[ad_1]

xxmmxx/iStock via Getty Images

HIPS facts and portfolio

The GraniteShares HIPS US High Income ETF (HIPS) has been tracking the TFMS HIPS Index since 1/6/2015. It has 60 holdings, a monthly distribution with an annual trailing rate of 8.93%, and management fees of 0.70%. It is a fund of funds with more than half of asset value in closed-end funds, which results in a total expense ratio of 2.88%: this is a big drag and a first red flag.

As described by GraniteShares in the prospectus,

the rules-based Index measures the performance of up to 60 high income U.S.-listed securities that typically have “pass-through” structures that require them to distribute substantially all of their earnings to shareholders as cash distributions. This “high income, pass-through” strategy is known as HIPS.

Eligible securities must meet market capitalization and liquidity thresholds. The index selects up to 15 securities for each of four “pass-through” categories (REITs, MLPs, closed-end funds, asset management/BDCs) based on a score featuring yield (higher is better) and volatility (lower is better). Constituents are equal-weighted within each category. The weights of categories are adjusted to minimize volatility and maximize return, measured over a look-back period. The minimum category weight is 15% and the maximum MLPs weight is 25%. The Index is reconstituted annually and may be rebalanced quarterly under certain conditions.

HIPS currently has 56% of asset value in closed-end funds and about 15% in each of other categories: MLPs, REITs, and BDCs. The fund is quite concentrated: the top 15 holdings, listed below, represent 51.5% of asset value.

|

Ticker |

Name |

Weight |

|

FCT |

First Trust Senior Floating Rate… |

3.86% |

|

FINS |

Angel Oak Financial Strategies |

3.74% |

|

JRI |

Nuveen Real Asset Income… |

3.54% |

|

BGH |

Barings Global Short Duration |

3.51% |

|

JQC |

Nuveen Credit Strategies Income… |

3.51% |

|

DLY |

DoubleLine Yield Opportunities |

3.48% |

|

HYI |

Western Asset High Yield Defin… |

3.44% |

|

ARDC |

Ares Dynamic Credit Allocation |

3.42% |

|

ISD |

PGIM High Yield Bond Fund Inc. |

3.42% |

|

HIX |

Western Asset High Income Fund |

3.40% |

|

GHY |

PGIM Global High Yield Fund Inc. |

3.38% |

|

KIO |

KKR Income Opportunities Fund |

3.33% |

|

EAD |

Allspring Income Opportunities |

3.30% |

|

HYT |

BlackRock Corporate High Yield |

3.22% |

|

EMD |

Western Asset Emerging Markets Debt Fund Inc. |

2.99% |

Historical performance

The next chart compares HIPS performance since inception with the S&P 500 (SPY) and a more relevant benchmark: an equal-weight portfolio of 4 ETFs representing the 4 asset categories of HIPS, rebalanced annually. For this calculation, I have chosen Amplify High Income ETF (YYY), iShares Mortgage Real Estate Capped ETF (REM), VanEck Vectors BDC Income ETF (BIZD), and ALPS Alerian MLP ETF (AMLP). Distributions are included and reinvested. I have reduced the REIT universe to mortgage REITs. It may not be absolutely correct, but as yield is a primary factor of selection, selected REITs are mostly of the mortgage kind.

|

since 1/13/2015 |

Total Return |

Annual. Return |

Drawdown |

Sharpe ratio |

Volatility |

|

HIPS |

23.80% |

3.02% |

-53.14% |

0.23 |

21.12% |

|

YYY+REM+BIZD+AMLP |

32.05% |

3.95% |

-55.44% |

0.28 |

22.02% |

|

SPY |

140.23% |

13.00% |

-33.72% |

0.91 |

14.55% |

HIPS has been lagging the stock benchmark by far, and it is also behind the ETF mix by almost one percentage point in annualized return. It means the strategy has failed to bring added value over the mix of passive indexes, which is a second red flag.

The third red flag, also visible in the previous table, is capital decay: the annualized return reinvesting all distributions, without paying any tax on them, is way below the distribution rate. It is confirmed by HIPS share price history (without dividend): it has lost more than 20% since inception.

