[ad_1]

undefined undefined/iStock via Getty Images

Investment thesis: with warning signs from the credit markets and spiking gas prices, this is not the time to add micro-caps.

Due to the rise of data showing that active management performs poorly over the long term, investors now use ETFs as the backbone of most portfolios. These funds allow investors to target broad indexes, such as the (IWC), which broadly tracks micro-cap stocks:

The iShares Micro-Cap ETF seeks to track the investment results of an index composed of micro-capitalization U.S. equities.

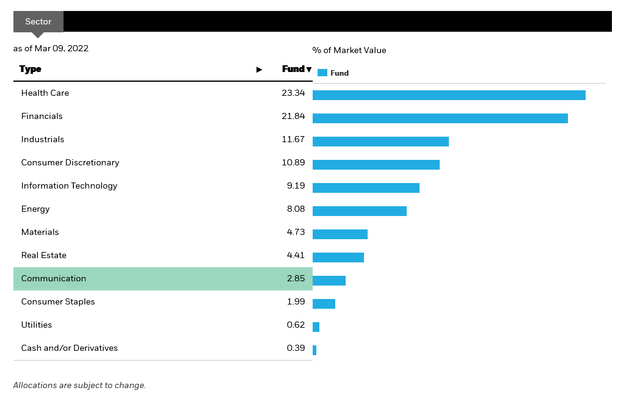

Here is the index’s sector breakdown:

Sector composition of IWC (Blackrock)

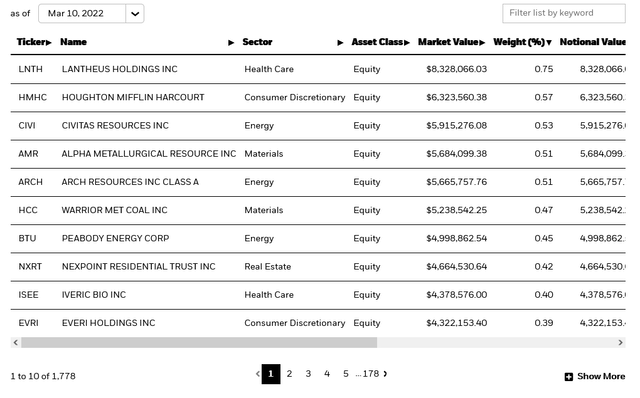

And here are the 10 largest holdings:

IWC’s 10 largest holdings (Blackrock)

My standard analytical framework for ETFs is to first look at the macroeconomic backdrop for the index. Then I compare the ETF’s performance to its peers. Finally, I look at the charts.

Since the IWC is a broad-based ETF, I’ll look at the macro-economy using the long-leading, leading, and coincidental indicator methodology developed by Arthur Burns and Geoffrey Moore of the Federal Reserve.

Long-leading

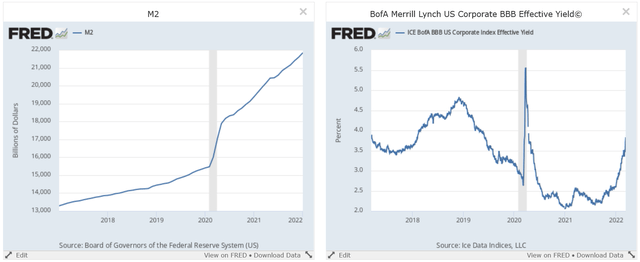

M2 and BBB effect yield (NASDAQ:FRED)

There is ample liquidity as shown by the strongly-rising M2 (left). But there’s been a strong spike in the BBB yield (right).

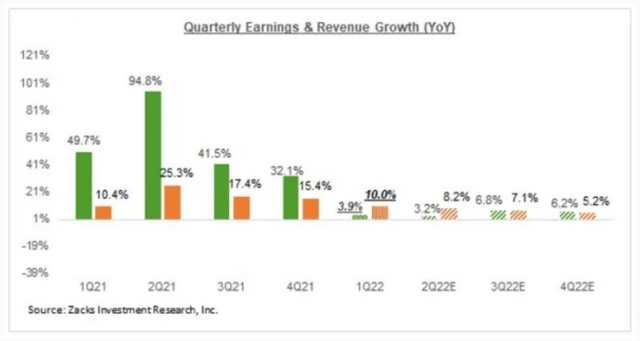

Corporate earnings are strong. From Zacks:

The overall earnings picture has been very strong lately, with the growth rates and the absolute dollar totals at very high levels. The growth pace decelerates significantly in the coming periods, as you can see in the chart below that provides a big-picture view of earnings on a quarterly basis.

The overall pace is expected to slow, however:

Earnings estimates (Zacks)

Leading Indicators

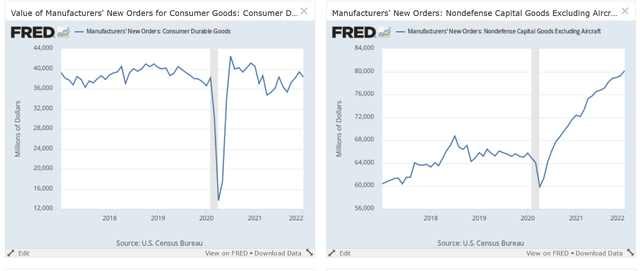

New orders for consumer durable goods and business equipment (FRED)

New orders for consumer durables (left) are still at strong rates and new orders for business equipment (right) are very strong.

