[ad_1]

ThitareeSarmkasat/iStock via Getty Images

This dividend ETF article series aims at evaluating products regarding the relative past performance of their strategies and quality metrics of their current portfolios. As holdings and their weights change over time, I may update reviews, usually no more than once a year.

FDRR strategy and portfolio

The Fidelity Dividend ETF for Rising Rates (FDRR) has been tracking the Fidelity Dividend Index for Rising Rates Index℠ since 09/12/2016. It has 123 holdings, a distribution yield of 2.18% and a total expense ratio of 0.29%.

As described in the prospectus, the index “is designed to reflect the performance of stocks of large and mid-capitalization dividend-paying companies that are expected to continue to pay and grow their dividends and have a positive correlation of returns to increasing 10-year U.S. Treasury yields”.

FDRR invests mostly in U.S. based companies (94.5% of asset value), but also in Europe (5%) and a tiny bit in Asia. Large companies represent 82% of the portfolio, mid-caps about 15% and small caps about 3%.

FDRR is significantly cheaper than the S&P 500 (SPY) regarding usual valuation ratios, reported in the table below.

|

FDRR |

SPY |

|

|

Price/Earnings TTM |

16.21 |

23.05 |

|

Price/Book |

3.3 |

4.3 |

|

Price/Sales |

2.62 |

3 |

|

Price/Cash Flow |

12.09 |

17.22 |

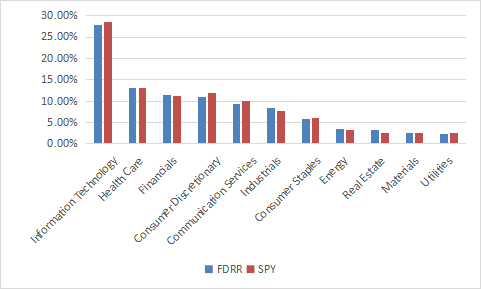

Technology is the heaviest sector and the fund’s sector composition is close to the S&P 500 (see next chart).

FDRR sectors (Chart: author; data: Fidelity)

The top 10 holdings, listed below with weights and some fundamental ratios, represent 28% of asset value. The fund has a significant exposure to risks related to the top 2 names: Apple (7.18%) and Microsoft (6.43%). Other holdings have a much lighter weight.

|

Ticker |

Name |

Weight% |

EPS growth %TTM |

P/E TTM |

P/E fwd |

Yield% |

|

AAPL |

Apple Inc |

7.18 |

62.83 |

27.60 |

27.24 |

0.53 |

|

MSFT |

Microsoft Corp |

6.43 |

39.98 |

31.48 |

31.54 |

0.84 |

|

JNJ |

Johnson & Johnson |

2.13 |

41.72 |

21.56 |

15.94 |

2.52 |

|

V |

Visa Inc |

1.86 |

26.04 |

35.12 |

28.97 |

0.72 |

|

ABBV |

AbbVie Inc |

1.83 |

125.31 |

23.32 |

10.59 |

3.75 |

|

HD |

Home Depot Inc. |

1.67 |

29.92 |

20.91 |

20.22 |

2.34 |

|

AVGO |

Broadcom Inc |

1.66 |

138.11 |

38.57 |

16.88 |

2.83 |

|

JPM.PK |

JPMorgan Chase & Co |

1.65 |

72.70 |

9.01 |

12.16 |

2.89 |

|

CSCO |

Cisco Systems Inc |

1.64 |

17.03 |

20.06 |

16.28 |

2.71 |

|

PFE |

Pfizer Inc |

1.64 |

125.29 |

12.42 |

6.84 |

3.35 |

Historical performance

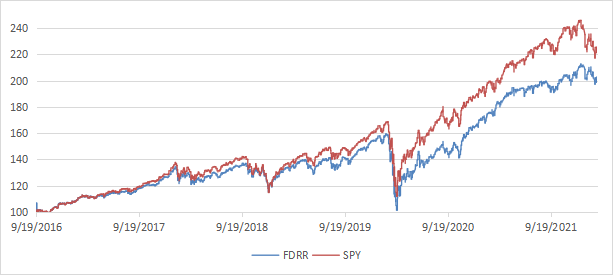

Since inception (09/12/2016), FDRR has underperformed SPY and the Vanguard Dividend Appreciation ETF (VIG) in total return and risk-adjusted performance (Sharpe ratio). It also shows a higher risk than VIG measured in drawdown and standard deviation of monthly return (“volatility”).

