[ad_1]

Olemedia/E+ via Getty Images

Despite the WisdomTree US Efficient Core Fund (NYSEARCA:NTSX) boasting 20% annualized returns since its inception, investors should be circumspect about directing their capital here. In fact, I believe that most investors are better served walking away from NTSX and moving onto the next attractive ETF. NTSX is not a fund where the returns speak for themselves because NTSX is not a one-size-fits-all investment vehicle. It is a leveraged instrument that provides S&P 500-like returns for one very specific use case. Investors looking to beat the market with this ETF may be underwhelmed with its small margin of outperformance, and investors looking to reduce volatility are not doing so without taking on more risk than they need to. While there are some unique positives to this fund, right now I do not see why most investors should pay it any mind.

Leverage Is Not Inherently Evil

It does not worry me that NTSX implements leverage in its strategy. Borrowing money to invest in markets is as old as markets themselves. Indeed, the late retail investor hero Jack Bogle has asserted that the optimal strategy, particularly for younger investors, is surprisingly not a portfolio consisting of 100% equities. You should instead use 2x or 3x leverage on 100% equities – so long as someone can bail you out at the bottom.

What he’s saying is that it’s okay to take extra risk as long as you don’t get wiped out. This is Jack, so of course he’s talking about leverage on a total US stock market index fund, or at least some other broadly diversified investment vehicle. Many investors, however, prefer increasing concentration risk by way of intentionally choosing single risky stocks instead of using borrowed capital to amplify their already diversified portfolios. In doing so, they underestimate the uncompensated risk they are actually taking. Oftentimes, this leads to catastrophe. It is possible that investors are turned off to the idea of leverage due to stories such as those featuring Long Term Capital Management and Archegos, but indeed, institutional investors and even some retail investors trade on margin regularly.

Maximizing Your Free Lunch

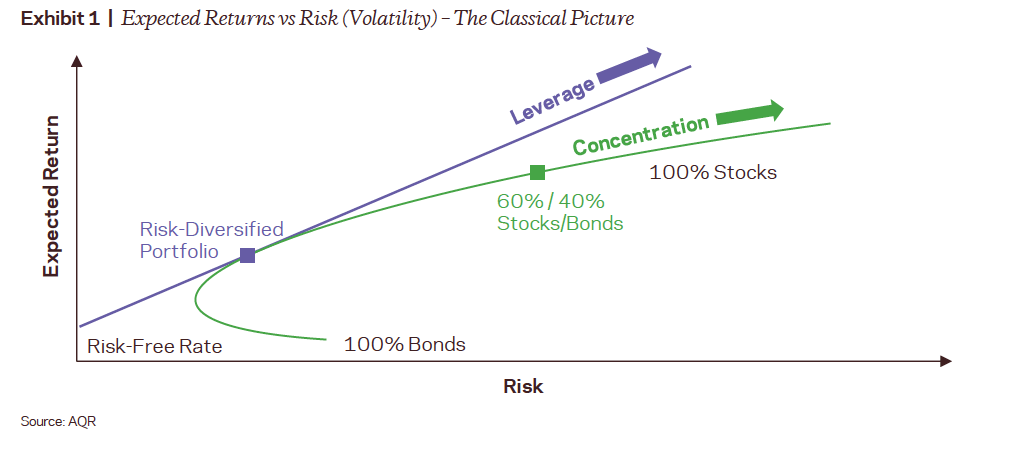

Using leverage to reduce the volatility of portfolios is not novel. The concept is elegantly illustrated by modern portfolio theory, which harkens back to the early 50s. Since the Sharpe ratio of stock-bond portfolios deteriorates with increasing exposure to market beta, using leverage to access portfolios that provide comparable returns for reduced volatility is not only mathematically possible but advisable. In other words, leveraging a safe portfolio is safer than riding out a risky portfolio. See the picture below to visualize this beautiful phenomenon. In 2008, Ayers and Nalebuff demonstrated with real world data that young investors ought to be using leveraged investments for retirement planning; it is the responsible thing to do. Even in the late 90s, AQR’s Cliff Asness published a paper suggesting that a leveraged “balanced” 60/40 stock-bond portfolio beats the S&P 500’s returns with comparable volatility.

