[ad_1]

Mirel Kipioro/iStock via Getty Images

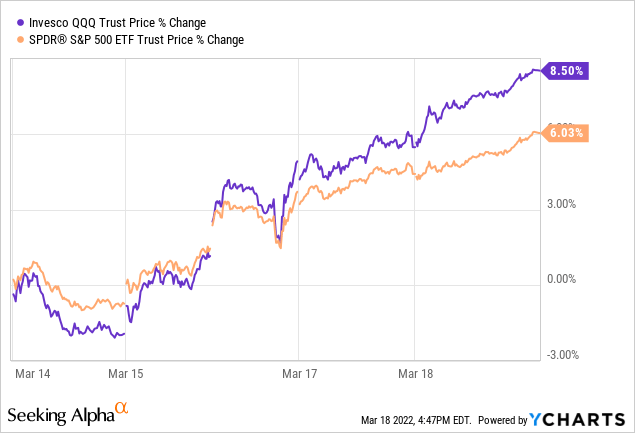

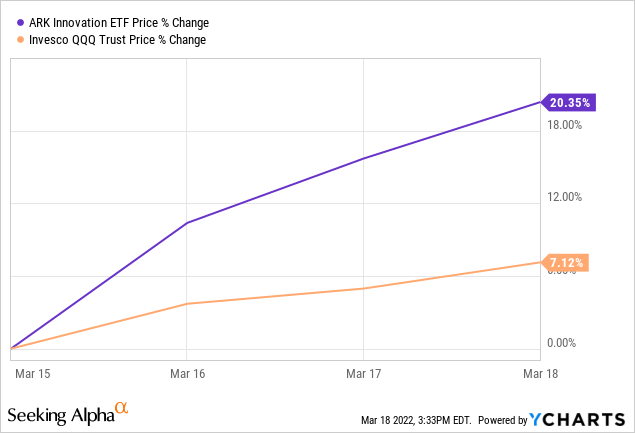

Stocks staged an impressive rally with the NASDAQ 100 (QQQ) and S&P 500 (SPY) ending the week up 9% and 6% each respectively. While NASDAQ remains in a correction territory down by 14% from its previous high, the resiliency here despite the volatile Russia-Ukraine headlines is encouraging to equity bulls. We believe that otherwise attractive valuations across several sectors along with underlying momentum in the U.S. economy evident by the solid labor market trends support a positive outlook towards stocks and risk assets. Our call is that there is more upside.

This week the climb in the major indexes was initially sparked by some headlines related to a potential Russia-Ukraine ceasefire agreement that ultimately fell apart. Still, we saw stocks extend gains off of the FOMC which saw a 25 basis point rate hike announcement, the first since 2018. It should not have been a surprise considering Fed has signaled a more hawkish tilt going back to November of last year when it effectively shut the door on the “inflation is transitory” narrative. The effort here with this hike was to maintain credibility with some sort of strategy to control long-term inflation expectations while also being cognizant of the macro environment and implications of significantly higher rates on economic growth.

So with that, our explanation for the strength in stocks is that we got a “buy the news” sort of event with the FOMC. The reality is that a 25 basis point hike or even an outlook for a few more increases this year is hardly enough to derail the economy. The sentiment over the last several weeks had been terrible with widespread selling and weakness amid the poor flow of headlines. There is also a case to be made that the selling had already gone far enough, more than pricing in some of the worst-case scenarios.

Getting straight to the point, we are bullish on stocks and beaten-down high-growth tech names in particular. We say beaten down but it’s more like a felony assault on the more speculative side of the market defined by companies that have limited current earnings. This group covering everything from clean energy, cloud computing, software application, hot IPOs have been trending lower since around Q1 2021 which was defined by peak valuations. On the flip side, we see several reasons to be bullish on stocks.

1) Attractive Valuations in Large-Cap Stocks

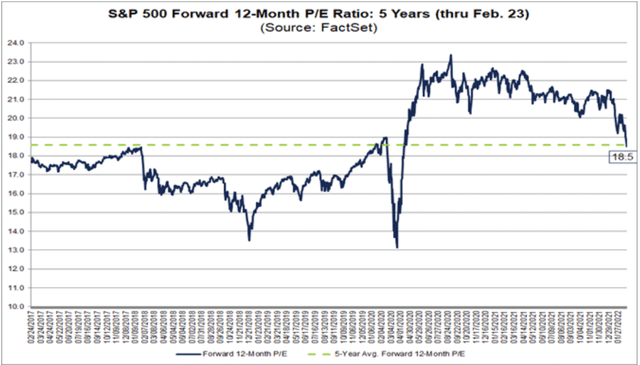

Data shows that the S&P 500 is trading at a forward P/E of approximately 18x, which is now below the 5-year average for the multiple. In our opinion, this chart alone squashes any talk of stocks being in a “bubble”. While 18x is above the longer 10-year and historical average for the multiple closer to 16x, the key insight we offer is that the composition of the S&P has shifted over the last several years, more towards tech and services.

