[ad_1]

DNY59/E+ via Getty Images

Fidelity MSCI Health Care Index ETF (FHLC) is a diversified healthcare exchange traded fund launched and managed by Fidelity Management & Research Company LLC. The ETF is co-managed by BlackRock Fund Advisors. It invests in US public equity shares of companies operating across health care sectors. The fund seeks to track the performance of the MSCI USA IMI Health Care 25/50 Index, by using representative sampling techniques. More than 88 percent of its portfolio consists of large caps stocks. This ETF was formed on October 21, 2013 and is domiciled in the United States.

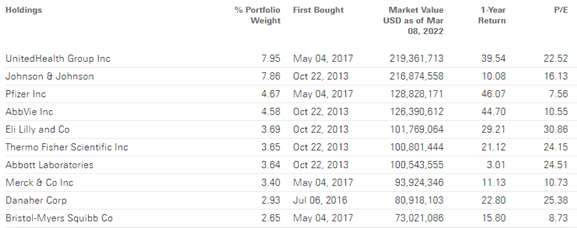

This ETF is one of those rare healthcare ETFs which have been able to grow during the pandemic. Healthcare sector as a whole had seen a steep fall in March & April 2020, and then some of the stocks bounced back, and some are still recovering. FHLC has suffered a very minimal loss during this pandemic. FHLC was also a rare healthcare fund to generate positive returns every year in the past five years. More than 73 percent price growth during the past five years makes it a standout performer. Interestingly, its top 10 holdings, which incidentally are its major holdings (more than 2.5% of its portfolio) too, have all generated a positive return in the past one year. Another interesting factor to note here is that all these stocks have been inducted in this ETF at least close to five years ago. This amplifies FHLC’s long-term outlook in its investment strategy.

Holdings

Source: Fidelity® MSCI Health Care ETF FHLC

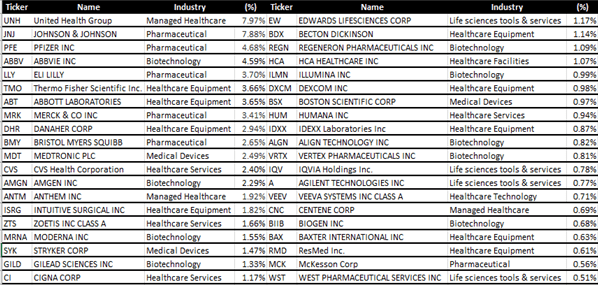

A detailed study of FHLC’s top 80 percent holding suggests that the fund is a truly diversified healthcare ETF. Its holdings are spread over the entire gamut of the healthcare sector – Managed Healthcare, Pharmaceutical, Biotechnology, Life Sciences Tools & Services, Medical Devices, Healthcare Equipment, Healthcare Services, Healthcare Facilities, Healthcare Supplies and Healthcare Technology. Within this top 80 percent investment, less than 9 percent have been invested in large cap indigenous biotechnology stocks (not considering AbbVie Inc. (NYSE:ABBV) which is a spin off from Abbott Laboratories (NYSE:ABT)).

Holdings

Source: FHLC – Fidelity MSCI Health Care Index ETF – Holdings – Zacks.com

The past year has been bad for the large cap (market capitalization over $12.9 billion) biotech firms, that included Amgen Inc. (AMGN), Moderna (MRNA), Celgene Corporation (NASDAQ:CELG), Gilead Sciences Inc. (GILD), Regeneron Pharmaceuticals Inc. (REGN), Horizon Therapeutics PLC (HZNP), Vertex Pharmaceuticals Inc. (VRTX), Illumina Inc. (ILMN), Biogen Inc. (BIIB), Seagen Inc. (SGEN), Alnylam Pharmaceuticals Inc. (ALNY), BioMarin Pharmaceutical Inc. (BMRN), Incyte Corporation (INCY), Viatris Inc. (VTRS), 10x Genomics, Inc. (TXG). Out of these 15 large cap stocks, only Regeneron Pharmaceuticals Inc. had been able to record double digit growth. Vertex Pharmaceuticals Inc. grew by 8.13 percent, and the remaining had a very poor year.

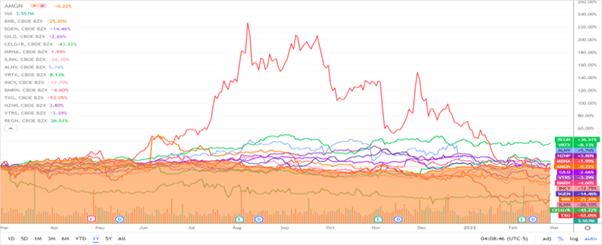

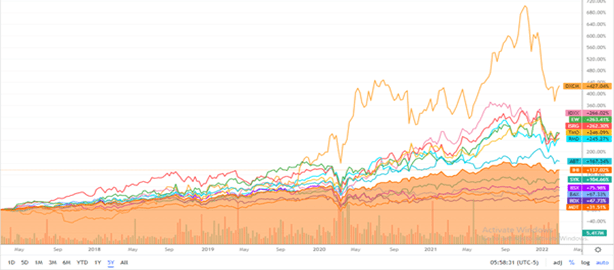

Performance (Seeking Alpha)

As can be seen, the fund has invested in various companies related to healthcare equipment and medical devices. As my regular readers might know, these are the two healthcare segments that recorded positive and impressive returns in the past one year. Pharmaceutical, Managed healthcare, Biotechnology, and Life care tools & services – all have suffered immensely during the same period. While most of the large companies in these four sectors recorded negative growth, the ones in healthcare equipment and medical devices have stood out. Concentrating on these two segments has surely been beneficial for this ETF, as this fund not only generated a strong return, but also has closely replicated the returns of S&P 500.