Leverage can be deployed to reduce volatility without reducing returns. (AQR)

The drawback of a traditional 60/40 portfolio is that while you benefit from the slightly negative long-term correlation between stocks and bonds, your exposure to equities is limited. After all, you had to purchase your “flight to safety” bonds with the money you wanted to allocate towards stocks. An impasse is reached where the investor does not want to sacrifice neither diversification nor expected returns.

Introducing WisdomTree’s Invention

In response, NTSX aims to ameliorate the tradeoff between diversification and exposure to market beta. Instead of having a 60/40 portfolio, we can use 1.5x leverage to construct a 90/60 portfolio with identical risk-adjusted returns. The 90% in equities captures most of the market returns, while the 60% in bonds offsets the volatility. The idea is that we now have a less volatile “100% stock” portfolio. This particular ETF focuses on US equity, but the WisdomTree International Efficient Core Fund (NTSI) and WisdomTree Emerging Markets Efficient Core Fund (NTSE) cover the rest of the globe.

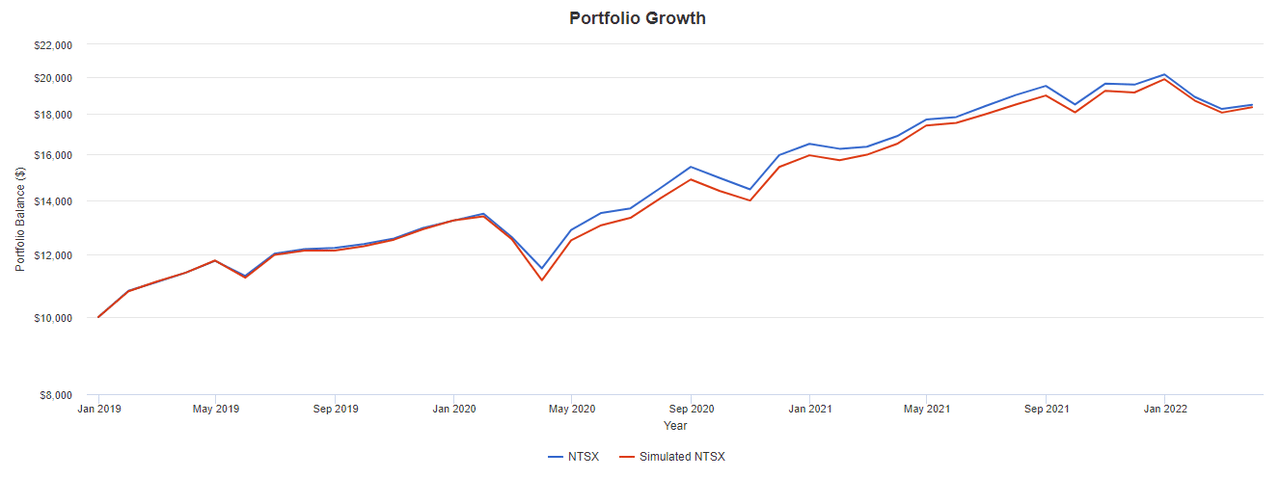

Below is a chart of NTSX, in blue, since its inception, as well as a “Simulated NTSX”, in red, having 90% tracking the S&P 500 and 60% tracking the total bond market. The performance is very similar. Unfortunately, NTSX has only been around for 3 years, which is not nearly enough data by which to judge a fund, so I will be using the Simulated NTSX for backtests.