source: FactSet

Even among the top constituents, names like Amazon.com Inc (AMZN), Tesla Inc (TSLA) end up skewing the index-wide valuation. It’s a lot different today than when Warren Buffet started investing in the 60s and a P/E of 15 was the benchmark for mostly financial and industrial names. In other words, the argument is that the S&P 500 today is cheap at the current level considering the growth outlook. From there, we believe the high-beta names and small-caps should be able to outperform going forward.

2) Post-Pandemic Boost

2 years into the pandemic and the U.S. Centers for Disease Control has finally removed the indoor mask guideline. Many of the cities and states with the most restrictive Covid rules since 2020 are rushing to ease restrictions citing sharply lower cases and hospitalization with an understanding that the majority of the population is either fully vaccinated or has some kind of acquired immunity.

As it relates to the economic outlook and stocks, the setup here is definitively bullish looking into the coming summer months that could see the second wave of a “reopening dynamic ” for several industries. Keep in mind it was only in November when the U.S. officially removed the travel ban that converted more than 20 countries. Higher global mobility with a boost from tourism can help balance some of the other soft spots and headwinds in the economy. We see a scenario where consumer discretionary even outperforms expectations that have been depressed lower balancing out the inflationary headwinds.

3) Fallout From Russian Sanctions Relatively Contained

While the price of WTI crude oil (USO) briefly hit $130 per barrel this month on the initial headlines of the U.S. banning Russian exports amid the broader financial sanctions, it’s telling that the market has pulled back. Part of this is based on the recognition that the actual impact on global supplies is modest. While Russia represents 8% of the world’s exports, keep in mind that many countries are continuing to do business. China, for example, representing nearly a third of Russian energy exports intends to continue buying. Similarly, the European Union despite some controversy has not moved towards an import ban.

source: finviz.com

The dynamic is similar across other commodities. While there is room for the price of oil to have some upside from here, any calls for oil at +$200 a barrel that would undermine the global macro outlook is likely premature in the current environment. An effort to increase production where possible either from OPEC or non-OPEC members can also help mitigate the near-term challenges. The other silver lining we have seen develop over the past week is some positive messaging from China that appears to be non-confrontational in the circumstance.

Messaging from President Xi towards the Biden Administration suggests a common goal of seeking peace and stability in the region. While the whole situation remains complex and rapidly changing, the market appears to be getting a better grasp of the fallout and economic implications. There is also the potential here that positive developments could arise. A headline for a ceasefire, or even ancillary geopolitical issues like the U.S. Iran nuclear deal could be enough for the market to breakout.

3 ETFs to Buy Now

The concept of the “pain trade” within investing is the idea that a certain market, asset class, or security will tend to go against the consensus. If “everyone” is bullish on a particular stock, that could imply that it has been bid up beyond fair value and the smart trade is to the downside. Inversely, over the last few weeks, it appears everyone was bearish with many pundits calling for a market crash while bringing up doom-and-gloom scenarios. This likely led to many investors either limiting exposure to risk assets or attempting to short which has thus far suffered from poor timing.

The good news is that there is still time to get back in. The theme we are going with today is the beaten-down name and high-growth segments that are well-positioned to recover from the recent volatility. Whether “the bottom” is in or we get some new volatility, we believe these funds will be trading higher over the next several months.

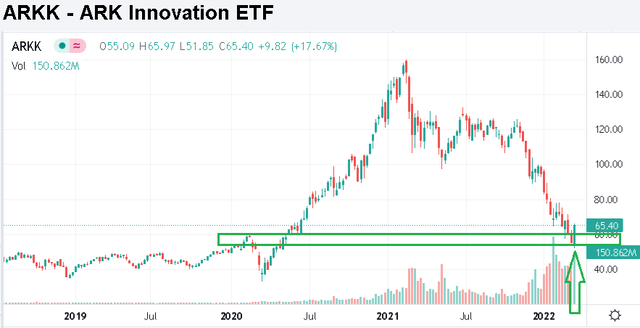

Ark Innovation ETF (ARKK) – Bullish on Unique Exposure to High-Growth Beaten Down Names

