[ad_1]

marchmeena29/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on February 12th, 2022.

Value stocks have outperformed YTD, as investors grow weary of tech stocks with frothy valuations and unclear growth prospects, and shift towards more reliable, cash-flow generating value stocks. In my opinion, the trend is set to continue, with higher interest rates as a catalyst. Due to this, I’ve covered several individual value ETFs these past few months, and thought to do an article summarizing the strongest of these. Three funds stand out.

The iShares Focused Value Factor ETF (FOVL) is the ETF with the highest value intensity in the market, offering investors strong, concentrated exposure to value stocks. FOVL is the purest value play ETF in the industry, and the best-performing value ETF YTD, a solid combination. Expect strong returns if investors continue to rotate into value, lackluster performance otherwise.

The Avantis U.S. Small Cap Value Fund (AVUV) is a strong, actively-managed, small-cap value ETF. The fund’s cheap valuation should lead to strong returns if investors continue to rotate into value, as has been the case YTD. The fund’s strong investment management team could still deliver reasonable returns if market conditions are less than ideal, as has been the case since the fund’s inception, due to alpha. AVUV is a two-pronged bet on small-cap value stocks and the fund’s management team, but the bet has worked, so far at least.

The Avantis International Small Cap Value ETF (AVDV) is an actively-managed fund investing in international small-cap value stocks, the most undervalued equity market niche right now. AVDV could benefit from the ongoing shift towards small-cap, value, and international stocks. Potential capital gains are massive, but these (mostly) not materialized. Yet.

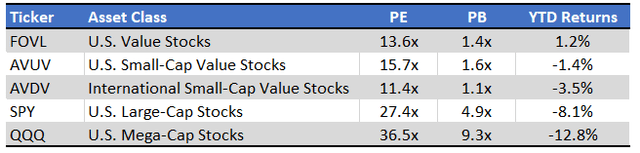

A quick table with select information of the above funds plus some benchmarks.

Fund Filings – Chart by author

The three funds above are all strong, aggressive value ETFs, should outperform if valuations continue to normalize, but are also relatively risky investment. As such, and in my opinion, the three funds are strong investment opportunities, but only appropriate for more aggressive investors.

FOVL – Pure Value Play

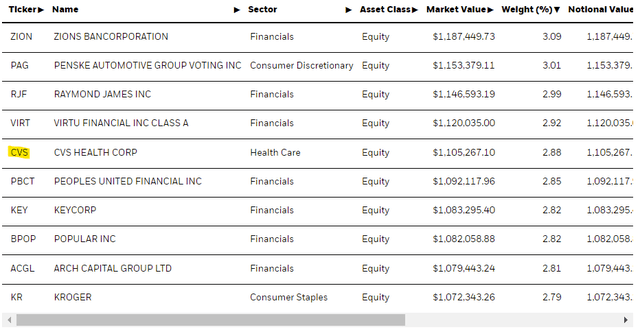

FOVL is a U.S. equity value index ETF. The fund focuses on cheaply valued U.S. stocks, with relatively little concern for diversification, risk-reduction, or alignment to broader equity indexes like the S&P 500. FOVL’s holdings are mostly small-cap stocks, as smaller companies currently sport comparatively cheap valuations, but includes some reasonable well-known mid-cap names like CVS (CVS).

FOVL Corporate Website

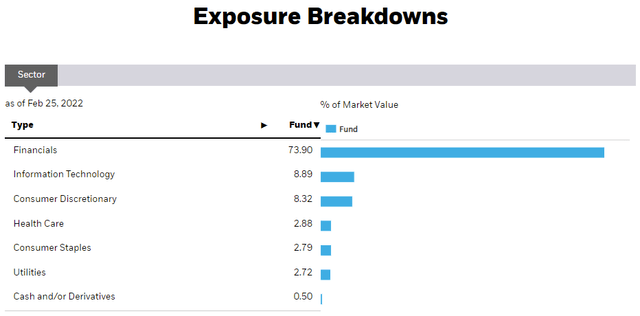

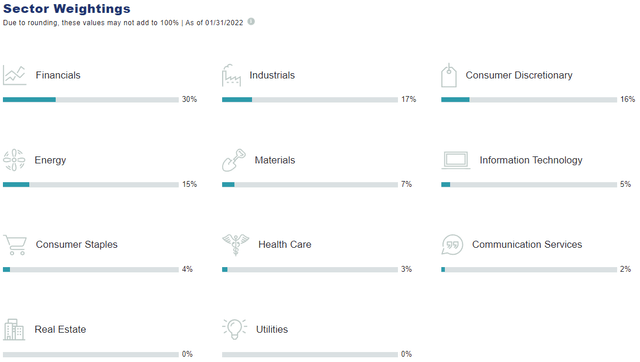

FOVL focuses quite heavily on financials, due to the glut of undervalued regional U.S. banks. Industry diversification is quite low.