NTSX is similar to a 1.5x-leveraged 60/40 portfolio. (Portfolio Visualizer)

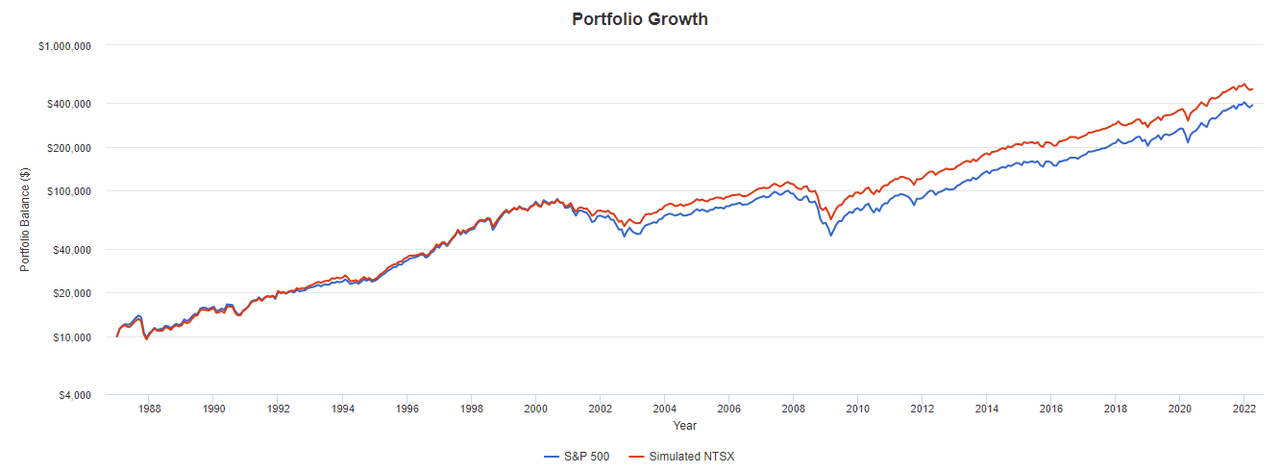

WisdomTree prides NTSX on performing very well against the S&P 500 since its inception. Given the fund’s sound theoretical basis, it is unsurprising that they are telling the truth. Below is a chart featuring Simulated NTSX, in red, and the S&P 500, in blue. The two portfolios tracked each other very closely until the end of the 20th century, at which point Simulated NTSX took the lead due to bonds beating out stocks. Despite bond interest rates being slammed to near zero at the end of that decade, Simulated NTSX continued its dominance over the S&P 500 due to its high market beta. This is exactly how the fund was meant to behave, and is a triumph of finance theory.

Simulated NTSX consistently beats the S&P 500 over the long term. (Portfolio Visualizer)

By the end of 2022, Simulated NTSX ended up with over $100,000 more than the S&P 500 from a principal of $10,000. Indeed, NTSX has beaten the S&P 500 by nearly 1% annualized thanks to its extra 50% exposure to assets. However, the difference between the two portfolios, in terms of time, is only around 3 years. For a simulation that spans nearly 35 years, I would say that the two portfolios are comparable.

NTSX is not the only fund that uses leverage, obviously. For instance, the infamous ProShares UltraPro QQQ (TQQQ) ETF seeks 3x daily returns of the Nasdaq 100 index. The ETF boasted an astronomical return in the 10 years following its inception but recently fell over 50% from its all time high. It is apparent that the way leverage is obtained matters quite a bit, and as with many other funds, the key word is “daily”, which invites volatility decay. NTSX, however, employs leverage differently. Of its funds, 90% are invested into the 500 largest cap US stocks – admittedly more akin to the top 500 stocks in the Russell 1000 than the entire S&P 500 I’ve been using as a benchmark – and the remaining 10% is used as collateral to obtain 60% notional exposure to U.S Treasury bonds using a bond ladder. Rebalancing occurs quarterly as opposed to everyday, and uses 5% rebalancing bands. In this way, volatility decay is largely mitigated. Using futures contracts instead of owning bond funds outright also has favorable tax treatment; the taxable flows that bonds generate are baked into the futures, which upon selling are largely taxed as capital gains instead of income.

