any time soon (even if it is conceivable that they remain somewhat range-bound, at a higher base level of prices). XME earnings should therefore be decent, within the range of estimates. And even allowing for some pessimism, XME is cheap.

I would have to remain bullish on metals and mining stocks, because the returns are difficult to match elsewhere based on present valuations.

[ad_2]

Source links Google News