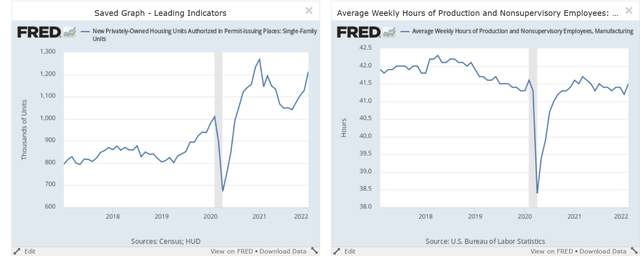

1-unit building permits and hourly wages (FRED)

1-unit building permits (left) are once again rising while wages (right) are growing modestly.

Commercial paper and 4-week moving average of initial unemployment claims (FRED)

There’s been an uptick in commercial paper rates (left). But initial claims for unemployment (right) are at low levels.

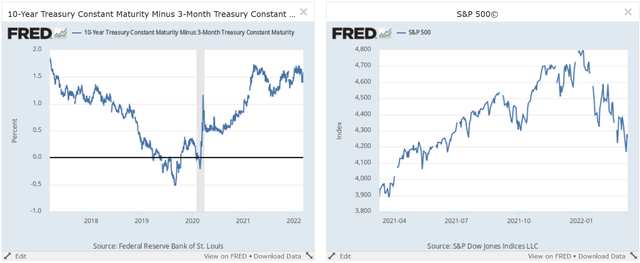

10-year/3-month treasury spread and S&P 500 (FRED)

The spread between the 10-year and 3-month treasury is still wide. But the S&P 500 is in a downtrend.

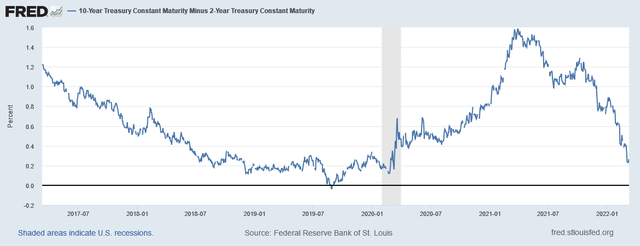

10-year-2-year spread (FRED)

Finally, the 10-year/2-year spread is narrowing pretty significantly.

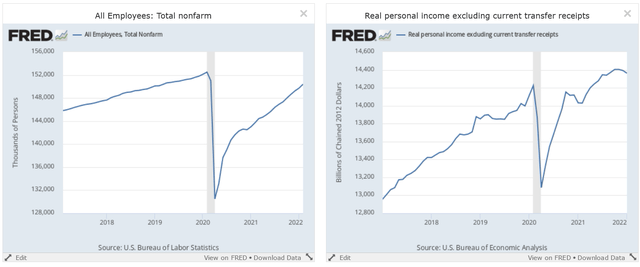

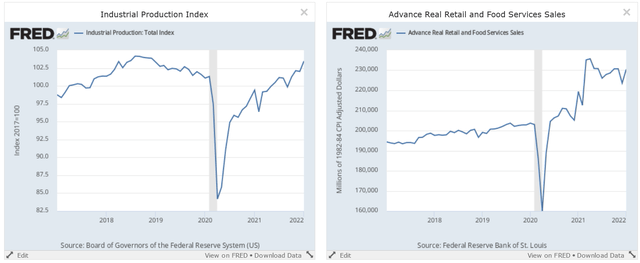

Coincidental Indicators

Total payroll employment and personal income less transfer payments (FRED)

Total payroll employment is still rising at a strong rate (left) while personal income less transfer payments (right) is just off 5-year highs.

Industrial production and retail sales (FRED)

Industrial production (left) is rising while retail sales (right) are still at strong levels.

Economic conclusion: the overall picture is still strong. But there is some weakness in the financial indicators. The 10-2 yield spread has tightened considerably, the stock market is selling off, and commercial paper yields are rising.

And then we have the war in Ukraine, which has spiked oil prices and US gas prices. The last time the price at the pump was at this level was right before the Great Recession in 2008-2009. James Hamilton has noted that oil prices are a leading cause of most post WW II recessions. All this means that the geopolitical shock could cause a recession. But, I would expect it to be pretty mild since all other indicators are still very strong.

Now let’s turn to the IWC’s performance by comparing it to the following peer group: IWM, IJH, QQQ, SPY, DIA, and OEF (seven total):

| Week | Month | 3-Months | 6-Months | 12-Months | |

| IWC’s relative performance | 1st | 1st | 5th | 7th | 7th |

Data from Finviz.com

The IWC was one of the worst performers over the long term. But it’s the top performer in recent time frames.

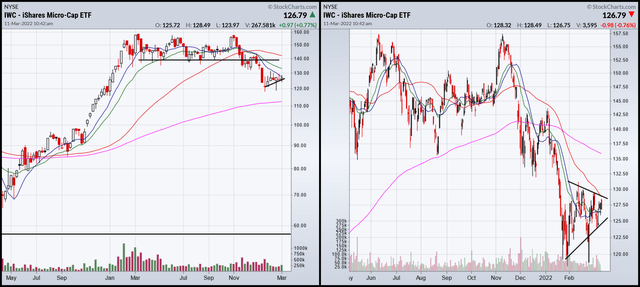

Finally, let’s take a look at the charts.

IWC weekly and daily (Stockcharts)

The IWC spent most of last year consolidating sideways (left). The right chart shows that the ETF has fallen nearly 20% since its highs last year.

Small-caps need a growing economy with no potential recession in sight. While the economic data is mostly favorable, there are potential issues in the credit markets and now, the foreign policy arena. This is not the time to add micro-caps to a portfolio.

[ad_2]

Source links Google News