[ad_1]

MicroStockHub/iStock via Getty Images

Introduction

The Invesco CurrencyShares Japanese Yen Trust ETF (NYSEARCA:FXY), is a product that has been around for the last 25 years and seeks to provide a cost-efficient route for those interested in holding the Japanese Yen. This product is designed to track the movements of the Japanese Yen in USD terms, and needless to say, it benefits when the USD/JPY currency pair depreciates. Unfortunately, that hasn’t quite been the case for a while now, as the currency pair has appreciated by around 7% this year, which also incidentally makes the Yen the worst performing G-10 currency in USD terms.

Given the relentless selling witnessed in the Yen this year, bargain-hunting opportunists may be licking their hands in glee at some prospect of mean reversion in the currency pair. Prima facie, whilst the opportunity is no doubt tempting, I believe there are a series of conflicting considerations that make calling the direction of the Yen a particularly challenging exercise. On account of this, I am currently neutral on FXY, and in this article, will attempt to lay down the bullish and bearish considerations which may be helpful for those looking to explore FXY.

Bullish considerations for FXY

The technicals point to some mean-reversion

TradingView

Technically, the USD/JPY pair looks overextended to the upside and could do with a breather. The $125 levels have previously represented a queasy zone for not just market technicians, but even the BOJ chief who tends to rev up his verbal communication when the pair hits that mark (did this in 2015 and is back at it, once again). Also, note that the RSI on the monthly chart rarely ever stays above 80 for long and we’ve recently hit that mark.

We may not necessarily see a prolonged reversal in the movements of the pair, given the fundamental backdrop which is in play (which I’ll cover later on in the piece), but I do worry about the risk-reward of piling on the Yen pressure at this juncture.

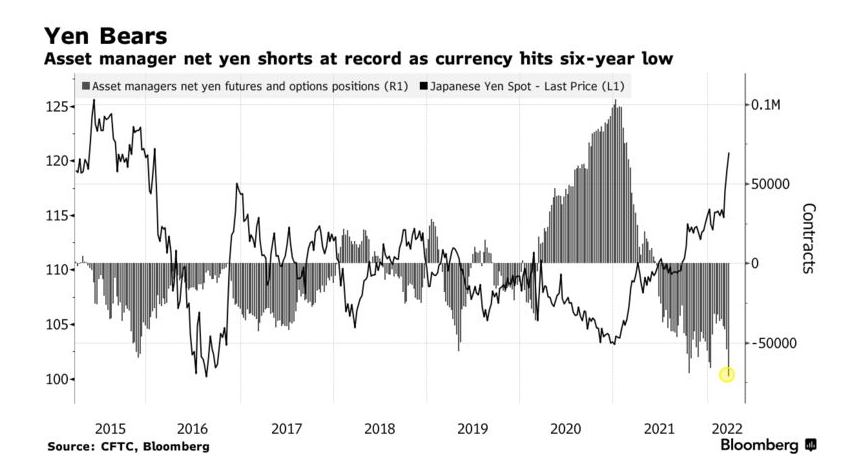

One also shouldn’t dismiss the prospects of a potential short squeeze; note that the level of net yen shorts has never been this high.

Bloomberg

Future inflation risks and a slowing economy will ramp up political pressure to normalize policy actions

Inflation may not necessarily be a burning issue for Japan at the moment relative to what the globe is experiencing, but I believe this will become a factor further down the line when you begin to factor in the spike in energy costs. Also, note that the weak base effect will likely linger till August and could put upward pressure on the YoY growth numbers. Over the years, the nation has largely always benefitted from a trade surplus position but over recent months, we’ve seen the situation reverse and this is mainly due to the nation’s vulnerability as an energy importer. The weakening currency only piles on the pressure. Note that the level of imports has been elevated for the past four months now, and the nation has been forced to encourage the likes of noted OPEC cartel member – UAE to help reduce prices.

Besides the direct effects of higher oil prices on households, also consider the effects linked to elevated input costs for Japanese businesses, which I don’t believe they are best placed to absorb. The Bank of Japan’s Tankan Business survey, a poll run across 10000 companies, reflects this lack of confidence. The Tankan business confidence index recently dropped for the first time since June 2020. It isn’t a great time for business confidence to go soft particularly as Q1-22 GDP will likely be rapidly scaled down from previous expectations of 4.5% to just 0.4%!

Note that Japan will go into election season in the summer, and I’m not sure the ruling party would want a sense of discontent amongst Japanese households and businesses ahead of this. In that case, would there be some political pressure on the BOJ to raise the ceiling on 10-year yields? We’ll have to wait and see. You may also see currency market interventions by the BOJ as they sell USD.

Safe haven qualities as global recession risk inches up

The Yen’s safe-haven aura appears to have dimmed in recent months, but you can’t discount this facet entirely if global recession risks pick up, as has been suggested recently by the Sentix economic indicator. Japan’s status as a behemoth net creditor and its surplus in global investment positions should not be discarded if global risk aversion picks up steam.

Bearish considerations for FXY

Yield differential vs US bonds is a massive source of concern

Bloomberg

The growing yield differential on US and JPY bonds is clearly the main driver for the JPY weakness, and it is difficult to see how things could change when both central banks appear to be gravitating toward monetary policies that are poles apart. Whilst the US Fed is attempting to stave off inflationary pressures, reduce its $9 trillion balance sheet, and hike policy rates to 1.75-2% by the end of the year (the markets think it could be much higher at 2.5%-2.75%), the Japanese central bank intends to keep interest rates locked near zero until inflation pressures are more “sustainable”.

Alternatively, you could perhaps also praise the BOJ for doing its bit to keep yields capped, given what it could do for debt servicing costs; Japan is one of the most indebted nations around with the debt to GDP rising from 236% in 2019 to 259% at the end of the year. The BOJ’s unconventional policy stance may have plenty of critics, but considering anemic inflation, and the severe indebtedness of the nation, one does wonder if the BOJ will put the prospects of the Yen at the forefront of things.

Based on historical purchase patterns, the BOJ has the potential to ramp up bond purchases even more

To ensure capped yields, the BOJ has been prepared to push the boat and recently engaged in a prolonged bond-buying exercise to cap yields on Japan’s 10-year bonds (recently over just three days, it ended up spending 3 trillion yen). Also, consider that the BOJ has a history of engaging in large bond purchases under the current chief – Haruhiko Kuroda, and one shouldn’t only consider what they spent last year (some 14 trillion yen) and assume that this is the limit; In fact, in 2015, net purchases were closer to 80 trillion yen. If they are going to keep up this bond-buying ferocity in Q2, it would be hard to make a case for the reversal in the USD/JPY.

Closing thoughts – Is FXY a Buy, Sell, or a Hold

As you can see from what I’ve covered in this article, there’s no easy fix here and no straightforward answer for where the Yen is headed. I believe both the bulls and the bears have some rather compelling arguments and thus I would rate FXY a HOLD.

[ad_2]

Source links Google News