This does not mean that you are magically getting a free 50% in bonds. There is no way around the fact that by getting exposure to $150 worth of assets for $100 invested, you are incurring some degree of risk. It’s obvious, but it’s easy to forget that market-beating returns tend to come with some strings attached. There is nothing shady happening on the equity side, so this comes down to the chaotic nature of futures contracts. After WisdomTree’s active management, the Treasury portion of this fund aims to have an average bond duration of 7 years, which is typical of a total bond market or intermediate term bond index fund. You are, of course, getting 6x this exposure, for an effective duration exceeding 40 years.

As a thought experiment, let us assume that Treasury interest rates rise 1%. In a bond index fund, this would constitute a 7-8% depreciation in the market value of your shares. However the futures approach is subject to a 40+% decline in the 10% you allocated. In theory, your 90% in equities should hedge this loss, but theories often blow up. Consider today’s low Treasury yields and inflation. If interest rates rise in response, then we could see stocks and bonds crashing simultaneously. To be fair, this has apparently not happened in the last 30 years, and the long-term negative correlation between these two asset classes actually saved Simulated NTSX during the 2000s. This is still, however, the risk of which a leveraged investor needs to be cognizant. The cost of having low volatility today is the chance your portfolio blows up tomorrow. If you survive that, though, then you’re still in business.

For this 1.5x leverage, NTSX charges an expense ratio of 0.20%. One way to examine this is by treating the fund as the combination of an S&P 500 index fund and leveraged Treasury fund. In a calculation that assumes the equity portion ought to cost 0.03%, then, effectively, NTSX shareholders are “paying 1.73%” for the futures. There are implied costs associated with futures trading, and WisdomTree wants a commission for their active management; presumably, this is where that 1.73% goes. While 0.20% overall is still quite cheap and arguably a bargain for the package being offered, some investors opt to handle the futures by themselves and spare themselves the fees.

Also, rest assured that the liquidity of NTSX is pegged to the liquidity of its underlying assets. The top 500 market cap weighted stocks in the US are probably going to stay liquid forever, and Treasury futures are among the most liquid futures contracts in the world. Investors should be comfortable buying and holding this ETF.