Performance (Seeking Alpha)

Source: Fidelity Covington Trust – Fidelity MSCI Health Care Index ETF Momentum Performance

Fidelity MSCI Health Care Index ETF’s top 80 percent investment includes investments in 12 healthcare equipment and medical device manufacturers- Thermo Fisher Scientific Inc. (TMO), Abbott Laboratories (ABT), Medtronic plc (MDT), Becton, Dickinson and Company (BDX), Boston Scientific Corporation (BSX), Stryker Corporation (SYK), Edwards Lifesciences Corporation (EW), Intuitive Surgical, Inc. (ISRG), IDEXX Laboratories, Inc. (IDXX), Baxter International Inc. (BAX), DexCom, Inc. (DXCM), and ResMed Inc. (RMD).

Comparison (Seeking Alpha)

Source: IHI article published recently

All these 12 stocks have generated strong growth over the past 5 years. Among these 12, the stock that recorded the minimum growth is Medtronic plc. However, 31.51 percent growth over the past 5 years is fairly good. There are stocks like DexCom, Inc., which grew by 427 percent during the same period. This fund has invested about 20 percent of its holdings in these 12 stocks. Selection of the right kind of stocks and remaining invested in those for a longer period surely has paid off.

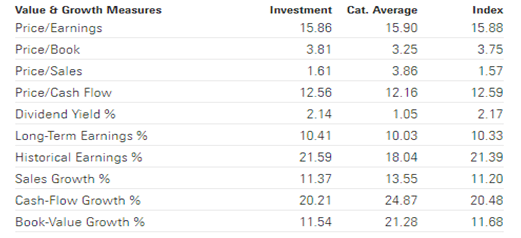

FHLC’s stocks have generated strong sales, and earnings growth, which are also at par with its benchmark index. FHLC’s cash flow has grown by over 20 percent. Its price multiples are also at par with its benchmark index. When compared to its peers, P/E of 15.86, Price/Book of 3.81, and Price/Cash Flow of 12.56, suggests that the price is moving in tandem with its peers when it comes to estimating its future potential from its earnings and assets. Investors believe that this ETF will be able to generate substantial income and cash flow utilizing its present level of assets and liquidity.

Fundamentals

Source: Fidelity® MSCI Health Care ETF FHLC

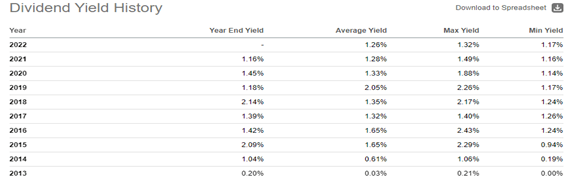

However, the yield is quite low at 2 percent or less than that. Though FHLC has been paying steady quarterly dividends since 2014, the yield has historically been quite low. It’s not surprising that the yield of the benchmark index and its peers are quite low too. Many healthcare ETFs don’t have a track record of strong dividend payment. As a result, it won’t be a bad idea for income seeking investors to stay away from this ETF.

Yield (Seeking Alpha)

Source: Fidelity Covington Trust – Fidelity MSCI Health Care Index ETF Dividend Yield

However, the future growth potential of the overall healthcare sector is quite good. One of its key investment segments, medical devices and healthcare equipment, is expected to grow even further. In North America alone, the medical devices market is projected to grow from $455.34 billion in 2021 to $657.98 billion in 2028 at a CAGR of 5.4%. FHLC’s investments are well poised to take advantage of this growth prospect. Besides, all its significant holdings are long term and are generating positive results. Most of these stocks are also trading at an attractive P/E. Inventors have every reason to be optimistic about this stock in the medium and long term.

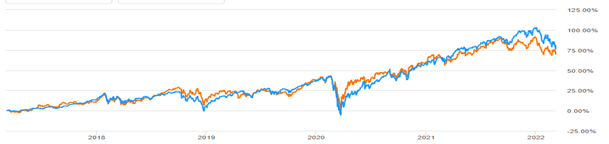

Historically, this fund has been one of the best performers, and one of those healthcare funds that have helped hedge against the impact of the pandemic. FHLC has been a standout performer and recorded significant growth in the past five years, at sync with the S&P 500. Barring biotechnology and a few other sectors, FHLC’s holdings in other healthcare segments have been quite productive. Being diversified over the entire spectrum of the healthcare sector will always make it less risky and less volatile as compared to segment specific healthcare ETFs, like Invesco Dynamic Biotechnology & Genome Portfolio ETF (PBE), iShares U.S. Medical Devices ETF (IHI), First Trust NYSE Arca Biotechnology Index Fund (FBT), ARK Genomic Revolution ETF (ARKG), etc. Going by the price multiples, investors too seem to be quite optimistic about the future performance of this ETF. As a growth seeking investor with average risk bearing capacity, I’d certainly like to keep Fidelity MSCI Health Care Index ETF in my portfolio of investments.

[ad_2]

Source links Google News