FOVL Corporate Website

In general terms, FOVL is an aggressive, concentrated, undiversified fund, with the holdings and industry exposures one would expect from such a fund. FOVL’s aggressiveness is its key differentiator, and provides investors with several key benefits and drawbacks.

FOVL’s aggressiveness means that it is the cheapest, most value-focused ETF on the market. The fund currently sports a measly 9.5x PE ratio, and a 1.3x PB ratio. Both figures are quite low on an absolute basis, and lower than average for a value fund. FOVL is also, as per Bloomberg, the equity index ETF with the highest value factor intensity in the market. Said metric is a quantitative measure of a fund’s exposure to value as an investment factor, and considers valuation metrics, concentration, and other relevant data points.

Bloomberg

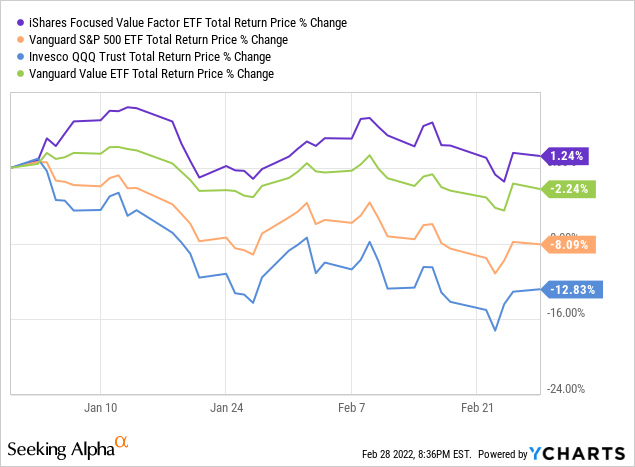

FOVL’s strong value exposure means that the fund should perform comparatively well if valuation gaps were to normalize. That has been the case YTD, with the fund outperforming broader equity market indexes, as well as most of its peers.

FOVL is an aggressive, concentrated bet on U.S. value stocks, and should perform comparatively well if said niche does. As mentioned previously, although this is the case for all value funds, it is particularly the case for FOVL, due to its increased value intensity. Concentrated bets can also be small bets, freeing investor funds for other investments.

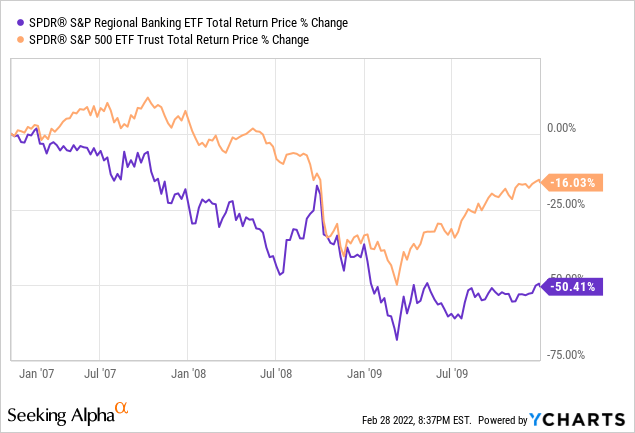

FOVL’s aggressiveness and concentration also serves to massively increase portfolio risk, volatility, and potential underperformance. Expect significant losses if regional banks underperform, for instance. This was the case during the past financial crisis, although backdated information for FOVL during said time period is not readily available.

Diversification serves to reduce the possibility of significant losses and underperformance. Equity indexes like the S&P 500 do not hold a massive allocation to niche industry sub-segments like regional banks, and so can’t really suffer +50% losses due to idiosyncratic factors. FOVL is not a particularly well-diversified fund, and so the fund could, in fact, suffer said losses during a particularly severe downturn. Although this has never been the case since the fund’s inception, it does look like the fund would have performed quite badly during the past financial crisis.

I last covered FOVL here.