|

Total Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

FDRR |

102.33% |

13.79% |

-36.52% |

0.84 |

15.32% |

|

SPY |

124.39% |

15.97% |

-33.72% |

0.98 |

15.20% |

|

VIG |

112.09% |

14.78% |

-31.72% |

0.97 |

13.92% |

Data calculated with Portfolio123

The next chart plots the equity value of $100 invested in FDRR and SPY since FDRR inception.

FDRR vs. SPY (Chart: author; Data calculated with Portfolio123)

In previous articles, I have shown how three factors may help cut the risk in a dividend portfolio: Return on Assets, Piotroski F-score, and Altman Z-score.

The next table compares FDRR since inception with a subset of the S&P 500: stocks with above-average dividend yield and ROA, a good Altman Z-score and a good Piotroski F-score. It is rebalanced annually to make it comparable with a passive index.

|

Total Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

FDRR |

102.33% |

13.79% |

-36.52% |

0.84 |

15.32% |

|

Dividend & quality subset |

115.39% |

15.11% |

-35.84% |

0.87 |

16.01% |

Past performance is not a guarantee of future returns. Data Source: Portfolio123

The dividend quality subset beats FDRR by 1.3 percentage point in annualized total return. However, the fund’s performance is real, and the subset is hypothetical. My core portfolio holds 14 stocks selected in this subset (more info at the end of this post).

Scanning FDRR with quality metrics

FDRR holds about 100 stocks, 9 of them are risky regarding my metrics. In my ETF reviews, risky stocks are companies with at least 2 red flags: bad Piotroski score, negative ROA, unsustainable payout ratio, bad or dubious Altman Z-score, excluding financials and real estate where these metrics are less relevant. They weigh less than 6% of asset value, which is a good point.

Based on weighted averages, Altman Z-score, Piotroski F-score are similar to SPY. However, FDRR’s ROA is much better. This points to a portfolio quality significantly superior to the benchmark.

|

Aggregates |

Altman Z-score |

Piotroski F-score |

ROA% TTM |

|

FDRR |

4.00 |

6.71 |

11.81 |

|

SPY |

3.49 |

6.53 |

7.82 |

(calculations by the author)

Takeaway

FDRR aims at providing exposure to dividend stocks that should profit from a rising rate environment. The fund’s sector structure is very similar to the S&P 500. However, it is significantly cheaper regarding usual valuation ratios. The current portfolio also shows a small percentage of risky stocks and a profitability superior to the benchmark (measured in return on assets). FDRR has underperformed the S&P 500 since inception, like most dividend-oriented ETFs on the same period. The risk measured in drawdown and realized volatility is similar to the broad index. It has also lagged the popular dividend growth ETF VIG (reviewed here). Moreover, VIG was less volatile and has a lower expense ratio (0.06% vs. 0.29%). The future will tell if FDRR can reach its objective, which is outperforming in a rising rate environment. It has lagged SPY by about 1.5 percentage points in the last 12 months as inflation spiked, but it may be too early to assess it on this point. FDRR has a 5-star rating at Morningstar, which I find a bit overrated given past performance. For transparency, a dividend-oriented part of my equity investments is split between a passive ETF allocation (FDRR is not part of it) and my actively managed Stability portfolio (14 stocks), disclosed and updated in Quantitative Risk & Value.

[ad_2]

Source links Google News