[ad_1]

iQoncept/iStock via Getty Images

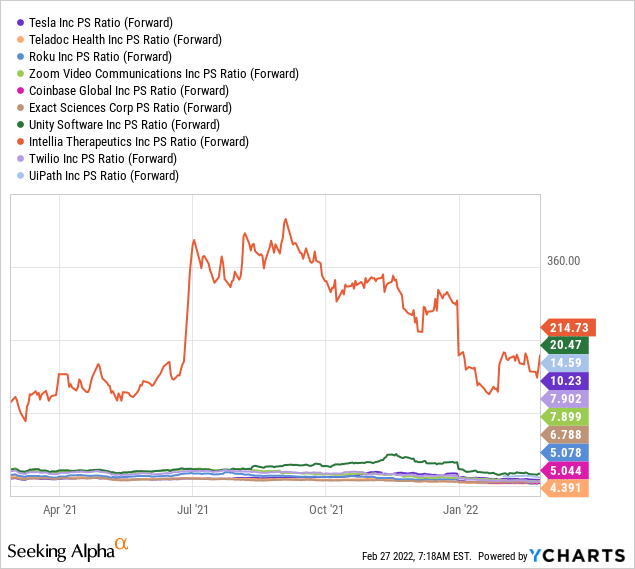

In 2022, an investment in Cathie Wood’s ARK Innovation ETF (ARKK) underperformed the S&P 500 by a wide margin. If the current rotation out of the growth sector continues, a heavy allocation of investment funds to overvalued and over-hyped technology stocks with massively inflated sales multiples will harm the fund’s performance.

The intrinsic value of the ARK Innovation ETF has fallen further as investors are less willing to pay unsustainable multiples for unprofitable companies and exit the growth sector of the stock market.

What Happened To ARK Innovation ETF This Year?

Big problems loom for thematic investment funds that doubled down on high-multiple stocks just as the valuation cycle peaked last year. Many tech stocks are down significantly as investors adjust to changing macro landscapes and risk scenarios.

While the ARK Innovation ETF outperformed during the Covid-19 period as wise bets on pandemic winners paid off, the exchange traded fund is now facing a period of significantly lower returns and higher volatility.

Investors are no longer willing to pay the highest sales multiples for companies that outperformed during the pandemic, and they are becoming increasingly aware that many of the companies that saw valuation increases are actually not very profitable at all.

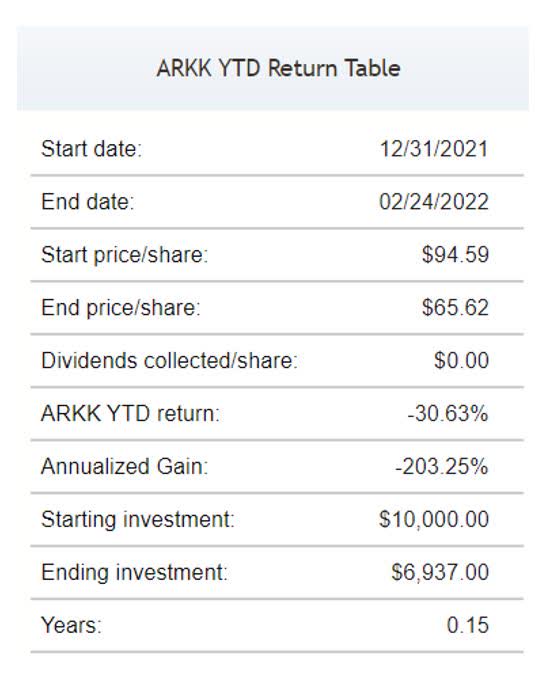

A $10k investment in Cathie Wood’s ARK Innovation ETF is now worth approximately $6.9K, implying a negative return of approximately 31%.

ARKK YTD Return Table (YTDReturn.com)

During the same period, the S&P 500 performed significantly better, with a negative return of only about 10% in the first two months of the year, owing to better diversification and less exposure to thematic investing.

ARKK And S&P500 Comparison (Yahoo Finance)

The ARK Innovation ETF has a significant allocation of funds to stocks that outperformed during the pandemic but have underperformed in recent weeks.

Whether it’s e-commerce platform Shopify (SHOP), streaming platform Roku (ROKU), big-data firm Palantir Technologies (PLTR), electric-vehicle enterprise Tesla (TSLA), fintech Block (SQ), video conferencing platform Zoom Video Communications (ZM), or cryptocurrency trading platform Coinbase (COIN). Cathie Wood doubled down on many of these stocks during the pandemic, paying peak sales multiples in many cases. Palantir, the big-data company that continues to be outrageously overvalued, is a case in point.