AVUV – Actively-Managed U.S. Small-Cap Value ETF

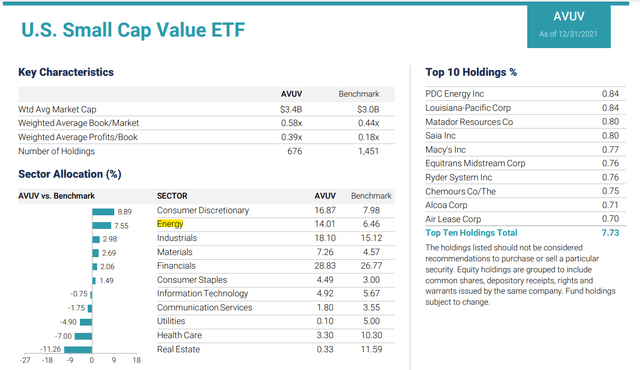

AVUV is an actively-managed U.S. small-cap value ETF. The fund offers investors ‘diversified’ exposure to said niche market segment, with 676 holdings from all relevant industry segments.

AVUV Corporate Website

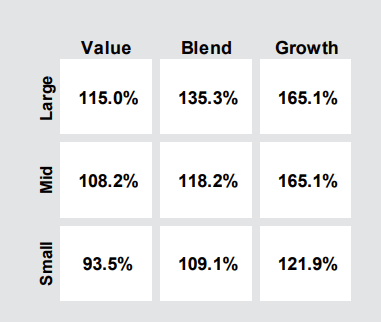

AVUV’s small-cap value stocks are looking comparatively cheap, at least compared to funds focusing on larger companies. In fact, as per J.P. Morgan, small-cap value stocks are the only equity market subsegment trading with historically below-average valuations. Everything else is overvalued, even value stocks.

J.P. Morgan Guide to the Markets

Considering the above, it seems that real value investors can only really invest in U.S. small-cap value stocks: broader ‘value’ stocks and funds are as overvalued as the rest of the market.

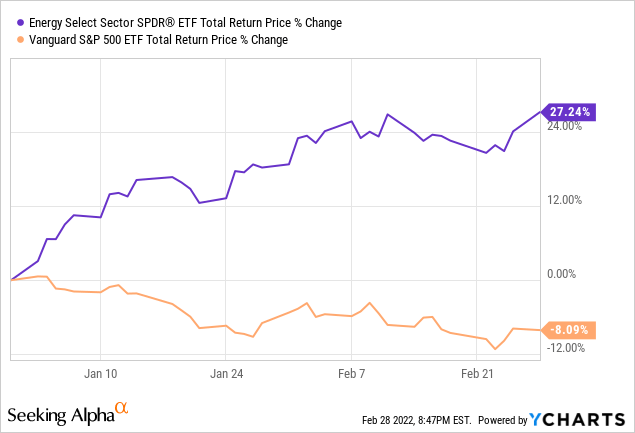

AVUV is a particularly strong choice in this industry niche, due to the fund’s strong investment management team. Said team consistently generates shareholder alpha through savvy security and industry selection / weights. As an example, in late 2021 AVUV’s managers decided to overweigh energy.

AVUV Factsheet

Energy has outperformed since, so it seems that the fund’s managers made the right call.

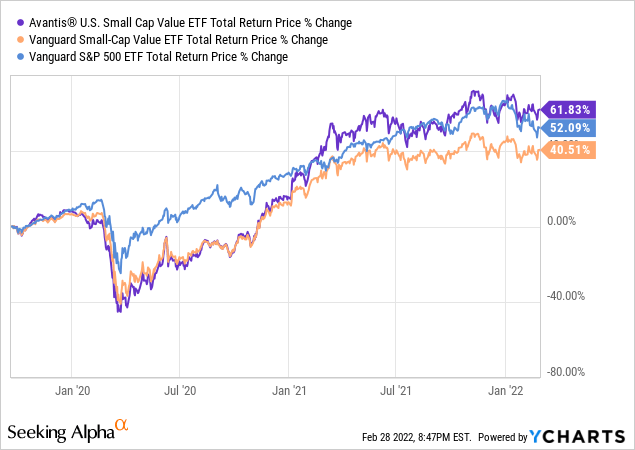

AVUV’s managers have consistently chosen and invested in best-performing securities and industries, leading to significant alpha and consistent outperformance relative to its benchmark. The fund has also moderately outperformed the S&P 500 since inception, stellar performance considering the subpar performance of small-cap value stocks during said time period.

