[ad_1]

lorozco3D/iStock via Getty Images

Treasury Inflation Protected Securities continue to offer a superior alternative to cash and bonds as the risk of continued elevated inflation rises. For fixed income investors looking to reduce their risk of capital loss in the event of an acceleration of inflation and aggressive interest rate hikes, the iShares TIPS Bond ETF (NYSEARCA:TIP) is a solid bet. The ETF tracks the performance of U.S. Treasury inflation-protected securities with a weighted average maturity of 8 years and an effective duration of 7.5 years. This means that prices are significantly more sensitive to rate changes than the shorter term Vanguard Short-Term Inflation-Protected Securities ETF (VTIP), but the potential for capital gains is also stronger should the Fed’s appetite to rate hikes wane amid rising economic headwinds.

The Inflation Cat Is Out Of The Bag

For TIP investors the most important variable is long-term inflation expectations. When these rise, all else equal, TIP holders benefit from a rise in the price of their inflation-linked bond holdings. Additionally, if the higher inflation expectations reflect a rise in actual inflation, they also benefit from higher coupon payments which are linked to the consumer price basket.

With 10-year breakeven inflation expectations at a record high 2.9% (going back over 20 years), headline inflation at its highest level in 40 years, and inflation concerns soaring to the top of investor concerns, the contrarian streak in me would like to position for a surprise downside reversal. However, history shows, both in the U.S. and overseas, that periods of high inflation tend to stick around for a while due to the self-reinforcing behavior of consumers. Once consumers’ mindsets shift from expecting broad price stability to expecting significant increases, it can be very difficult to put the inflation cat back in the bag. (see ‘The Inflation/Deflation Debate: Taking The Over’ and ‘Hyperinflation Risks Are Rising’ for a more thorough reading on the dynamics of inflation.)

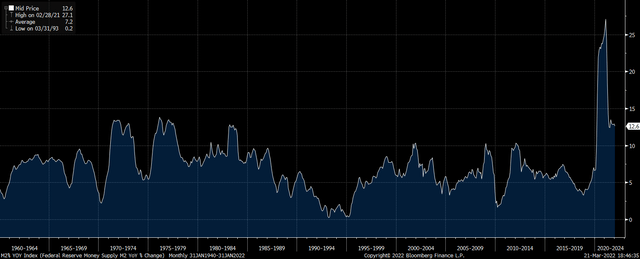

In the past, it has taken aggressive interest rates hikes and budget cuts to curb money supply growth and rein in inflation expectations, which I do not believe are on the agenda anytime soon. In fact, M2 money supply growth continues to grow at its fastest pace in decades despite halving from its peak.

U.S. M2 Money Supply Growth (Federal Reserve, Bloomberg)

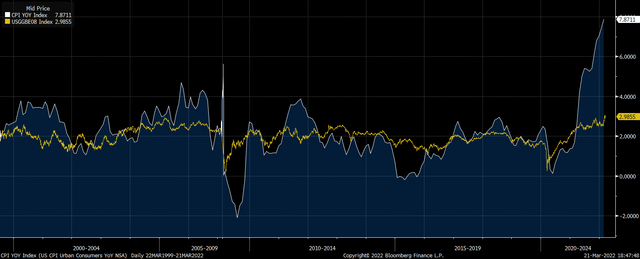

These factors suggest to me that despite being at all-time highs, long-term breakeven inflation expectations still have further to run on the upside. 8-year breakevens, the tenor most important for the TIP ETF, currently sit at 3.0%, suggesting that bond investors expect there to be a significant decline in headline CPI over the coming years from its current level of 7.9%. For context, the last time inflation was at its current levels, it averaged over 4% over the following 8 years even after interest rates were hiked to double-digit levels.

U.S. Headline CPI Vs 8-Year Breakeven Inflation Expectations, % (Bloomberg)

Inverted Yield Curve Suggest Economic Slowdown Ahead

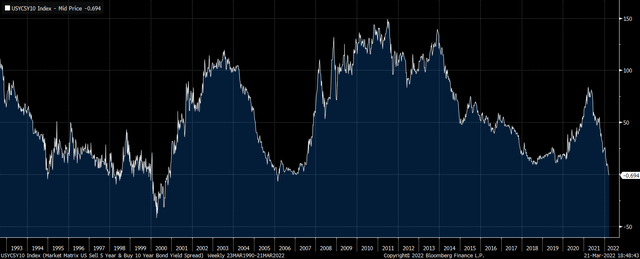

Even if breakeven inflation expectations do continue to rise, an aggressive rate hiking cycle by the Fed could cause nominal bond yields to rise ever more, which would cause real yields to rise undermining the TIP. This is of course a significant risk, particularly with the long end of the yield curve having yet to move significantly higher in line with the front of the curve. However, the reason for this is likely that bond investors are anticipating that the Fed’s hiking cycle will hit a wall as the recovery in economic growth reverses.

Inversion of the yield curve has a strong track record of predicting economic slowdowns and subsequent rate cuts, and given the higher levels of debt in the economy today compared with any other time in history, we should expect to see cracks appear sooner rather than later.

Spread of 10-Year UST Over 5-Year UST (Bloomberg)

A Potential Hedge Against Recession

Another thing I like about the TIP ETF and inflation-linked bonds in general at present is that we may be at an inflection point where economic weakness is no longer seen as disinflationary. In previous periods of economic weakness, most notably 2008 and 2020, the TIP sold off as economic weakness resulted in a surge in money demand and falling inflation expectations. With the war in Ukraine putting pressure on global commodity supplies, we could see a stagflationary scenario where economic weakness fails to bring down inflation expectations as consumers and investors anticipate additional monetary and fiscal stimulus.

[ad_2]

Source links Google News