How to Use NTSX

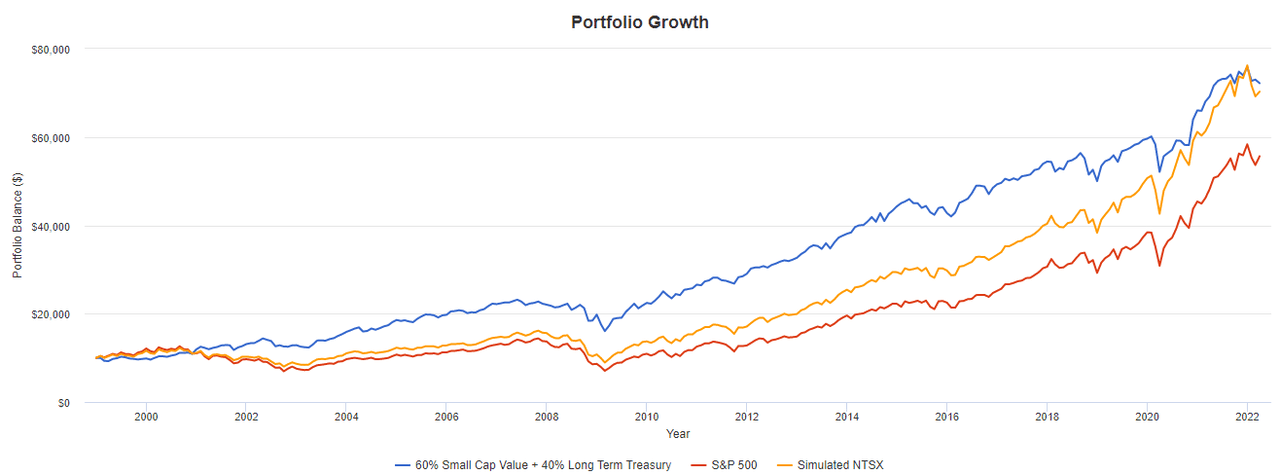

One strategy, and perhaps the most appealing strategy, is to full-send 100% NTSX. Below is a figure showing the returns of Simulated NTSX, in yellow, the S&P 500, in red, and a balanced portfolio of 60% small cap value and 40% long term Treasuries, in blue. It is clear that investing in the small cap and value factors, coupled with the negative correlation of long term Treasuries, produces even better total returns, risk-adjusted returns, and smaller maximum drawdown than even Simulated NTSX. It is similar to a barbell strategy. That being said, both Simulated NTSX and the factor-tilted balanced portfolio soundly beat the S&P 500 by many metrics.

A barbell strategy using small cap value and long term treasuries competes with NTSX. (Portfolio Visualizer)

We should bear in mind, however, that US markets have had a phenomenal last few decades. In particular, the US bond market has had a 40-year bull run where interest rates dropped from over 10% to nearly zero. Bonds did extremely well in the 10 years beginning the 21st century, and small cap value stocks showed their premium in the recovery following the global financial crisis. More importantly, NTSX itself, as opposed to the Simulated fund, has not experienced a recession with rising interest rates. It will be interesting to observe to what extent NTSX’s outperformance over the S&P 500 holds up in those dire economic conditions.

The point I want to illustrate is that there are other strategies that have a statistical edge over the S&P 500 that do not require leverage. You do not need leverage if you want to accept more risk, and you certainly should not be taking on leverage for the sake of taking on leverage. That being said, if an investor is insistent on riding out a total stock market fund, the diversification benefit NTSX provides is probably worthwhile. I find it hard to imagine that there are not better options, though.

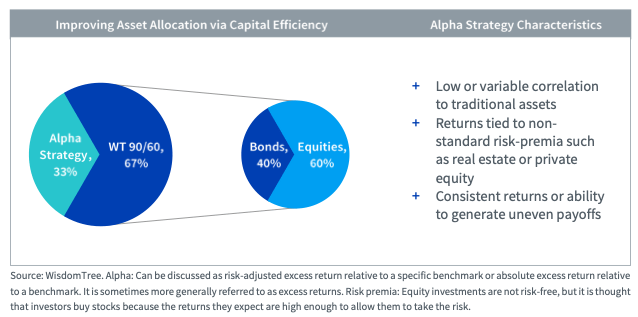

The recommended use case of this fund is to allocate 67% of your portfolio to NTSX and use the remaining 33% for alpha-seeking or zero-return investments. Here is where I defer to the expertise and excellent analysis of Bogleheads advisory board member nisiprius. The 67% in NTSX should have the equivalent exposure of a 60/40 balanced fund, while the remaining 33% of your capital is freed up for whatever you want. As a basis, if this 33% were held in cash as collateral for NTSX, you would have what is effectively a 100% 60/40 balanced portfolio. The 33% could instead be placed in a zero real return asset such as gold and benefit from its uncorrelation to stocks and bonds, thus further reducing volatility while reaping the rewards of a 60/40 portfolio. As nisiprius correctly says, NTSX is a “specialized tool for a particular job”.

WisdomTree’s alpha-seeking strategy using NTSX. (WisdomTree)

Regardless of how you allocate the 33% freed up capital, what you have is a leveraged investment. That is not to say it is a bad thing, but it is subtle and can easily be overlooked by mental accounting. This is still a reasonable option for those who are especially concerned about volatility. For the most part, volatility is reduced, except for the one edge case where stocks and bonds simultaneously crash. A retiree who needs to constantly sell shares to fund their lifestyle, but is concerned about sequence of returns risk, may consider this approach if they deem the black swan downside to be unlikely in their lifetime. In some respects, this reminds me of a leveraged all-weather portfolio. An investor who wants to reap the rewards of a 60/40 portfolio but speculate with 33% of their wealth is unfortunately not getting the deal they think they’re getting. Whether or not that bites them in the future, however, is a different question.

Is NTSX Worth Buying?