In my opinion, AVUV’s cheap valuation should lead to strong, market-beating returns if valuation gaps normalize, and the fund’s management team should lead to reasonable returns otherwise, a win-win combination.

On a more negative note, AVUV’s focus on small-cap equities increases portfolio risk and volatility, for two key reasons. First, is the fact that smaller companies tend to be riskier than average, as small companies tend to have weaker balance sheets, and undiversified revenue streams. Second, is the fact that AVUV lack of investment in larger companies serves to reduce diversification, indirectly boosting risk and volatility. As with FOVL, this is a relatively risky investment.

I last covered AVUV here.

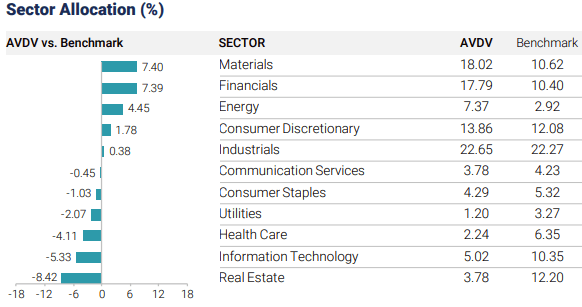

AVDV – Actively-Managed International Small-Cap Value ETF

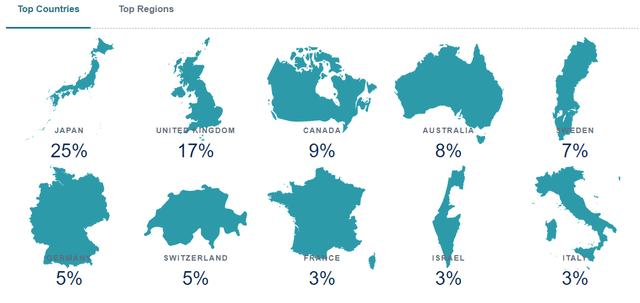

AVDV is, in simple terms, the international version of AVUV. It is operated by the same investment management team, it is also actively-managed, and also offers ”diversified’ exposure to an incredibly niche industry segment. Importantly, the fund does not meaningfully invest in Russian securities, with these accounting for less than 0.1% of its value. This is the case today, and was also true in prior months.

AVDV Corporate Website

AVDV Corporate Website

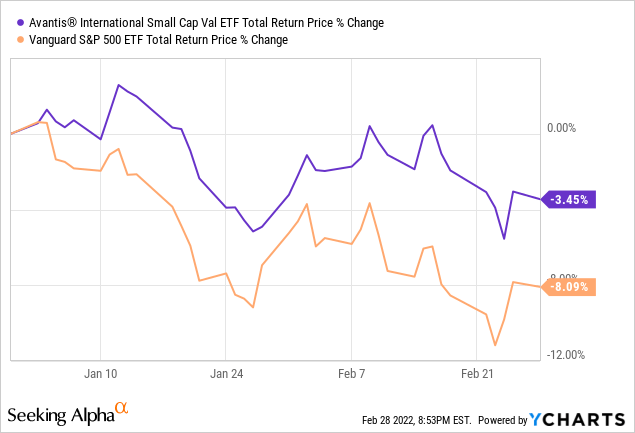

AVDV has the same benefits as AVUV: cheap, undervalued holdings plus a strong investment management. It also has the same drawback: niche, undiversified holdings. The key difference is the country / regional focus. AVUV focuses on U.S. equities, while AVDV focuses on international equities. Said difference has two important implications for investors.