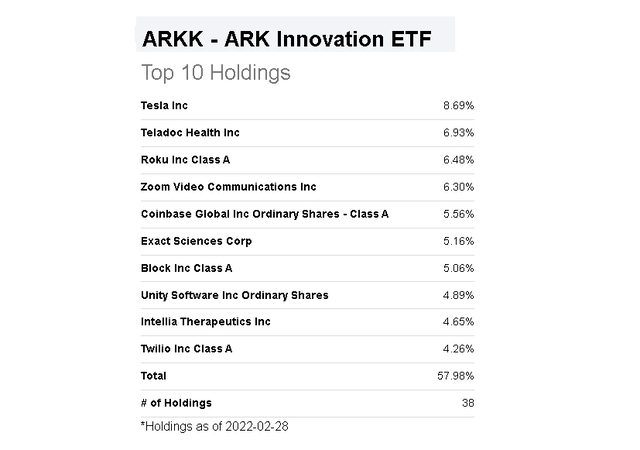

From a low under $52 last week, The Ark Innovation ETF is technically in a bull market, up over 20% from its low and also approaching its 50-day moving average. This is a controversial fund considering its portfolio manager Cathie Wood has transcended into a quasi-celebrity status following a blowout year in 2020 when ARKK was one of the performing funds in the market returning over 150%. It’s been a reversal of fortunes of the sort with the fund down by 55% from its high last year. It’s a great poster-child for the market dynamic of deflated valuations among a group of more speculative high-growth emerging names that are mostly unprofitable.

Seeking Alpha

The attraction here is that unique equity exposure which ends up representing a high-beta bet on the market that we expect to outperform going forward. It has nothing to do with Cathie Woods. We covered the fund in a recent article highlighting how the average underlying holding is expected to grow sales by over 30% in 2022 and maintain that rate in 2023. Across a group of 38 holdings, the fund is primed to surprise the upside.

Seeking Alpha

Even as most of these stock prices have collapsed from the highs of last year, its largest business as usual with the long-term outlook intact. As it relates to inflation and higher rates, consider that many of these tech stocks likely won’t see significant cost pressures from higher inputs while they may be able to raise pricing in the current market. The rising interest rate story is not new, and likely explains a large part of the selloff already.

The type of stocks in ARKK should always command a growth premium in terms of multiples and all that was missing previously was the sentiment. The rally now may be enough to force some short-covering and a new wave of momentum. We believe the ARKK can rally back towards $90 by year-end as our initial price target

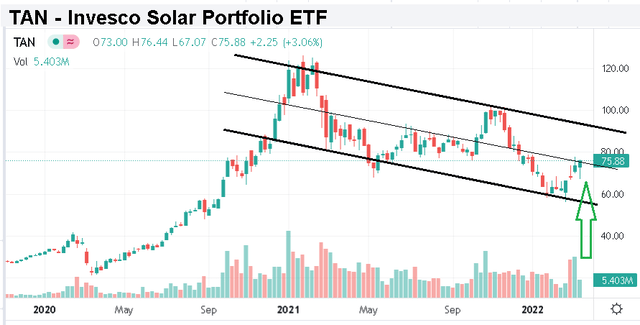

Invesco Solar ETF (TAN) – Ukraine-Russia Crisis Highlights Appeal of Renewable Energy

Even with the commodity price of oil pulling back from its high this week, record gas and fuel prices are on the minds of most consumers. There is a newfound recognition of the importance of energy independence with an effort to move away from fossil fuels into alternatives. We think solar can be a big winner here.

Seeking Alpha

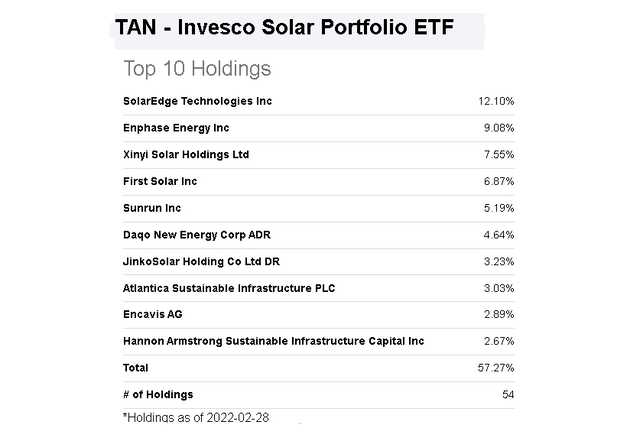

We like the Invesco Solar Portfolio ETF (TAN) which provides exposure to a basket of 51 leading companies across solar panel manufacturers, utility-scale project developers, residential rooftop solar systems installers, and those involved with related technologies.

