[ad_1]

asbe/iStock via Getty Images

Silver prices have come under renewed pressure over the past few days amid some weakness in commodity prices and gold, with the latter appearing to finally succumb to intensifying upside pressure on real bond yields. The metal is now trading at its most undervalued level on record relative to its historical drivers, and should benefit from the ongoing rise in money supply, which continues to grow at double-digit rates. While silver faces some further near-term risks from continued rate hikes and a potential decline in commodity prices amid the declining growth outlook, on balance, I continue to see it as a buy, particularly from a long-term perspective.

As the world’s leading silver ETF, the iShares Silver Trust (NYSEARCA:SLV), which has tracked the spot price with a median 12-month tracking error of just 0.48%, should continue to offer investors direct exposure to the metal. With an expense fee of 0.50%, this is far lower than the spreads on buying the physical metal. Inflows into the SLV have risen sharply since January, with the ETF seeing a 10% rise in its ounces of silver under management to 575 thousand, while the net asset value has risen to USD14.3bn.

The Positives: Silver Is Extremely Undervalued And Money Printing Continues

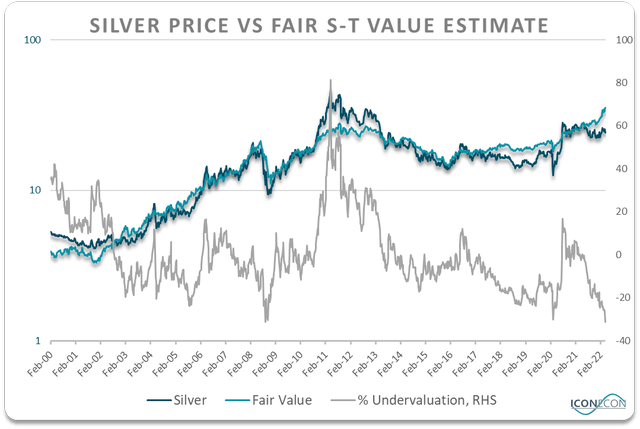

Regular readers will be familiar with my fair-value silver price model, which is based on the metal’s historical correlation with gold price and the price of the Bloomberg commodity complex (BCOMP). The r-squared between silver and a 50:50 basket of gold and the BCOMP has been over 0.9 since 2000, and over 0.8 since 1980. Over the past year, despite gold trading close to new all-time highs and the BCOMP blowing past its own all-time highs, silver has continued to lag. As a result, silver is now extremely undervalued on this metric. As the chart below shows, based on the correlation since 2000, silver is now as undervalued it was at its 2008 lows.

Bloomberg, Author’s calculations

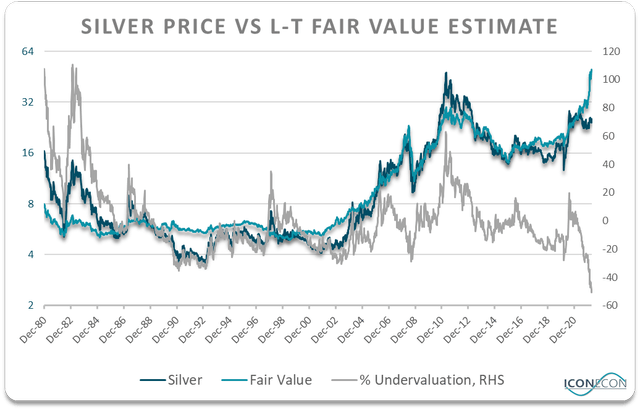

Looking longer term, based on the correlation going back to 1980, silver is even more undervalued, trading at a record 50% below the levels implied by gold and the BCOMP.

Bloomberg, Author’s calculations

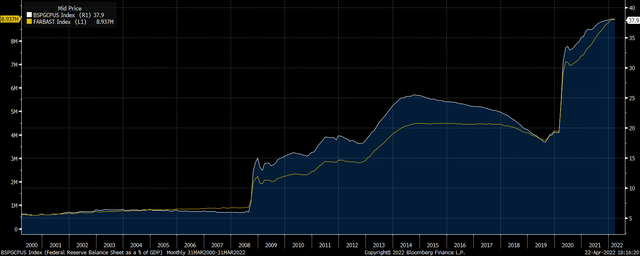

Another positive factor for silver is the ongoing rise in U.S. money supply growth. For all the talk of monetary tightening, the Fed’s balance sheet has risen 15%y/y to a new all-time high, while M2 is also still growing at double-digit rates. U.S. and global policymakers are so addicted to deficit spending that it is difficult to see how money supply will be curtailed any time soon, which should act as a significant tailwind for assets in relatively fixed supply such as silver.

Fed Balance Sheet. Nominal And % of GDP (Bloomberg)

The Negatives: Real Rates Are Surging And Commodities Face Downward Pressure

Given silver’s characteristics as a monetary metal and its usefulness as an input into the industrial process, particularly in green energy supply, I have little reason to believe that this long-term correlation has broken down permanently. However, this does not mean that silver prices are guaranteed to rise as it is also likely that gold and the commodity complex will decline.

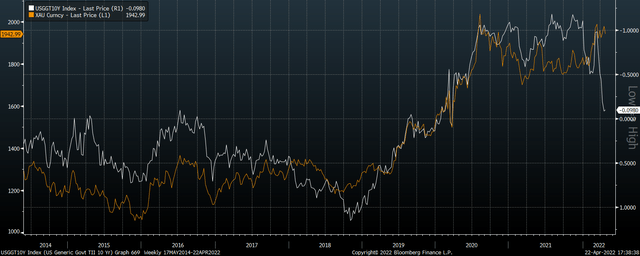

Regarding the outlook for gold, for the past several years I have been bullish based in part on the fact that real U.S. bond yields were extremely low and likely to stay that way over the long term. However, the rapid rise in yields has seen real yields surge even as breakeven inflation expectations have risen to new record highs. As the chart below shows, gold now appears to be overvalued from a short-term perspective thanks to the rise in 10-year inflation-linked bonds, and the near-term risks are skewed to the downside. The higher real yields rise, the greater the opportunity cost of owning gold and silver as stores of value.

Gold Price Vs U.S. 10-Year Inflation-Linked Bond Yield (Inverted) (Bloomberg)

Regarding the outlook for commodity prices – a proxy for industrial demand for silver – slowing economic growth, particularly in China, suggests current record prices are unsustainable. In inflation-adjusted terms the Bloomberg commodity complex is close to its 2008 and 2011 bubble peaks after adjusting for inflation, and this is already beginning to undermine economic growth. China’s increasingly aggressive COVID lockdown measures are sure to hurt Chinese commodity demand, while U.S. leading economic indicators are turning down. The industrial case for silver is therefore slowly being undermined.

Summary

The bullish case for silver due to its extreme level of undervaluation has been complicated by the surge in real U.S. bond yields and the related risks to industrial demand from slowing global growth. However, the risks are still skewed to the upside, particularly from a long-term perspective as there appears to be little prospect of a genuine slowdown in money creation. The SLV has begun to see inflows recover after declining in the wake of last year’s Reddit-inspired influx, and I continue to expect the ETF to track the silver price for the foreseeable future.

[ad_2]

Source links Google News