HIPS share price (TradingView on Seeking Alpha)

In fact, all the ETFs I have chosen to build a relevant benchmark have lost value in share price since their respective inceptions (see next charts).

YYY share price (TradingView on Seeking Alpha) REM share price (TradingView on Seeking Alpha) BIZD share price (TradingView on Seeking Alpha) AMLP share price (TradingView on Seeking Alpha)

The 3 red flags are structural, not related to management: even for excellent fund managers, it is difficult to make a good recipe with bad ingredients. Other similar ETFs like the Global X Alternative Income ETF (ALTY), reviewed here, have the same issues.

These issues are not specific to HIPS and ALTY: securities with yields above 6% suffer from capital decay. The 10-year average annualized return including dividends of all ETFs with a yield superior to 6% is 4.5%…for an average yield of 8.8%! The 10-year average annualized return including dividends of all Russell 1000 stocks with a dividend yield superior to 6% is 5.9%, for an average yield of 8% (data calculated with Portfolio123).

Capital decay also means income stream decay. HIPS has maintained a constant monthly distribution since 2017 thanks to a significant return of capital: $2.86 per share in five years (source: my calculation with GraniteShares data). This is not sustainable: the yield cannot go up indefinitely to offset the loss in asset value.

The problem of high-yield ETFs is not the offer, but the demand from people who are chasing yields without understanding capital decay. The full picture for an income-seeking investor is not pretty, considering the current inflation rate and the tax paid on distributions. HIPS might be used as an instrument for swing trading or tactical allocation, but I think it is not a reasonable buy-and-hold investment. This is true for a number of high-yield instruments, not only this one.

A solution to get high yields without decay

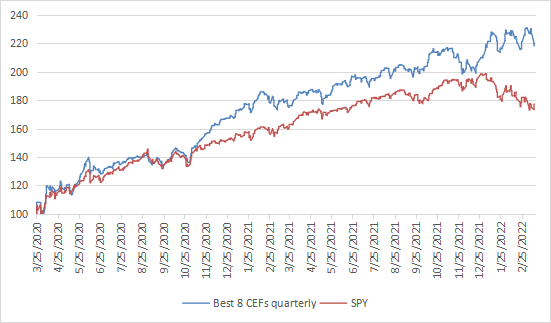

Capital and income decay is a structural issue in many closed-end funds, like in most high-yield instruments. However, it is not inexorable if one knows how to trade CEFs instead of using them as buy-and-hold instruments. I designed a 5-factor ranking system statistically related to forward returns across the full CEF universe, and started publishing the 8 best-ranked liquid CEFs in Quantitative Risk & Value (QRV) after the March 2020 market meltdown. The list is updated every week. Its average dividend yield varies around 7-8%. It is not a model portfolio: trading the list every week is too costly in spreads and slippage. Its purpose is helping income investors find funds with a good entry point. In the table and chart below, I give the hypothetical example of starting a portfolio on 3/25/2020 with my initial “Best 8 Ranked CEFs” list and updating it every 3 months since then, ignoring intermediate updates to limit transaction costs. Returns are calculated with holdings initially in equal weights without rebalancing until the next 3-month update. Dividends are reinvested at the beginning of every 3-month period.

|

since 3/25/2020 |

Total Return |

Annual.Return |

Drawdown |

Sharpe ratio |

Volatility |

|

Best 8 CEFs quarterly |

118.51% |

48.58% |

-9.84% |

2.55 |

15.87% |

|

SPY |

77.21% |

33.62% |

-12.87% |

1.87 |

16.22% |

Best 8 CEFs list performance (chart: author: data: portfolio123)

Dates and lists can be checked in QRV post history (trial is free). Past performance is not a guarantee of future return.

The “Best 8” list has done quite well in the current correction. I don’t expect it to beat SPY in the future like it did in the past 2 years, but a discount-driven rotational strategy in CEFs has a much better chance to protect both capital and income stream against erosion and inflation than any high-yield passive investment like HIPS.

[ad_2]

Source links Google News