Seeking Alpha

This is a group that faced the setback in late 2021 with the collapse of the Build Back Better Act which would have provided billions in incentives and subsidies over the next decade for solar. Those programs could be back on the table later this year with new support from congress as a tailwind for the group. Either way, we are bullish on several underlying companies and the TAN ETF is a good way to invest across a diversified group of leaders and emerging players that have value on the selloff.

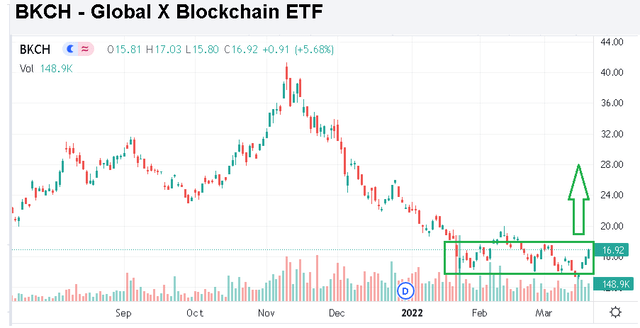

Global X Blockchain ETF (BKCH) – Bullish on Crypto Stocks as Bitcoin Breaks Out

One area of “tech” that we are very bullish on is Bitcoin (BTC-USD), crypto, and broader blockchain technologies. While many people have been calling for the demise of digital assets for several years, it’s clear to us that this market segment is here to stay.

The bullish case for crypto as we see it is the expanding applications as a payment method and through Web 3.0 along with the function as a store of value. Regulatory moves over the past year including a recent effort by the Biden Administration effectively recognize the legitimacy of crypto within the financial system add to the long-term outlook. Institutional investors allocating just a fraction of capital towards the asset class is likely the most positive tailwind for Bitcoin pricing which we believe will continue to represent the “gold standard” of crypto.

While Bitcoin has been highly volatile over the last several months, we like the setup here with the asset forming a bottom and trending higher since a low in January. From the current level of $41k, a rally above $45k could open the door for a move above $50k and a possible retest of 2021 highs.

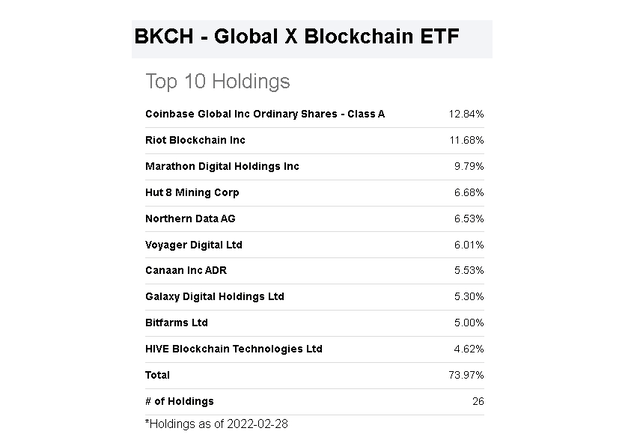

source: finviz

While simply buying Bitcoin directly is one option, we are bullish on related equities that are leveraged to the upside and can outperform going forward. We like the Global X Blockchain ETF because it provides exposure to 25 “crypto stocks” among bitcoin mining companies like Marathon Digital Holdings Inc (MARA), and Hut 8 Mining Corp (HUT) along with leaders on the financials side like Coinbase Global Inc (COIN) and Galaxy Digital Holdings Ltd (OTCPK:OTCPK:BRPHF).

Seeking Alpha

This group has been under pressure over the last several months but the opportunity here is an attractive entry point for a long-term holding. In a scenario where the price of Bitcoin gains momentum bringing some new positive momentum towards the segment, we believe the BKCH ETF can rally back towards its level from Q3 above $30 per share representing near 100% upside. Recognizing crypto as still speculative, we like the reward to risk setup here with a long trade using the recent lows as a stop level.

Seeking Alpha

Final Thoughts

The main insight we offer is that there is still a bullish case for stocks. The ETF we have covered here are higher risk but we believe they can work in the context of a diversified portfolio. The strategy should be to average into positions over days and weeks to secure a low-cost basis.

Without minimizing the ongoing Russia-Ukraine situation, the key risk here that we now see as unlikely would be an escalation into a more widespread conflict involving either NATO or the United States. A deteriorating in the global macro outlook beyond what may already be some depressed expectations could open the door for another leg lower in stocks. Inflationary trends and energy prices are also important monitoring points.

[ad_2]

Source links Google News