I do not own any NTSX in my portfolio because it is not necessary for me to reach my financial goals. I would not want to be in a situation where the stock and bond markets crash simultaneously, when I am then exposed to 150% of the downside and subsequent compounding risk. It is easier for me to increase my savings rate and live below my means than it is to chase the 1% excess returns and worry about the perfect storm ruining my portfolio. An unleveraged but still aggressive portfolio meets my needs. If NTSX continues to outperform the S&P 500, then I still would not mind delaying my retirement by 3 years. I understand that NTSX is statistically bound to do me wonders, but I only get one sequence of returns, and I only get one chance to stay the course in the event of a serious drawdown. I’d rather not take my chances.

I would not recommend this ETF to my friends, especially to those who are new investors, without first understanding their specific financial situation and risk tolerance. I would be more likely to recommend this ETF to those who understand what they’re getting into and have the mettle to withstand any turbulence.

NTSX is a great choice for believers in WisdomTree’s intended use case, but I would imagine it is a rare investor who needs both a 60/40 holding and something else. If your portfolio is sufficiently large, you could get away with taking less risk and still live a comfortable retirement. If you are concerned with making lots of money, then you’d want something like HEDGEFUNDIE’s Excellent Adventure instead of meek 90/60 returns. If your portfolio is small and you really need that combination of balanced fund returns and low volatility, then NTSX starts making more sense. If you need returns with a short time horizon, then you might even consider a substantial allocation to NTSX.

I would slightly recommend NTSX to young investors with small portfolios who plan to dollar cost average into a 60/40 portfolio over the course of their investing lifetime. This entails greater exposure to their desired asset allocation earlier in their life, thus improving the time diversification of their portfolio. However, similar results could be achieved using a high equity allocation early on, and then having a glide path towards 60/40 later in life. NTSX, in this case, is just another means to an end. I can’t strongly recommend it because it’s not necessary.

I also think that NTSX is a decent, albeit also unnecessary, substitute for an S&P 500 or comparable index fund. I would prefer 100% NTSX to 100% S&P 500 for bond diversification, but for lower allocations I think this benefit is muted. I would wait to see how NTSX fares during a rising-rate recession before swapping out my S&P 500 fund for it.

Seeking Alpha’s Quant is currently pessimistic about this ETF because of its recent downwards momentum, giving it a Sell rating and a score of 1.82/5. I tend to agree with the Quant’s poor assessment in the short term. The S&P 500 is currently down 9% YTD, and since bonds are also struggling, NTSX is down 15%. There are concerns about the market potentially being in an overleveraged bubble, and the last thing I would want to do is jump on the bandwagon before the situation clears itself – especially since I don’t need to. As Warren Buffett said:

“If you don’t have leverage, you don’t get in trouble. That’s the only way a smart person can go broke, basically. And I’ve always said, ‘If you’re smart, you don’t need it; and if you’re dumb, you shouldn’t be using it.'”

Leverage Your Portfolio, But Do It Prudently

The financial theory, past performance, and strategies employed by NTSX support its reputation as a quality leveraged fund. However, this does not preclude a thorough examination of one’s temperament as an investor. Just because you can buy this fund does not mean you should buy this fund. I would suspect that most investors are better suited to unpretentious investments like target date funds, and that this fund will be an extravagance to most. There are intelligent ways to take risk if you need it, but this is certainly not the only option and may not even be the best option to meet your needs. However, if you qualify for this ETF’s special use cases and think you can stick to your game plan, then by all means, go for it. The mathematics are on your side, and so are the data. This fund will serve you well.

NTSX is currently underperforming the S&P 500 by, unsurprisingly, 1.5x. The Federal Reserve is still planning rate hikes, and that will adversely affect this fund. If you already hold this fund, you’re probably holding it for certain reasons, and you shouldn’t abandon your plan for the world. For everyone else, I would not be enthusiastic about hopping on the train unless you know what you’re doing. If you’re just looking to throw money at this ETF and see where it goes, I wouldn’t be doing that right now, but you could be doing far worse than NTSX.

[ad_2]

Source links Google News