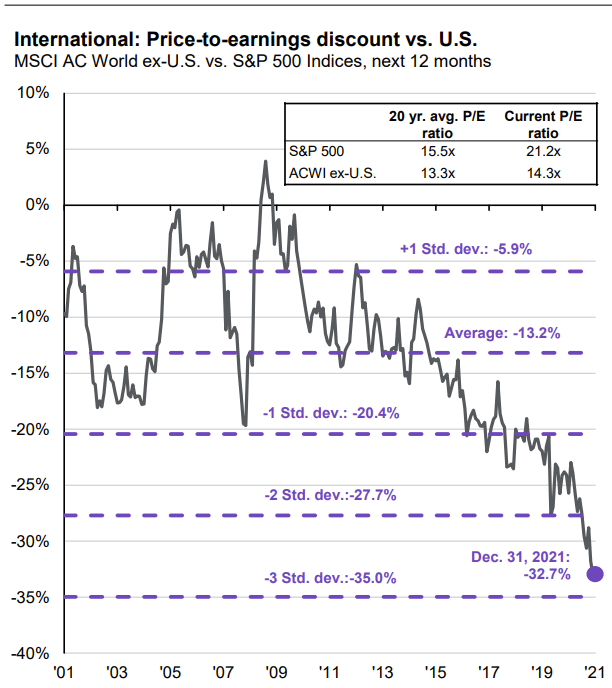

First, is the fact that international stocks are currently cheaper than U.S. equities, and by quite a large margin. International stocks sport PE ratios about one-third lower than comparable U.S. equities. This is a large gap on an absolute basis, and the widest gap in decades.

J.P. Morgan Guide to the Markets

Cheaper valuations could lead to strong capital gains and market-beating returns, as has been the case YTD.

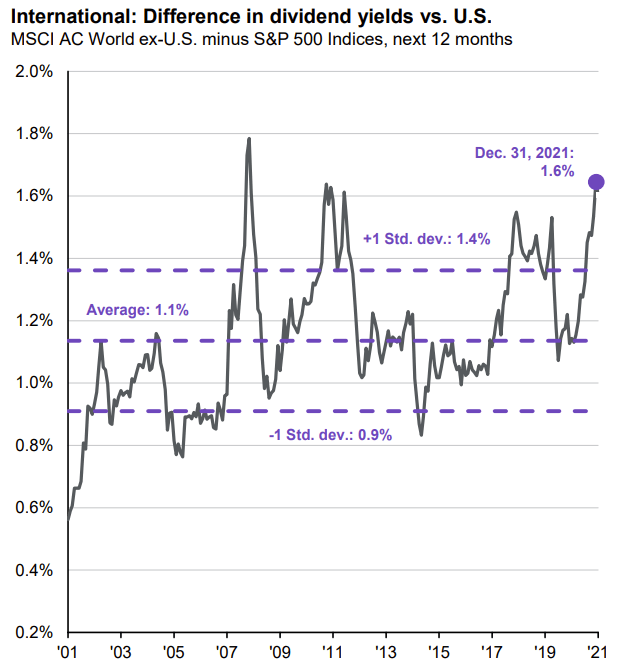

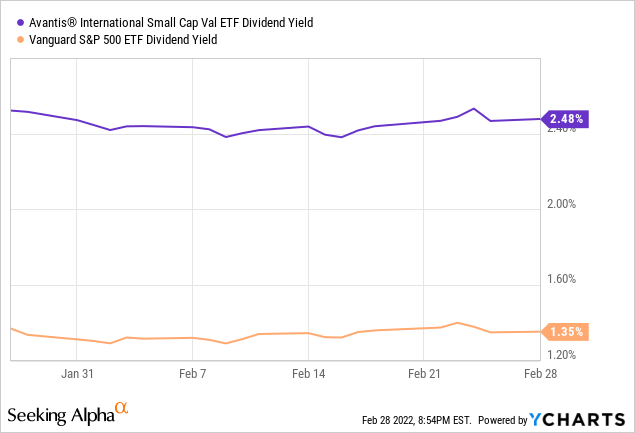

Cheaper valuations also mean higher dividend yields, which directly increase shareholder returns regardless of market sentiment. International equities currently sport dividend yields which are 1.6% higher than those of comparable U.S. equities. It is not a large difference, but it is a difference, and broadly beneficial for international stock investors.

J.P. Morgan Guide to the Markets

AVDV itself yields 2.5%, which is 1.1% higher than that of the S&P 500. Broadly similar, slightly lower, figures as above.

Second, is the fact that international exposure increases diversification, which reduces portfolio risk and volatility. U.S. equities sometimes perform quite badly, as has been the case this year, so exclusively investing in U.S. equities is unwise. Some international exposure is ideal, and AVDV provides investors with that.

I last covered AVDV here.

Conclusion

Value ETFs offer investors cheap valuations and the possibility of substantial capital gains if valuations were to normalize. Most value ETFs have outperformed YTD and will, I believe, continue to outperform in the coming months. The three funds presented here are all particularly strong value funds, and buying opportunities.

[ad_2]

Source links Google News