[ad_1]

gesrey/iStock via Getty Images

Over the past month since my previous update on Treasury Inflation Protected Securities (TIPS), U.S. bond yields have surged, causing a rise in inflation-linked bond yields across the curve. The iShares TIPS Bond ETF (NYSEARCA:TIP) has sold off significantly creating an even better opportunity. While still only priced for zero real returns over the next 8 years, there is potential for strongly positive returns in the coming years as nominal bond yields fall amid declining equity prices and weakening real economic growth. Furthermore, the TIP will likely outperform nominal bonds over the coming years as inflation remains stubbornly high.

The TIP ETF

The ETF tracks the performance of U.S. Treasury inflation-protected securities with a weighted average maturity of 8 years and an effective duration of 7.5 years. TIPS generate returns in two ways: Firstly, they pay coupons which rise with inflation, and like any other bond, they appreciate in value when yields fall. Unlike regular bonds, TIPS rise in value when investor expectations of long-term interest rates decline relative to expectations of inflation. As expectations can change significantly, as we have seen with the spike in rate hike expectations over the past month or so, TIPS prices are sensitive to rate changes. For investors looking for inflation protection with less upside potential but less risk of capital loss, the Vanguard Short-Term Inflation-Protected Securities ETF (VTIP) is an alternative.

TIP ETF And Total Return (Bloomberg)

Rate Hike Expectations At Odds With Outlook For Stocks And Economy

The spread between the 7-year U.S. Treasury and the Fed funds rate is now 251bps, which is the highest since yields collapsed in 2010. Such aggressive rate hike expectations seem out of tune with the outlook for the U.S. economy and asset prices. U.S. stocks remain in a huge speculative bubble in my view, with the potential to fall in half over the coming years as profit margins mean and valuations mean revert. The combination of high interest rates and falling equity prices is likely to squeeze the least productive sectors of the economy sooner rather than later, at which point, talk of rate hikes is likely to evaporate. The most important driver of the TIP is nominal bond prices, so any sign that the Fed will take a less aggressive stance would likely see a strong upside reversal in the ETF.

10-Year UST vs Fed Funds Rate (Bloomberg)

Inflation Expectations Are Still Underpriced

In the short term, inflation expectations tend to be closely correlated with commodity prices and, to a lesser extent, equity prices. Both of which look to be overdue for a pullback. This may suggest that the near-term outlook for regular bonds is, therefore, stronger than inflation-linked bonds, and this may be the case. However, from a longer-term perspective, inflation expectations implied by inflation-linked bonds seem too low. If reported inflation remains elevated as I believe is likely, inflation-linked bonds will outperform.

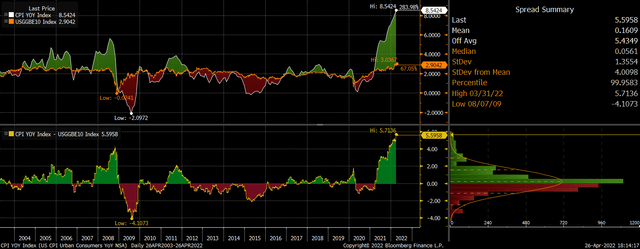

Whether or not year-over-year inflation has peaked or will peak in the coming months is not particularly important. For what it’s worth, the month-over-month figures suggest we are not yet at the peak, but even if we are and inflation falls steadily back to 2.0% by 2030, it will still have averaged over 5%.

CPI Vs 10-Year Breakeven Inflation Expectations (Bloomberg)

Inflation expectations implied by yield on similar maturity inflation-linked bonds imply an average CPI rate of just 3.1% over this period. With the Fed’s balance sheet still growing at 15% annually and fiscal deficits likely to continue to necessitate further expansion, 3.1% seems far too low. If this is to happen, CPI had better peak soon or it would imply a need to deflation at some point in the coming years, which is something U.S. policymakers fear even more than high inflation.

Long-Term Decline In Real Yields Not Over

I am happy to hold a position in TIP despite its weak long-term real return prospects. Not only because returns are at least likely to be higher than on U.S. stocks, but also because any material declines in stocks would likely cause weaker structural growth. With weaker growth comes a lower equilibrium level of real interest rates due to weaker long-term growth prospects and increasingly interventionist fiscal and monetary policies. This long-term declining trend in real bond yields is unlikely to have ended despite the recent spike, and its resumption would result in strong risk-adjusted returns for the TIP.

10-Year U.S. TIPS (Bloomberg)

[ad_2]

Source links Google News