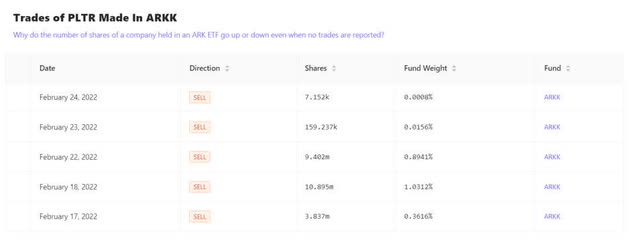

Cathie Wood’s Ark Investment Management sold approximately 11.8 million shares of Palantir Technologies last week after the big-data company’s fourth-quarter earnings fell short of expectations and the stock price plummeted. The transaction is said to have been worth $123.3 million, which is a large sum even for the billion-dollar exchange traded funds of Cathie Wood’s ARK brand. The concerning point is that Palantir stock was trading at 52-week lows at the time of the sales, implying that Cathie Wood incurred a significant loss on the ARK investment position in Palantir.

Palantir was the most heavily sold stock in the ARK Investment ETF portfolio, according to the fund’s recent trade history.

Trades of PLTR Made In ARKK (Cathiesark.com)

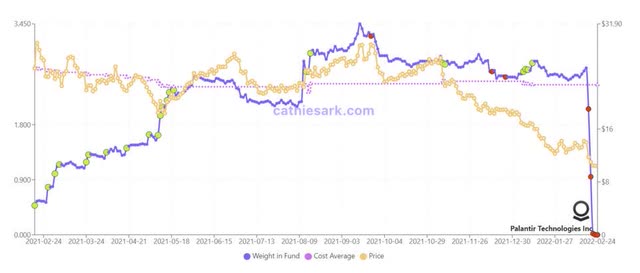

Cathie Wood bought the dip in Tesla, Zoom Video Communications, and Coinbase while liquidating her Palantir position last week. Palantir’s weighting has now been reduced to zero.

PLTR Weighting In ARKK Fund (Cathiesark.com)

However, Cathie Wood is in for more pain because the ARK Innovation ETF remains heavily overweight high-multiple stocks, and there are no signs of the tech rout abating anytime soon. This suggests that further downward pressure on the fund’s net asset value is possible.

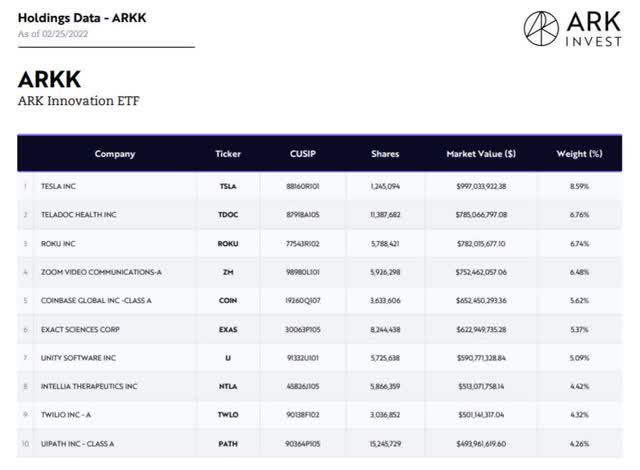

Holding Data (ARK Innovation ETF)

Despite significant corrections this year, all of ARK Innovation ETF’s top ten investment holdings are likely still overvalued, as they all trade at inflated sales multiples. Companies that lack fundamental profitability are at risk of further valuation adjustments as the great rotation away from growth and toward value accelerates.

High Chance Of Significant Underperformance, High Volatility

Overweighting high-multiple stocks at a time when the market is re-calibrating valuation multiples in response to new economic realities such as surging inflation, rising interest rates, and the war drums now sounding in Ukraine is a recipe for disaster.

Worse, as of February 25, 2022, the top ten holdings of the ARK Innovation ETF represented a massive 58% of the fund’s total investments, implying that fund performance will be heavily influenced by how well a few of the ETF’s high-multiple stocks perform.

Because investors are now realizing that they overpaid for growth stocks during the Covid-19 boom, funds that follow a thematic investment strategy, such as the ARK Innovation ETF, may be primed for a longer period of below-average returns.

My Conclusion

Being overweight growth stocks with highly inflated sales multiples at a time when investors are pivoting in the opposite direction indicates the possibility of significant fund underperformance. The great rotation out of growth and into value is still ongoing, implying that net asset value declines are still possible.

The core holdings of ARK Innovation ETF are all high-multiple stocks. Investors must brace themselves for fund underperformance and high volatility as the tech rout continues.

[ad_2]

Source links Google News