[ad_1]

3D_generator/iStock via Getty Images

This is an update of a review published in March 2021.

CWB strategy and portfolio

The SPDR Bloomberg Barclays Convertible Securities ETF (CWB) has been tracking the Bloomberg Barclays US Convertible Liquid Bond Index since 4/14/2009. The expense ratio is 0.40% and the current distribution yield is 2.13%.

As described in the prospectus, “the Index is designed to represent the market of U.S. convertible securities, such as convertible bonds and convertible preferred stock. Convertible bonds are bonds that can be exchanged, at the option of the holder or issuer, for a specific number of shares of the issuer’s equity securities. Convertible preferred stock is preferred stock that includes an option for the holder to convert to common stock“.

Eligible securities must have an issue amount of at least $350 million, a par amount outstanding of at least $250 million, and at least 31 days until maturity. There is no condition on the issuer’s credit rating. The index is rebalanced once a month.

Optionality allows companies to borrow money at a lower rate, and possibly avoid paying the principal, should the bond be converted (in this case, the debt is “paid” by common shareholders in dilution). Optionality is also attractive for lenders willing to mix fixed income and speculation on the share price. As a consequence, CWB portfolio is growth-oriented, and as a hybrid asset, its behavior is part equity, part fixed income. Due to embedded optionality, CWB is classified by some brokers as a derivative product. This may require some adjustments in your trading permissions if you want to buy it.

CWB has 310 holdings with an average rate of 2.09% and an average maturity of 3.8 years, attached to conditional call options in the issuers’ common stocks.

The next table lists the top 15 issuers, weighing about 27% of the portfolio. Each company may have several bonds held in CWB (total weights by issuer are my calculation).

|

Issuer |

Weight % |

|

NEXTERA ENERGY (NEE) |

2.72 |

|

PALO ALTO NETWORKS (PANW) |

2.68 |

|

LIBERTY MEDIA (LMACA) |

2.64 |

|

BROADCOM INC. (AVGO) |

2.55 |

|

DISH NETWORK CORP. (DISH) |

2.05 |

|

DANAHER CORP. (DHR) |

2.02 |

|

WELLS FARGO & CO. (WFC) |

1.97 |

|

SNAP INC. (SNAP) |

1.57 |

|

BANK OF AMERICA CORP. (BAC.PK) |

1.49 |

|

SEA LTD. (SE) |

1.43 |

|

DEXCOM, INC. (DXCM) |

1.22 |

|

WAYFAIR INC. (W) |

1.13 |

|

PIONEER NATURAL RESOURCES (PXD) |

1.11 |

|

AKAMAI TECHNOLOGIES, INC. (AKAM) |

1.02 |

|

FORD MOTOR COMPANY (F) |

1.00 |

The portfolio has significantly changed since my review of March 2021: at this time, the largest issuer was Tesla (TSLA) with a weight of 3.08%.

Historical performance

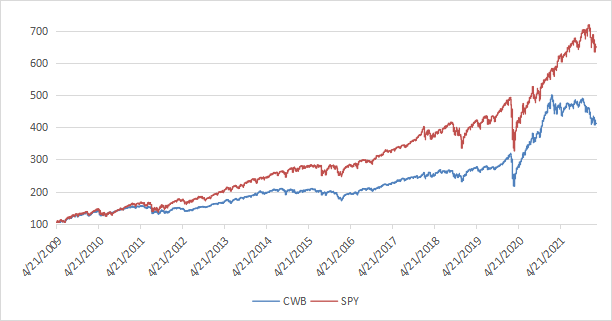

Due to its characteristics of a hybrid asset, CWB behavior is closer to a stock index than a bond index. Its correlation coefficient with SPY is 0.86 since inception. CWB has lagged the stock benchmark by 4 percentage points in annualized total return and shows similar risk metrics on this period (drawdown and volatility).

|

Annual Return |

Drawdown |

Sharpe Ratio |

Volatility |

|

|

CWB |

11.63% |

-32.06% |

0.93 |

12.38% |

|

SPY |

15.66% |

-33.72% |

1.08 |

13.83% |

Data calculated with Portfolio123

The next chart plots the equity value of $100 investments in CWB and SPY since inception.

CWB vs. SPY (chart: author; data: Portfolio123)

CWB tactical rotation

Tactical allocation strategies consist of over-weighting assets with the highest probability of future gains. This probability is often arbitrarily measured by past performance. Countless variants are possible depending on the performance metric, weight calculation, look-back period, decision frequency, asset list, number of positions. The next table tracks a strategy with only two ETFs: CWB and the iShares 7-10 Year Treasury Bond ETF (IEF). Every week, it goes long 100% in the ETF with the highest 3-month return, or in cash if both have their prices below the 200-day simple moving average. This CWB-IEF rotational model is compared to two bond benchmarks: a total bond market ETF (BND) and IEF itself.

|

Since CWB Inception |

Annual Return |

Drawdown |

|

CWB-IEF rotation |

5.04% |

-12.60% |

|

Bond Benchmark (BND) |

3.22% |

-10.67% |

|

IEF |

3.41% |

-9.49% |

Calculations with Portfolio123. Past performance, real or simulated, is not a guarantee of future returns.

Takeaway

CWB portfolio may change significantly over time. It had an exceptional performance in 2020 due to its concentration in high momentum companies. Risk-adjusted performance from 2009 to 2019 and in 2021 has been much less attractive compared with a stock index. CWB correlation to stocks may boost the performance of a bond ETF portfolio in a bull market. It may also be used in a tactical allocation strategy with other bond ETFs. The CWB-IEF rotation presented here is a simplistic example. QRV Bond Rotation is based on the same idea.

[ad_2]

Source links Google News